Title: Understanding the Alaska Notice of Public Sale of Collateral (Consumer Goods) on Default Introduction: Alaska law enforces a Notice of Public Sale of Collateral (Consumer Goods) on Default to protect the rights of lenders and creditors in the event of non-payment or default by borrowers. This legal notice serves as a notification to the borrower and other interested parties regarding the intention to sell the collateral securing a loan or debt. Different types of public sale notices may exist, depending on the specific circumstances. In this article, we will delve into the details of the Alaska Notice of Public Sale of Collateral (Consumer Goods) on Default, explaining its significance and variations. 1. Understanding the Purpose of the Notice: The Alaska Notice of Public Sale of Collateral (Consumer Goods) on Default is a legal document that lenders and creditors use to inform borrowers and other relevant parties about their intent to sell the collateral when a borrower defaults on a loan or debt. Its purpose is to ensure transparency and provide interested parties with an opportunity to raise objections, redeem the collateral, or participate in the auction. 2. Key Elements of the Notice: — The Identification of the Parties Involved: The notice typically includes the names of the borrower and lender, clearly identifying the relationship between them. — Description of the Collateral: A detailed description of the consumer goods serving as collateral is provided. This includes specifics such as make, model, serial numbers, and any distinguishing features. — Default Overview: The notice outlines the reasons for which the borrower is in default, such as non-payment or breach of loan agreement terms. — Date, Time, and Location of the Sale: Specific details about the upcoming public auction or sale are mentioned, ensuring interested parties have ample time to make necessary arrangements. 3. Types of Alaska Notices of Public Sale of Collateral (Consumer Goods) on Default: — Automobile and Vehicle Notice: In cases where a vehicle or automobile serves as the collateral, a specific notice is provided, encompassing all relevant details pertaining to the sale of the particular vehicle. — Personal Property Notice: Consent is required before selling personal property serving as collateral (other than real estate). This type of notice will highlight the personal property being sold, providing a comprehensive description. 4. Consequences of the Sale: Once the public sale of collateral occurs, the lender will typically use the proceeds to cover the outstanding debt, fees, and expenses related to the sale. If there is any surplus, it may be returned to the borrower. On the other hand, if the sale does not cover the full debt amount, the lender may pursue legal action to recover the remaining balance. Conclusion: Alaska's Notice of Public Sale of Collateral (Consumer Goods) on Default plays a crucial role in protecting the rights of lenders and creditors, ensuring transparency and allowing for opportunities to redeem the collateral or bid in the auction. This notice acts as a legally binding document designed to facilitate fair practices in debt recovery and loan default situations.

Alaska Notice of Public Sale of Collateral (Consumer Goods) on Default

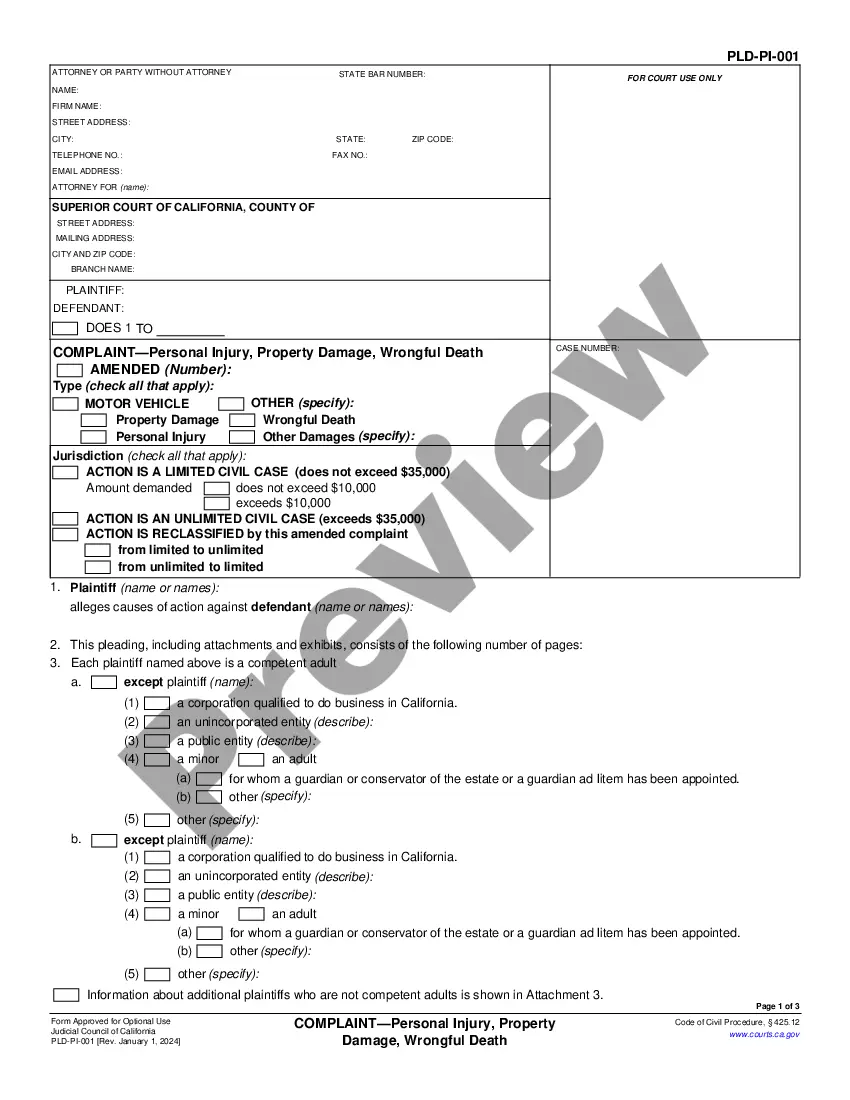

Description

How to fill out Alaska Notice Of Public Sale Of Collateral (Consumer Goods) On Default?

If you need to full, down load, or produce authorized papers layouts, use US Legal Forms, the largest selection of authorized types, which can be found on the web. Take advantage of the site`s basic and convenient look for to find the paperwork you require. Different layouts for company and personal uses are categorized by groups and suggests, or key phrases. Use US Legal Forms to find the Alaska Notice of Public Sale of Collateral (Consumer Goods) on Default with a few mouse clicks.

When you are presently a US Legal Forms customer, log in for your accounts and then click the Obtain switch to get the Alaska Notice of Public Sale of Collateral (Consumer Goods) on Default. You can also entry types you earlier acquired in the My Forms tab of the accounts.

Should you use US Legal Forms for the first time, refer to the instructions beneath:

- Step 1. Ensure you have chosen the form to the appropriate metropolis/country.

- Step 2. Take advantage of the Review choice to look through the form`s articles. Never neglect to read the explanation.

- Step 3. When you are unhappy with the type, use the Look for discipline on top of the display screen to get other models of your authorized type format.

- Step 4. Upon having discovered the form you require, click on the Get now switch. Pick the rates plan you prefer and add your credentials to register for an accounts.

- Step 5. Process the transaction. You can utilize your charge card or PayPal accounts to finish the transaction.

- Step 6. Find the file format of your authorized type and down load it on your own gadget.

- Step 7. Full, modify and produce or indication the Alaska Notice of Public Sale of Collateral (Consumer Goods) on Default.

Every authorized papers format you buy is your own forever. You possess acces to each and every type you acquired in your acccount. Select the My Forms segment and choose a type to produce or down load once again.

Contend and down load, and produce the Alaska Notice of Public Sale of Collateral (Consumer Goods) on Default with US Legal Forms. There are thousands of specialist and state-particular types you can utilize to your company or personal requirements.