Alaska Exchange Agreement: An Alaska Exchange Agreement, often referred to as a 1031 exchange agreement, is a legal arrangement that allows taxpayers in the United States to defer capital gains taxes on the sale of certain types of property. This agreement is authorized under Section 1031 of the Internal Revenue Code and provides a tax strategy for individuals or entities looking to reinvest the proceeds from the sale of property into a like-kind replacement property. The Alaska Exchange Agreement facilitates a tax-deferred exchange, commonly known as a 1031 exchange, through a Qualified Intermediary (QI). A Qualified Intermediary is a third-party entity that acts as a facilitator and holds the funds from the relinquished property sale to be used for the purchase of the replacement property. The purpose of an Alaska Exchange Agreement is to allow investors to redirect proceeds from the sale of an investment property into a new property without having to immediately pay capital gains taxes. By utilizing this exchange agreement, investors can benefit from potential appreciation and income generation from the newly acquired property, while deferring capital gains taxes to a later date. Different Types of Alaska Exchange Agreements: 1. Simultaneous Exchange: In this type of exchange, the relinquished property is sold, and the replacement property is acquired on the same day. The QI facilitates the transfer of funds between the parties involved. 2. Delayed Exchange: This is the most common type of 1031 exchange. It involves a time gap between the sale of the relinquished property and the acquisition of the replacement property. Taxpayers have 45 days to identify potential replacement properties and 180 days to close on one or more of the identified properties. 3. Reverse Exchange: In a reverse exchange, the replacement property is acquired first, and then the relinquished property is sold. This type of exchange allows taxpayers to secure a desirable replacement property without the risk of losing it. 4. Build-to-Suit Exchange: This exchange involves the construction of a replacement property using the proceeds from the sale of the relinquished property. The QI holds the funds during the construction phase. Benefits of Alaska Exchange Agreement and Brokerage Arrangement: 1. Tax Deferral: The primary benefit of utilizing an Alaska Exchange Agreement is the ability to defer capital gains taxes on the sale of investment property. This allows investors to reinvest their funds and potentially generate higher returns. 2. Portfolio Diversification: The exchange agreement provides investors with the opportunity to diversify their investment portfolio by acquiring different types of property. This can help mitigate risk and enhance long-term investment strategies. 3. Wealth Preservation: By deferring taxes, investors can preserve their wealth and have additional funds available for reinvestment or other purposes. 4. Financial Flexibility: The exchange agreement offers investors the freedom to adapt their investment strategy as market conditions change. They can sell properties and acquire new ones without immediate tax consequences. In conclusion, an Alaska Exchange Agreement, also known as a 1031 exchange agreement, is a powerful tool for investors to defer capital gains taxes on the sale of qualifying investment properties. Various types of exchanges, such as simultaneous, delayed, reverse, and build-to-suit, provide flexibility and tax advantages. Utilizing an exchange agreement and brokerage arrangement can help investors optimize their investment strategies, preserve wealth, and diversify their portfolios.

Alaska Exchange Agreement, Brokerage Arrangement

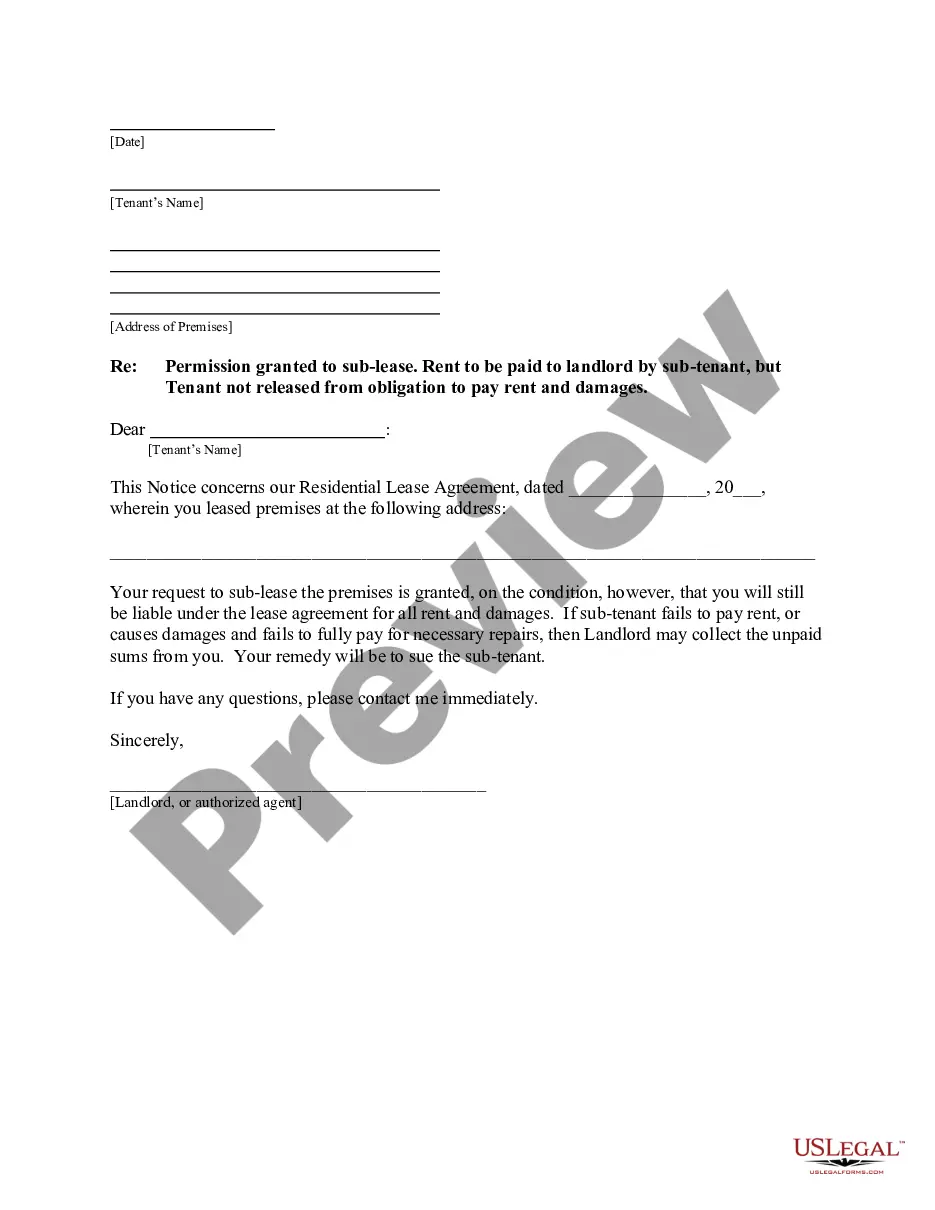

Description

How to fill out Alaska Exchange Agreement, Brokerage Arrangement?

US Legal Forms - one of several most significant libraries of legitimate varieties in the USA - provides a wide range of legitimate papers web templates you may acquire or print out. Utilizing the website, you may get 1000s of varieties for organization and specific uses, categorized by groups, says, or search phrases.You will find the most recent versions of varieties such as the Alaska Exchange Agreement, Brokerage Arrangement in seconds.

If you already have a subscription, log in and acquire Alaska Exchange Agreement, Brokerage Arrangement through the US Legal Forms collection. The Down load option can look on each and every develop you look at. You have access to all in the past downloaded varieties in the My Forms tab of your respective bank account.

If you would like use US Legal Forms the very first time, allow me to share easy guidelines to help you started off:

- Ensure you have chosen the proper develop for your area/state. Go through the Review option to examine the form`s articles. See the develop description to ensure that you have selected the proper develop.

- When the develop doesn`t fit your specifications, take advantage of the Look for area at the top of the monitor to obtain the one which does.

- Should you be satisfied with the form, validate your choice by clicking on the Acquire now option. Then, select the prices strategy you favor and provide your references to sign up on an bank account.

- Procedure the financial transaction. Make use of bank card or PayPal bank account to finish the financial transaction.

- Choose the structure and acquire the form in your gadget.

- Make changes. Fill up, change and print out and indicator the downloaded Alaska Exchange Agreement, Brokerage Arrangement.

Every web template you included with your account lacks an expiry day and is yours permanently. So, in order to acquire or print out yet another copy, just proceed to the My Forms area and click on about the develop you will need.

Gain access to the Alaska Exchange Agreement, Brokerage Arrangement with US Legal Forms, the most substantial collection of legitimate papers web templates. Use 1000s of skilled and state-distinct web templates that satisfy your small business or specific requires and specifications.