Alaska Post Bankruptcy Petition Discharge Letter is a crucial document that signifies the completion of a bankruptcy case in Alaska. After going through the bankruptcy process, individuals or businesses seeking debt relief will receive this letter, officially discharging their eligible debts. The discharge is a fundamental component of the bankruptcy process and provides a fresh financial start for the debtor. When a bankruptcy case is filed in Alaska, the debtor’s financial situation is evaluated, and if the court approves the discharge, a Post Bankruptcy Petition Discharge Letter is issued. This letter releases the debtor from personal liability for certain kinds of debts, preventing creditors from taking any further collection actions against the discharged debts. It is important to note that while the debtor may not owe the discharged debts anymore, certain types of debts, such as child support or tax debts, are not generally dischargeable. There are two primary types of Alaska Post Bankruptcy Petition Discharge Letters: Chapter 7 and Chapter 13. 1. Chapter 7 Discharge Letter: Also known as a "straight bankruptcy" or a "liquidation bankruptcy," Chapter 7 is the most common type of bankruptcy filed in Alaska. The Chapter 7 discharge letter is granted to individuals or businesses who successfully complete the liquidation process, whereby their non-exempt assets are sold to repay creditors. This discharge typically occurs within a few months after filing for bankruptcy. 2. Chapter 13 Discharge Letter: Chapter 13 bankruptcy, often referred to as a "reorganization bankruptcy" or a "wage earner's plan," involves the creation of a repayment plan over three to five years. The Chapter 13 discharge letter is received upon successfully completing the repayment plan, ensuring that the remaining eligible debts are discharged. It is important to understand that the discharge letter is not automatically issued upon the completion of bankruptcy proceedings. Debtors must adhere to all the court's requirements, including attending mandatory financial management courses and meeting all applicable deadlines, to receive their Alaska Post Bankruptcy Petition Discharge Letter. In summary, an Alaska Post Bankruptcy Petition Discharge Letter is a significant document that marks the completion of bankruptcy proceedings and releases eligible debts for individuals or businesses seeking debt relief. Chapter 7 and Chapter 13 are the two main types of discharge letters depending on the bankruptcy case type. Obtaining this letter signifies a fresh financial start and protection from further collection actions on discharged debts.

Alaska Post Bankruptcy Petition Discharge Letter

Description

How to fill out Alaska Post Bankruptcy Petition Discharge Letter?

It is possible to spend hrs on the Internet looking for the legal record design which fits the state and federal requirements you require. US Legal Forms gives a large number of legal types that are evaluated by pros. You can easily down load or print the Alaska Post Bankruptcy Petition Discharge Letter from the service.

If you have a US Legal Forms account, you can log in and then click the Download option. After that, you can complete, change, print, or indication the Alaska Post Bankruptcy Petition Discharge Letter. Every single legal record design you get is your own permanently. To have another version associated with a bought form, proceed to the My Forms tab and then click the related option.

If you use the US Legal Forms site initially, adhere to the easy recommendations under:

- First, make sure that you have selected the best record design for that state/city of your liking. Read the form information to make sure you have selected the proper form. If available, make use of the Review option to check through the record design too.

- If you want to locate another model in the form, make use of the Lookup discipline to discover the design that suits you and requirements.

- Once you have found the design you need, simply click Buy now to move forward.

- Find the prices program you need, type your references, and sign up for an account on US Legal Forms.

- Complete the financial transaction. You can utilize your credit card or PayPal account to pay for the legal form.

- Find the formatting in the record and down load it to the gadget.

- Make adjustments to the record if possible. It is possible to complete, change and indication and print Alaska Post Bankruptcy Petition Discharge Letter.

Download and print a large number of record themes while using US Legal Forms web site, which provides the most important variety of legal types. Use professional and status-particular themes to tackle your company or person requirements.

Form popularity

FAQ

A bankruptcy dismissal closes your bankruptcy case, and if it occurs before you receive a discharge, it will mean that: you've lost the protection of the automatic stay (the order that prohibits creditors from collecting debts), and. you'll continue to be liable for your debts.

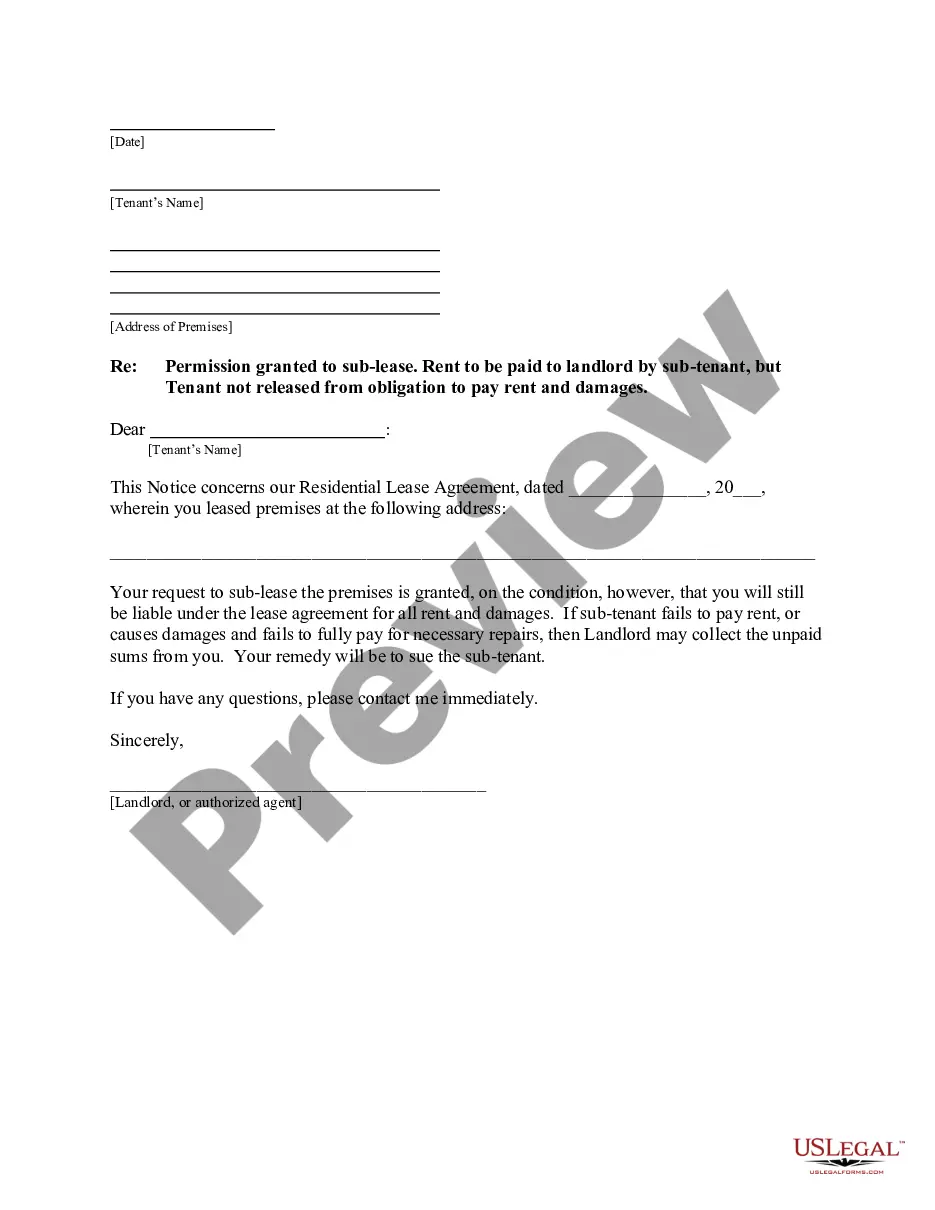

A "discharge letter" is a term used to describe the order that the bankruptcy court mails out toward the end of the case. The order officially discharges (wipes out) qualifying debt, such as credit card and utility bill balances, medical debt, and personal loans.

For most filers, a Chapter 7 case will end when you receive your dischargethe order that forgives qualified debtabout four to six months after filing the bankruptcy paperwork. Although most cases close after that, your case might remain open longer if you have property that you can't protect (nonexempt assets).

Following a bankruptcy discharge, debt collectors and lenders can no longer attempt to collect the discharged debts. That means no more calls from collectors and no more letters in the mail, as you are no longer personally liable for the debt. A bankruptcy discharge doesn't necessarily apply to all of the debt you owe.

A bankruptcy discharge, also known as a discharge in bankruptcy, refers to a permanent court order that releases a debtor from personal liability for certain types of debts. It is sometimes referred to simply as a discharge and comes at the end of a bankruptcy.

The bankruptcy is reported in the public records section of your credit report. Both the bankruptcy and the accounts included in the bankruptcy should indicate they are discharged once the bankruptcy has been completed. To verify this, the first step is to get a copy of your personal credit report.

The court can either dismiss it or discharge it. According to the United States Courts, the goal should be a discharge because this means the court accepts your bankruptcy case and forgives your debts. A dismissal occurs when something goes wrong with your case and the court is unable to finalize the bankruptcy claim.

Since a chapter 12 or chapter 13 plan may provide for payments to be made over three to five years, the discharge typically occurs about four years after the date of filing.

The bankruptcy is reported in the public records section of your credit report. Both the bankruptcy and the accounts included in the bankruptcy should indicate they are discharged once the bankruptcy has been completed. To verify this, the first step is to get a copy of your personal credit report.

Assuming that everything goes according to schedule, you can expect to receive your bankruptcy discharge (the court order that wipes out your debts) about 60 days after your 341 meeting of creditors hearing, plus a few days for mailing.