An Alaska Subordination Agreement Subordinating Existing Mortgage to New Mortgage is a legal document used in real estate transactions to establish the priority of multiple mortgages on a property. Keywords that are relevant to this topic include: Alaska, subordination agreement, mortgage, existing mortgage, new mortgage, real estate, priority, legal document, property, lender, borrower. In Alaska, when a borrower seeks to refinance an existing mortgage with a new one, a subordination agreement may be necessary if there are multiple loans on the property. This agreement ensures that the new mortgage takes priority over the existing one. It clarifies the rights and priorities of the lenders involved. Different types of Alaska Subordination Agreement Subordinating Existing Mortgage to New Mortgage may include: 1. First Mortgage Subordination Agreement: This type of agreement is used when the existing mortgage is the first lien on the property. By signing the subordination agreement, the existing lender agrees to subordinate their lien to any new mortgage lender. 2. Second Mortgage Subordination Agreement: In situations where the existing mortgage is already subordinate to another mortgage, a second mortgage subordination agreement is required. This agreement ensures that the new mortgage takes priority over both the existing mortgage and the first subordinate mortgage. 3. Subsequent Mortgage Subordination Agreement: When a borrower wants to secure an additional loan or mortgage on a property, this agreement is used to establish the priority of the existing mortgages. It ensures that the new mortgage lender has priority over any other loans or mortgages after the first one. 4. Commercial Mortgage Subordination Agreement: In commercial real estate transactions, where multiple loans are involved, a commercial mortgage subordination agreement may be necessary. This agreement serves to establish the order of priority for the lenders, ensuring that they are protected in case of default or foreclosure. The Alaska Subordination Agreement Subordinating Existing Mortgage to New Mortgage is a critical legal document that protects the rights of lenders and borrowers. It ensures that the lender of the new mortgage has the first lien position on the property, giving them priority in case of default or foreclosure. This agreement is typically prepared by attorneys or experienced real estate professionals to ensure compliance with Alaska's laws and regulations.

Alaska Subordination Agreement Subordinating Existing Mortgage to New Mortgage

Description

How to fill out Alaska Subordination Agreement Subordinating Existing Mortgage To New Mortgage?

Are you within a place the place you need to have papers for possibly company or specific uses nearly every time? There are a variety of authorized file layouts accessible on the Internet, but discovering types you can rely on isn`t effortless. US Legal Forms provides 1000s of type layouts, like the Alaska Subordination Agreement Subordinating Existing Mortgage to New Mortgage, that happen to be composed to fulfill state and federal demands.

If you are currently knowledgeable about US Legal Forms site and also have your account, simply log in. Afterward, you are able to obtain the Alaska Subordination Agreement Subordinating Existing Mortgage to New Mortgage web template.

Should you not provide an account and would like to begin to use US Legal Forms, adopt these measures:

- Obtain the type you want and ensure it is to the appropriate area/state.

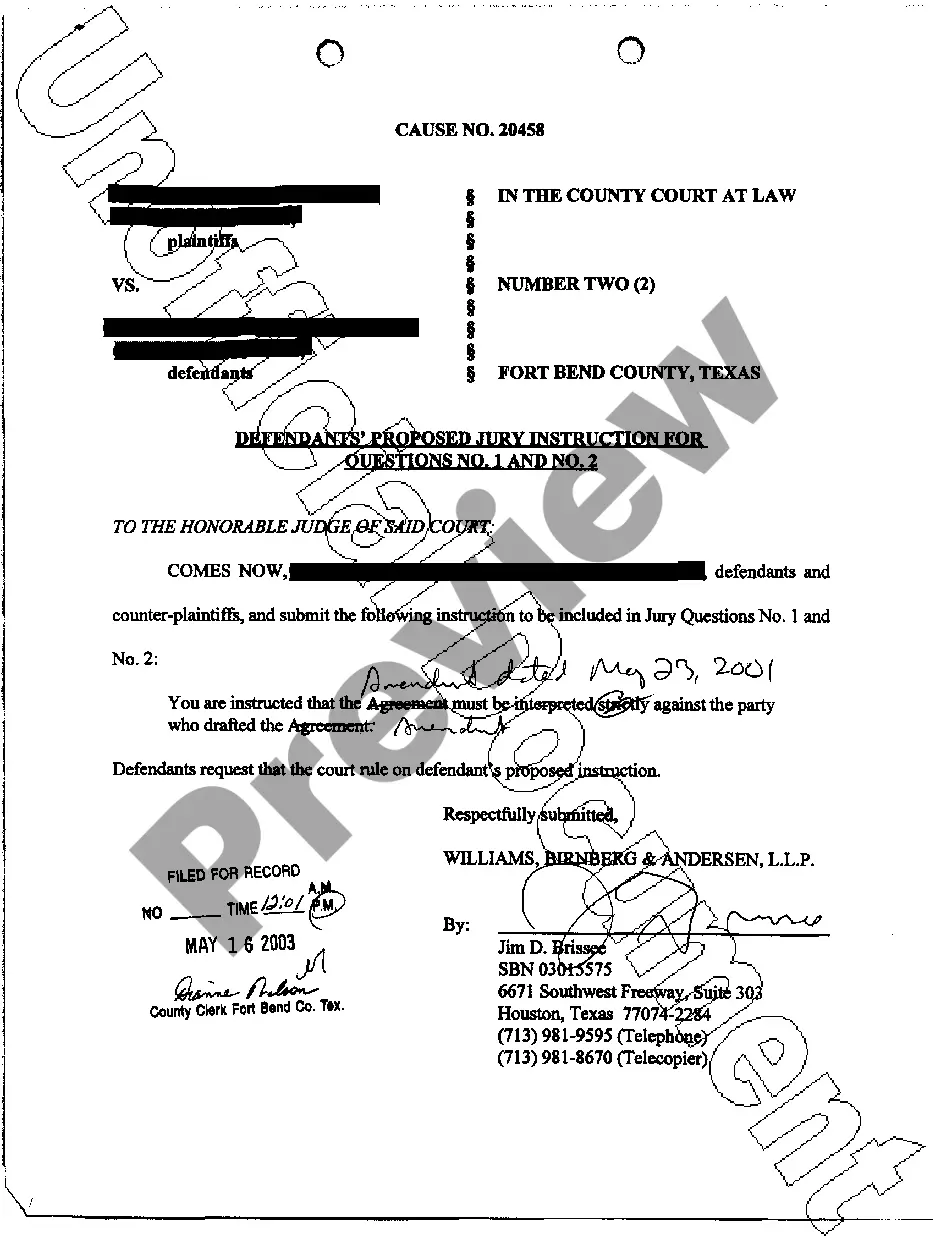

- Make use of the Review switch to examine the form.

- Read the information to actually have selected the correct type.

- If the type isn`t what you`re looking for, make use of the Research area to discover the type that meets your needs and demands.

- When you obtain the appropriate type, simply click Buy now.

- Opt for the costs plan you need, submit the specified info to produce your bank account, and purchase an order using your PayPal or bank card.

- Choose a convenient file file format and obtain your copy.

Locate every one of the file layouts you might have bought in the My Forms food list. You can aquire a further copy of Alaska Subordination Agreement Subordinating Existing Mortgage to New Mortgage any time, if necessary. Just click the required type to obtain or produce the file web template.

Use US Legal Forms, one of the most considerable collection of authorized kinds, in order to save efforts and steer clear of blunders. The service provides skillfully made authorized file layouts that you can use for a range of uses. Produce your account on US Legal Forms and begin creating your lifestyle easier.

Form popularity

FAQ

A subordinate mortgage loan is any loan not in the first lien position. The subordination order goes by the order the loans were recorded. For example, your first mortgage (the mortgage used to buy the house) is recorded first because it's the first loan you borrow.

Subordination clauses are most commonly found in mortgage refinancing agreements. Consider a homeowner with a primary mortgage and a second mortgage. If the homeowner refinances his primary mortgage, this in effect means canceling the first mortgage and reissuing a new one.

A subordination agreement is an instrument that allows a first lien or interest to be paid off and allows another first mortgage company to come in and be the first priority lien holder. It is very common for the borrower to pay subordination fees.

A subordination agreement prioritizes debts, ranking one behind another for purposes of collecting repayment from a debtor in the event of foreclosure or bankruptcy. A second-in-line creditor collects only when and if the priority creditor has been fully paid.

8) Keep the original signed subordination agreement in your file to be given to your title agent to record AT THE SAME TIME they record the RIM easement. Do not record the mortgage subordination agreement ahead of easement recording.

Many people have a subordinate mortgage in the form of a home equity line of credit or home equity loan. A subordinate mortgage is secured by your property but sits in second position, if you have a primary mortgage, for getting paid in the event you default.

Again, if you're refinancing your first mortgage and the property also has a subordinate mortgage, the refinancing lender will usually handle the process of getting the necessary subordination agreement. But you need to ensure that the required subordination agreement is completed before the new loan's closing date.

A subordination real estate mortgage clause gives the loan it's in reference to first lien position. It states that any other loans or liens on the property take a second lien position. Most first mortgage lenders won't fund a loan unless there is a subordination clause giving them first lien position.

A junior mortgage is a mortgage that is subordinate to a first or prior (senior) mortgage. A junior mortgage often refers to a second mortgage, but it could also be a third or fourth mortgage (e.g. home equity loans or lines of credit (HELOCs)).

The order of subordination is determined based on the type of loan against your property. If you only have one home mortgage and no other liens, you'll find that mortgage subordination won't come into play until you have more than one lien on your home.