Alaska Checklist of Matters to be Considered in Drafting a Verification of an Account

Category:

State:

Multi-State

Control #:

US-13326BG

Format:

Word;

Rich Text

Instant download

Description

Account verification is the process of verifying that a new or existing account is owned and operated by a specified real individual or organization.

How to fill out Checklist Of Matters To Be Considered In Drafting A Verification Of An Account?

Are you currently in a situation where you require documents for either business or personal purposes regularly.

There are numerous legal document formats available online, but finding templates you can rely on is challenging.

US Legal Forms provides thousands of form templates, including the Alaska Checklist of Items to be Considered in Drafting a Verification of an Account, designed to meet state and federal standards.

Choose the pricing plan you prefer, fill in the required details to create your account, and complete the purchase using your PayPal or credit card.

Select a convenient document format and download your copy.

- If you are already familiar with the US Legal Forms site and have an account, simply Log In.

- Then, you can download the Alaska Checklist of Items to be Considered in Drafting a Verification of an Account template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Locate the form you need and ensure it is for the correct jurisdiction/county.

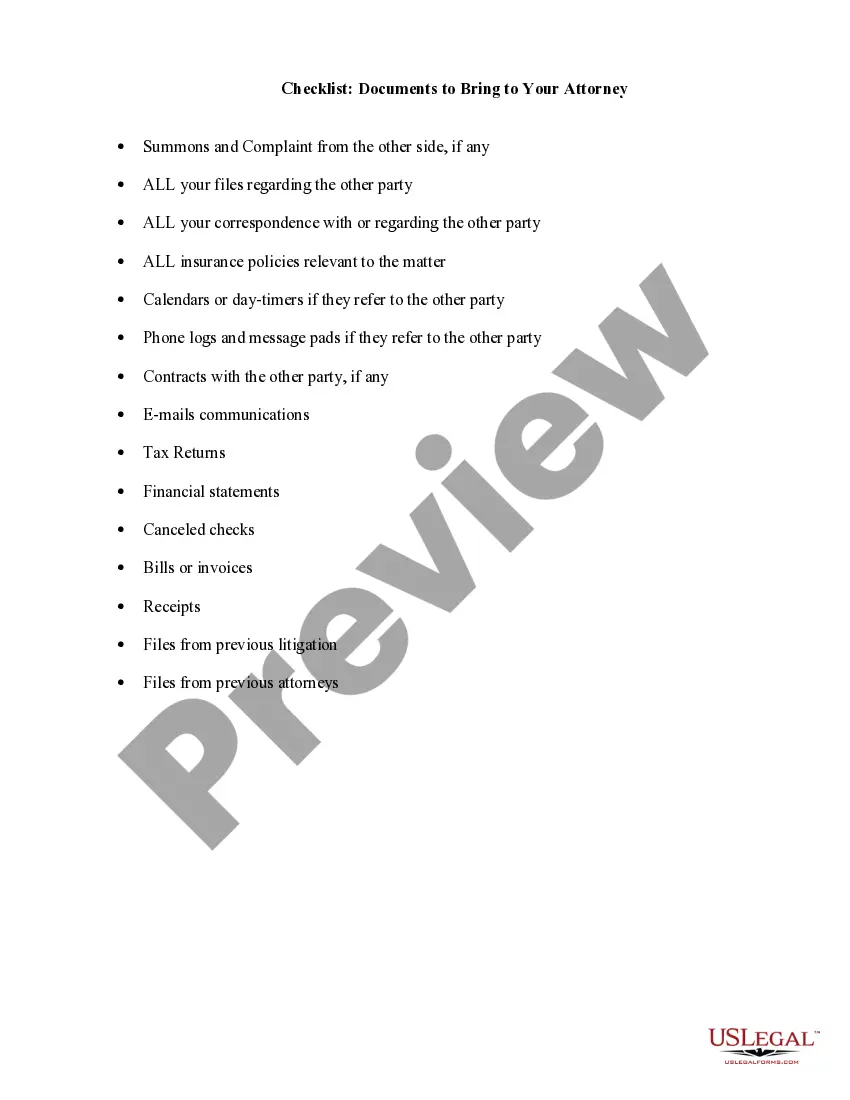

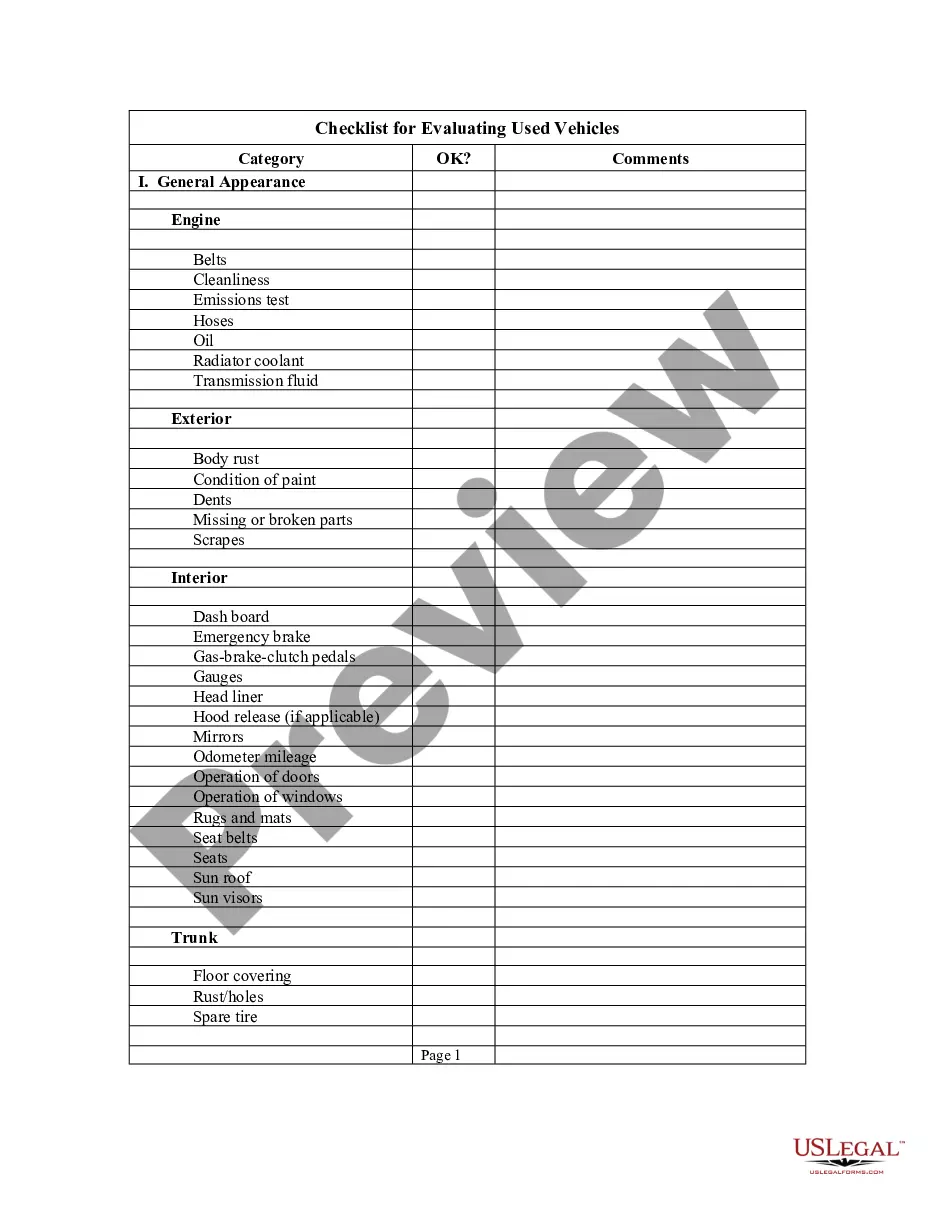

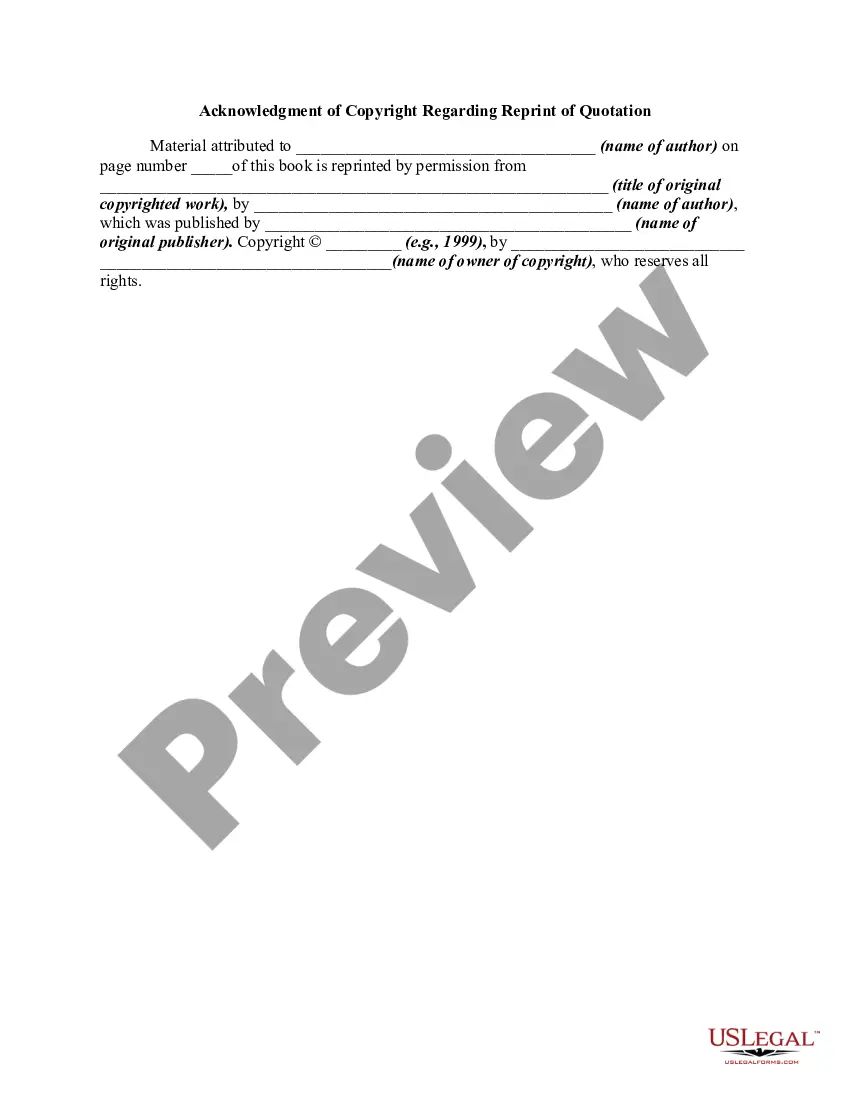

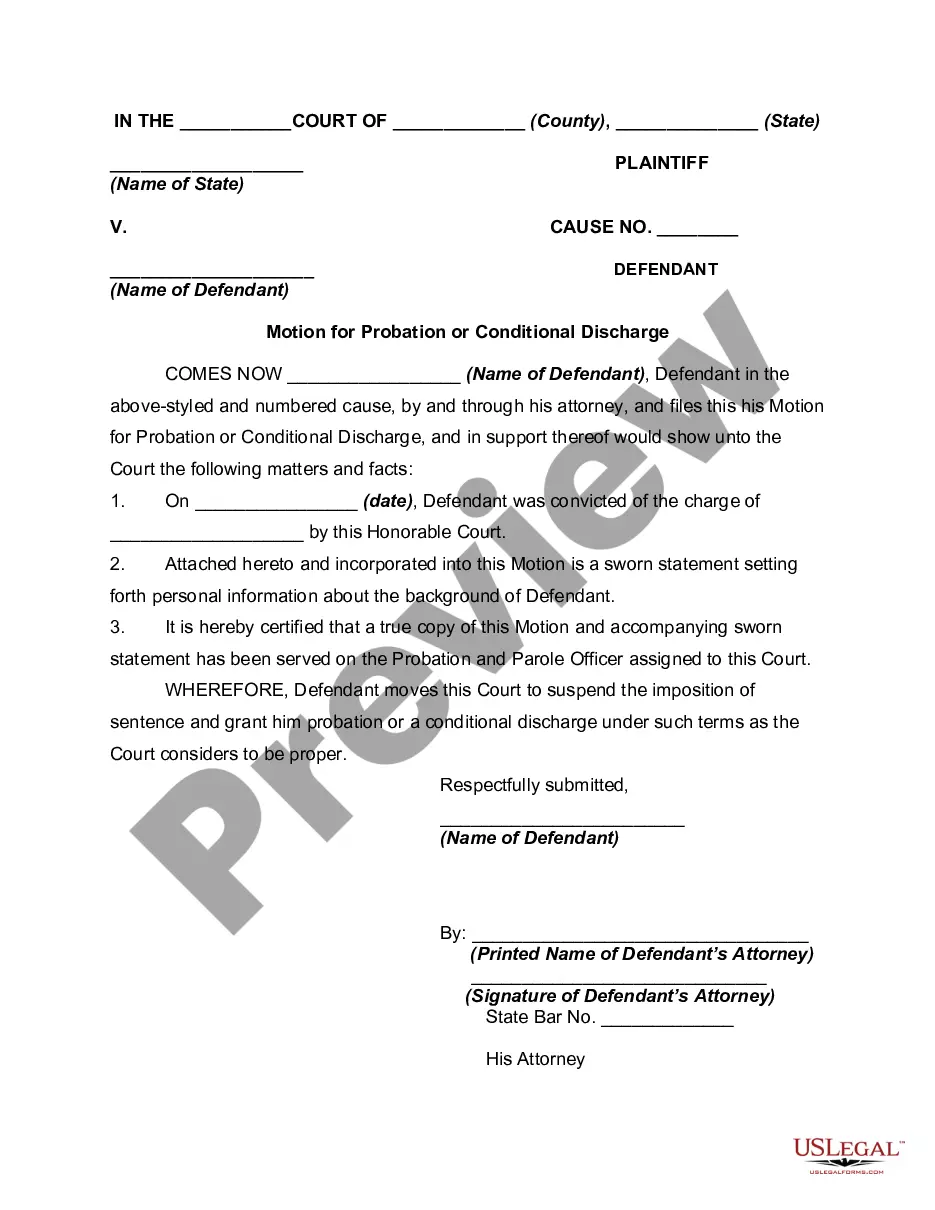

- Utilize the Preview option to review the form.

- Check the description to confirm that you have selected the correct form.

- If the form is not what you are looking for, use the Search field to find the form that meets your needs and specifications.

- Once you find the right form, click on Get now.