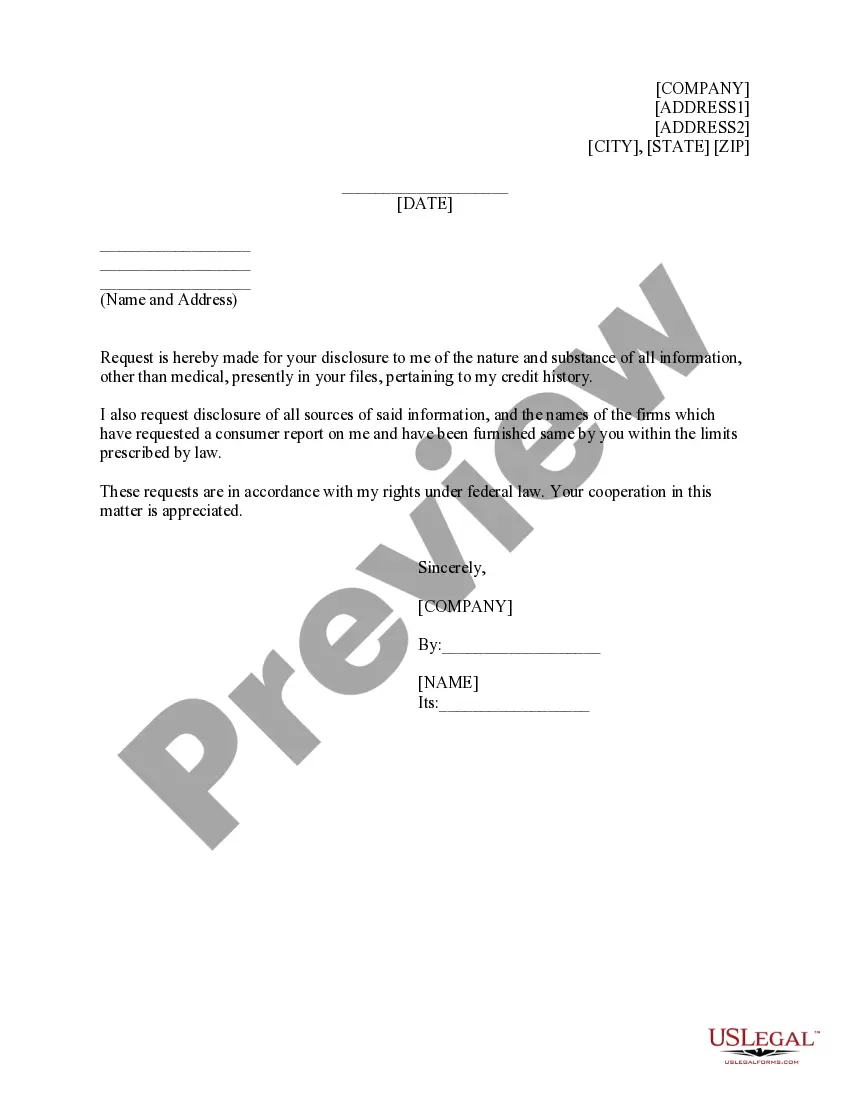

Alaska Credit Information Request

Description

How to fill out Credit Information Request?

Are you presently in a situation where you frequently require documentation for either business or personal purposes? There is a plethora of legal document templates available online, but finding forms you can trust is challenging.

US Legal Forms offers a vast array of form templates, including the Alaska Credit Information Request, designed to satisfy state and federal regulations.

If you are already familiar with the US Legal Forms website and have an account, simply Log In. After that, you can download the Alaska Credit Information Request template.

Access all the document templates you have purchased in the My documents section. You can download another copy of the Alaska Credit Information Request anytime, if necessary. Simply click the desired form to download or print the document template.

Utilize US Legal Forms, the most extensive collection of legal forms, to save time and avoid errors. The service provides professionally designed legal document templates that you can use for various purposes. Create your account on US Legal Forms and start simplifying your life.

- Get the form you need and ensure it is for the correct city/state.

- Use the Review button to examine the form.

- Read the description to confirm you have selected the appropriate form.

- If the form is not what you are searching for, use the Search field to find the form that fits your needs and requirements.

- Once you find the correct form, click Buy now.

- Choose the pricing plan you prefer, fill in the necessary details to create your account, and pay for the order using your PayPal or Visa or Mastercard.

- Select a convenient document format and download your copy.

Form popularity

FAQ

To get on the upgrade request list in Alaska, you need to manage your account directly through Alaska Airlines. Begin by logging into your mileage plan account, where you can indicate your interest in upgrades. This process may require you to keep track of availability on your desired flights. Remember to check for notifications regarding your Alaska Credit Information Request to stay informed about any changes or opportunities.

Alaska Airlines gift certificates are available in increments from $25 up to $500 USD. Certificates can be customized specifically for the recipient and the occasion, then delivered via email or printed and mailed. Best of all, our gift certificates do not expire.

When you cancel or change a nonrefundable Alaska Airlines ticket, you can choose to receive any remaining ticket value as a credit certificate for future travel. Certificates are valid for 12 months from the issue date of your original ticket, or 30 days from the date of exchange or cancellation, whichever is greater.

Alaska Airlines Visa Card credit score To get the Alaska Airlines Visa Signature® Card, you should have a FICOA® Score of at least 670. It usually takes good credit to get approved, and a credit score of at least 700 will give you even better odds.

Bank of America is most likely to check your Experian credit report when you submit a credit card application. After Experian, Bank of America will turn to Equifax. The bank will only use TransUnion data if necessary.

The Alaska Airlines Visa Signature credit card earns Mileage Plan miles. You earn 3 miles per dollar on eligible Alaska Airlines purchases and unlimited 1 mile per dollar on all other purchases. The number of miles you can earn is unlimited.

It may take up to 30 days from when you submitted your application to receive a decision. If you are approved, you can expect your card in 7-10 business days. But if you're denied and think you can justify why you should be approved, you can call customer service and ask for reconsideration.

The Alaska Airlines Visa Signature® credit card, issued by Bank of AmericaA®, stands out from much of the airline-card competition for one major reason: It offers an annual Companion Fare, which allows you to get a ticket for a traveling partner for just $121 ($99 plus taxes and fees from $22) once a year.

To get the Alaska Airlines Visa Signature® Card, you should have a FICOA® Score of at least 670. It usually takes good credit to get approved, and a credit score of at least 700 will give you even better odds.

Your credit certificate will remain valid for 12 months from the issue date of your original ticket, or 30 days from the date of exchange/cancellation (whichever is greater). Credit certificates cannot be redeemed for cash, check, or gift certificates and cannot be credited back to a charge card.