Alaska Equipment Lease with Lessor to Purchase Equipment Specified by Lessee is a contractual agreement that allows businesses in Alaska to lease equipment from a lessor with an option to purchase the specified equipment at the end of the lease term. This type of lease arrangement is commonly used by companies in various industries to acquire necessary equipment without a large upfront investment. The equipment lease allows the lessee, which is the company or individual using the equipment, to use the equipment for a specific period of time while paying regular lease payments to the lessor, who is the owner of the equipment. At the end of the lease term, the lessee has the option to purchase the equipment for a predetermined price, commonly referred to as the buyout price or residual value. This type of lease is beneficial for businesses that have a short-term need for equipment or for those wishing to test the equipment before committing to a full purchase. It provides flexibility and the opportunity to upgrade equipment as technology advances or business needs change. Some common types of Alaska Equipment Lease with Lessor to Purchase Equipment Specified by Lessee include: 1. Construction Equipment Lease: This type of lease is specifically designed for the construction industry, allowing businesses to lease heavy machinery, such as excavators, bulldozers, or cranes, with the option to purchase at the lease end. 2. Medical Equipment Lease: Medical facilities and healthcare providers often choose this lease option to acquire expensive medical equipment, such as MRI machines, ultrasound machines, or surgical tools. It allows them to meet their immediate needs without committing to a long-term purchase. 3. Restaurant Equipment Lease: Restaurants, cafés, and food service establishments can take advantage of this lease type to acquire commercial-grade kitchen equipment, such as refrigerators, ovens, or dishwashers, with the possibility to purchase them at the end of the lease. 4. Technology Equipment Lease: Companies in the tech industry often opt for this lease arrangement to access the latest technology equipment, such as computers, servers, or networking devices, knowing they have the option to upgrade or purchase the equipment when required. 5. Industrial Equipment Lease: Industries like manufacturing and logistics frequently rely on this lease option to lease heavy machinery, forklifts, conveyor systems, or warehouse equipment, with the option to own them in the long run. In summary, Alaska Equipment Lease with Lessor to Purchase Equipment Specified by Lessee offers businesses the opportunity to access and utilize necessary equipment without a huge initial investment. With various types of leases available, companies can find the specific arrangement that suits their industry and equipment needs. This lease structure allows flexibility, adaptability, and the option to eventually own the equipment, providing a practical solution for businesses based in Alaska.

Alaska Equipment Lease with Lessor to Purchase Equipment Specified by Lessee

Description

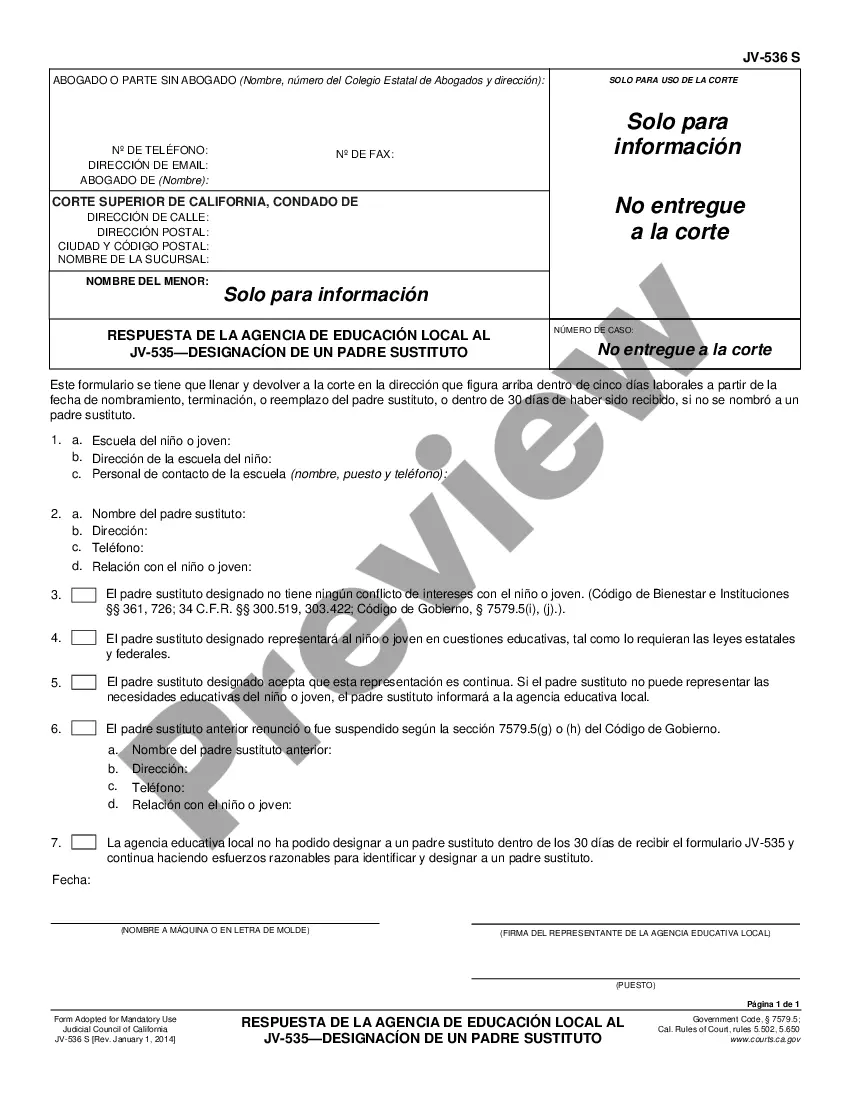

How to fill out Alaska Equipment Lease With Lessor To Purchase Equipment Specified By Lessee?

US Legal Forms - among the greatest libraries of authorized kinds in the States - provides a wide array of authorized document web templates it is possible to down load or printing. Using the web site, you can find a large number of kinds for organization and personal functions, categorized by classes, claims, or key phrases.You will discover the newest types of kinds just like the Alaska Equipment Lease with Lessor to Purchase Equipment Specified by Lessee in seconds.

If you already possess a monthly subscription, log in and down load Alaska Equipment Lease with Lessor to Purchase Equipment Specified by Lessee from your US Legal Forms catalogue. The Obtain button can look on every type you see. You gain access to all in the past saved kinds in the My Forms tab of your own profile.

If you want to use US Legal Forms initially, listed here are simple guidelines to obtain started out:

- Ensure you have picked out the right type for the metropolis/state. Select the Preview button to analyze the form`s information. See the type information to ensure that you have selected the right type.

- In the event the type doesn`t fit your specifications, take advantage of the Lookup industry at the top of the monitor to get the one which does.

- In case you are content with the form, validate your option by simply clicking the Get now button. Then, opt for the rates plan you like and supply your references to register to have an profile.

- Process the purchase. Utilize your charge card or PayPal profile to perform the purchase.

- Choose the file format and down load the form in your device.

- Make changes. Complete, edit and printing and indicator the saved Alaska Equipment Lease with Lessor to Purchase Equipment Specified by Lessee.

Each and every format you included with your money lacks an expiration particular date and it is your own permanently. So, if you want to down load or printing one more backup, just visit the My Forms portion and click on on the type you will need.

Get access to the Alaska Equipment Lease with Lessor to Purchase Equipment Specified by Lessee with US Legal Forms, the most considerable catalogue of authorized document web templates. Use a large number of professional and condition-certain web templates that meet up with your company or personal requires and specifications.

Form popularity

FAQ

What is equipment leasing? Equipment leasing is a type of financing in which you rent equipment rather than purchase it outright. You can lease expensive equipment for your business, such as machinery, vehicles or computers.

The equipment leasing company leases the asset to other companies either on the operating lease or finance lease. The Finance Lease also called as Capital Lease is the long term arrangement wherein the lessee is obligated to pay the lease rent until the expiry of the lease contract.

A lease will always have at least two parties: the lessor and the lessee. The lessor is the person or business that owns the equipment. The lessee is the person or business renting the equipment. The lessee will make payments to the lessor throughout the contract.

Equipment leasing is a type of financing in which you rent equipment rather than purchase it outright. You can lease expensive equipment for your business, such as machinery, vehicles or computers.

Capital Lease Criteria The criteria for a capital lease can be any one of the following four alternatives: Ownership. The ownership of the asset is shifted from the lessor to the lessee by the end of the lease period; or. Bargain purchase option.

The equipment account is debited by the present value of the minimum lease payments and the lease liability account is the difference between the value of the equipment and cash paid at the beginning of the year. Depreciation expense must be recorded for the equipment that is leased.

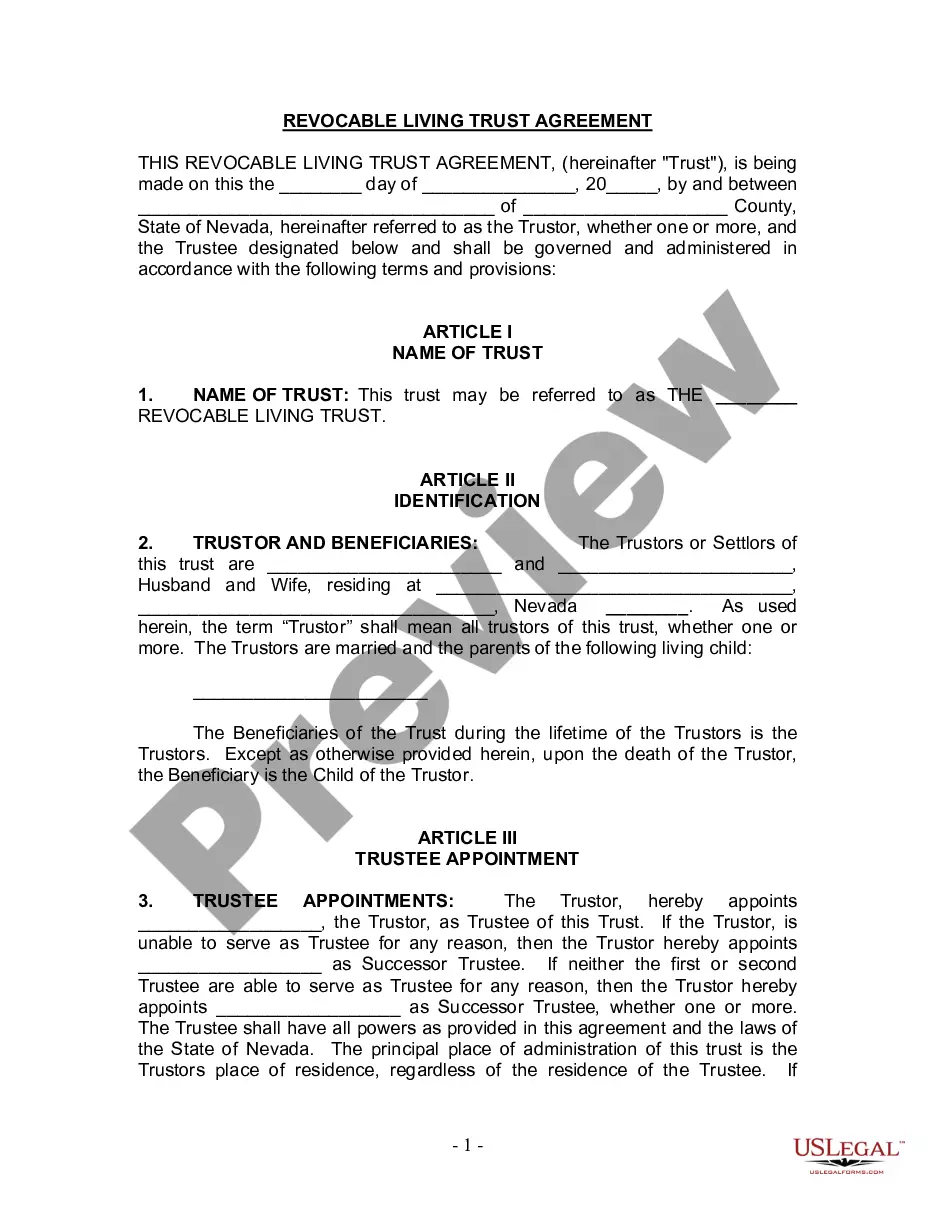

An equipment lease agreement is a contractual agreement where the lessor, who is the owner of the equipment, allows the lessee to use the equipment for a specified period in exchange for periodic payments. The subject of the lease may be vehicles, factory machines, or any other equipment.

Capital leases transfer ownership to the lessee while operating leases usually keep ownership with the lessor. For accounting purposes, short-term leases under 12 months in length are treated as expenses and longer-term leases are capitalized as assets.

Learn more about Equipment Leasing!Sale/Leaseback: (allows you to use your equipment to get working capital)True Lease or Operating Equipment Leases: (Also known as fair market value leases)The P.U.T. Option Lease (Purchase upon Termination)TRAC Equipment Leases.More items...