Dear [Debt Collector's Name], I am writing to you in regard to the Fair Debt Collection Practices Act (FD CPA) and my rights as a consumer. I have recently been contacted by your agency regarding an alleged debt, and I would like to bring to your attention the provisions outlined in the FD CPA that must be adhered to during our communication. Under the FD CPA, debt collectors are required to provide consumers with certain information and adhere to specific practices. I expect your agency to comply with these regulations to ensure a fair and lawful debt collection process. Firstly, I would like to state that I am aware of my rights as a consumer and demand that you respect them throughout our interactions. One of these rights is to request written verification of the debt you claim I owe. According to section 809(b) of the FD CPA, you are obliged to provide me with a validation of the debt within five days of our initial contact. This verification should include information such as the amount owed, the name of the original creditor, and any additional details relevant to the debt. Moreover, I would like to express my expectation for you to cease all communication until this debt has been properly validated. As per section 805(c) of the FD CPA, if a consumer disputes the validity of a debt in writing, the debt collector must cease all collection efforts until the requested verification has been provided. I am requesting that you halt any attempts to collect on this debt until you can provide me with the requested documentation. Additionally, I want to emphasize that I do not wish to be contacted at inconvenient times or places. Section 805(a)(1) of the FD CPA clearly states that debt collectors are prohibited from contacting consumers at inconvenient hours or places, unless the consumer has explicitly given permission to do so. In consideration of this provision, I kindly request that you restrict your communication to regular business hours through written correspondence. Furthermore, I expect you to respect my right to privacy. Pursuant to section 804(b) of the FD CPA, debt collectors are prohibited from discussing a consumer's debt with any unauthorized third parties. This includes friends, family, and coworkers. I insist that you refrain from contacting anyone other than myself in relation to this debt. Please be aware that any violation of the FD CPA may result in legal action being pursued against your agency. I understand that this law grants me the right to seek damages, including statutory fines, attorney fees, and actual damages caused by any violations. I hope that we can resolve this matter appropriately and amicably within the boundaries set forth by the FD CPA. Furthermore, I am awaiting your prompt response, including the requested debt validation, and your commitment to honoring the regulations stipulated by the Fair Debt Collection Practices Act. Sincerely, [Your Name]

Alaska Sample Letter to Debt Collector Re Fair Debt Collection and Practices Act

Description

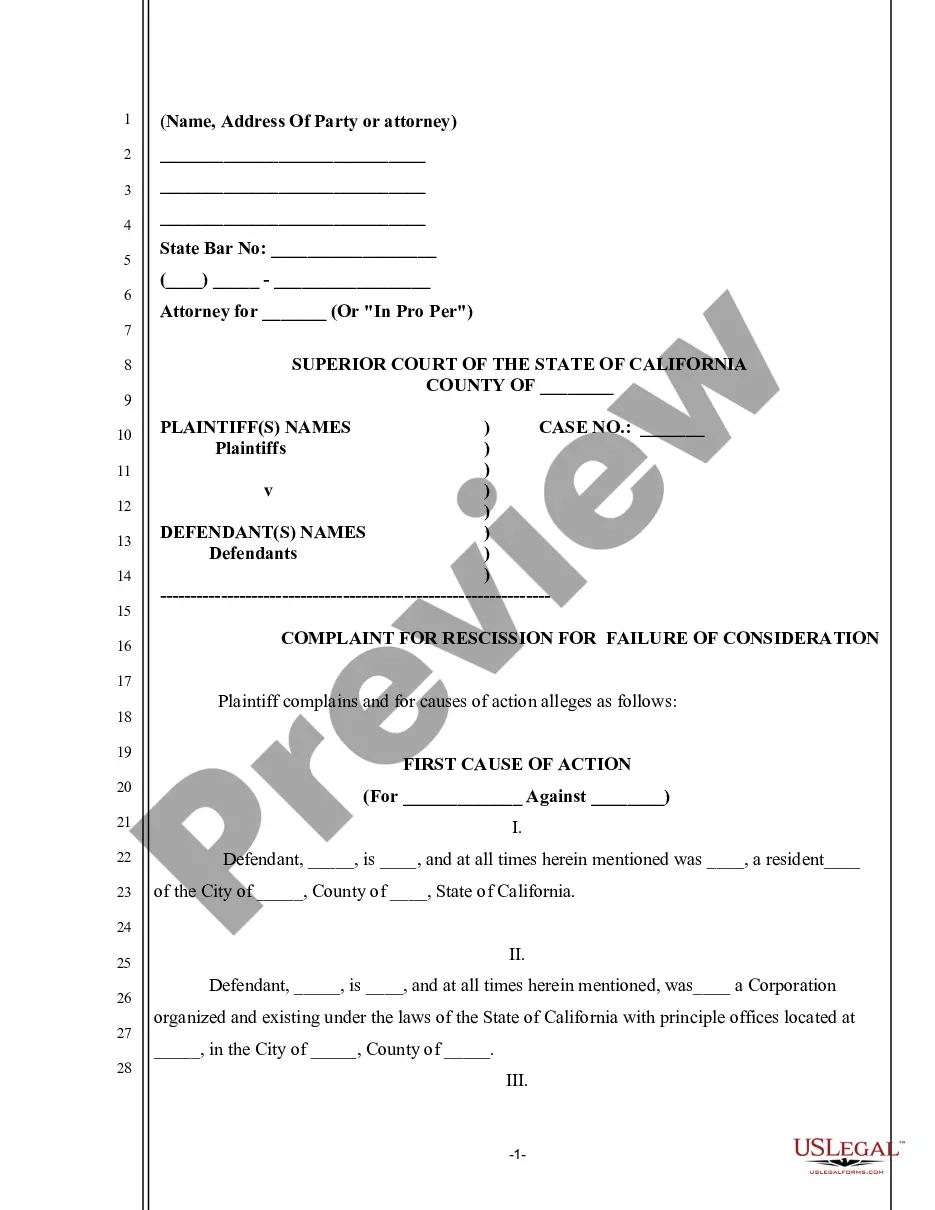

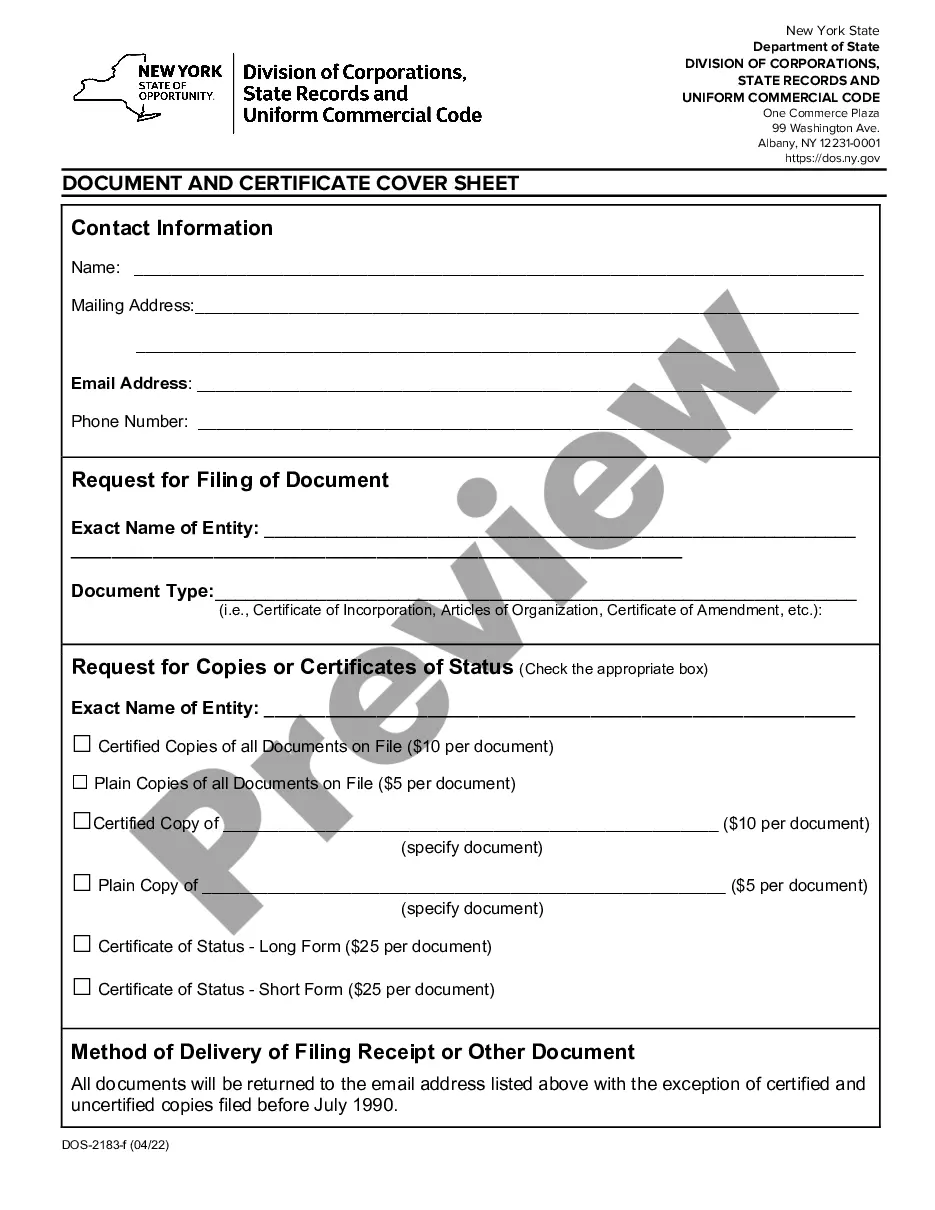

How to fill out Alaska Sample Letter To Debt Collector Re Fair Debt Collection And Practices Act?

If you want to comprehensive, obtain, or print legitimate papers templates, use US Legal Forms, the greatest selection of legitimate kinds, which can be found on the Internet. Utilize the site`s basic and convenient look for to find the paperwork you require. Different templates for business and personal uses are categorized by groups and states, or search phrases. Use US Legal Forms to find the Alaska Sample Letter to Debt Collector Re Fair Debt Collection and Practices Act in a couple of clicks.

Should you be presently a US Legal Forms consumer, log in to the profile and then click the Acquire key to get the Alaska Sample Letter to Debt Collector Re Fair Debt Collection and Practices Act. You can even access kinds you formerly downloaded inside the My Forms tab of your respective profile.

If you use US Legal Forms for the first time, follow the instructions under:

- Step 1. Ensure you have selected the shape to the proper area/region.

- Step 2. Use the Preview solution to check out the form`s content. Never neglect to read the description.

- Step 3. Should you be unhappy together with the form, use the Search industry on top of the display to get other variations of your legitimate form design.

- Step 4. When you have found the shape you require, click the Purchase now key. Select the prices strategy you choose and add your references to register for the profile.

- Step 5. Method the financial transaction. You can use your Мisa or Ьastercard or PayPal profile to complete the financial transaction.

- Step 6. Choose the formatting of your legitimate form and obtain it on the gadget.

- Step 7. Full, change and print or indicator the Alaska Sample Letter to Debt Collector Re Fair Debt Collection and Practices Act.

Each legitimate papers design you get is your own permanently. You may have acces to each form you downloaded inside your acccount. Click the My Forms area and decide on a form to print or obtain again.

Compete and obtain, and print the Alaska Sample Letter to Debt Collector Re Fair Debt Collection and Practices Act with US Legal Forms. There are thousands of professional and state-particular kinds you can use to your business or personal requires.

Form popularity

FAQ

A debt collector may not use any false, deceptive, or misleading representation or means in connection with the collection of any debt.

The Fair Debt Collection Practices Act (FDCPA) makes it illegal for debt collectors to use abusive, unfair, or deceptive practices when they collect debts.

Harassment of the debtor by the creditor ? More than 40 percent of all reported FDCPA violations involved incessant phone calls in an attempt to harass the debtor.

Contacted By a Debt Collector? Know Your Rights. Debt collectors are not allowed to threaten you with arrest, violence, or harm. They are not allowed to threaten to call or harass your employer or your family members, misrepresent the amount you owe, use obscene or profane language, or call repeatedly to annoy you.

Debt collectors cannot harass or abuse you. They cannot swear, threaten to illegally harm you or your property, threaten you with illegal actions, or falsely threaten you with actions they do not intend to take. They also cannot make repeated calls over a short period to annoy or harass you.

An effective debt collection letter should include all of the following: The total amount the client owes you. The original date the balance was due. Instructions detailing how to make the overdue payment. The new due date, whether a specific date or as soon as possible.

The Federal Fair Debt Collection Practices Act (FDCPA) and the Alaska Unfair Trade Practices and Consumer Protection Act prevent debt collectors from using unfair and deceptive practices when collecting a debt. These laws do not, however, forgive any legitimate debt you may owe.

Collectors are required by Fair Debt Collection Practices Act (FDCPA) to send you a written debt validation notice with information about the debt they're trying to collect. It must be sent within five days of the first contact. The debt validation letter includes: The amount owed.