Alaska Checklist — Health and Disability Insurance: A Comprehensive Guide If you reside in Alaska and are looking to secure proper health and disability insurance coverage, it is essential to familiarize yourself with the Alaska Checklist — Health and Disability Insurance. This detailed guide aims to provide you with key information and necessary steps to ensure you obtain the appropriate insurance policies that cater to your healthcare and disability needs. Keywords: Alaska checklist, health insurance, disability insurance, coverage, policies, healthcare needs, disability needs. Alaska offers several types of health insurance and disability insurance plans to its residents, each designed to address specific medical requirements and financial circumstances. Below is an overview of different types of insurance policies available in Alaska: 1. Health Maintenance Organization (HMO) Plans: An HMO plan allows you to select a primary care physician within a network and obtain healthcare services exclusively through that network. These plans usually require a referral from your primary care physician to see a specialist. HMO plans generally offer lower out-of-pocket expenses but limit your choice of healthcare providers. 2. Preferred Provider Organization (PPO) Plans: PPO plans grant you more flexibility by allowing you to choose healthcare providers both in and out of network. This means you can visit specialists without requiring referrals. While PPO plans offer more freedom, they typically come with higher monthly premiums and deductibles. 3. Exclusive Provider Organization (EPO) Plans: Similar to HMO plans, EPO plans require you to stay within a specific network of healthcare providers. However, they do not mandate referrals to see specialists. EPO plans may be more affordable than PPO plans but offer lower flexibility in terms of provider choice. 4. Point of Service (POS) Plans: POS plans combine features of both HMO's and PPO's. You are required to choose a primary care physician within a network, who may refer you to specialists within or outside the network. POS plans offer greater flexibility in exchange for higher out-of-pocket costs. 5. High-Deductible Health Plans (HDPS): HDPS generally have lower monthly premiums and higher deductibles. These plans are suitable for individuals who anticipate minimal healthcare expenses in a year. HDPS are often paired with Health Savings Accounts (Has), allowing you to save for medical expenses with pre-tax money. In addition to health insurance coverage, disability insurance is a crucial component when considering your overall financial security. Disability insurance protects your income in case you are unable to work due to injury or illness. In Alaska, some variations of disability insurance include: 1. Short-Term Disability Insurance: This type of insurance provides coverage for a limited period, typically up to 26 weeks. It helps replace a portion of your income if you are temporarily disabled and unable to work. 2. Long-Term Disability Insurance: Long-term disability insurance offers coverage for an extended duration, potentially until retirement age. It provides a regular income when an injury or illness leads to a prolonged absence from work. 3. Social Security Disability Insurance (SDI): SDI is a federal program designed to provide income support for individuals who are unable to work due to a severe disability that is expected to last at least one year or result in death. To qualify for SDI, applicants must meet certain criteria set by the Social Security Administration. Understanding the diverse options available for health and disability insurance is crucial for safeguarding your well-being and financial stability. By reviewing this Alaska Checklist — Health and Disability Insurance, you can ensure you make informed decisions that best suit your unique healthcare and disability needs.

Alaska Checklist - Health and Disability Insurance

Description

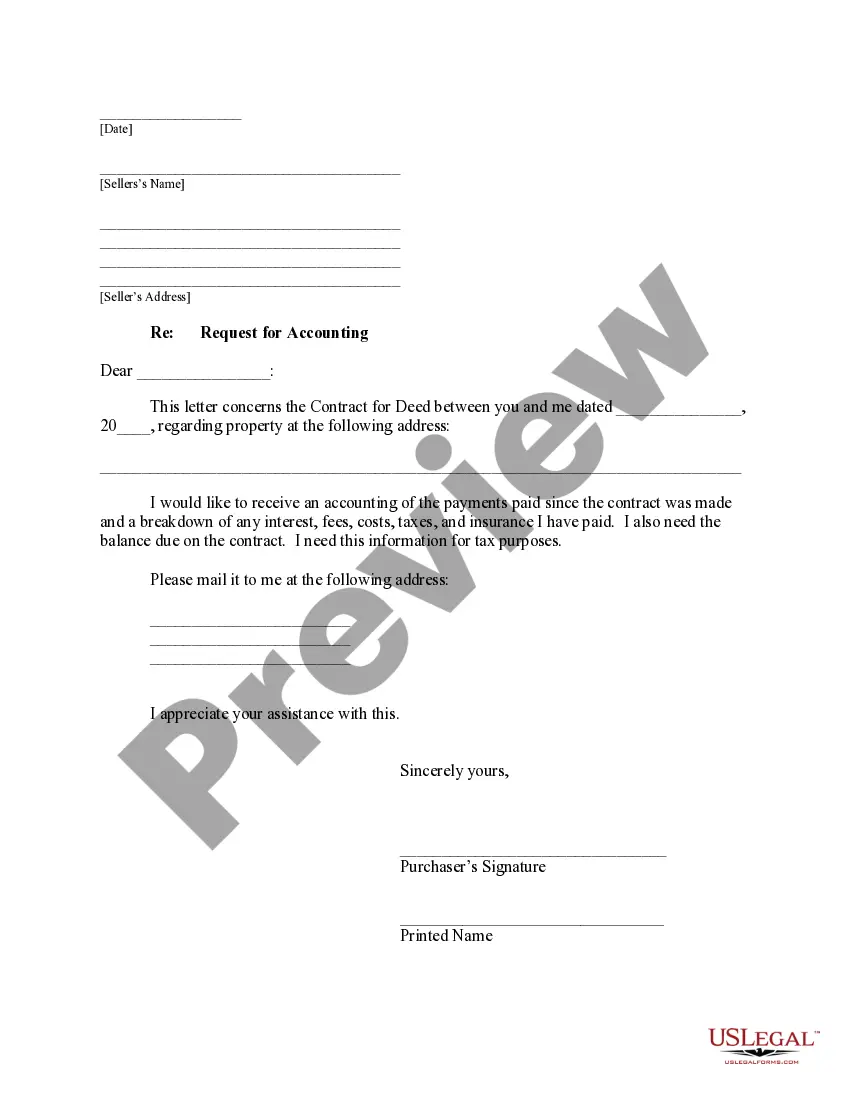

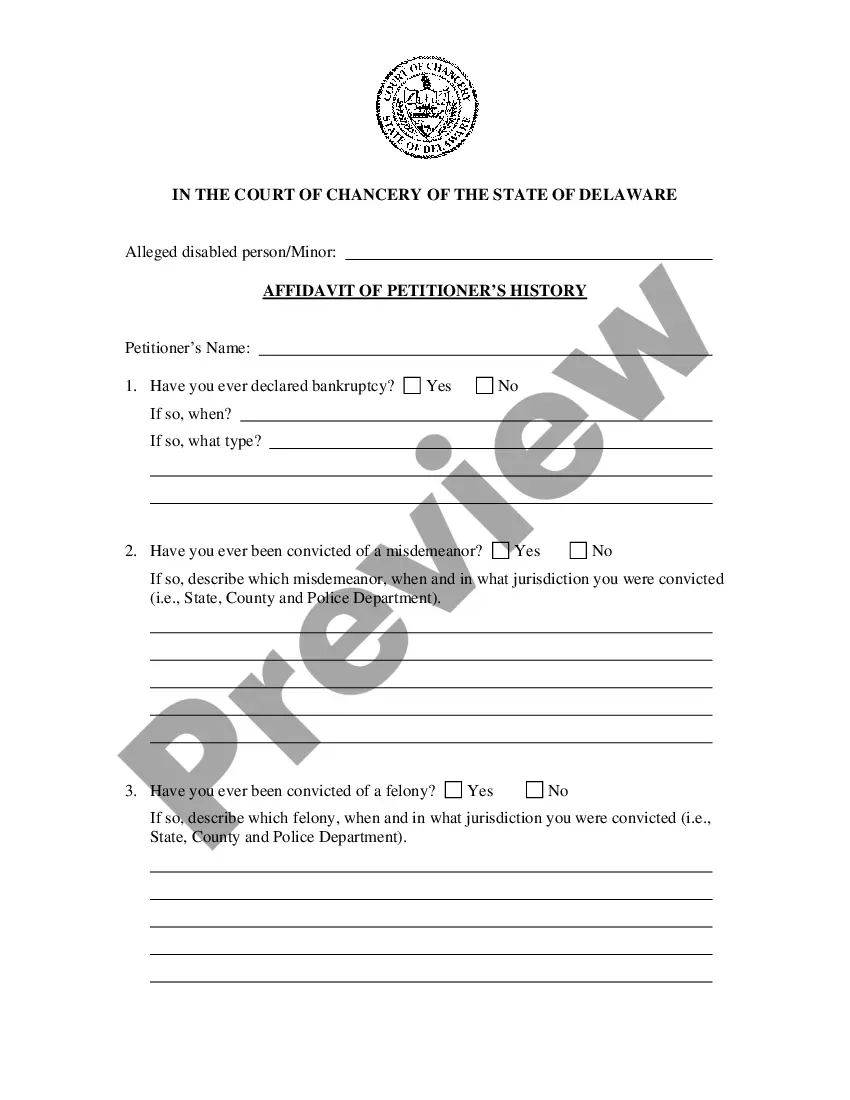

How to fill out Alaska Checklist - Health And Disability Insurance?

Are you currently in a place where you need to have files for sometimes business or person functions nearly every working day? There are plenty of legitimate file templates available on the net, but discovering ones you can rely on is not simple. US Legal Forms delivers thousands of form templates, just like the Alaska Checklist - Health and Disability Insurance, that happen to be composed to fulfill federal and state requirements.

If you are previously acquainted with US Legal Forms web site and have your account, just log in. After that, you may download the Alaska Checklist - Health and Disability Insurance design.

Should you not offer an profile and want to start using US Legal Forms, adopt these measures:

- Discover the form you require and make sure it is for the proper town/area.

- Take advantage of the Review switch to examine the shape.

- Browse the explanation to actually have selected the appropriate form.

- In the event the form is not what you`re trying to find, take advantage of the Search field to find the form that fits your needs and requirements.

- If you obtain the proper form, simply click Buy now.

- Opt for the pricing program you want, fill out the necessary details to create your money, and pay money for your order with your PayPal or bank card.

- Choose a practical paper format and download your version.

Locate all of the file templates you have purchased in the My Forms food selection. You can aquire a extra version of Alaska Checklist - Health and Disability Insurance anytime, if needed. Just click the essential form to download or print out the file design.

Use US Legal Forms, by far the most extensive assortment of legitimate varieties, in order to save efforts and avoid mistakes. The support delivers professionally produced legitimate file templates which can be used for a variety of functions. Generate your account on US Legal Forms and begin producing your lifestyle a little easier.