The Alaska Business Deductions Checklist is a comprehensive guide designed to assist Alaska-based businesses in identifying and maximizing their eligible tax deductions. This invaluable tool helps businesses navigate through the complex realm of tax laws and regulations specific to the state of Alaska, ensuring that they take advantage of every tax-saving opportunity available to them. The checklist is tailored to meet the unique needs of various types of businesses operating within Alaska, including sole proprietorship, partnerships, limited liability companies (LCS), and corporations. Each type of business entity may have specific deductions that are applicable to their operations, and the checklist takes this into account, providing detailed guidance on deduction opportunities that pertain to specific business structures. Key topics covered in the Alaska Business Deductions Checklist include business expenses, which encompass a wide range of costs that can be deducted to reduce taxable income. These expenses often include employee salaries and benefits, rent or mortgage payments for business premises, office supplies, utilities, equipment purchases, advertising and marketing costs, professional services fees, and many more. The checklist provides an extensive list of potential deductions, serving as a handy reference tool to ensure businesses don't overlook any eligible expenses. Another important aspect covered in the checklist is depreciation and amortization. Businesses can deduct the cost of long-term assets over time, reflecting their gradual decline in value or the consumption of their benefits. The checklist outlines the specific methods and rules applicable in Alaska for determining the deduction amount for various types of assets, such as machinery, vehicles, buildings, and intangible assets like patents or copyrights. Furthermore, the checklist addresses deductions related to employee-related expenses, such as wages, salaries, bonuses, and benefits. It provides guidance on how to properly calculate deductions for payroll taxes, Social Security contributions, health insurance premiums, and retirement plan contributions. Additionally, the Alaska Business Deductions Checklist covers deductions specific to certain industries or sectors prevalent in the state. For instance, deductions related to the oil and gas industry, fishing and seafood processing, tourism and hospitality, renewable energy, and various other sectors may have unique considerations and eligibility criteria. The checklist ensures that businesses in these industries have a clear understanding of the deductions for which they may qualify. In summary, the Alaska Business Deductions Checklist is a comprehensive resource designed to help businesses in Alaska identify and capitalize on every possible tax deduction. By utilizing this checklist, businesses can effectively reduce their taxable income, ultimately leading to significant savings and ensuring compliance with Alaska-specific tax regulations.

Alaska Business Deductions Checklist

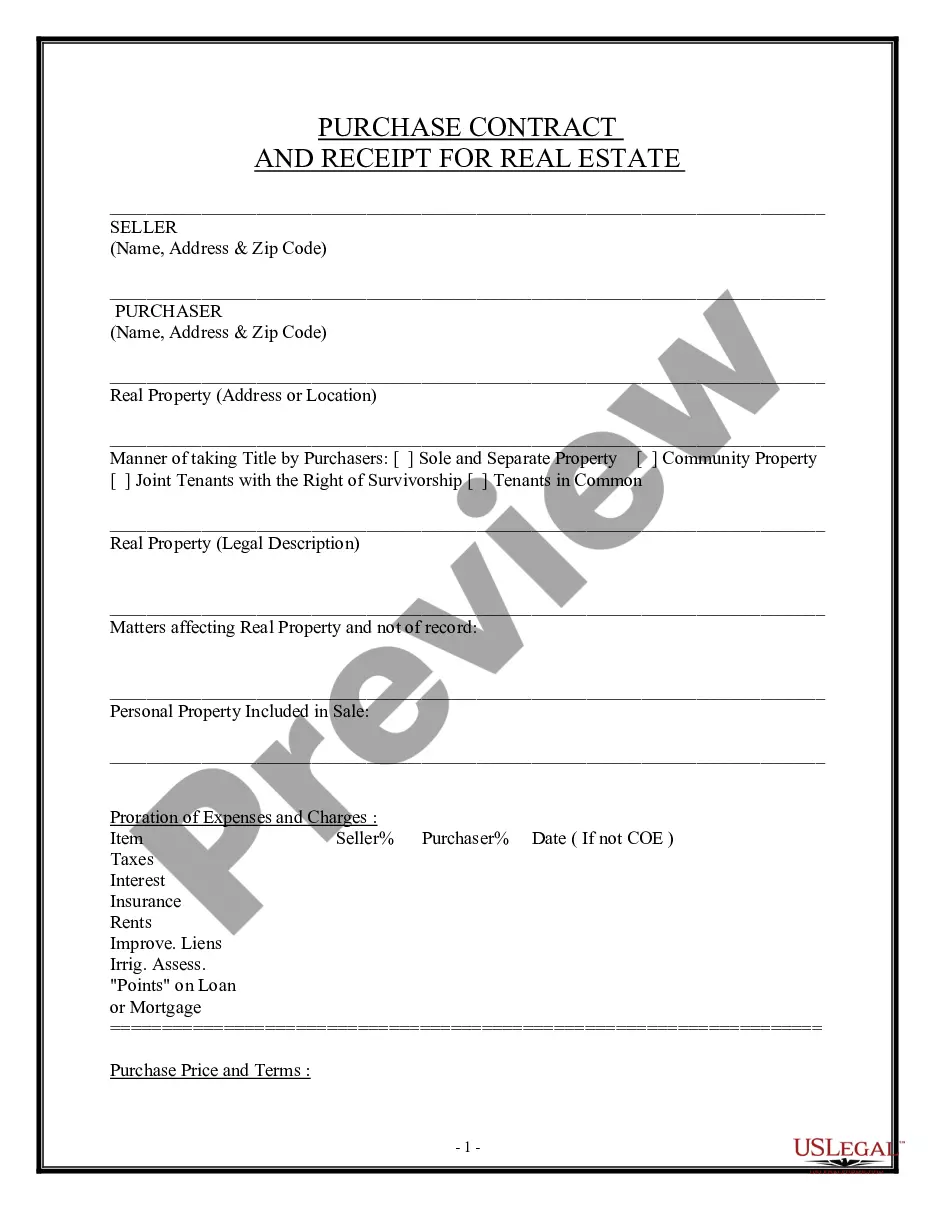

Description

How to fill out Business Deductions Checklist?

If you need to total, obtain, or generate legal document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Take advantage of the website's simple and convenient search to locate the documents you need.

A selection of templates for business and personal uses are categorized by types and states, or keywords.

Step 4. Once you have found the form you need, click the Get now button. Choose your preferred payment plan and enter your credentials to register for an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the transaction.

- Use US Legal Forms to locate the Alaska Business Deductions Checklist with just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Acquire button to access the Alaska Business Deductions Checklist.

- You can also access forms you have previously downloaded from the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow these instructions.

- Step 1. Ensure you have selected the form for the correct state/region.

- Step 2. Utilize the Preview option to review the form's details. Remember to read the information carefully.

- Step 3. If you are not satisfied with the form, use the Search section at the top of the screen to find other versions of the legal document template.

Form popularity

FAQ

Some deductions, like the standard mileage deduction for vehicle use, do not require receipts, provided you maintain a written log. Using the Alaska Business Deductions Checklist can help you understand these exceptions and how to properly document your claims. This approach keeps your tax filings organized and compliant, allowing you to focus on growing your business.

Several business expenses qualify as 100% tax deductible, including office supplies, certain travel expenses, and your home office costs if you use part of your home for business. By using the Alaska Business Deductions Checklist, you can easily pinpoint these expenses and ensure you are not overlooking anything significant. This thoroughness can lead to substantial savings come tax time.

To qualify for a business deduction, first identify and document all eligible expenses related to your business operations. Then, refer to your Alaska Business Deductions Checklist to ensure you include all necessary items. Finally, file the appropriate forms with your tax return to claim these deductions and lighten your tax burden.

To effectively track your business expenses, gather all relevant receipts, invoices, and bank statements. Maintain a detailed record of each transaction alongside a copy of your Alaska Business Deductions Checklist. This preparation will simplify your filing process, helping you maximize allowable deductions and avoid potential tax issues.

Yes, the IRS requires proof of business expenses when you claim deductions. Adequate documentation, such as receipts and invoices, is essential to support your claims. The Alaska Business Deductions Checklist outlines the types of records you should keep. By organizing your records properly, you reduce the chances of complications when filing your taxes.

An LLC can deduct various expenses such as operational costs, employee salaries, and business travel. Additionally, certain personal expenses may qualify if they are directly tied to business activities. The Alaska Business Deductions Checklist serves as a valuable resource for understanding what you can deduct. By using this checklist, you can better manage your finances and increase your tax savings.

To claim business expenses, you must be a business owner and show that the expenses are ordinary and necessary. Additionally, keeping accurate records is essential for any deductions. Utilize the Alaska Business Deductions Checklist to understand specific documentation needed for various expenses. Being informed helps you maximize your deductions and adhere to tax laws.

Yes, you need proof to write off business expenses. Keeping detailed records helps you correctly fill out your tax forms. The Alaska Business Deductions Checklist can guide you on what type of documentation to maintain. This ensures that your deductions meet IRS requirements, reducing the risk of audits.

To qualify for a 100% meal deduction, the meals must be directly related to business activities, such as client meetings or employee training. Meals provided to employees as part of a holiday party or team-building event are also fully deductible. Keeping an Alaska Business Deductions Checklist will help you track these qualifying expenses accurately. This approach can enhance your tax strategy.

One of the most overlooked tax breaks for businesses is the home office deduction. Many business owners miss eligible expenses associated with maintaining a home office. Make sure to use an Alaska Business Deductions Checklist to identify all potential deductions, including utilities and internet. Taking advantage of this can lead to substantial savings.