Alaska Termination of Grantor Retained Annuity Trust in Favor of Existing Life Insurance Trust

Description

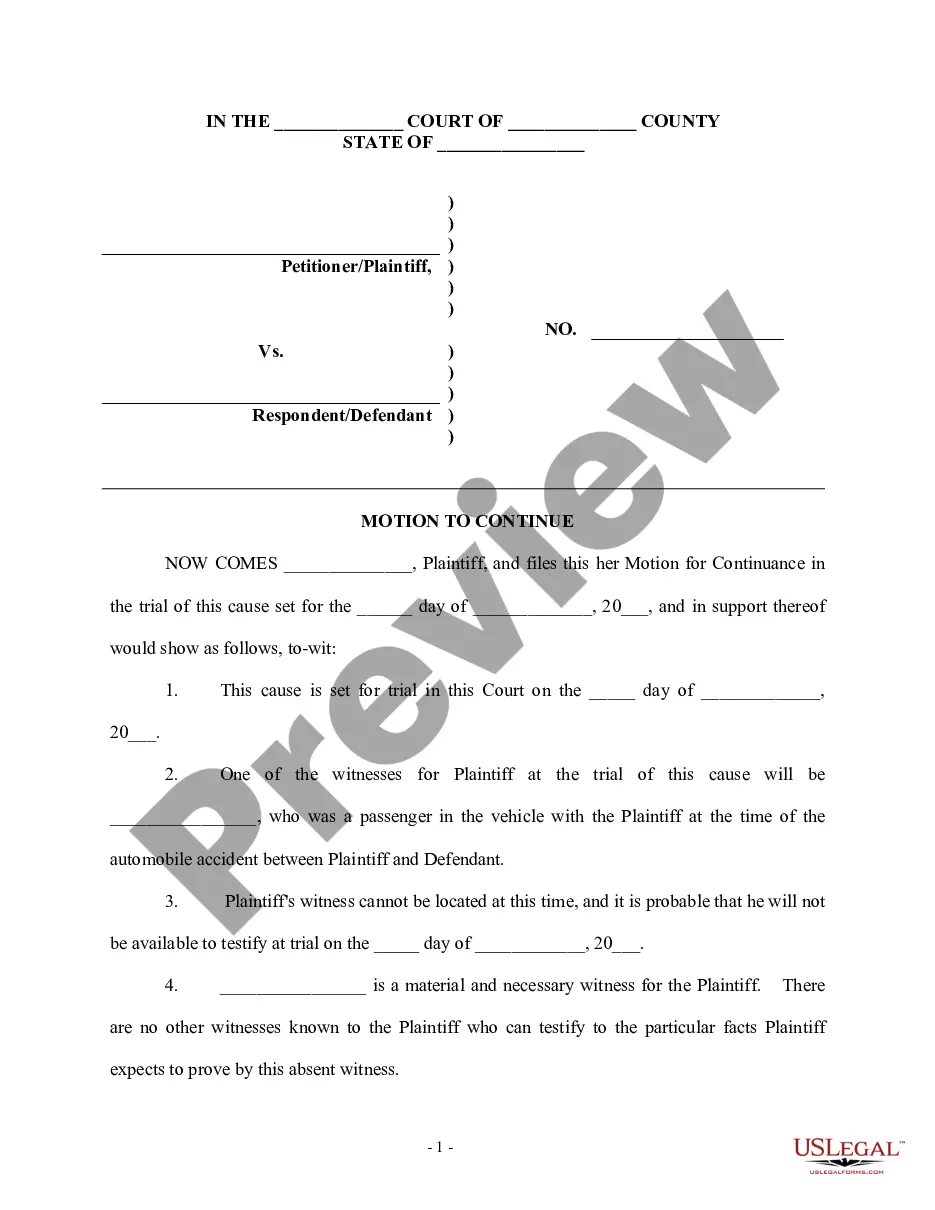

How to fill out Termination Of Grantor Retained Annuity Trust In Favor Of Existing Life Insurance Trust?

You can invest hours online attempting to discover the legal document format that complies with the federal and state requirements you will need.

US Legal Forms provides thousands of legal templates that have been reviewed by experts.

You can easily download or create the Alaska Termination of Grantor Retained Annuity Trust in Favor of Existing Life Insurance Trust from my service.

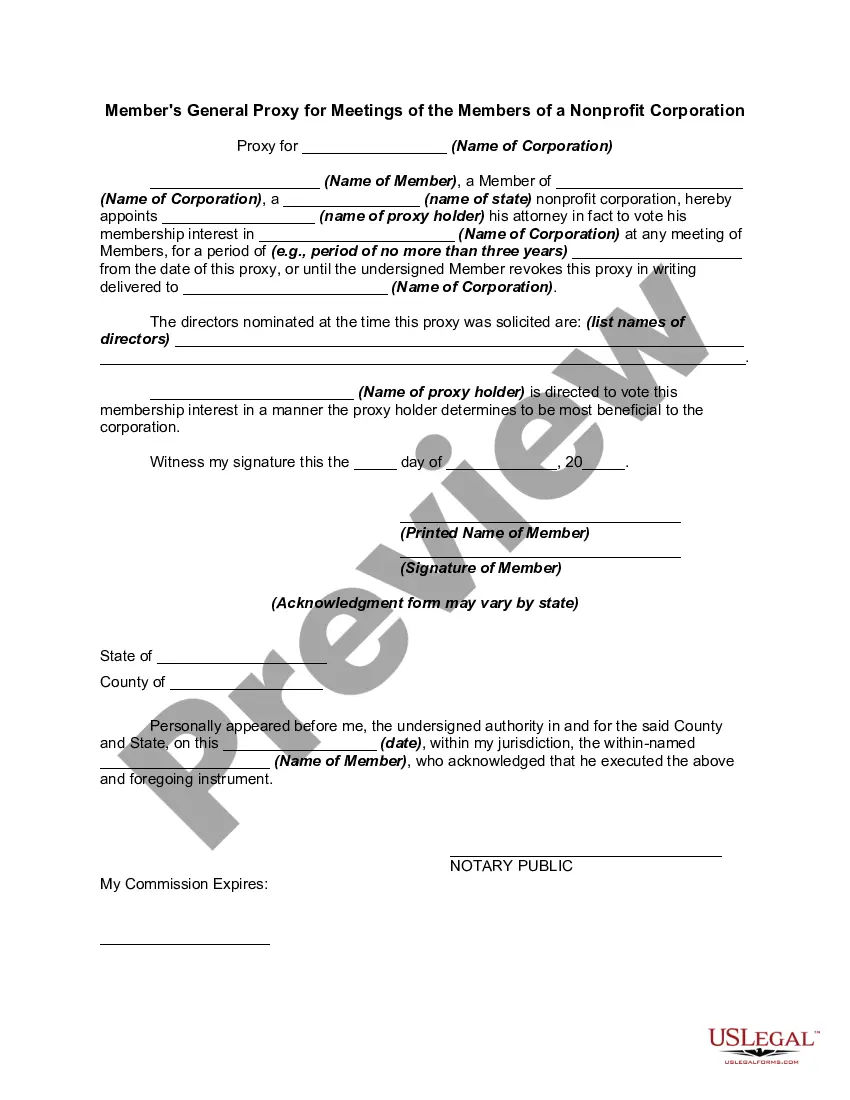

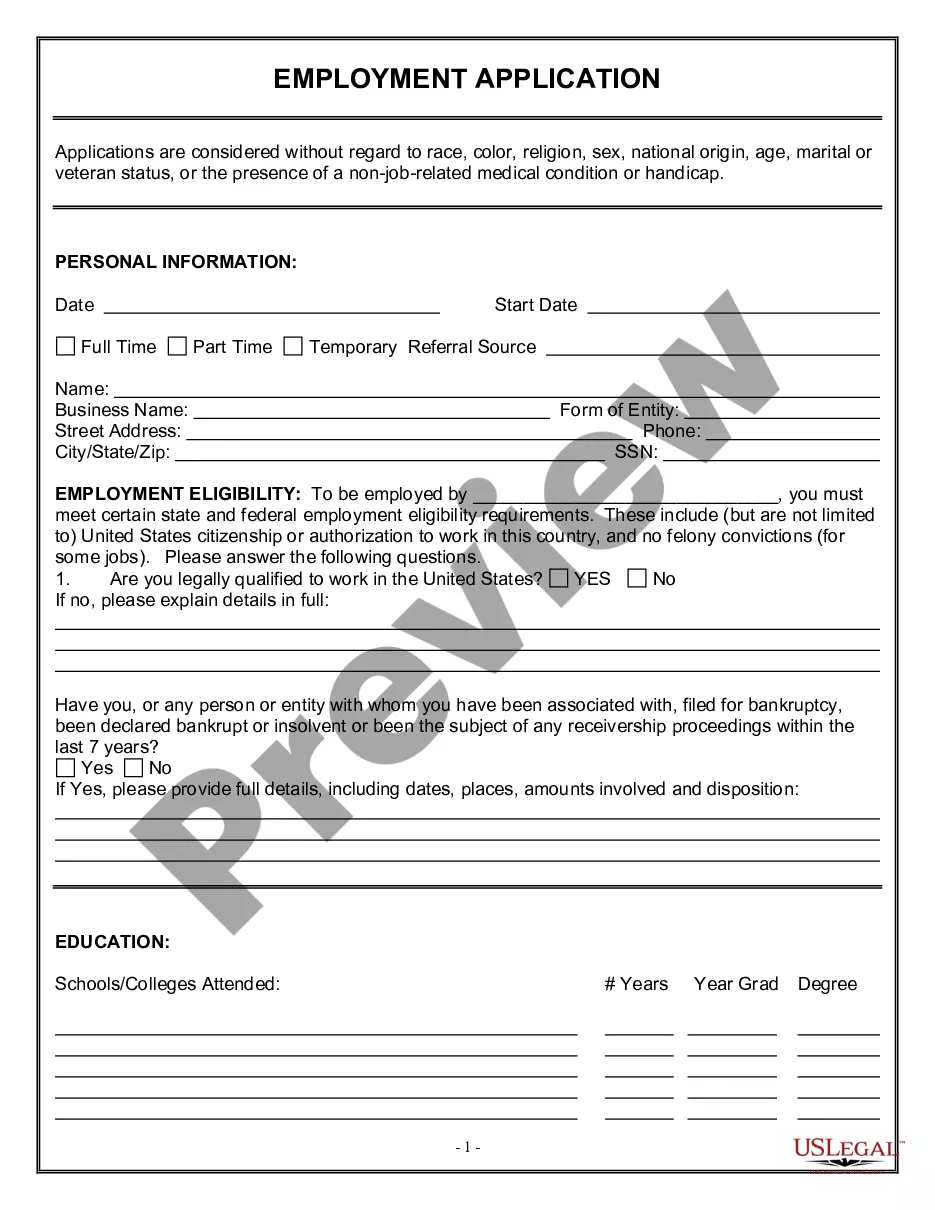

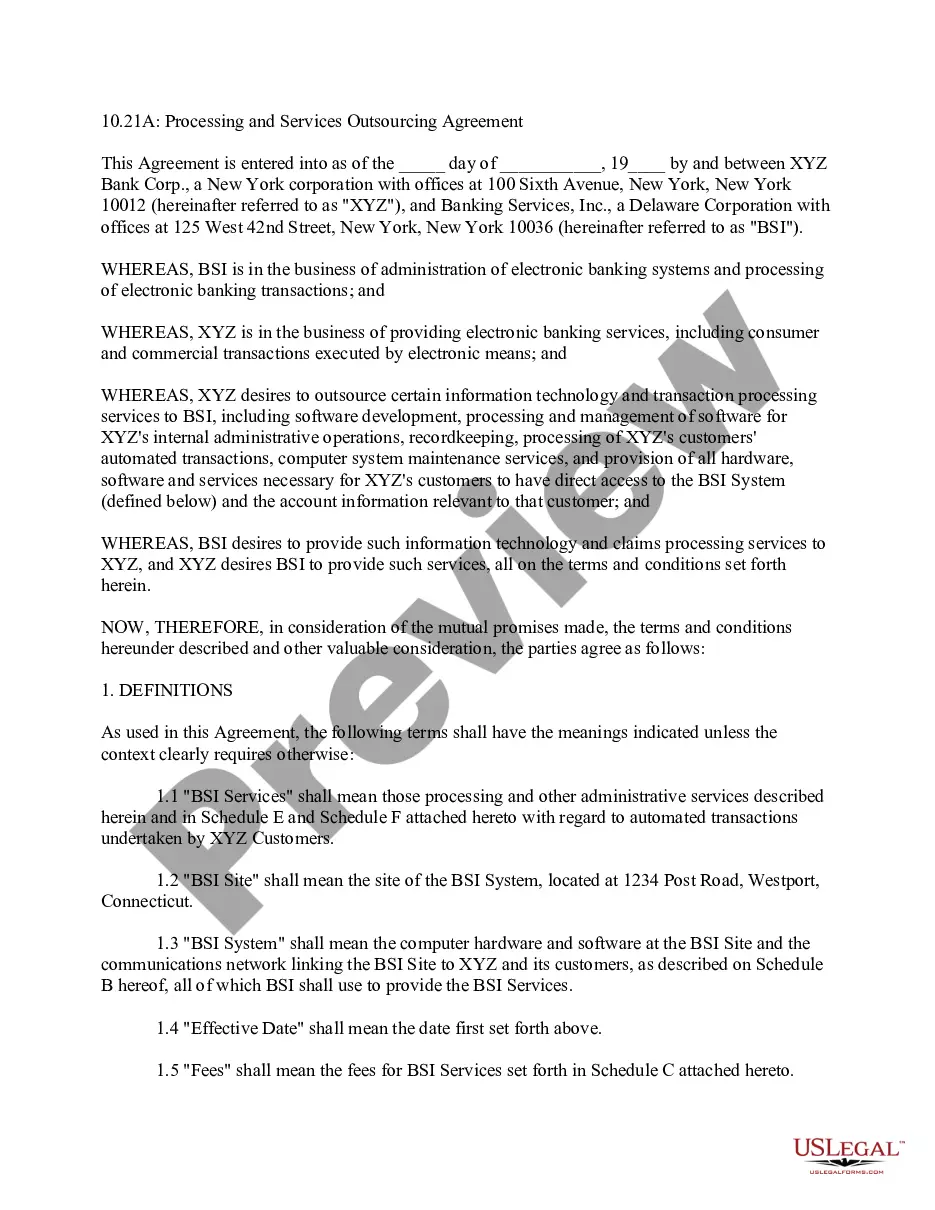

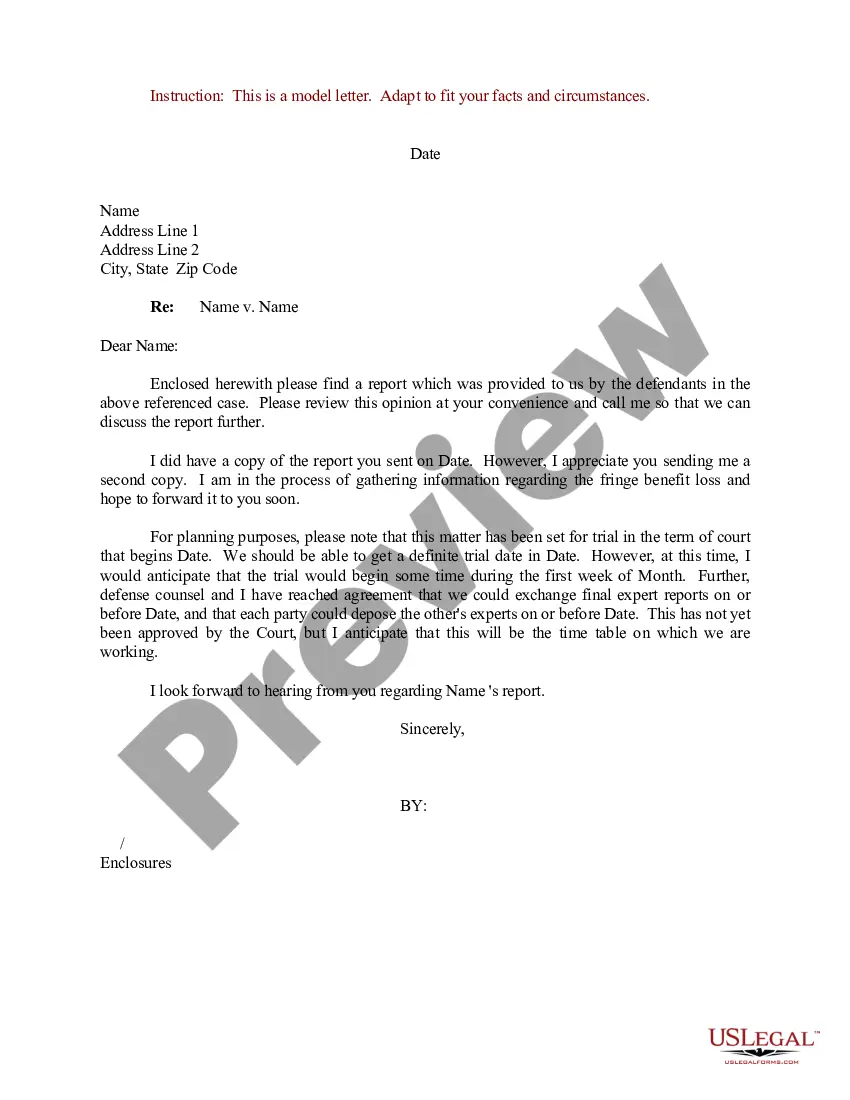

Refer to the template outline to confirm you have chosen the right document. If available, use the Preview button to review the document format as well.

- If you already have a US Legal Forms account, you can Log In and click on the Download button.

- Then, you can complete, modify, print, or sign the Alaska Termination of Grantor Retained Annuity Trust in Favor of Existing Life Insurance Trust.

- Every legal document template you acquire is yours indefinitely.

- To access another copy of a purchased form, go to the My documents section and click on the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions listed below.

- First, ensure that you have selected the correct document format for the region/area of your choice.

Form popularity

FAQ

If an irrevocable trust has its own tax ID number, then the IRS requires the trust to file its own income tax return, which is IRS form 1041. During the lifetime of the grantor, any interest, dividends, or realized gains on the assets of the trust are taxable on the grantor's 1040 individual income tax return.

Even an irrevocable trust can be revoked with a court order. A court may execute an order that permits the dissolution of a life insurance trust if changes in trust or tax laws or in the grantor's family situation make the life insurance trust no longer serve its original purpose.

A grantor trust is considered a disregarded entity for income tax purposes. Therefore, any taxable income or deduction earned by the trust will be taxed on the grantor's tax return.

For all practical purposes, the trust is invisible to the Internal Revenue Service (IRS). As long as the assets are sold at fair market value, there will be no reportable gain, loss or gift tax assessed on the sale. There will also be no income tax on any payments paid to the grantor from a sale.

As the Trustor of a trust, once your trust has become irrevocable, you cannot transfer assets into and out of your trust as you wish. Instead, you will need the permission of each of the beneficiaries in the trust to transfer an asset out of the trust.

One easy way to terminate a life insurance trust, the grantor to stops making the premium payments, known as gifts, to the trust. If the grantor stops making payments to the trust, then the policy will lapse. This causes the purpose of the trust to be eliminated.

Is an irrevocable life insurance trust (ILIT) a grantor trust? A13. Usually, yes. Most ILITs are grantor trusts since these trust instruments typically provide that income may be applied toward the payment of premiums on policies insuring the grantor's life (or the grantor's spouse's life).

Putting the life insurance policy in the trust can remove it from the grantor's personal assets. As an irrevocable trust, once the life insurance is owned by the trust, you can't take it back.

In other words, if the grantor (or a non-adverse party) has the power to revoke any part of a trust and reclaim the trust assets, then the grantor will be taxed on the trust income.

If a trust is a grantor trust, then the grantor is treated as the owner of the assets, the trust is disregarded as a separate tax entity, and all income is taxed to the grantor.