Alaska Assignment Creditor's Claim Against Estate

Description

How to fill out Assignment Creditor's Claim Against Estate?

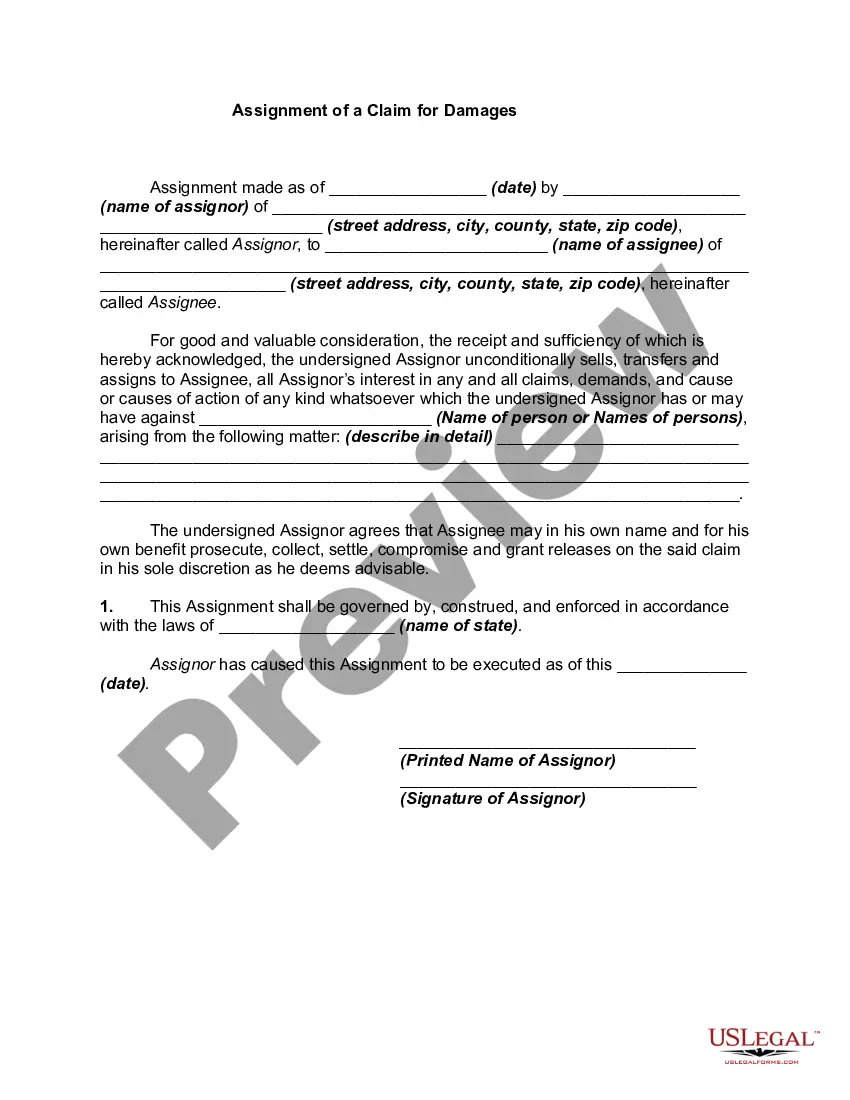

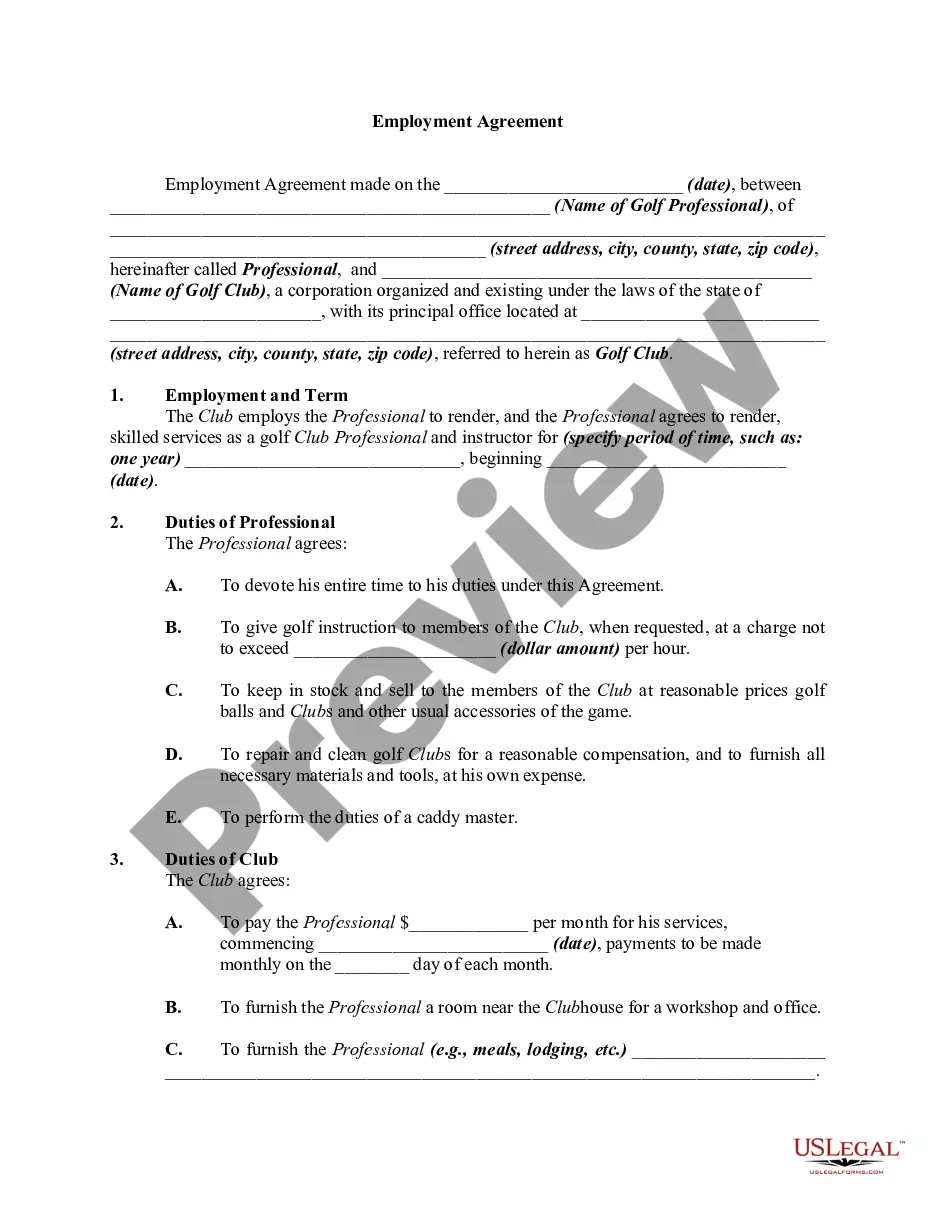

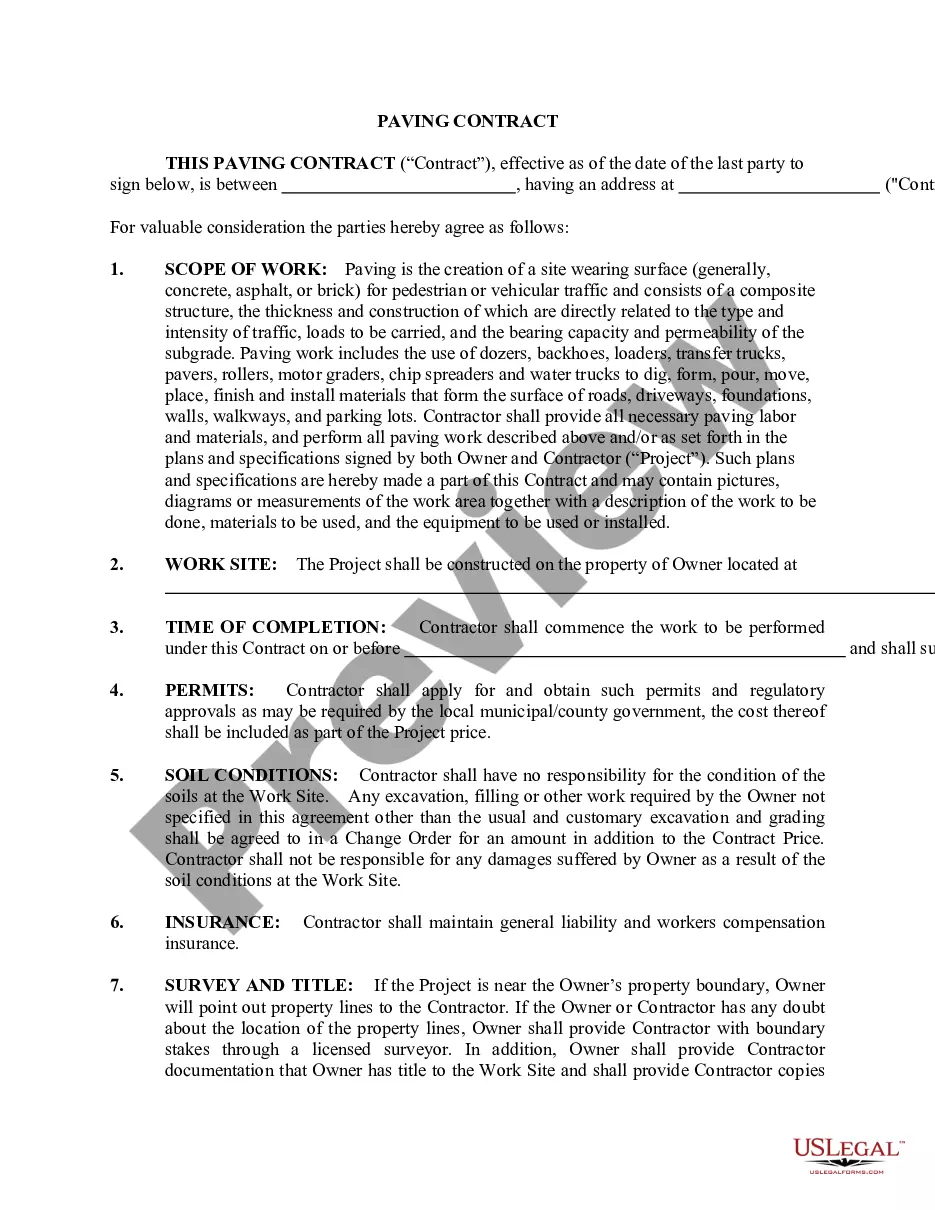

You can spend time online searching for the official document template that meets the federal and state requirements you need.

US Legal Forms offers thousands of legal documents that have been reviewed by professionals.

You can conveniently download or print the Alaska Assignment Creditor's Claim Against Estate from your service.

Review the form details to confirm that you have chosen the correct version. If available, utilize the Review button to examine the document template as well.

- If you possess a US Legal Forms account, you can sign in and click the Download button.

- Afterward, you can fill out, modify, print, or sign the Alaska Assignment Creditor's Claim Against Estate.

- Every legal document template you purchase is yours indefinitely.

- To obtain an additional copy of any purchased form, navigate to the My documents section and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the straightforward instructions below.

- First, ensure that you have selected the correct document template for the state or city of your choice.

Form popularity

FAQ

What debt is forgiven when you die? Most debts have to be paid through your estate in the event of death. However, federal student loan debts and some private student loan debts may be forgiven if the primary borrower dies.

If you live in a community property state, debts incurred after the marriage by one spouse can be treated as a shared financial obligation. So if your spouse opened up a credit card or took out a business loan, then passed away you could still be responsible for paying it.

As we have covered in our blog before, Ohio courts have been very clear: estate creditor's must present their claims within 6 months of the decedent's date of death.

In New York, creditors have a maximum of seven months to file claims against an estate.

No, when someone dies owing a debt, the debt does not go away. Generally, the deceased person's estate is responsible for paying any unpaid debts. The estate's finances are handled by the personal representative, executor, or administrator.

Every personal representative must, unless the notice has been given by a special administrator as provided in Section 215 of this title, within two (2) months after the issuance of his letters, file notice to the creditors of the decedent stating that claims against said deceased will be forever barred unless

Unsecured Creditors The notice must state that the creditor has four months for bringing forth any claims against the estate. If the unsecured creditor does not act within that time period, debt collection may be barred.

The cut and dry answer is this: Your debt belongs to you and you alone; it is not passed on to your family members when you die.

How long does a probate take? Probate usually takes between six months and a year to finish, but often longer. A probate may take more time if there are debts to handle, disagreements between the beneficiaries or heirs, problems finding or transferring property or other complicated matters.

If you received a cash inheritance, the court may order the bank account levied, which would allow the creditor to take the funds in the bank account to settle the debt. If the inheritance is real estate, the creditor may place a lien on the property.