Alaska Checklist - Partnership Agreement

Description

The partnership agreement is the heart of the partnership, and it must be enforced as written, with very few exceptions. Partners' rights are determined by the partnership agreement. If the agreement is silent regarding a matter, the parties' rights are typically determined by the UPA.

How to fill out Checklist - Partnership Agreement?

You can spend numerous hours online trying to locate the sanctioned document template that meets the state and federal criteria you require.

US Legal Forms offers thousands of legal forms that have been reviewed by experts.

You can easily download or create the Alaska Checklist - Partnership Agreement from the service.

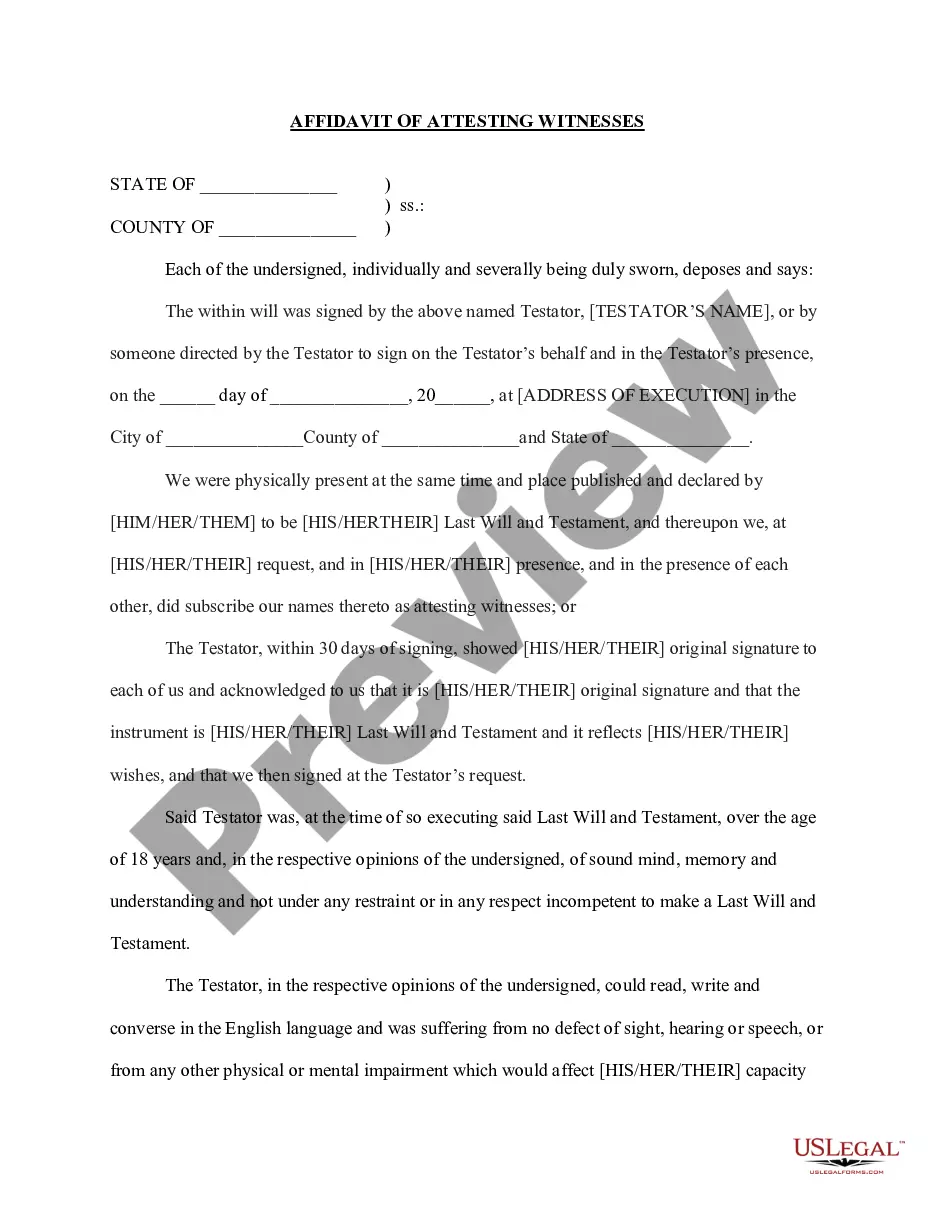

If available, use the Preview button to review the document template as well.

- If you have a US Legal Forms account, you can Log In and click the Download button.

- After that, you can complete, edit, print, or sign the Alaska Checklist - Partnership Agreement.

- Every legal document template you acquire is yours indefinitely.

- To obtain another copy of any downloaded form, go to the My documents tab and click the corresponding button.

- If you're using the US Legal Forms website for the first time, follow these straightforward instructions below.

- First, ensure you have selected the correct document template for your state/city of preference.

- Review the form description to confirm you've chosen the appropriate form.

Form popularity

FAQ

To set up a partnership agreement, first identify the key elements you want to include, such as ownership shares, roles, and responsibilities. Next, outline the decision-making process and define how profits or losses will be split among partners. Use the Alaska Checklist - Partnership Agreement to ensure you cover all necessary legal aspects and compliance requirements. Finally, consider reviewing the agreement with legal professionals to provide additional assurance and clarity.

To fill out a partnership form, begin by gathering all necessary information about the partnership, including the names of partners and their contributions. Clearly outline the partnership's purpose and financial arrangements to avoid confusion. Refer to the Alaska Checklist - Partnership Agreement for a comprehensive guide to ensure you fill all sections correctly.

Filling out a partnership agreement involves detailing the roles, responsibilities, and profit-sharing arrangements of each partner. Start by including essential information like the partnership name, business address, and contributions by each partner. The Alaska Checklist - Partnership Agreement will provide a structured approach to ensure you cover all critical areas.

Alaska does not have a state income tax, meaning residents do not file a state tax return for individual income. However, if you're part of a partnership, you still need to file the appropriate partnership tax return. Using the Alaska Checklist - Partnership Agreement can simplify your requirements and help you stay in compliance.

Several states permit composite returns for partnerships, including California, Kentucky, and Maryland, among others. A composite return allows the partnership to file a single tax return on behalf of its non-resident partners, simplifying the process. Familiarizing yourself with the Alaska Checklist - Partnership Agreement will facilitate your compliance with these regulations.

The four main types of partnerships are general partnerships, limited partnerships, limited liability partnerships, and joint ventures. Each type has different structures and liability implications for the partners involved. Understanding these distinctions is important, and using the Alaska Checklist - Partnership Agreement can guide you in selecting the best type for your business.

Yes, Alaska requires partnerships to file a tax return, specifically the Form 65. Partnerships must report income, deductions, and credits on this form, even though Alaska does not impose a personal income tax. Your Alaska Checklist - Partnership Agreement can help ensure you include all necessary information when completing this tax form.

Structuring a partnership agreement requires clear definition of each partner's role, the distribution of profits, and methods for dispute resolution. You should also include terms for adding new partners and handling partner departures. Following the guidelines in the Alaska Checklist - Partnership Agreement can lead to a strong and effective partnership framework.

No, Alaska does not tax partnerships at the state level. This means that partnerships can operate without the burden of state income tax, allowing for more flexibility in financial planning. Such a feature is crucial when considering forming a partnership, as noted in the Alaska Checklist - Partnership Agreement.

Many states tax partnerships, but regulations vary widely. States like California and New York have specific tax obligations for partnerships, while others like Alaska do not impose state income tax. Knowing these differences is important when reviewing the Alaska Checklist - Partnership Agreement.