Alaska Sample Letter for Tax Clearance Letters

Description

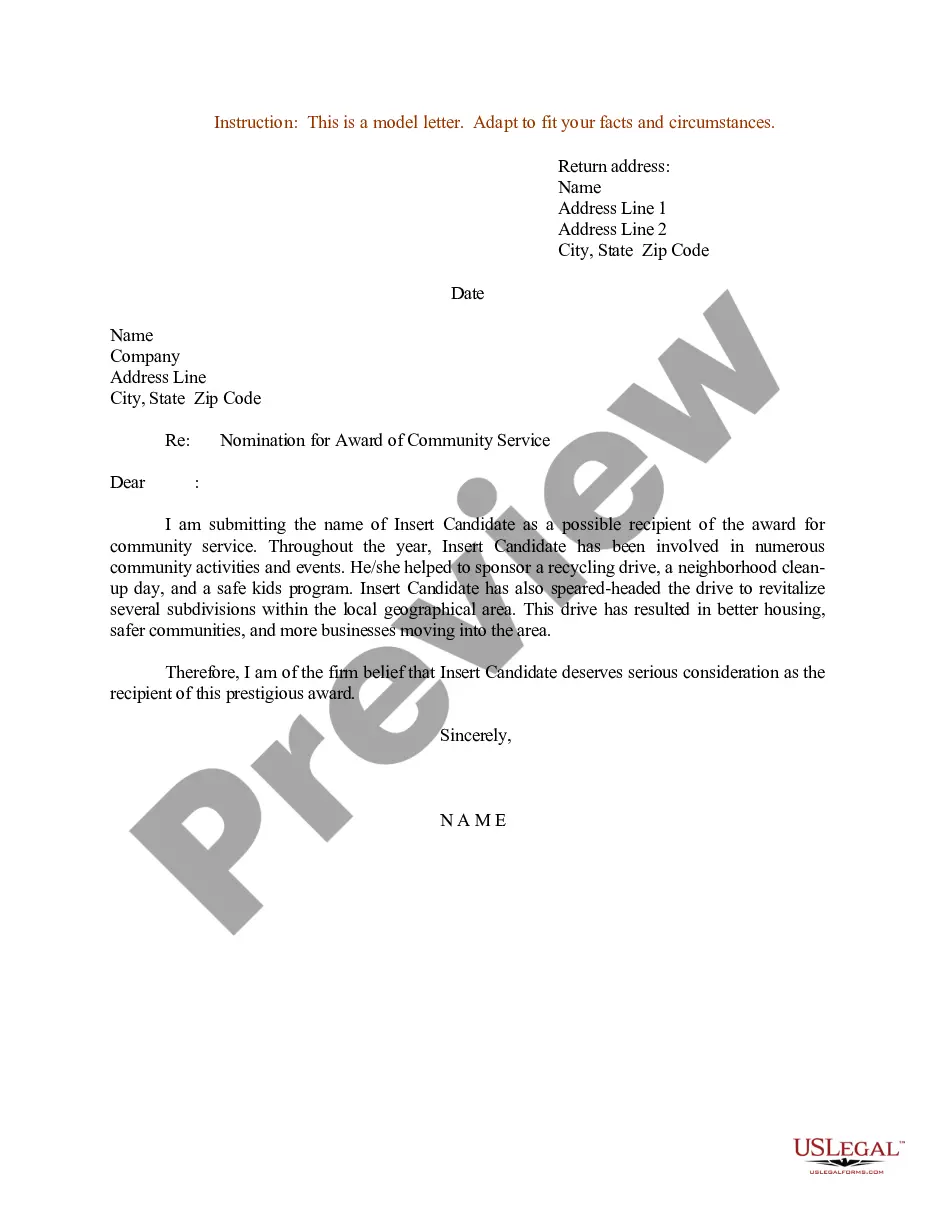

How to fill out Sample Letter For Tax Clearance Letters?

Choosing the right lawful file design could be a struggle. Of course, there are a variety of layouts available on the net, but how can you obtain the lawful form you require? Make use of the US Legal Forms website. The support offers 1000s of layouts, like the Alaska Sample Letter for Tax Clearance Letters, that can be used for enterprise and private demands. Every one of the kinds are inspected by experts and satisfy federal and state demands.

If you are previously authorized, log in in your profile and click the Download option to get the Alaska Sample Letter for Tax Clearance Letters. Use your profile to search throughout the lawful kinds you might have purchased in the past. Check out the My Forms tab of the profile and have an additional version of your file you require.

If you are a fresh end user of US Legal Forms, listed here are straightforward recommendations that you should adhere to:

- First, ensure you have selected the proper form for the city/county. You are able to look over the shape while using Review option and study the shape outline to guarantee it is the right one for you.

- In case the form does not satisfy your requirements, utilize the Seach industry to discover the right form.

- When you are positive that the shape would work, click the Get now option to get the form.

- Choose the rates strategy you desire and type in the necessary information. Design your profile and purchase the order using your PayPal profile or Visa or Mastercard.

- Opt for the data file format and obtain the lawful file design in your system.

- Complete, revise and printing and indication the received Alaska Sample Letter for Tax Clearance Letters.

US Legal Forms will be the greatest local library of lawful kinds in which you will find different file layouts. Make use of the service to obtain expertly-made documents that adhere to status demands.

Form popularity

FAQ

Do you have physical nexus in Alaska? If you live in Alaska, you're in luck. Alaska does not have a state-wide sales tax! Instead, the state recently passed legislation allowing local jurisdictions to elect to require that e-commerce businesses with economic nexus to collect sales tax.

Alaska does not levy a general sales tax or an individual income tax. However, some localities levy general sales taxes. After federal transfers, Alaska's largest sources of per capita revenue were property taxes ($2,329) and charges ($2,147), such as state university tuition and highway tolls.

Any kind of economic activity could trigger the nexus, once your total sales reach a certain threshold amount. The threshold in Alaska is $100,000 in annual sales or 200 separate sales transactions, whichever your business reaches first.

What is economic nexus? The term economic nexus refers to a business presence in a US state that makes an out-of-state seller liable to collect sales tax there once a set level of transactions or sales activity is met.

Having a clearance certificate confirms that an estate of a person who died, trust, or corporation has paid all amounts of income tax and GST/HST, interest, and penalties it owed at the time the certificate was issued, or that the Minister of National Revenue has accepted security for the payment.

Alaska does not impose a statewide sales tax and therefore does not have any statewide sales tax exemptions. Cities and boroughs are authorized to levy a sales and use tax on sales, rents, or services made within the boroughs or city. Local exemptions may be granted by ordinance.

The Alaska Constitution provides that the State of Alaska is exempt from all taxes emanating from within Alaska. Taxes emanating from within Alaska include city and/or borough levied taxes, as well as state taxes, and includes sales, use, room, property, and other miscellaneous taxes.

Form 6000 is the standard Alaska Corporation Net Income Tax.