Alaska Sample Letter for Insufficient Amount to Reinstate Loan

Description

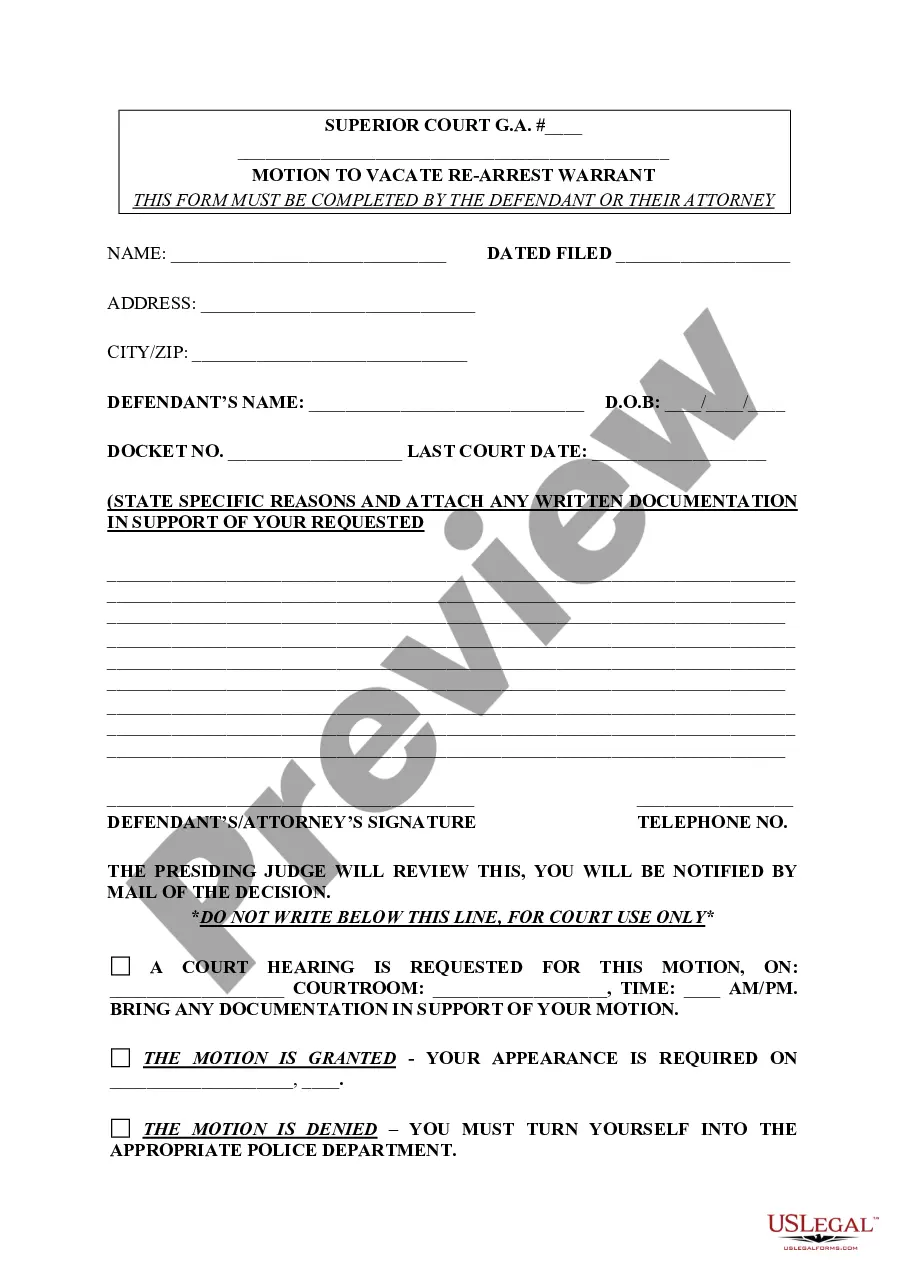

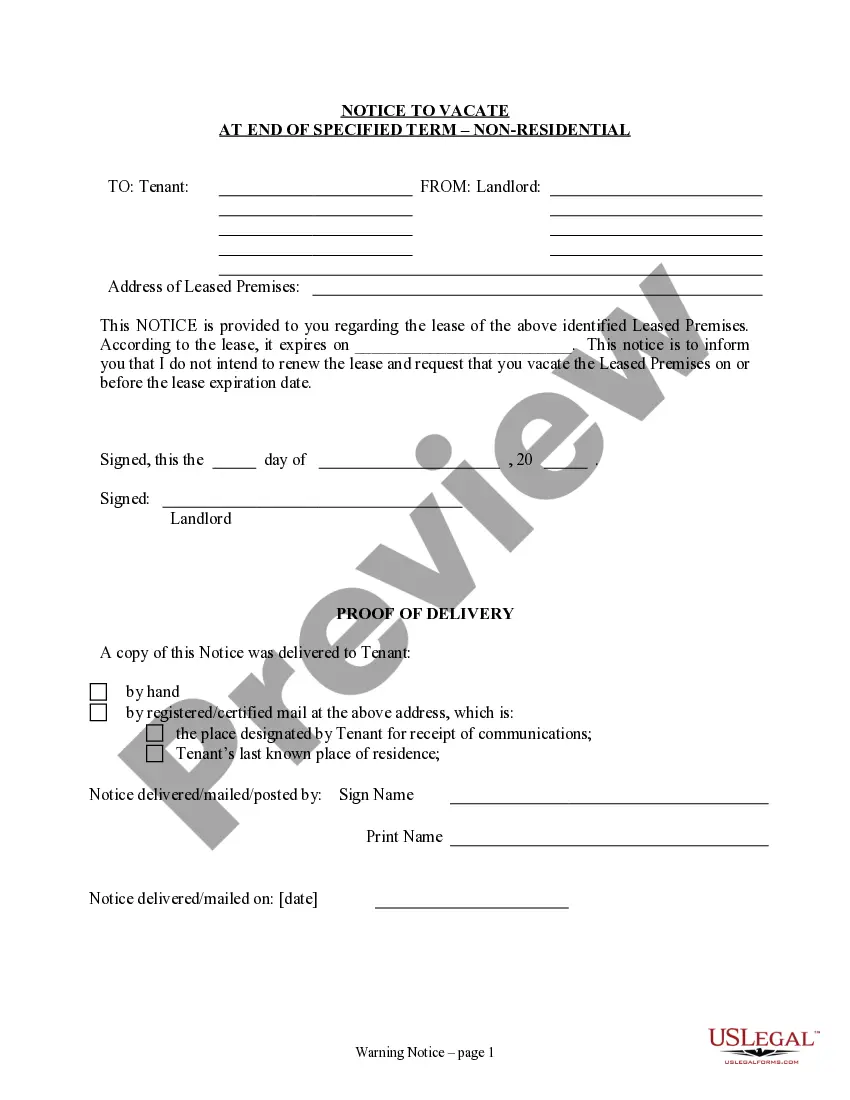

How to fill out Sample Letter For Insufficient Amount To Reinstate Loan?

If you require extensive, acquire, or generate legal document templates, utilize US Legal Forms, the largest compilation of legal forms available online.

Utilize the website's straightforward and user-friendly search to locate the documents you need.

Various templates for business and personal purposes are categorized by areas and states, or keywords.

Step 4. Once you find the form you need, click the Get now button. Choose the pricing plan you prefer and provide your credentials to register for an account.

Step 5. Complete the transaction. You can use your Visa or MasterCard or PayPal account to finalize the purchase.

- Use US Legal Forms to find the Alaska Sample Letter for Insufficient Amount to Reinstate Loan with just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to find the Alaska Sample Letter for Insufficient Amount to Reinstate Loan.

- You can also access forms you previously downloaded from the My documents tab in your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct jurisdiction.

- Step 2. Utilize the Preview option to review the form’s content. Don't forget to read the details.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find alternative legal form templates.

Form popularity

FAQ

To write a forgiveness letter for credit, begin by addressing the relevant credit issuer directly. Mention your account details and clearly explain the circumstances that have led to your request for forgiveness. Highlight any improvements you’ve made to your financial situation, emphasizing your commitment to fulfilling your obligations. For a solid starting point, refer to an Alaska Sample Letter for Insufficient Amount to Reinstate Loan to guide your writing and maximize the chances of a favorable response.

When crafting a debt relief letter, first address it to the correct creditor or lender. Include your account details and specify the amount you owe, making it clear why you require debt relief. Clearly state your plan for repayment or request for a settlement, supported by your current financial situation. Utilizing an Alaska Sample Letter for Insufficient Amount to Reinstate Loan can help you create a well-structured request that resonates with your creditor.

To write a letter asking for forgiveness, start by clearly stating your request at the beginning. Acknowledge the situation that led to your need for forgiveness and express regret honestly. You can also mention how you plan to address the issue moving forward, ensuring the reader understands your commitment to making things right. If you're looking for guidance, consider using an Alaska Sample Letter for Insufficient Amount to Reinstate Loan to structure your letter effectively.

Statute 10.06.490 addresses limited liability companies (LLCs) and their management structures in Alaska. It lays out the rights and obligations of members within the LLC framework. When managing finances related to an LLC, an Alaska Sample Letter for Insufficient Amount to Reinstate Loan can help establish clear communication regarding any financial disputes.

A 72-hour hold in Alaska refers to a legal process that allows landlords to hold a tenant's personal property for a limited time after eviction. This practice is designed to ensure that landlords can secure their property while the tenant gathers their belongings. If you're facing such a situation, an Alaska Sample Letter for Insufficient Amount to Reinstate Loan can help clarify your position.

Statute 34.03.290 relates to the rights and duties of landlords and tenants regarding rental agreements in Alaska. This statute outlines necessary provisions such as notice requirements and the handling of security deposits. When drafting any related correspondence, consider the advantages of an Alaska Sample Letter for Insufficient Amount to Reinstate Loan to maintain clarity.

In Alaska, violating the conditions of release can result in severe consequences, including revocation of your release and potential incarceration. The court may impose additional restrictions or hold a hearing to determine the next steps. If financial obligations are involved, you might benefit from creating an Alaska Sample Letter for Insufficient Amount to Reinstate Loan to address any outstanding issues promptly.

Landlords in Alaska cannot engage in self-help eviction tactics, such as locking tenants out or shutting off utilities. Additionally, landlords must refrain from discrimination when selecting tenants and must adhere to privacy laws regarding notice before entering the property. If issues arise that necessitate formal communication, using an Alaska Sample Letter for Insufficient Amount to Reinstate Loan can be beneficial.

Statute 10.06 in Alaska primarily addresses the rules related to partnership laws. It establishes legal foundations for forming partnerships and outlines the responsibilities of partners to each other. Understanding these statutes can be crucial, especially if you are drafting agreements; utilizing an Alaska Sample Letter for Insufficient Amount to Reinstate Loan can assist in clarifying financial obligations.

In Alaska, a landlord must return the security deposit within 14 days after the tenant vacates the rental property. This timeline ensures that tenants receive their funds promptly, assuming the landlord does not have any claims against the deposit for damages. If you find yourself in a situation involving withheld deposits, consider using an Alaska Sample Letter for Insufficient Amount to Reinstate Loan to assert your rights.