Alaska Estoppel Affidavit of Mortgagor

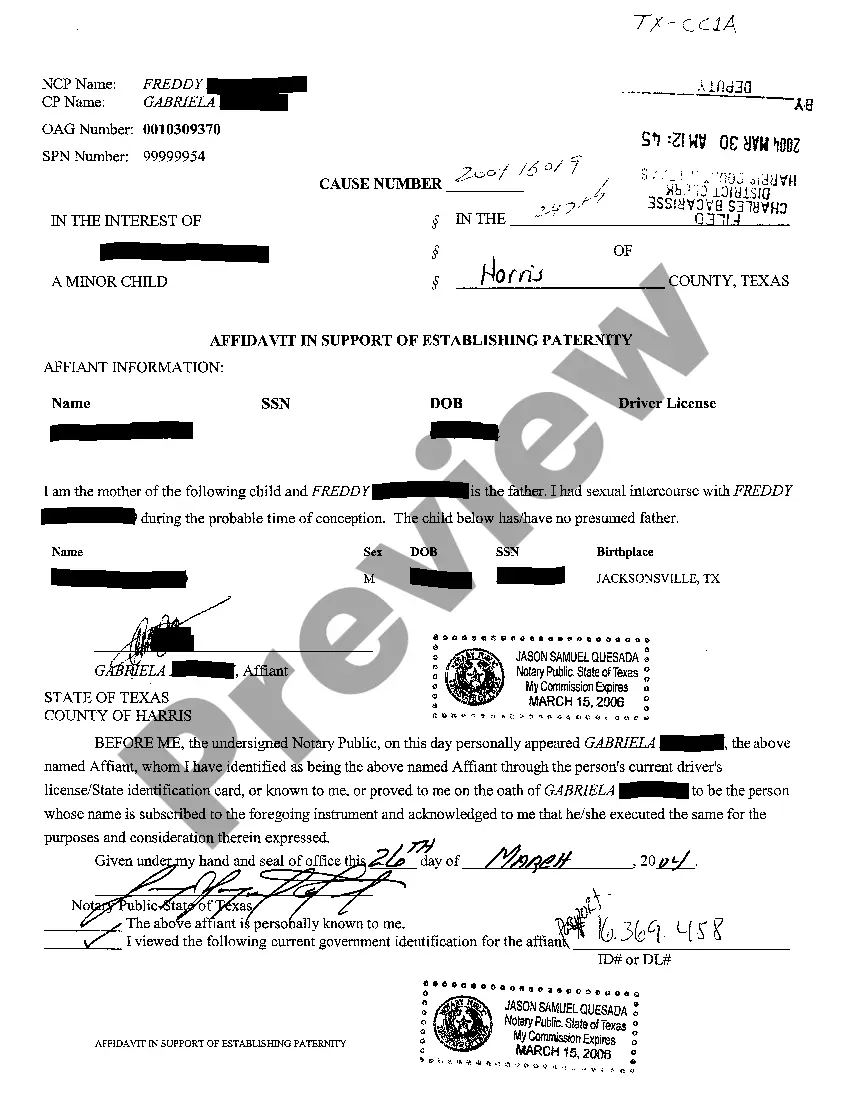

Description

How to fill out Estoppel Affidavit Of Mortgagor?

US Legal Forms - one of the most extensive collections of legal documents in the USA - provides a vast array of legal paper templates that you can obtain or create.

While utilizing the site, you can discover numerous forms for business and personal purposes, organized by categories, recommendations, or keywords.

You can retrieve the latest versions of forms like the Alaska Estoppel Affidavit of Mortgagor in moments.

Read the form description to confirm that you have chosen the correct form. If the form does not fulfill your criteria, use the Search box at the top of the screen to locate the one that does.

Once you are satisfied with the form, finalize your choice by clicking the Purchase now button. Then, choose the payment plan you prefer and provide your information to register for an account.

- If you already have a subscription, Log In and retrieve the Alaska Estoppel Affidavit of Mortgagor from the US Legal Forms library.

- The Obtain button will appear on every form you view.

- You have access to all previously downloaded forms from the My documents tab in your account.

- If you’re using US Legal Forms for the first time, here are straightforward steps to assist you in getting started.

- Make sure you have selected the appropriate form for your region/area.

- Select the Review button to examine the form’s details.