Alaska Loan Agreement for Friends: A Comprehensive Guide Introduction: The Alaska Loan Agreement for Friends is a legal document that outlines the terms and conditions of a loan between friends residing in the state of Alaska. This agreement ensures clarity and protection for both parties involved and helps maintain a healthy financial relationship. Here, we explore the key aspects of an Alaska Loan Agreement for Friends, highlighting its elements, legal requirements, and possible variations. Keywords: Alaska Loan Agreement for Friends, legal document, terms and conditions, loan, friends, financial relationship. Key Elements of an Alaska Loan Agreement for Friends: 1. Parties Involved: The agreement should clearly identify the lender (the friend lending the money) and the borrower (the friend receiving the funds). This section includes their full legal names, addresses, and contact information. 2. Loan Amount and Interest: The agreement specifies the loan amount provided by the lender and whether interest will be charged. If there is an agreed-upon interest rate, it should be clearly stated, including whether it will be compounded or simple interest. 3. Repayment Terms: This section outlines the repayment terms, including the repayment schedule, installment amounts, and due dates. It may also detail any late-payment penalties or grace periods, if applicable. 4. Security or Collateral: If the loan is secured by collateral, such as a personal asset, it should be clearly described. This protects the lender by providing recourse in case of default. 5. Governing Law: The agreement should state that it is governed by the laws of the State of Alaska, ensuring that any disputes will be settled according to Alaska's legal framework. 6. Signatures and Witnesses: Both parties should sign the agreement to indicate their understanding and acceptance of its terms. It is also recommended having witnesses present during the signing, although this may not be a legal requirement in Alaska. Types of Alaska Loan Agreements for Friends: 1. Simple Loan Agreement: This is the most basic form of loan agreement between friends, where the lender provides a specific amount for a certain period without charging any interest. 2. Promissory Note: If the loan involves interest, a promissory note can be used to outline the terms and conditions. This note serves as evidence of the loan, including repayment terms, interest rate, and any other relevant details. 3. Secured Loan Agreement: In cases where a tangible asset is used as collateral to secure the loan, a secured loan agreement is necessary. This agreement specifies the terms of the loan and the details of the collateral provided. Conclusion: The Alaska Loan Agreement for Friends acts as a legally binding contract, protecting both parties in a lending arrangement between friends. By clearly defining the terms and conditions, including loan amount, interest, repayment terms, and governing law, this agreement fosters transparency and minimizes potential misunderstandings or conflicts. Whether it be a simple loan agreement, promissory note, or secured loan agreement, friends in Alaska have various options available to ensure a smooth borrowing and lending process.

Alaska Loan Agreement for Friends

Description

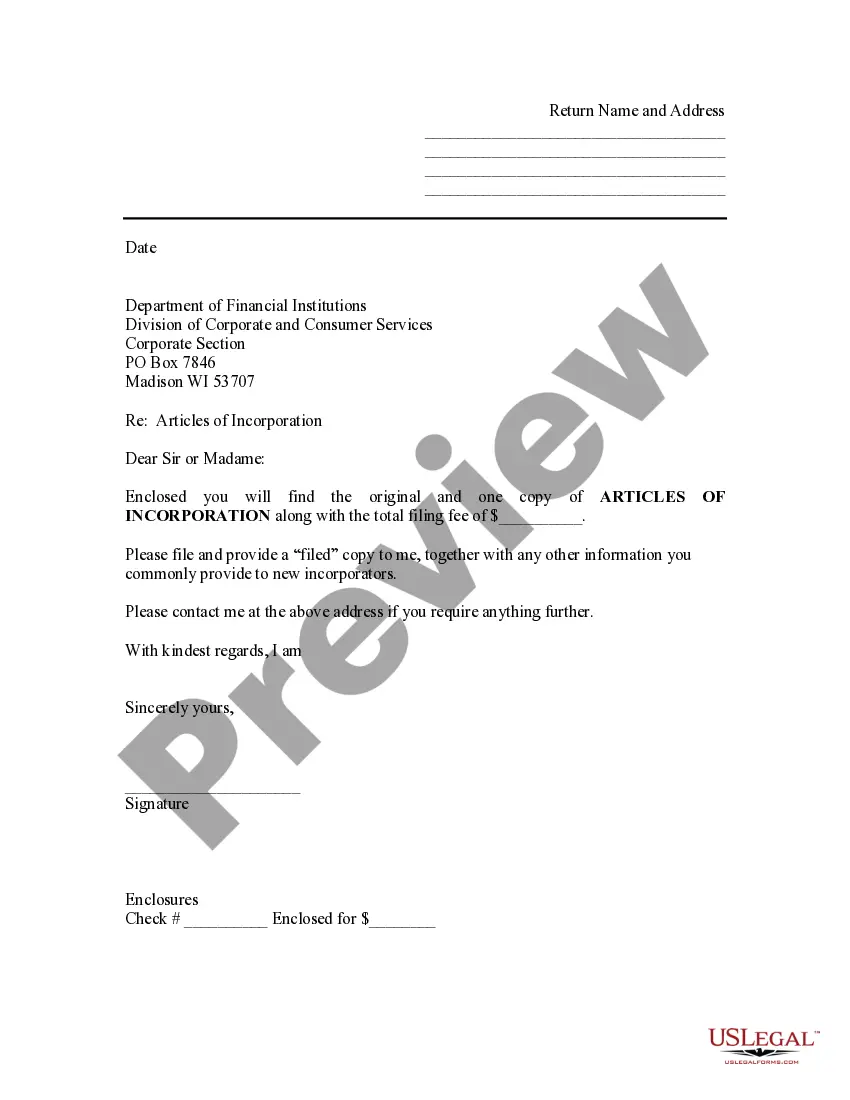

How to fill out Loan Agreement For Friends?

US Legal Forms - one of several largest libraries of legitimate kinds in the United States - gives a variety of legitimate document templates it is possible to obtain or produce. While using web site, you can get a huge number of kinds for company and individual functions, sorted by categories, suggests, or keywords.You will discover the most up-to-date models of kinds such as the Alaska Loan Agreement for Friends in seconds.

If you already possess a registration, log in and obtain Alaska Loan Agreement for Friends from your US Legal Forms local library. The Acquire button will appear on every single develop you view. You have access to all earlier saved kinds in the My Forms tab of your bank account.

If you wish to use US Legal Forms for the first time, here are straightforward instructions to obtain started out:

- Make sure you have picked the right develop for your city/county. Go through the Review button to analyze the form`s content. Look at the develop description to actually have selected the proper develop.

- In case the develop does not satisfy your demands, make use of the Research field at the top of the display screen to find the the one that does.

- When you are content with the shape, verify your selection by clicking the Buy now button. Then, select the rates program you like and supply your qualifications to register to have an bank account.

- Procedure the purchase. Make use of charge card or PayPal bank account to finish the purchase.

- Pick the formatting and obtain the shape on your own device.

- Make alterations. Load, modify and produce and signal the saved Alaska Loan Agreement for Friends.

Every web template you included with your account lacks an expiry date and is also your own for a long time. So, if you would like obtain or produce one more backup, just check out the My Forms area and then click in the develop you will need.

Get access to the Alaska Loan Agreement for Friends with US Legal Forms, the most considerable local library of legitimate document templates. Use a huge number of expert and express-particular templates that satisfy your organization or individual needs and demands.

Form popularity

FAQ

The two sides must sign a promissory note that spells out the interest rate, terms and conditions, length of repayment period, and ability to transfer the loan to another party.

What should be in a personal loan contract? Names and addresses of the lender and the borrower. Information about the loan co-borrower or cosigner, if it's a joint personal loan. Loan amount and the method for disbursement (lump sum, installments, etc.) Date the loan was provided. Expected repayment date.

It makes sense to write-up a formal loan agreement ? even for very small amounts. If you have something down in writing at the start that is signed, it can help with disputes later on. A written loan agreement can benefit both parties because you can use it as protection if one of you breaches the terms.

Personal loans Promissory notes are sometimes used for loans between friends or relatives. Especially if a significant amount is being loaned, it is a good idea to have a promissory note to assure the payee's ability to get repaid from the payor's estate in the event of the death of the payor.

What should be in a personal loan contract? Names and addresses of the lender and the borrower. Information about the loan co-borrower or cosigner, if it's a joint personal loan. Loan amount and the method for disbursement (lump sum, installments, etc.) Date the loan was provided. Expected repayment date.

Wiedman suggests putting everything involving the loan in your written agreement: "The date of the loan, loan amount, repayment terms, interest rate, payment due dates and so forth." That said, putting everything in writing can make things awkward, but it's a safe move if you want to ensure repayment.

The two sides must sign a promissory note that spells out the interest rate, terms and conditions, length of repayment period, and ability to transfer the loan to another party.

Steps to take before you lend money Only loan to people you trust. ... Make sure the borrower knows the loan is not a gift. ... Inspect the borrower's financial statements. ... Limit the loan amount to what you can afford. ... If you deny someone a loan, be careful of cosigning loans. ... Get it in writing!