Alaska Irrevocable Funded Life Insurance Trust where Beneficiaries Have Crummey Right of Withdrawal with First to Die Policy with Survivorship Rider

Description

How to fill out Irrevocable Funded Life Insurance Trust Where Beneficiaries Have Crummey Right Of Withdrawal With First To Die Policy With Survivorship Rider?

US Legal Forms - one of the most important collections of legal documents in the United States - offers a vast selection of legal document templates that you can download or print.

By using the website, you can access thousands of forms for business and personal use, organized by categories, states, or keywords. You can find the latest versions of documents such as the Alaska Irrevocable Funded Life Insurance Trust where Beneficiaries Have Crummey Right of Withdrawal with First to Die Policy with Survivorship Rider in just minutes.

If you already have an account, Log In and download the Alaska Irrevocable Funded Life Insurance Trust where Beneficiaries Have Crummey Right of Withdrawal with First to Die Policy with Survivorship Rider from the US Legal Forms library. The Download option will appear on every form you view. You have access to all previously saved forms in the My documents section of your account.

Complete the transaction. Use a credit card or PayPal account to finish the transaction.

Select the format and download the document to your device. Make changes. Fill out, modify, and print and sign the saved Alaska Irrevocable Funded Life Insurance Trust where Beneficiaries Have Crummey Right of Withdrawal with First to Die Policy with Survivorship Rider. Every format you saved in your account does not have an expiration date and is yours indefinitely. Therefore, if you wish to download or print another copy, simply navigate to the My documents section and click on the document you wish to access. Access the Alaska Irrevocable Funded Life Insurance Trust where Beneficiaries Have Crummey Right of Withdrawal with First to Die Policy with Survivorship Rider through US Legal Forms, one of the most comprehensive collections of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal needs.

- If you are using US Legal Forms for the first time, here are some simple steps to get started.

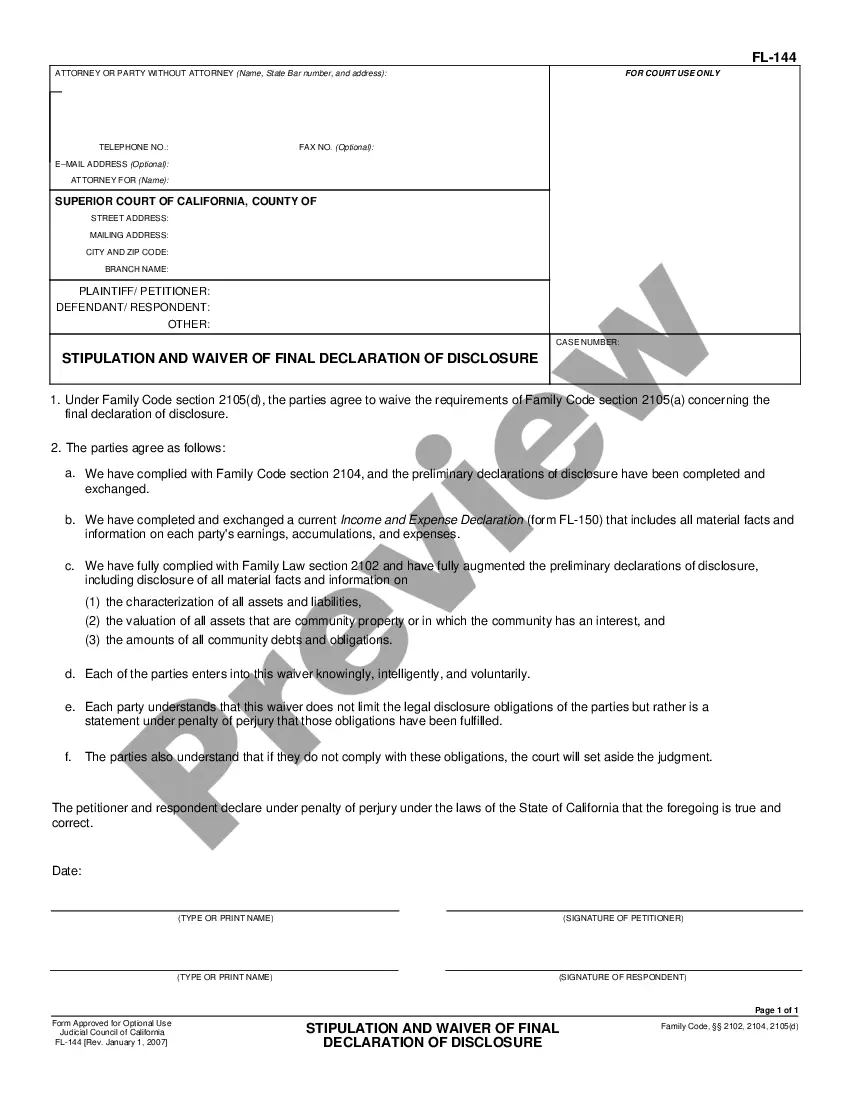

- Ensure you have selected the correct form for your city/state. Click on the Preview option to review the form's content.

- Check the form summary to confirm you have chosen the right document.

- If the form does not meet your needs, use the Search box at the top of the page to find the one that does.

- If you are satisfied with the document, affirm your choice by clicking on the Purchase now button.

- Then, choose the payment plan you desire and provide your details to register for an account.

Form popularity

FAQ

When the policyholder of an irrevocable trust passes away, the trust remains intact and the provisions outlined in the trust document dictate the distribution of assets. Specifically for the Alaska Irrevocable Funded Life Insurance Trust where Beneficiaries Have Crummey Right of Withdrawal with First to Die Policy with Survivorship Rider, the trust ensures that the beneficiaries receive their due benefits without going through probate, providing a streamlined financial legacy.

However, the cash value accumulating in a life insurance policy is free from taxation as is the death benefit. So there are no tax issues with having a policy owned in an ILIT.

As the Trustor of a trust, once your trust has become irrevocable, you cannot transfer assets into and out of your trust as you wish. Instead, you will need the permission of each of the beneficiaries in the trust to transfer an asset out of the trust.

Even an irrevocable trust can be revoked with a court order. A court may execute an order that permits the dissolution of a life insurance trust if changes in trust or tax laws or in the grantor's family situation make the life insurance trust no longer serve its original purpose.

Most ILITs do not have taxable income and therefore do not require an income tax return. In terms of gift tax reporting, if you transferred an existing life insurance policy to the ILIT, a gift tax return may be required to inform the IRS of the transfer (gift) of the life insurance policy to the ILIT.

Crummey Trusts and Crummey Powers Since the beneficiaries do not have to pay any income taxes when they receive the proceeds of the life insurance policy, the Crummey trust allows the transfer of considerable wealth tax-free.

If you are the owner and insured, then the death benefit of a life insurance policy will be included in your gross estate. However, when life insurance is owned by an ILIT, the proceeds from the death benefit are not part of the insured's gross estate and thus not subject to state and federal estate taxation.

The buildup of cash value within a policy owned by the trustee of an ILIT is wholly free from income tax. Even more important, the life insurance proceeds ultimately received by the trustee of the ILIT are not subject to the federal income tax.

When trust beneficiaries receive distributions from the trust's principal balance, they do not have to pay taxes on the distribution. The Internal Revenue Service (IRS) assumes this money was already taxed before it was placed into the trust.

Putting the life insurance policy in the trust can remove it from the grantor's personal assets. As an irrevocable trust, once the life insurance is owned by the trust, you can't take it back.