Alaska Employment of Executive with Stock Options and Rights in Discoveries is a comprehensive employment agreement specifically designed to attract and retain top-performing executives in companies involved in exciting exploratory ventures and groundbreaking discoveries. This employment model reflects unique benefits and additional compensation that executives receive in recognition of their contribution to the company's success in Alaska and beyond. Executives entering into an Alaska Employment agreement with stock options and rights in discoveries gain access to a range of financial incentives aimed at aligning their interests with the long-term goals of the company, while providing an opportunity to participate in the growth and prosperity generated by significant discoveries and developments. This compensation structure encourages executives to invest their time, expertise, and commitment to drive innovation and maximize shareholder value. The two primary types of compensation earned by the executives are stock options and rights in discoveries. 1. Stock Options: Stock options grant executives the right to purchase a specific number of company shares at a predetermined price (strike price) within a defined time frame. These options typically have vesting periods that ensure executives remain committed to the company's success in the long run. By offering these options, companies motivate executives to contribute to the growth and profitability of the organization, directly linking their personal wealth with the overall performance of the company's stock. 2. Rights in Discoveries: Rights in discoveries are an additional unique feature of the Alaska Employment agreement, specifically applicable in industries involved in ground-breaking research, exploration, and development projects. These rights entitle executives to a share of the financial benefits generated by substantial discoveries or technological breakthroughs. Such discoveries could include the identification of promising oil and gas deposits, mineral resources, or even new advancements in renewable energy sources. Executives with rights in discoveries benefit directly from the commercial success of these findings, enhancing their overall compensation package. The inclusion of stock options and rights in discoveries in the Alaska Employment agreement not only provides executives with substantial financial rewards but also serves as an effective retention tool by creating a mutually beneficial relationship where the executives' success is directly tied to the company's achievements. This compensation structure facilitates the attraction and retention of top talent, fostering a culture of innovation and driving long-term sustainable growth in Alaska's dynamic business environment.

Alaska Employment of Executive with Stock Options and Rights in Discoveries

Description

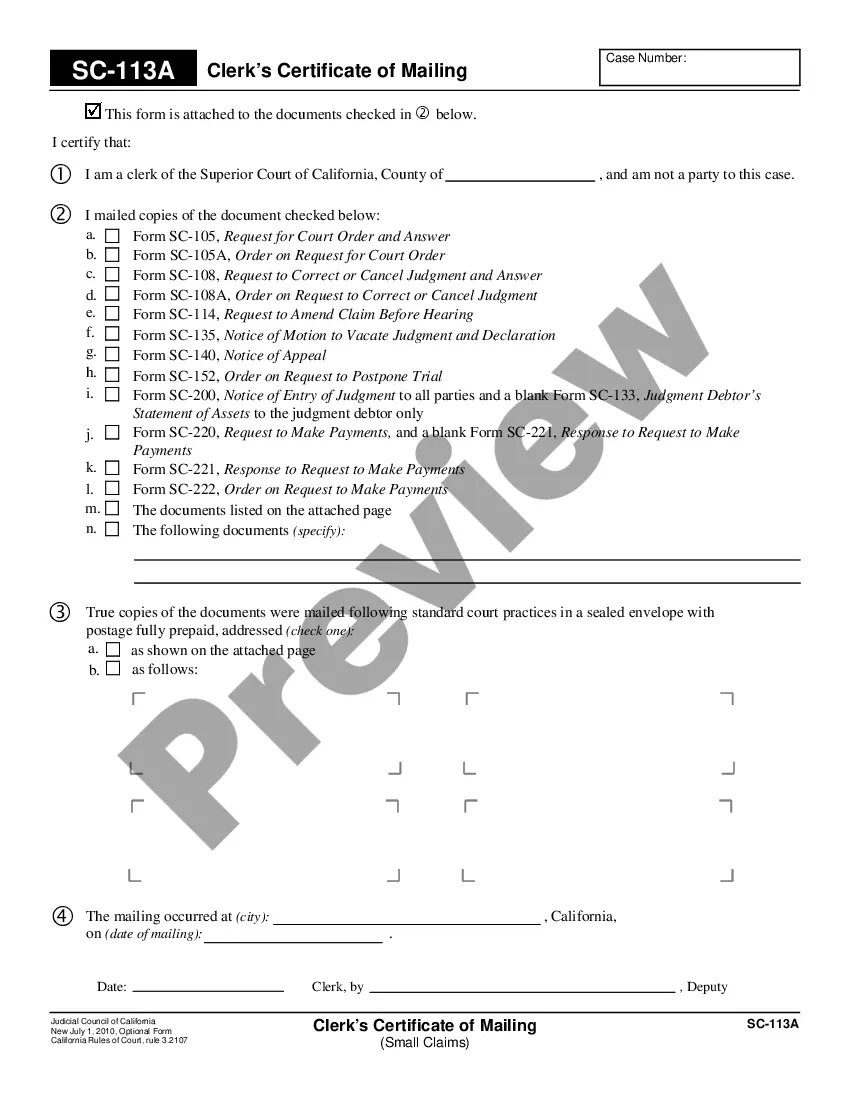

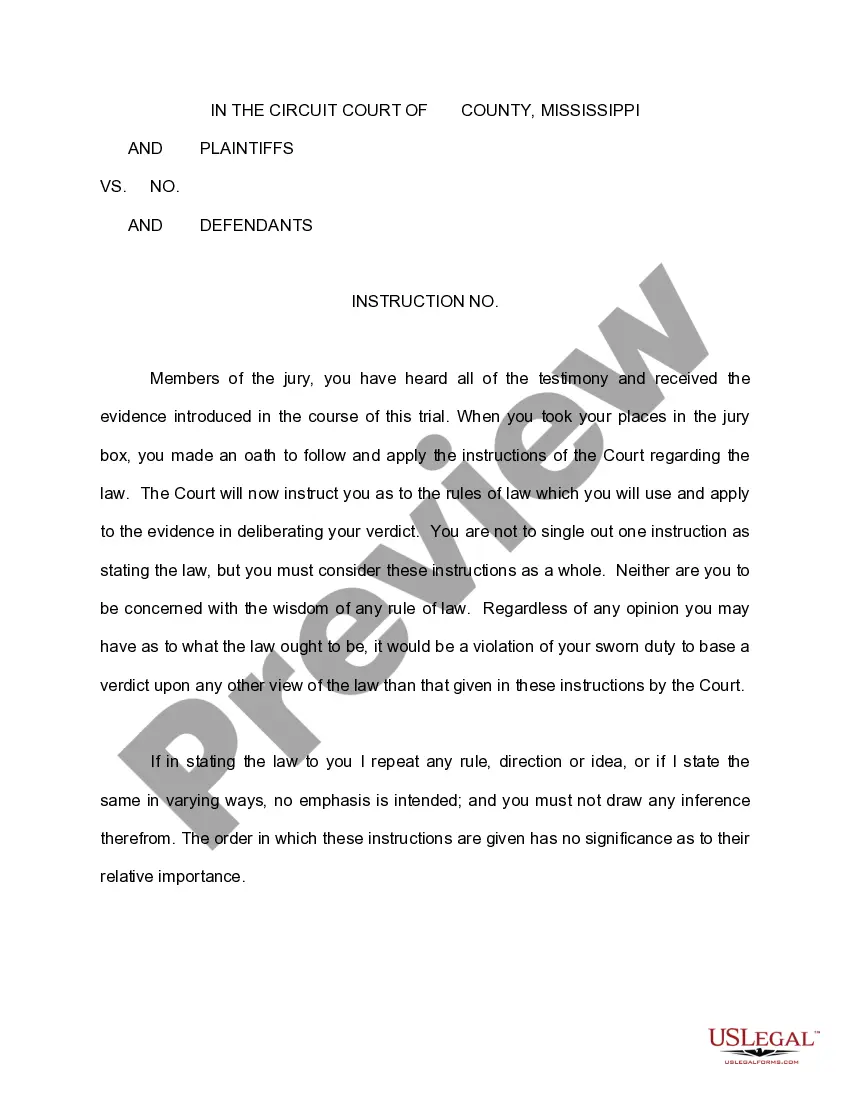

How to fill out Alaska Employment Of Executive With Stock Options And Rights In Discoveries?

If you want to total, obtain, or printing lawful file layouts, use US Legal Forms, the largest selection of lawful varieties, which can be found online. Utilize the site`s basic and practical search to discover the paperwork you need. Numerous layouts for company and specific purposes are sorted by classes and says, or keywords. Use US Legal Forms to discover the Alaska Employment of Executive with Stock Options and Rights in Discoveries within a few clicks.

Should you be currently a US Legal Forms customer, log in in your accounts and click the Download switch to get the Alaska Employment of Executive with Stock Options and Rights in Discoveries. You can also gain access to varieties you previously delivered electronically inside the My Forms tab of your own accounts.

Should you use US Legal Forms for the first time, refer to the instructions listed below:

- Step 1. Be sure you have selected the form for that proper metropolis/country.

- Step 2. Make use of the Preview solution to look through the form`s content. Do not forget about to read the description.

- Step 3. Should you be unhappy together with the type, use the Look for area on top of the display screen to find other variations of your lawful type format.

- Step 4. Once you have located the form you need, click the Purchase now switch. Pick the rates prepare you like and put your qualifications to sign up for an accounts.

- Step 5. Approach the deal. You may use your charge card or PayPal accounts to accomplish the deal.

- Step 6. Select the formatting of your lawful type and obtain it on your system.

- Step 7. Comprehensive, edit and printing or indication the Alaska Employment of Executive with Stock Options and Rights in Discoveries.

Every single lawful file format you buy is your own permanently. You may have acces to each type you delivered electronically within your acccount. Click on the My Forms segment and decide on a type to printing or obtain once more.

Remain competitive and obtain, and printing the Alaska Employment of Executive with Stock Options and Rights in Discoveries with US Legal Forms. There are many expert and status-particular varieties you can use to your company or specific needs.

Form popularity

FAQ

Under the fair value method of the current accounting standard, the value of employee stock options is measured when they are granted. However, the options' value might also be measured at the end of the vesting period or when they are exercised, and arguments for measuring value at those points have been made.

Key Takeaways. Employee stock options are offered by companies to their employees as equity compensation plans. These grants come in the form of regular call options and give an employee the right to buy the company's stock at a specified price for a finite period of time.

Stock options are an employee benefit that grants employees the right to buy shares of the company at a set price after a certain period of time. Employees and employers agree ahead of time on how many shares they can purchase and how long the vesting period will be before they can buy the stock.

The statute does not apply because its words read literally and in light of its purposes do not apply stock options are not wages. Wages are defined by the statute as all amounts for labor performed by employees of every description, whether the amount is fixed or ascertained by the standard of time, task, piece,

Stock Options and Equity Are Not Wages: In IBM v. Bajorek (1999) 191 F. 3d 1033, the Ninth Circuit Court of Appeals held that equity is not considered a wage because it has no monetary value.

The Employee Stock Option Plan (ESOP) is an employee benefit plan. It is issued by the company for its employees to encourage employee ownership in the company. The shares of the companies are given to the employees at discounted rates. Any company can issue ESOP.

Statutory Stock OptionsYou have taxable income or deductible loss when you sell the stock you bought by exercising the option. You generally treat this amount as a capital gain or loss. However, if you don't meet special holding period requirements, you'll have to treat income from the sale as ordinary income.

An executive stock option is a contract that grants the right to buy a specified number of shares of the company's stock at a guaranteed "strike price" for a period of time, usually several years.

Your W-2 includes income from any other compensation sources you may have, such as stock options, restricted stock, restricted stock units, employee stock purchase plans, and cash bonuses.

Stock options are a way for companies to motivate employees to be more productive. Through stock options, employees receive a percentage of ownership in the company. Stock options are the right to purchase shares in a company, usually over a period and according to a vesting schedule.