Alaska Guaranty with Pledged Collateral is a financial arrangement commonly used in commercial transactions and loan agreements. It acts as a form of security or collateral to protect the lender (guarantee recipient) in case the borrower (guarantor) defaults on the loan. In this arrangement, the guarantor pledges specific assets or property as collateral to secure the loan. By pledging collateral, the guarantor is assuring the lender that if they are unable to repay the loan, the lender has the right to seize and sell the pledged assets to recover their funds. There are several types of Alaska Guaranty with Pledged Collateral that can be utilized depending on the nature of the transaction or loan agreement: 1. Real Estate Pledge: In this scenario, the guarantor pledges a property, such as land, buildings, or homes, as collateral. The value of the property determines the maximum loan amount that can be guaranteed. 2. Equipment Pledge: If the loan is intended for purchasing or leasing equipment, the guarantor can pledge the equipment itself as collateral. In case of default, the lender may seize and sell the equipment to recover their loan amount. 3. Inventory Pledge: In certain cases, guarantors can pledge their existing stock or inventory as collateral to secure a loan. This type of collateral is commonly used in businesses heavily reliant on inventory, such as retail or manufacturing. 4. Cash Pledge: Rather than pledging physical assets, some lenders may require the guarantor to deposit a specific amount of cash into a designated account. This provides the lender with easily accessible funds to cover potential default. 5. Securities Pledge: Guarantors can pledge certain securities, such as stocks, bonds, or mutual funds, as collateral. In case of default, the lender has the right to sell the securities to obtain the loan amount. It's worth noting that the specific terms and conditions of an Alaska Guaranty with Pledged Collateral can vary depending on the agreement between the borrower, guarantor, and lender. The type of pledged collateral, its valuation, and the procedures for default and recovery are usually outlined in a detailed contract or promissory note signed by all parties involved.

Alaska Guaranty with Pledged Collateral

Description

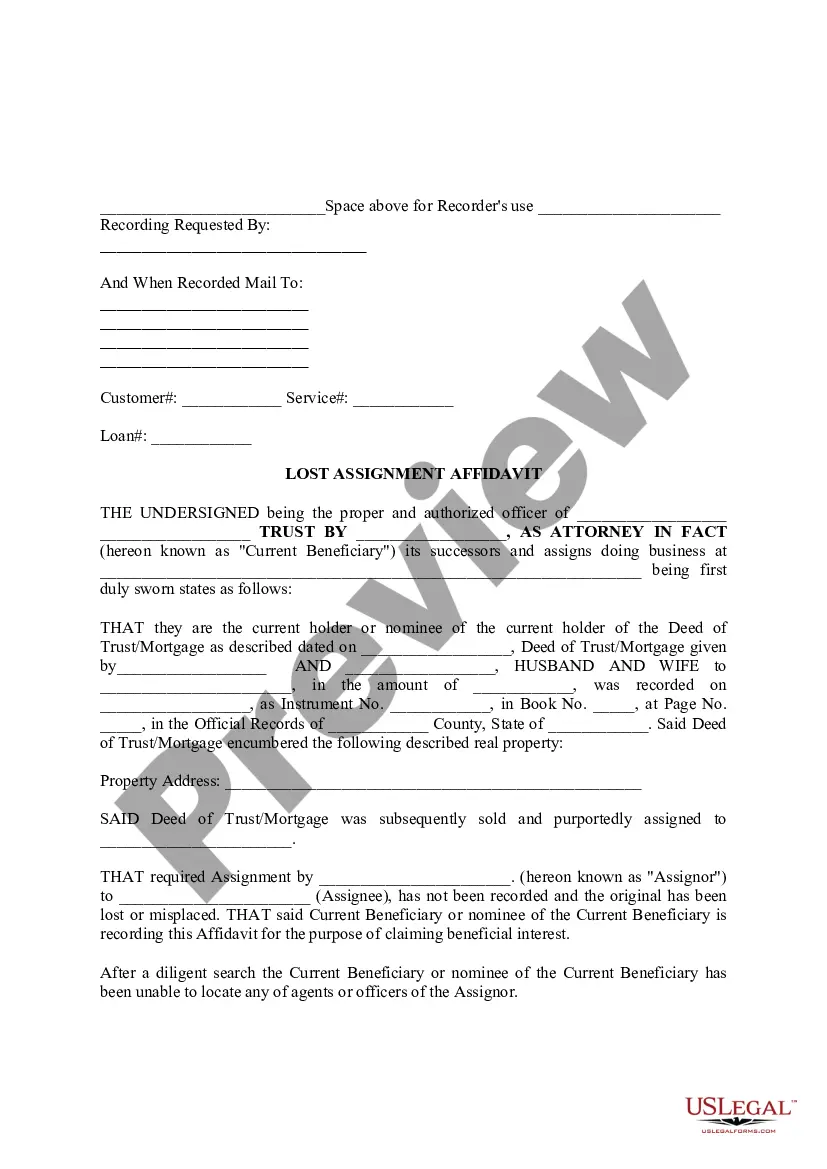

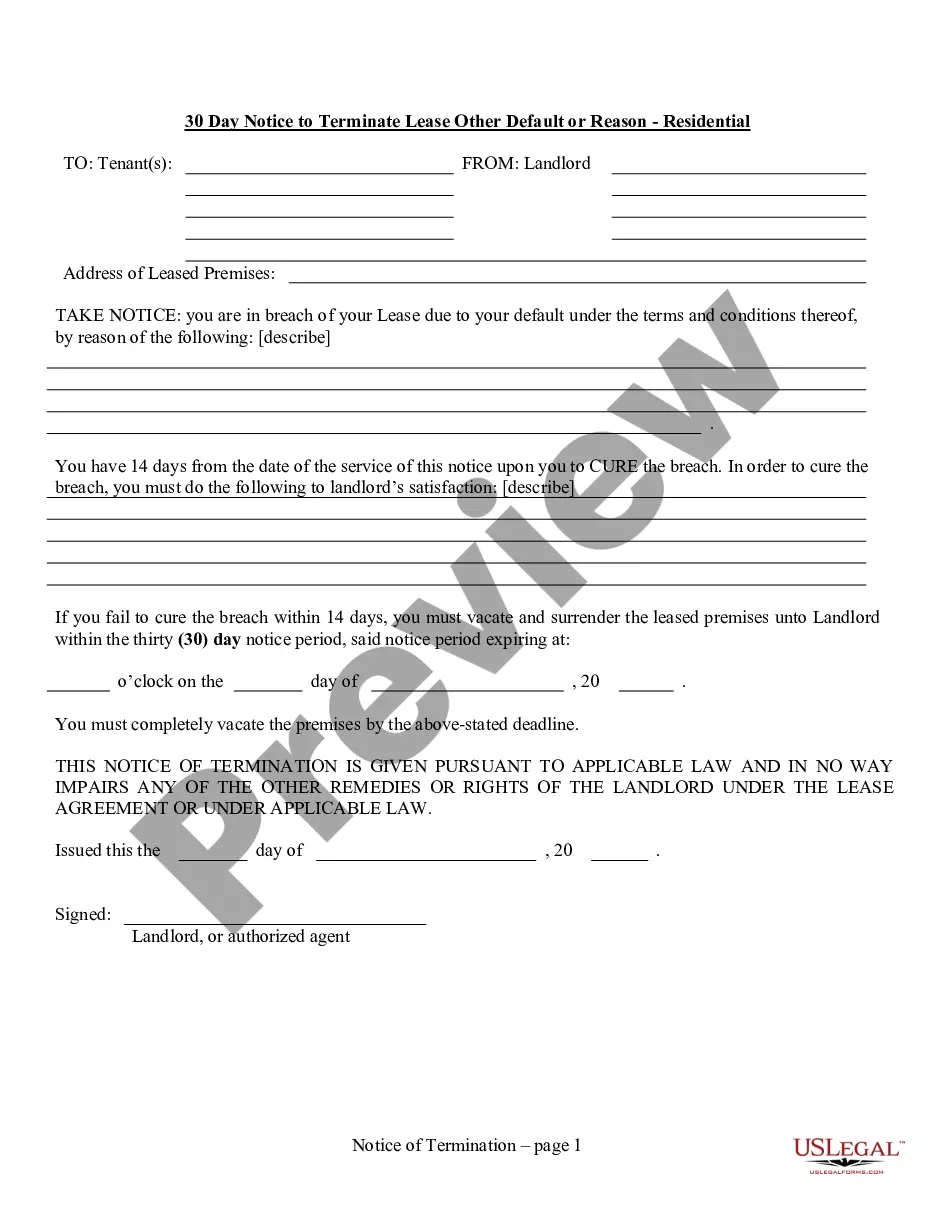

How to fill out Alaska Guaranty With Pledged Collateral?

US Legal Forms - one of several biggest libraries of legitimate kinds in America - provides a variety of legitimate record themes you are able to acquire or print out. Utilizing the web site, you may get a huge number of kinds for company and person uses, categorized by categories, states, or keywords.You will discover the latest variations of kinds much like the Alaska Guaranty with Pledged Collateral within minutes.

If you currently have a membership, log in and acquire Alaska Guaranty with Pledged Collateral in the US Legal Forms local library. The Obtain switch will show up on every single kind you look at. You have accessibility to all previously delivered electronically kinds inside the My Forms tab of your own bank account.

If you would like use US Legal Forms for the first time, listed below are basic guidelines to obtain started off:

- Be sure you have selected the right kind for the town/region. Select the Preview switch to check the form`s content. Look at the kind explanation to actually have chosen the proper kind.

- If the kind does not match your specifications, utilize the Search area at the top of the screen to get the one which does.

- When you are satisfied with the form, verify your choice by simply clicking the Acquire now switch. Then, opt for the costs strategy you want and supply your accreditations to register for an bank account.

- Approach the transaction. Make use of bank card or PayPal bank account to perform the transaction.

- Choose the format and acquire the form in your gadget.

- Make modifications. Load, modify and print out and sign the delivered electronically Alaska Guaranty with Pledged Collateral.

Each template you included with your bank account does not have an expiry day and is yours permanently. So, in order to acquire or print out yet another version, just visit the My Forms segment and click on in the kind you want.

Obtain access to the Alaska Guaranty with Pledged Collateral with US Legal Forms, probably the most extensive local library of legitimate record themes. Use a huge number of professional and express-distinct themes that fulfill your small business or person requires and specifications.