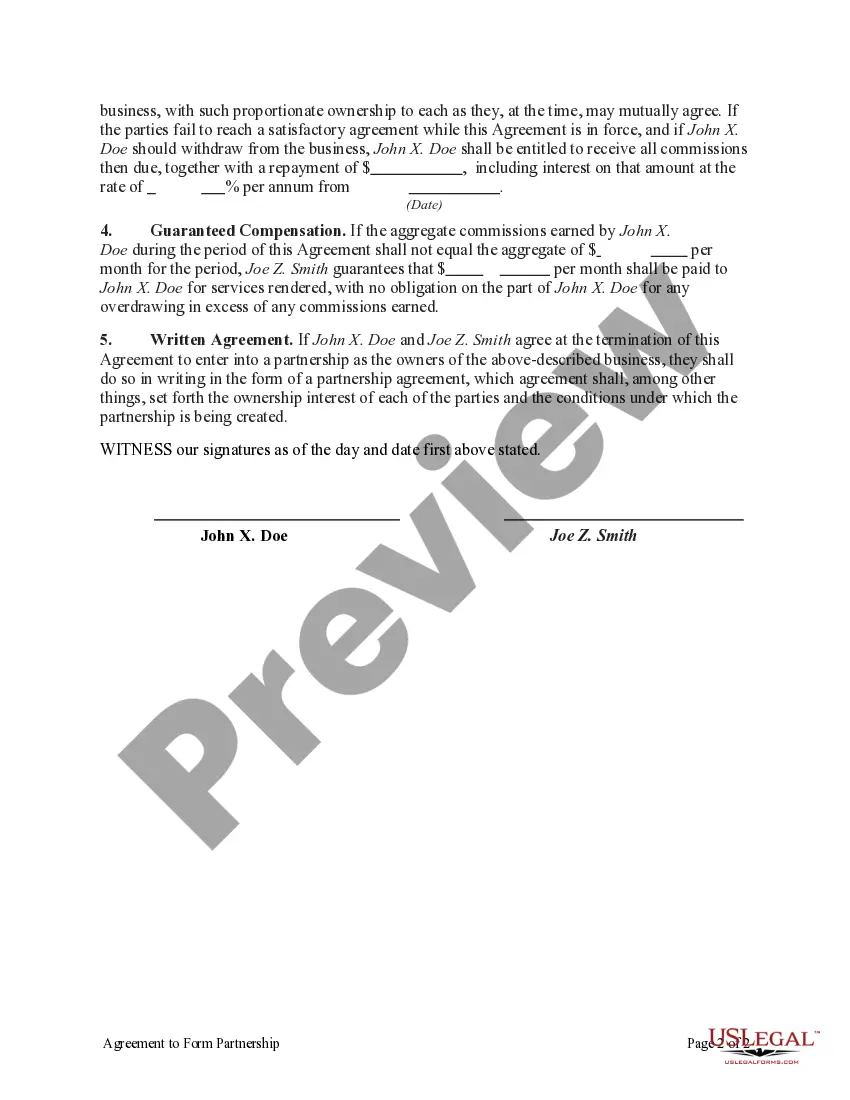

Alaska Agreement to Form Partnership in Future to Conduct Business — Explained An Alaska Agreement to Form Partnership in Future to Conduct Business refers to a legal document that outlines the intentions of two or more parties to establish a partnership at a later date. This agreement serves as a preliminary understanding between the parties involved before entering into a formal partnership arrangement. Keywords: Alaska, Agreement to Form Partnership, Future, Conduct Business, Legal Document, Preliminary Understanding, Formal Partnership Arrangement. Types of Alaska Agreement to Form Partnership in Future to Conduct Business: 1. Alaska General Partnership Agreement: This type of agreement outlines the terms and conditions under which the partners plan to operate a general partnership in Alaska. It includes provisions related to profit sharing, decision-making authority, contribution of capital, and roles and responsibilities of each partner. 2. Alaska Limited Partnership Agreement: In this arrangement, there are two types of partners involved: general partners and limited partners. General partners have unlimited liability and actively participate in the business operations, while limited partners have limited liability and only provide capital without participating in the day-to-day management of the business. 3. Alaska Limited Liability Partnership Agreement: This agreement allows professionals, such as lawyers, accountants, or architects, to form a partnership while enjoying the benefits of limited liability protection. In this partnership model, each partner is shielded from personal liability for the actions or debts of other partners. 4. Alaska Joint Venture Agreement: A joint venture agreement is formed when two or more parties come together for a specific project or business venture. This agreement outlines the goals, responsibilities, and profit-sharing arrangements for each party involved. It helps ensure that all parties have a clear understanding of their roles and obligations in the joint business endeavor. 5. Alaska Silent Partnership Agreement: This type of agreement is formed when one partner provides capital to a business but does not actively participate in its day-to-day operations. The silent partner typically receives a share of profits in proportion to their investment. 6. Alaska Partnership Agreement for Startups: This agreement is tailored for startups planning to enter into a partnership in the future. It may include provisions related to intellectual property rights, equity sharing, investment commitments, and the criteria for triggering the formal partnership formation. In conclusion, an Alaska Agreement to Form Partnership in Future to Conduct Business acts as a preliminary understanding between parties intending to establish a partnership. The specific type of partnership agreement chosen may vary based on the nature of the business, the liability preferences of the partners, and the objectives of the partnership. It is crucial to consult legal professionals to draft and tailor the agreement according to the specific needs and circumstances of the parties involved.

Alaska Agreement to Form Partnership in Future to Conduct Business — Explained An Alaska Agreement to Form Partnership in Future to Conduct Business refers to a legal document that outlines the intentions of two or more parties to establish a partnership at a later date. This agreement serves as a preliminary understanding between the parties involved before entering into a formal partnership arrangement. Keywords: Alaska, Agreement to Form Partnership, Future, Conduct Business, Legal Document, Preliminary Understanding, Formal Partnership Arrangement. Types of Alaska Agreement to Form Partnership in Future to Conduct Business: 1. Alaska General Partnership Agreement: This type of agreement outlines the terms and conditions under which the partners plan to operate a general partnership in Alaska. It includes provisions related to profit sharing, decision-making authority, contribution of capital, and roles and responsibilities of each partner. 2. Alaska Limited Partnership Agreement: In this arrangement, there are two types of partners involved: general partners and limited partners. General partners have unlimited liability and actively participate in the business operations, while limited partners have limited liability and only provide capital without participating in the day-to-day management of the business. 3. Alaska Limited Liability Partnership Agreement: This agreement allows professionals, such as lawyers, accountants, or architects, to form a partnership while enjoying the benefits of limited liability protection. In this partnership model, each partner is shielded from personal liability for the actions or debts of other partners. 4. Alaska Joint Venture Agreement: A joint venture agreement is formed when two or more parties come together for a specific project or business venture. This agreement outlines the goals, responsibilities, and profit-sharing arrangements for each party involved. It helps ensure that all parties have a clear understanding of their roles and obligations in the joint business endeavor. 5. Alaska Silent Partnership Agreement: This type of agreement is formed when one partner provides capital to a business but does not actively participate in its day-to-day operations. The silent partner typically receives a share of profits in proportion to their investment. 6. Alaska Partnership Agreement for Startups: This agreement is tailored for startups planning to enter into a partnership in the future. It may include provisions related to intellectual property rights, equity sharing, investment commitments, and the criteria for triggering the formal partnership formation. In conclusion, an Alaska Agreement to Form Partnership in Future to Conduct Business acts as a preliminary understanding between parties intending to establish a partnership. The specific type of partnership agreement chosen may vary based on the nature of the business, the liability preferences of the partners, and the objectives of the partnership. It is crucial to consult legal professionals to draft and tailor the agreement according to the specific needs and circumstances of the parties involved.