Alaska Credit Application

Description

How to fill out Credit Application?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a range of legal document templates that you can download or print.

By utilizing the website, you can access thousands of forms for business and personal purposes, categorized by types, states, or keywords. You can find the latest versions of forms like the Alaska Credit Application in just minutes.

If you have a monthly membership, Log In to download the Alaska Credit Application from the US Legal Forms library. The Download button will appear on each form you view. You can access all previously stored forms in the My documents section of your account.

Choose the format and download the form to your device.

Make adjustments. Fill out, edit, and print and sign the saved Alaska Credit Application. Each template you add to your account has no expiration date and belongs to you indefinitely. Therefore, if you wish to download or print another version, simply go to the My documents section and click on the form you need.

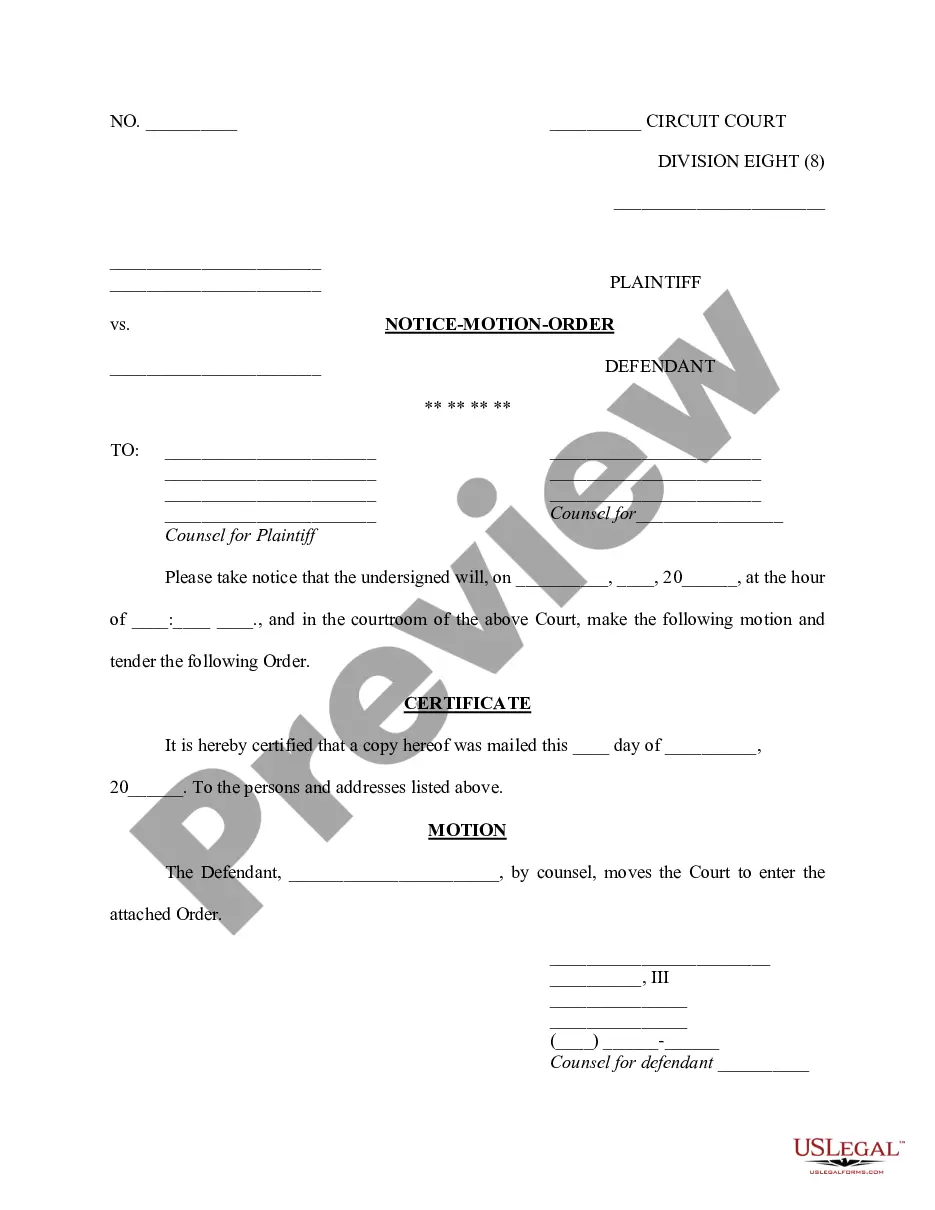

- Ensure that you have selected the correct form for your area/region. Click on the Preview button to evaluate the form's content.

- Review the form details to confirm that you have chosen the right one.

- If the form does not meet your needs, use the Search field at the top of the screen to find one that does.

- Once satisfied with the form, confirm your selection by clicking on the Purchase now button.

- Next, choose your preferred payment plan and provide your information to create an account.

- Complete the transaction. Use your credit card or PayPal account to finalize the purchase.

Form popularity

FAQ

Alaska Airlines: $440 Overall, we value Alaska Mileage Plan miles at 1.1 cents each, which means 40,000 miles will be equal to $440 worth of travel. When flying with Alaska Airlines, you'll pay a range of pricing depending on demand, distance and fare class.

Your credit certificate will remain valid for 12 months from the issue date of your original ticket, or 30 days from the date of exchange/cancellation (whichever is greater). Credit certificates cannot be redeemed for cash, check, or gift certificates and cannot be credited back to a charge card.

An optional service to help prevent declined purchases, returned checks or other overdrafts when you link your eligible Bank of America® checking account to your credit card. Transfer fees may apply.

Although Alaska allows refunds only for purchased refundable tickets, it does offer an exception if it changes or cancels your flight. And if you need to cancel a nonrefundable ticket, the airline will allow you to use the cost of your unused ticket for future travel, as long as travel is booked within a year.

The Alaska Airlines Visa Signature® credit card, issued by Bank of AmericaA®, stands out from much of the airline-card competition for one major reason: It offers an annual Companion Fare, which allows you to get a ticket for a traveling partner for just $121 ($99 plus taxes and fees from $22) once a year.

In the following situations, consumers are entitled to a refund of the ticket price and/or associated fees. Cancelled Flight A consumer is entitled to a refund if the airline cancelled a flight, regardless of the reason, and the consumer chooses not to travel.

If your flight does indeed qualify for a refund, though, you can expect to receive it anywhere from five days to a month after requesting it.

While not every ticket is refundable, we are committed to refunding all eligible tickets within 20 business days for cash purchases and 7 business days for credit card purchases. Note: It may take 7-14 business days for your credit card company to post your refund to your account.

The Alaska Airlines Visa Signature® credit card, issued by Bank of AmericaA®, stands out from much of the airline-card competition for one major reason: It offers an annual Companion Fare, which allows you to get a ticket for a traveling partner for just $121 ($99 plus taxes and fees from $22) once a year.

Alaska Airlines Visa Card credit score To get the Alaska Airlines Visa Signature® Card, you should have a FICOA® Score of at least 670. It usually takes good credit to get approved, and a credit score of at least 700 will give you even better odds.