An Alaska Employment Offer Letter is a legal document that outlines the terms and conditions of employment for an individual who has been offered a job in the state of Alaska. It specifies important details such as the job title, start date, compensation, benefits, and various other provisions that govern the employer-employee relationship. When it comes to determining whether an employee is exempt or non-exempt, there are various factors considered in accordance with the Alaska labor laws. The status of being exempts or non-exempt relates to an employee's eligibility for overtime pay. Non-exempt employees are entitled to receive overtime pay for any hours worked beyond the standard 40-hour workweek, whereas exempt employees, as the term suggests, are exempt from this requirement. Instead, exempt employees typically receive a fixed salary regardless of the number of hours worked. Alaska recognizes different categories for determining whether an employee can be classified as exempt or non-exempt, the most common of which are: 1. Executive Exemption: Employees who primarily perform managerial duties, supervise two or more full-time employees, have hiring and firing authority, and exercise significant independent judgment may qualify for this exemption. Executives typically hold high-level positions within an organization. 2. Administrative Exemption: Employees who perform non-manual work directly related to the management or general business operations of the employer may be eligible for this exemption. Administrative employees often have decision-making authority and exercise discretion in matters of significance. 3. Professional Exemption: Professionals in fields such as law, medicine, teaching, or other specialized occupations may qualify for this exemption. To be exempt, these employees generally need to have advanced knowledge or specialized skills obtained through extended education or training. 4. Outside Sales Exemption: Employees who primarily engage in sales or solicitations outside the employer's place of business may be classified as exempt. This exemption typically applies to sales representatives who spend a significant amount of time outside the office. It is essential for employers in Alaska to understand the criteria for classification as exempt or non-exempt employees. Incorrectly classifying employees can lead to legal repercussions, including potential wage and hour claims. Consulting legal professionals or Alaska Labor Standards and Safety Division can ensure compliance with the state's labor laws and prevent any potential issues. In conclusion, an Alaska Employment Offer Letter must clearly state whether the offered position is exempt or non-exempt, based on the specific criteria provided in Alaska labor laws. Employers should accurately classify employees to determine eligibility for overtime pay, which plays a crucial role in establishing fair and lawful employment practices.

Alaska Employment Offer Letter Exempt or Non-Exempt

Description

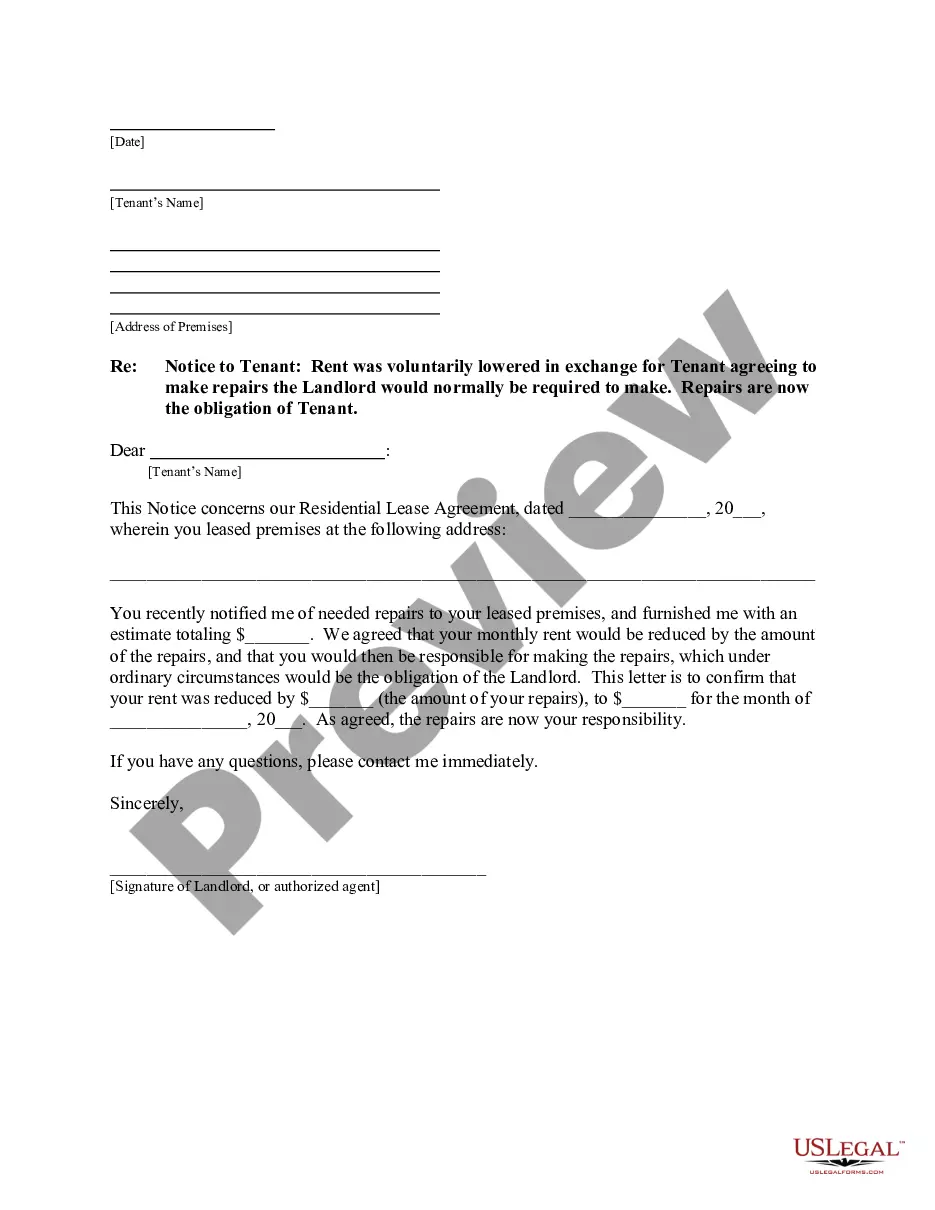

How to fill out Alaska Employment Offer Letter Exempt Or Non-Exempt?

US Legal Forms - one of many greatest libraries of legitimate varieties in the United States - gives a variety of legitimate papers templates it is possible to download or print. While using website, you can find 1000s of varieties for organization and person purposes, sorted by classes, says, or search phrases.You can find the most recent types of varieties just like the Alaska Employment Offer Letter Exempt or Non-Exempt in seconds.

If you have a membership, log in and download Alaska Employment Offer Letter Exempt or Non-Exempt through the US Legal Forms collection. The Acquire button will show up on every develop you see. You get access to all in the past saved varieties within the My Forms tab of your respective bank account.

If you would like use US Legal Forms the first time, allow me to share simple guidelines to help you get started off:

- Be sure to have picked out the right develop for the town/area. Click on the Review button to analyze the form`s information. Read the develop information to ensure that you have selected the correct develop.

- When the develop doesn`t suit your demands, utilize the Look for discipline near the top of the display to obtain the one that does.

- If you are pleased with the form, verify your decision by clicking the Get now button. Then, choose the pricing plan you favor and offer your qualifications to sign up to have an bank account.

- Process the financial transaction. Utilize your charge card or PayPal bank account to complete the financial transaction.

- Find the format and download the form on your own product.

- Make changes. Fill out, change and print and signal the saved Alaska Employment Offer Letter Exempt or Non-Exempt.

Each web template you included in your account lacks an expiration day and it is the one you have permanently. So, if you want to download or print another version, just visit the My Forms segment and click on around the develop you will need.

Gain access to the Alaska Employment Offer Letter Exempt or Non-Exempt with US Legal Forms, the most considerable collection of legitimate papers templates. Use 1000s of professional and condition-distinct templates that meet up with your small business or person requires and demands.

Form popularity

FAQ

Exempt (Salaried) Employees. As part of the FLSA, exempt employees are those individuals who are not subject to receive overtime pay. To qualify for exempt status, the employee must meet the salary minimum and the position must pass the Department of Labor (DOL) Job Duties Test.

An exempt employee is an employee who does not receive overtime pay or qualify for minimum wage. Exempt employees are paid a salary rather than by the hour, and their work is executive or professional in nature.

Because the statutory language states that the minimum wage will be adjusted annually for inflation and there was no inflation in 2020, the minimum wage will remain at $10.34 in the calendar year 2022. By law, Alaska's minimum wage must remain at least $1 per hour over the federal minimum wage.

Like many other states, Alaska is an at-will employment state. This means that either employee or employer can terminate the work agreement at any time. The responsibility of the employer is to make sure that the reason for the firing is not illegal.

Exempt employees must be paid on a salary basis, as discussed above. Nonexempt employees may be paid on a salary basis for a fixed number of hours or under the fluctuating workweek method. Salaried nonexempt employees must still receive overtime in accordance with federal and state laws.

In Alaska, an employer does not need to give a reason to fire an employee. Therefore, he/she has not violated any wage and hour law. You may wish to check with an attorney to see whether you can file a civil lawsuit against your employer for wrongful discharge.

Individuals employed in a bona fide administrative, executive, and professional capacity who pass the duties tests are exempt from the overtime provisions of the law (AK Stat. Sec. 23.10.

Public Policy: Like many other states, Alaska observes what's known as a public policy exception to the notion of at-will employment. Basically, this means Alaska's employees cannot be fired for reasons Alaskan society would recognize as illegal.