Alaska Assignment of Security Agreement and Note with Recourse

Description

How to fill out Assignment Of Security Agreement And Note With Recourse?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a variety of legal document templates that you can download or print.

By using the website, you can access thousands of forms for business and personal use, categorized by types, states, or keywords.

You can find the most recent versions of forms such as the Alaska Assignment of Security Agreement and Note with Recourse within moments.

If the form does not meet your needs, use the Search field at the top of the screen to find one that does.

If you are satisfied with the form, confirm your selection by clicking the Get now button. Then, select the payment plan you want and provide your information to register for the account.

- If you have a membership, Log In and download the Alaska Assignment of Security Agreement and Note with Recourse from the US Legal Forms library.

- The Download button will appear on each form you view.

- You can access all previously downloaded forms from the My documents section of your account.

- To use US Legal Forms for the first time, here are some straightforward steps to get started.

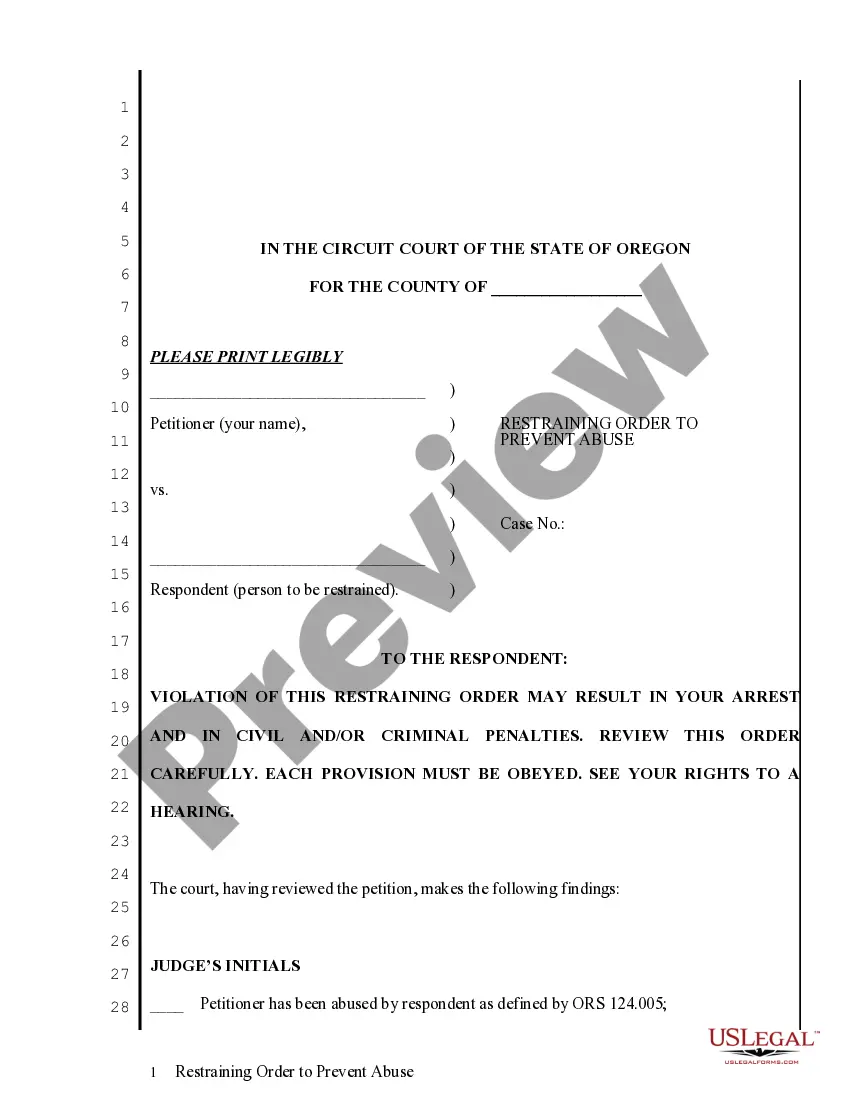

- Ensure you have chosen the correct form for your city/state. Click the Preview button to check the form’s details.

- Review the description of the form to ensure you have chosen the right one.

Form popularity

FAQ

Without recourse can mean that the buyer of a promissory note or other negotiable instrument assumes the risk of default. A sale that is with recourse means that the seller bears responsibility for the sold asset if it turns out to be defective, and the buyer can seek recourse from the seller.

Recourse loans are loans that allow the lender to seize many of the borrower's assets if the borrower fails to repay their loaneven assets that were not included in the loan agreement as collateral. With a nonrecourse loan, the lender may only seize those assets specified in the original loan agreement as collateral.

One form of transaction is "assignment without recourse," which means that once the loan is sold or transferred, neither the borrower nor the new loan holder can hold the original loan-maker liable for anything.

A sale that is with recourse means that the seller bears responsibility for the sold asset if it turns out to be defective, and the buyer can seek recourse from the seller. Sales without recourse means that the buyer accepts the risk associated with purchasing an item.

Full recourse is a state in which a debt obligation is owed regardless of the borrower's personal and financial situation. With full recourse, the lender can take whatever assets it wants to satisfy the borrower's debt.

What Is Recourse? A recourse is a legal agreement that gives the lender the right to pledged collateral if the borrower is unable to satisfy the debt obligation. Recourse refers to the lender's legal right to collect.

Recourse factoring is the most common and means that your company must buy back any invoices that the factoring company is unable to collect payment on. You are ultimately responsible for any non-payment. Non-recourse factoring means the factoring company assumes most of the risk of non-payment by your customers.

Recourse is defined as a means of assistance or source of help during a difficult situation or conflict. When you call the police after your car has been stolen and turn to the police for help, this is an example of a situation where the police were your recourse.

Security agreements are generally used to supplement a secured promissory note. The note is the borrower's actual promise to repay the money it received. The enclosed security agreement assumes the existence of a secured promissory note, but that agreement is not included with this package.

Primary tabs. A phrase meaning that one party has no legal claim against another party. It is often used in two contexts: 1. In litigation, someone without recourse against another party cannot sue that party, or at least cannot obtain adequate relief even if a lawsuit moves forward.