Alaska Security Agreement regarding Member Interests in Limited Liability Company provides legal protection and a framework for securing the interests of members in an LLC. It serves as a binding contract between the LLC and the member(s), outlining the rights, responsibilities, and obligations of the parties involved. This agreement also helps mitigate risks associated with member interests, providing assurance to both the LLC and its members. Keywords: Alaska, security agreement, member interests, limited liability company, LLC. 1. Types of Alaska Security Agreements regarding Member Interests in Limited Liability Company: a. Pledge Agreement: A pledge agreement is a common type of security agreement in which a member pledges their interest in the LLC as collateral for a loan or other obligations. This agreement allows the lender to take possession of the pledged interest in case of default. b. Mortgage Agreement: In some cases, an Alaska LLC may enter into a mortgage agreement with one or more members to secure a debt or obligation. This agreement grants the lender a security interest in the member's interest, providing a legal claim if the member defaults. c. Collateral Agreement: A collateral agreement may be used when a member pledges other assets as security for their interest in an Alaska LLC. This agreement outlines the terms and conditions of using alternative collateral to secure the member's interest. d. Investment Agreement: An investment agreement is used when a member invests additional capital into the LLC in exchange for a specific percentage of ownership interest. This agreement defines the terms of the investment, including the member's rights, responsibilities, and potential returns. e. Membership Interest Pledge Agreement: Similar to a pledge agreement, a membership interest pledge agreement is specifically tailored to secure the interests of members in an Alaska LLC. It provides a comprehensive framework for pledging membership interests as collateral. f. Purchase Agreement: In some situations, an Alaska LLC may allow members to buy and sell their interests. A purchase agreement outlines the terms, conditions, and procedures for such transactions, ensuring clear guidelines and protection for all parties involved. It is important for members of an LLC in Alaska to understand the specific type of security agreement being utilized and seek legal advice to ensure compliance with state laws and the enforceability of the agreement.

Alaska Security Agreement regarding Member Interests in Limited Liability Company

Description

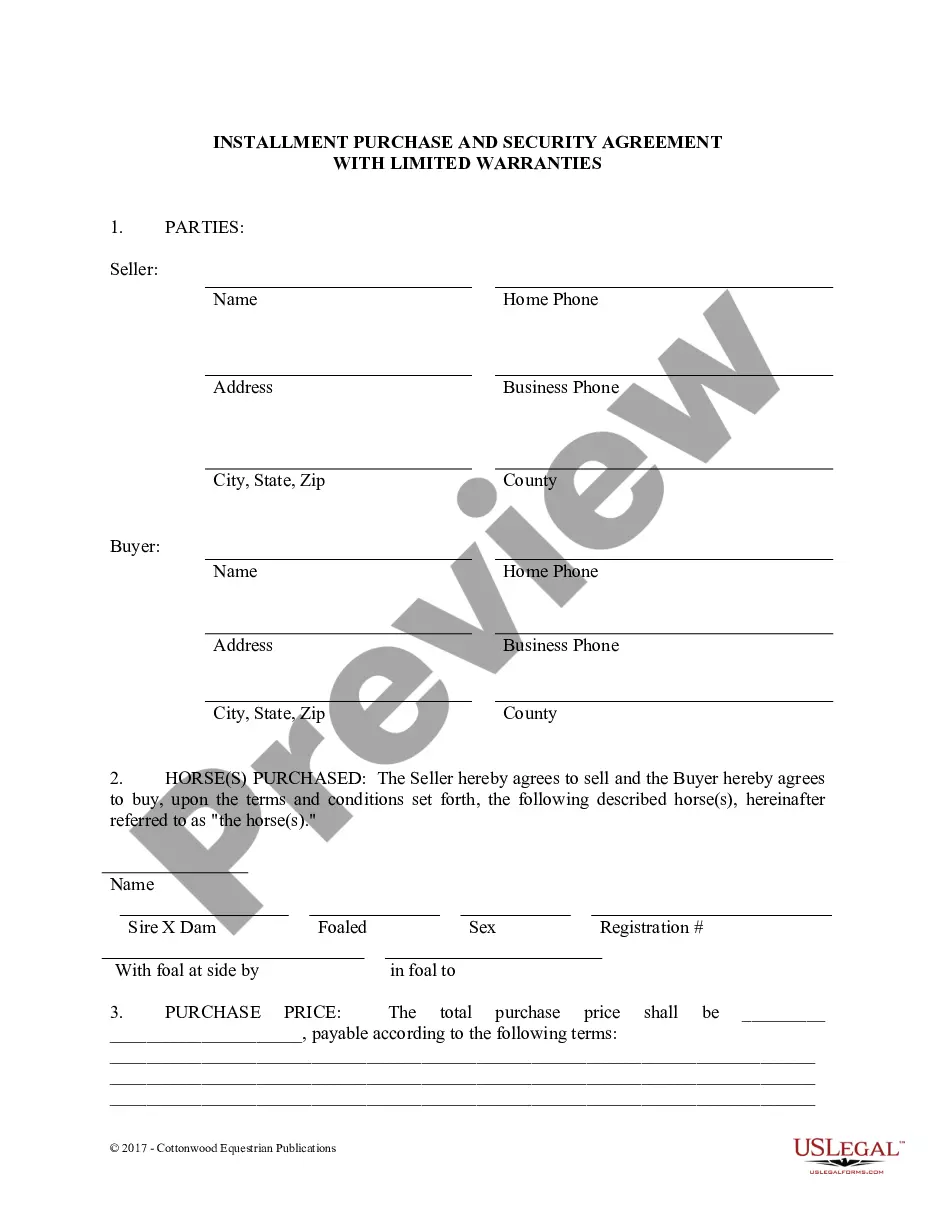

How to fill out Alaska Security Agreement Regarding Member Interests In Limited Liability Company?

US Legal Forms - one of the most significant libraries of legal varieties in the United States - delivers a wide array of legal papers layouts it is possible to down load or produce. Using the internet site, you will get thousands of varieties for organization and person functions, sorted by groups, claims, or search phrases.You can find the most up-to-date versions of varieties like the Alaska Security Agreement regarding Member Interests in Limited Liability Company within minutes.

If you have a registration, log in and down load Alaska Security Agreement regarding Member Interests in Limited Liability Company from the US Legal Forms local library. The Down load option will show up on each develop you view. You gain access to all previously downloaded varieties in the My Forms tab of your respective accounts.

If you wish to use US Legal Forms for the first time, allow me to share straightforward directions to help you get began:

- Be sure to have picked the right develop for your personal area/state. Click the Preview option to review the form`s articles. Browse the develop outline to actually have chosen the appropriate develop.

- In case the develop doesn`t fit your needs, take advantage of the Research field towards the top of the screen to discover the the one that does.

- When you are satisfied with the shape, confirm your decision by clicking on the Acquire now option. Then, select the costs plan you favor and supply your credentials to sign up on an accounts.

- Method the financial transaction. Make use of bank card or PayPal accounts to perform the financial transaction.

- Find the structure and down load the shape in your product.

- Make adjustments. Load, change and produce and sign the downloaded Alaska Security Agreement regarding Member Interests in Limited Liability Company.

Each format you included in your money lacks an expiration day which is your own eternally. So, in order to down load or produce another backup, just go to the My Forms portion and click on about the develop you require.

Gain access to the Alaska Security Agreement regarding Member Interests in Limited Liability Company with US Legal Forms, one of the most considerable local library of legal papers layouts. Use thousands of skilled and state-certain layouts that meet up with your company or person demands and needs.

Form popularity

FAQ

5 steps for maintaining personal asset protection and avoiding piercing the corporate veilUndertaking necessary formalities.Documenting your business actions.Don't comingle business and personal assets.Ensure adequate business capitalization.Make your corporate or LLC status known.

As a general rule, limited liability companies (LLCs) protect business owners' personal assets from liability for financial obligations, judgments, and other problems the business might experience.

The main reason people form LLCs is to avoid personal liability for the debts of a business they own or are involved in. By forming an LLC, only the LLC is liable for the debts and liabilities incurred by the businessnot the owners or managers.

There is no requirement for an LLC to have an operating agreement in the State of Alaska, however, it is highly recommended as it is the only document that states the ownership (important for multi-member companies) along with other valuable business information.

What Is Limited Liability Protection? Limited liability protection means that if your company incurs legal liability, personal assets stay protected. The extent and nature of that protection varies from state to state, so you want to be sure to speak with an attorney to make sure that you get it right.

Limited liability - The company has its own legal entity so the liability of members or shareholders is limited and generally they will not be personally liable for the debts of the company.

Every Alaska LLC owner should have an operating agreement in place to protect the operations of their business. While not legally required by the state, having an operating agreement will set clear rules and expectations for your LLC while establishing your credibility as a legal entity.

The members of an LLC can decide how to operate the various aspects of the business by forming an operating agreement. An operating agreement is not required for an LLC to exist, and if there is one, it need not be in writing. LLC members should protect their interests by creating a written operating agreement.

An operating agreement is a key business document that shows your business operates like a legit company. Without the operating agreement, your state might not acknowledge you as an LLC, and which means someone could sue to go after you without there being any shield to protect your personal assets.

LLC Flexibility The hallmark of LLCs is their flexibility. LLCs offer the protection of its members not being personally liable for debts or obligations. There are no restrictions on the number of persons or types of entities which can own membership interests in an LLC.