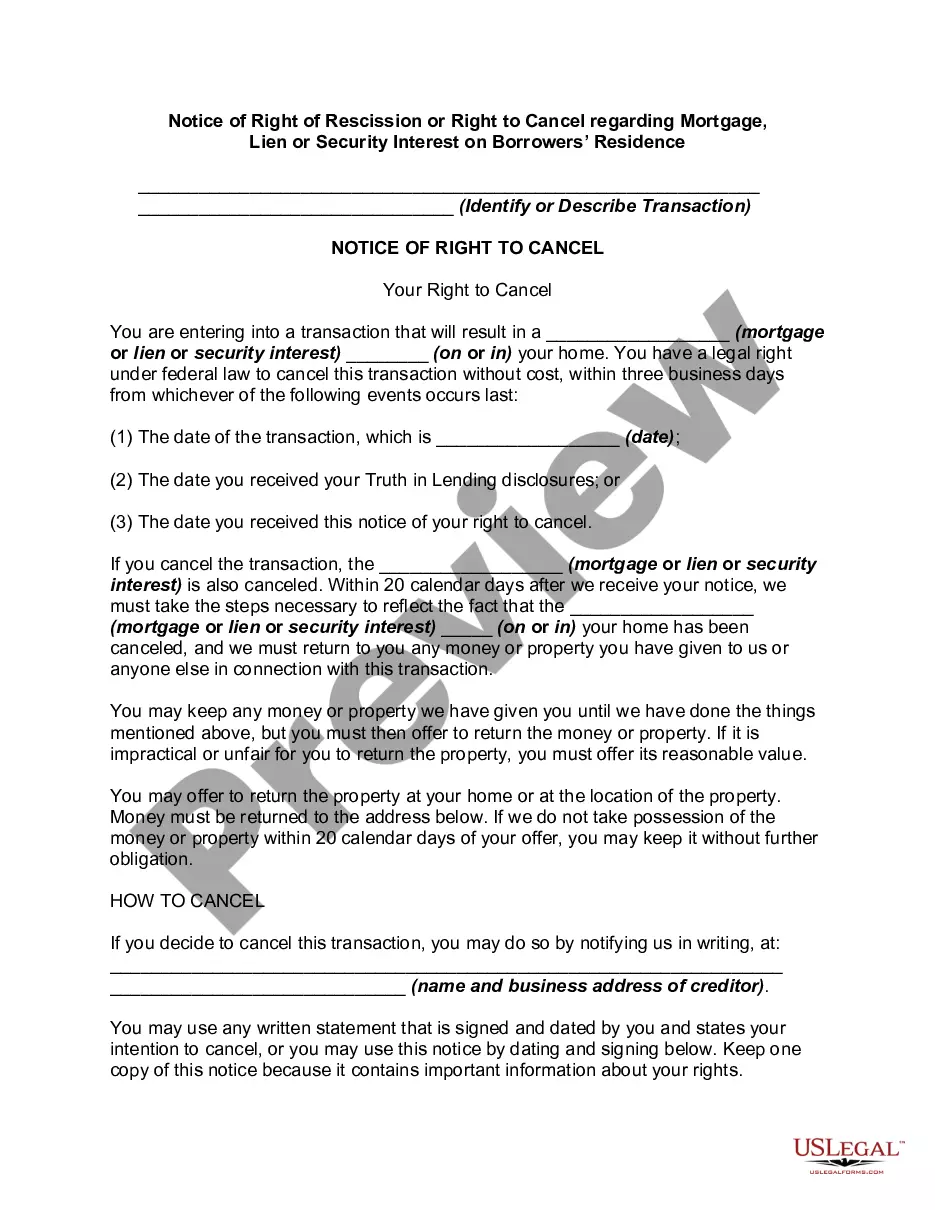

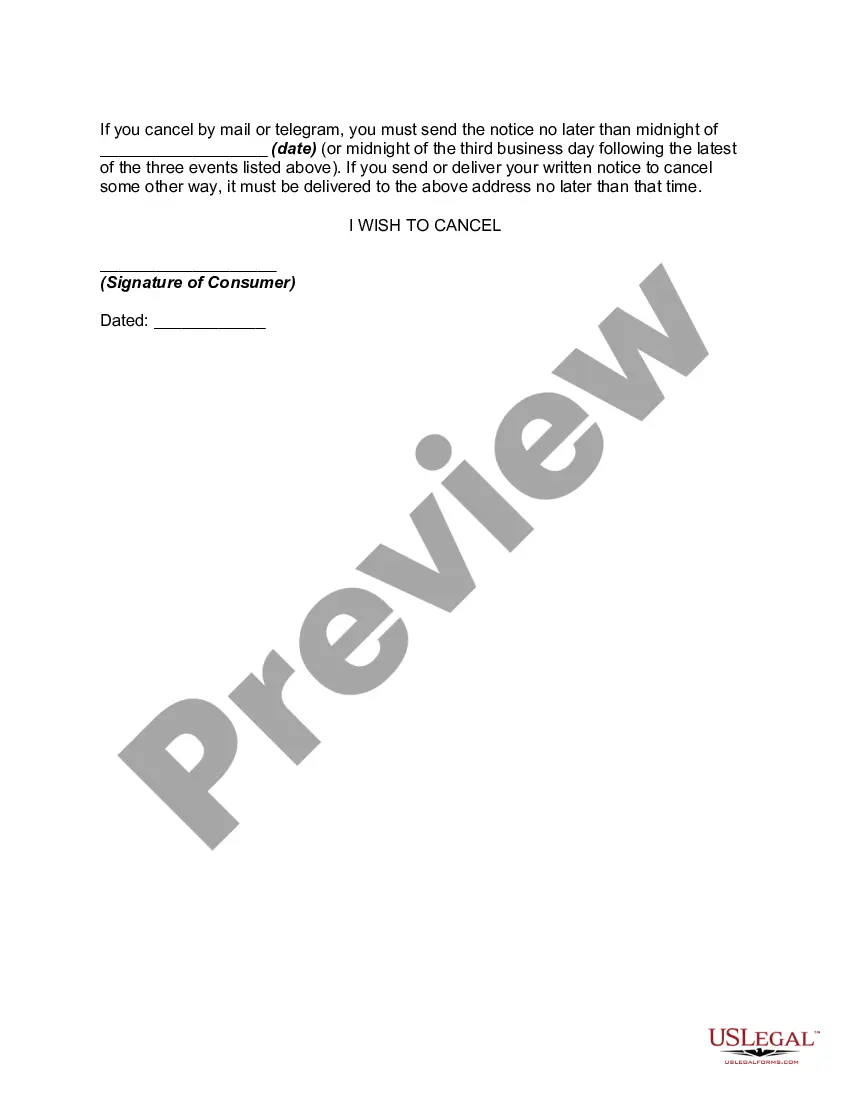

According to 12 CFR 226.23, in a credit transaction in which a security interest is or will be retained or acquired in a consumer's principal dwelling, each consumer whose ownership interest is or will be subject to the security interest shall have the right to rescind the transaction, with some exceptions. To exercise the right to rescind, the consumer shall notify the creditor of the rescission by mail, telegram or other means of written communication. Notice is considered given when mailed, when filed for telegraphic transmission or, if sent by other means, when delivered to the creditor's designated place of business. The consumer may exercise the right to rescind until midnight of the third business day following consummation, delivery of the notice required by paragraph (b) of this section, or delivery of all material disclosures, whichever occurs last.

Title: Understanding Alaska's Notice of Right of Rescission or Right to Cancel regarding Mortgage, Lien or Security Interest on Borrowers' Residence Keywords: Alaska, notice of right of rescission, right to cancel, mortgage, lien, security interest, borrowers' residence, types Introduction: The state of Alaska enforces certain provisions to safeguard borrowers who enter into mortgage agreements, liens, or security interests on their residences. These provisions, known as the Notice of Right of Rescission or Right to Cancel, ensure that borrowers have sufficient time and information to make informed decisions regarding their loan agreements. Let's explore the types and significance of these notices in further detail. Types of Alaska Notice of Right of Rescission or Right to Cancel: 1. Mortgage Notice of Right of Rescission: When borrowers in Alaska obtain a mortgage loan to finance their residential property, they are entitled to a Notice of Right of Rescission. This notice allows borrowers a cooling-off period, typically three business days, within which they can review the terms and conditions of the mortgage contract and decide if it aligns with their best interests. 2. Lien Notice of Right of Rescission: Alaska borrowers who grant a lien on their residence as security for a loan also benefit from a Notice of Right of Rescission. Similar to the mortgage rescission, this notice grants borrowers a specific period, commonly three business days, to reconsider the impact of the lien on their property and choose to cancel the agreement if deemed necessary. 3. Security Interest Notice of Right of Rescission: If borrowers in Alaska offer a security interest, such as their residence, to secure a loan, they are provided with a Notice of Right of Rescission. This notice gives the borrowers a timeframe, typically three business days, to assess the consequences and implications of granting a security interest against their property before finalizing the agreement. Importance and Purpose of Notice of Right of Rescission or Right to Cancel: 1. Protecting borrower's rights: The notice ensures that borrowers have the necessary time and resources to understand the terms and potential consequences of their loan agreements, preventing them from entering into unfair or predatory contracts. 2. Promoting informed decision-making: By granting borrowers a period to review the terms and conditions, Alaska aims to empower borrowers to make informed choices regarding their mortgage, lien, or security interest agreements, eliminating any potential pressure to make hasty decisions. 3. Opportunity for cancellation: During this rescission period, borrowers have the right to rescind or cancel the contract without penalty or loss. This provision provides borrowers with an additional layer of protection, ensuring they are not locked into undesirable or unfavorable loan agreements. Conclusion: Alaska's Notice of Right of Rescission or Right to Cancel regarding Mortgage, Lien, or Security Interest on Borrowers' Residence is designed to safeguard the interests of borrowers. It ensures that Alaskan borrowers have an adequate timeframe to assess their loan agreements, promoting transparency, and allowing them to make informed decisions that align with their financial well-being.Title: Understanding Alaska's Notice of Right of Rescission or Right to Cancel regarding Mortgage, Lien or Security Interest on Borrowers' Residence Keywords: Alaska, notice of right of rescission, right to cancel, mortgage, lien, security interest, borrowers' residence, types Introduction: The state of Alaska enforces certain provisions to safeguard borrowers who enter into mortgage agreements, liens, or security interests on their residences. These provisions, known as the Notice of Right of Rescission or Right to Cancel, ensure that borrowers have sufficient time and information to make informed decisions regarding their loan agreements. Let's explore the types and significance of these notices in further detail. Types of Alaska Notice of Right of Rescission or Right to Cancel: 1. Mortgage Notice of Right of Rescission: When borrowers in Alaska obtain a mortgage loan to finance their residential property, they are entitled to a Notice of Right of Rescission. This notice allows borrowers a cooling-off period, typically three business days, within which they can review the terms and conditions of the mortgage contract and decide if it aligns with their best interests. 2. Lien Notice of Right of Rescission: Alaska borrowers who grant a lien on their residence as security for a loan also benefit from a Notice of Right of Rescission. Similar to the mortgage rescission, this notice grants borrowers a specific period, commonly three business days, to reconsider the impact of the lien on their property and choose to cancel the agreement if deemed necessary. 3. Security Interest Notice of Right of Rescission: If borrowers in Alaska offer a security interest, such as their residence, to secure a loan, they are provided with a Notice of Right of Rescission. This notice gives the borrowers a timeframe, typically three business days, to assess the consequences and implications of granting a security interest against their property before finalizing the agreement. Importance and Purpose of Notice of Right of Rescission or Right to Cancel: 1. Protecting borrower's rights: The notice ensures that borrowers have the necessary time and resources to understand the terms and potential consequences of their loan agreements, preventing them from entering into unfair or predatory contracts. 2. Promoting informed decision-making: By granting borrowers a period to review the terms and conditions, Alaska aims to empower borrowers to make informed choices regarding their mortgage, lien, or security interest agreements, eliminating any potential pressure to make hasty decisions. 3. Opportunity for cancellation: During this rescission period, borrowers have the right to rescind or cancel the contract without penalty or loss. This provision provides borrowers with an additional layer of protection, ensuring they are not locked into undesirable or unfavorable loan agreements. Conclusion: Alaska's Notice of Right of Rescission or Right to Cancel regarding Mortgage, Lien, or Security Interest on Borrowers' Residence is designed to safeguard the interests of borrowers. It ensures that Alaskan borrowers have an adequate timeframe to assess their loan agreements, promoting transparency, and allowing them to make informed decisions that align with their financial well-being.