The Alaska Family Limited Partnership Agreement and Certificate is a legally binding document that outlines the terms and conditions of a family limited partnership (FLP) in the state of Alaska. It specifies the rights, responsibilities, and obligations of all parties involved in the partnership. This arrangement is commonly utilized by families to protect and manage their assets, while enjoying various tax benefits and estate planning advantages. The Alaska Family Limited Partnership Agreement and Certificate address several key aspects of the partnership, such as the purpose of the FLP, the capital contributions made by each partner, and the distribution of profits and losses. It also includes provisions related to management and decision-making, including the roles and responsibilities of general partners and limited partners. One type of Alaska Family Limited Partnership Agreement and Certificate is the traditional FLP, which involves two types of partners: general partners a limited partners. General partners have more control over the day-to-day activities of the partnership and are responsible for managing its operations. On the other hand, limited partners have limited liability and are primarily passive investors. Another type of Alaska Family Limited Partnership Agreement and Certificate is the voting FLP, which allows limited partners to have a say in specific decisions of the partnership. Unlike the traditional FLP, limited partners in a voting FLP can participate in voting on matters such as asset allocation, major business decisions, and admission of new partners. Additionally, the Alaska Family Limited Partnership Agreement and Certificate may include provisions for succession planning, which outlines the transfer of partnership interests in the event of death or incapacity of a partner. This ensures a smooth transition of assets and management responsibilities within the family. Overall, the Alaska Family Limited Partnership Agreement and Certificate is a comprehensive legal document that establishes the structure, rights, and obligations of a family limited partnership in Alaska. It provides a framework for managing and protecting family assets, while offering various tax advantages and estate planning opportunities. Whether it is a traditional or voting FLP, this agreement plays a crucial role in facilitating the successful operation and management of the partnership.

Alaska Family Limited Partnership Agreement and Certificate

Description

How to fill out Alaska Family Limited Partnership Agreement And Certificate?

Are you presently inside a position the place you require papers for either organization or individual functions virtually every day time? There are a lot of legal papers themes available on the net, but locating ones you can rely isn`t effortless. US Legal Forms delivers thousands of form themes, just like the Alaska Family Limited Partnership Agreement and Certificate, which can be created to meet state and federal needs.

When you are previously familiar with US Legal Forms website and have your account, basically log in. Following that, you can acquire the Alaska Family Limited Partnership Agreement and Certificate format.

If you do not come with an bank account and would like to begin to use US Legal Forms, abide by these steps:

- Find the form you require and make sure it is for the proper town/state.

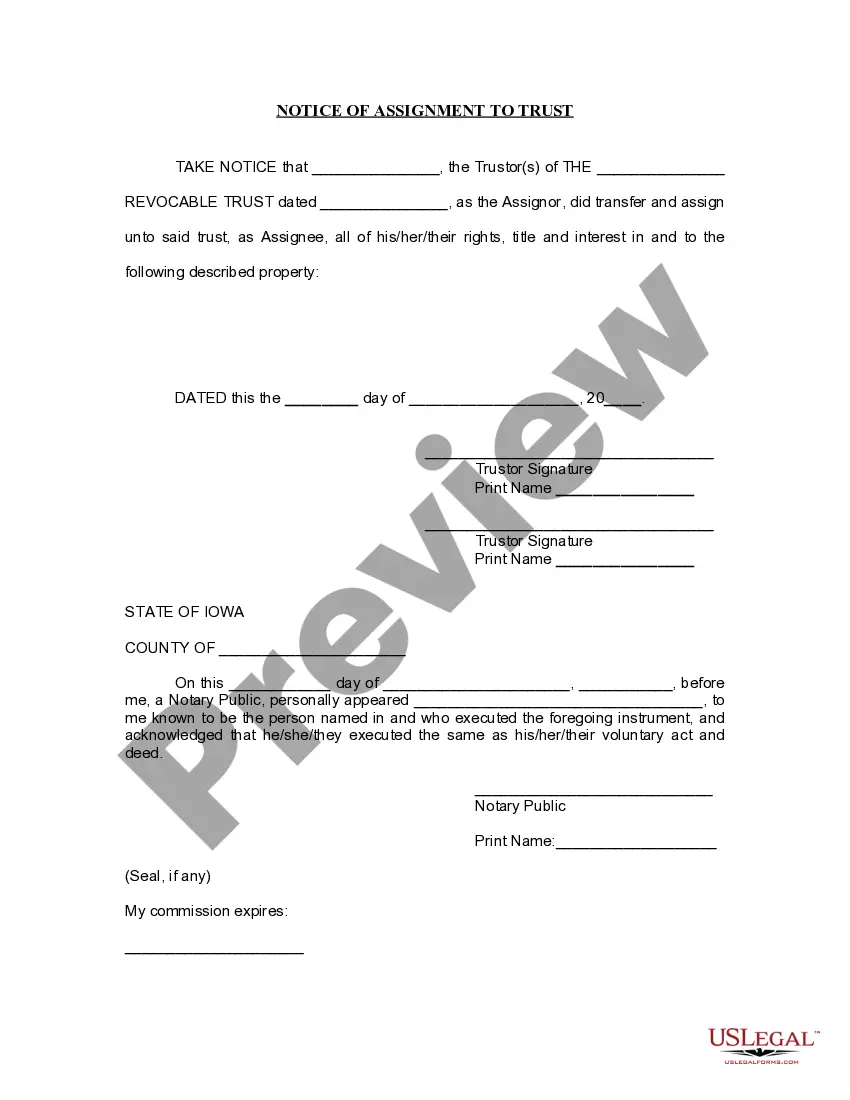

- Take advantage of the Review button to check the form.

- Browse the explanation to actually have chosen the correct form.

- In case the form isn`t what you are looking for, use the Look for industry to obtain the form that fits your needs and needs.

- Whenever you obtain the proper form, click Purchase now.

- Pick the costs prepare you would like, fill out the specified information to produce your account, and pay for an order utilizing your PayPal or charge card.

- Select a hassle-free paper file format and acquire your duplicate.

Find all of the papers themes you may have purchased in the My Forms menus. You can get a further duplicate of Alaska Family Limited Partnership Agreement and Certificate whenever, if required. Just go through the required form to acquire or printing the papers format.

Use US Legal Forms, probably the most comprehensive variety of legal forms, to save lots of efforts and prevent blunders. The assistance delivers appropriately made legal papers themes that can be used for an array of functions. Make your account on US Legal Forms and start making your way of life a little easier.

Form popularity

FAQ

If any portion of a business activity occurs within the State of Alaska then the expectation, per Alaska Statutes (law), is the business will have an Alaska Business License. Per AS 43.70. 020(a) a business license is required for the privilege of engaging in a business in the State of Alaska.

An LP must have two or more owners. At least one must be a general partner who has unlimited, personal liability, and one must be a limited partner who has limited liability but is prohibited from participating in business management.

Limited liability partnership (LLP) is a type of general partnership where every partner has a limited personal liability for the debts of the partnership. Partners will not be liable for the tortious damages of other partners but potentially for the contractual debts depending on the state.

Limited Partnerships are a type of partnership that allow for passive investment without the exposure to unlimited liability. They consist of one or more ?general partners? and one or more ?limited partners.? In Ontario, Limited Partnerships are governed by the Limited Partnerships Act.

A limited partnership has two types of partners: general partners and limited partners. It must have one or more of each type. All partner, limited and general, share the profits of the business. Each general partner has unlimited liability for the obligations of the business.

A Limited Partnership Agreement is essential for a Limited Partnership. Limited Partnership's typically do not have bylaws like a corporation and Limited Partnerships laws have fewer guidelines than are provided for corporations.

Some states only require that the certificate contains the name of the limited partnership, the name and address of the registered agent and registered office, and the names and addresses of all of the general partners.

The firm name of your limited liability partnership must contain the words ?limited liability partnership? or ?societe a responsabilite limitee? or the abbreviations ?LLP?, ?L.L.P.? or ?s.r.l.? as the last words or letters of the firm name.