Alaska Charitable Contribution Payroll Deduction Form

Description

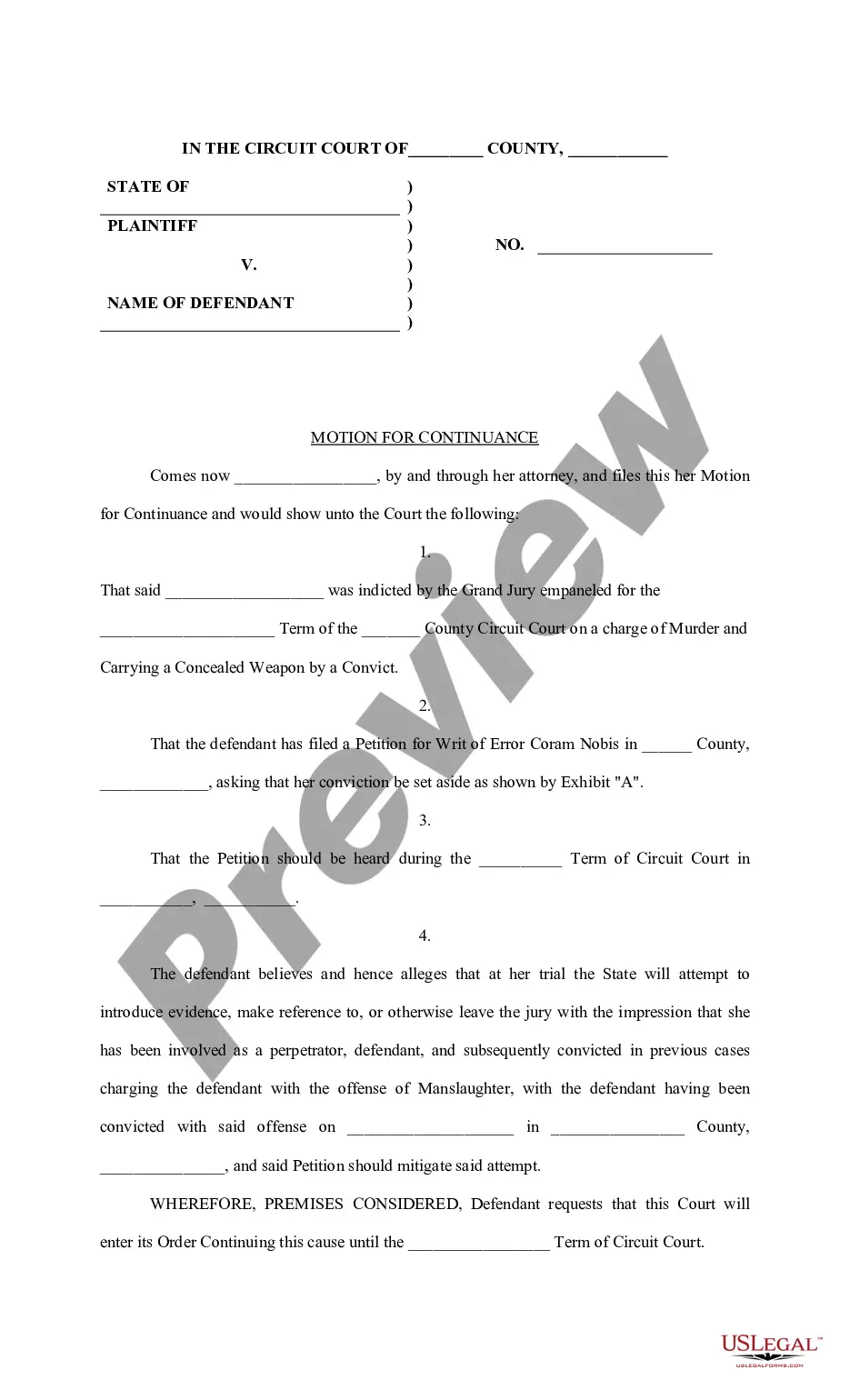

How to fill out Charitable Contribution Payroll Deduction Form?

Selecting the correct legal document template can be a challenge.

Of course, there are numerous templates accessible online, but how can you find the legal document you need.

Utilize the US Legal Forms website.

If you are already registered, Log In to your account and click the Obtain button to get the Alaska Charitable Contribution Payroll Deduction Form. Use your account to access the legal forms you have previously purchased. Visit the My documents tab in your account to retrieve another copy of the documents you need. If you are a new user of US Legal Forms, here are simple steps for you to follow: First, ensure you have selected the correct form for your city/region. You can preview the form using the Review button and read the form details to confirm it’s the correct one for you. If the form does not meet your needs, use the Search area to find the appropriate form. When you are sure the form is suitable, click the Purchase now button to obtain the form. Choose the pricing plan you prefer and enter the required information. Create your account and pay for the order using your PayPal account or Visa or Mastercard. Select the file format and download the legal document template to your device. Complete, modify, print, and sign the received Alaska Charitable Contribution Payroll Deduction Form. US Legal Forms is the largest collection of legal documents where you can find numerous paper templates. Utilize the service to acquire properly crafted documents that adhere to state regulations.

- The service offers thousands of templates, such as the Alaska Charitable Contribution Payroll Deduction Form, suitable for business and personal use.

- All forms are reviewed by professionals and comply with federal and state regulations.

Form popularity

FAQ

Your Alaska PFD gets reported on Form 1040, Schedule 1, Line 8....Then enter:Permanent Fund Dividend Division in Who Paid You?92-6001185 for the Payer's Federal ID Number.Enter 992 in Box 3, then select Continue.

Your Alaska PFD gets reported on Form 1040, Schedule 1, Line 8.

Taxpayers report the PFD payments as other income on Line 21 of Form 1040, Line 13 of Form 1040A or Line 3 of Form 1040EZ. The PFD payments are added to your other ordinary income from work and other sources.

For 2021, you can deduct up to $300 for cash contributions to qualifying charities ($600 for married couples filing jointly). For more information, see Expanded tax benefits help individuals and businesses give to charity in 2021 at the IRS website.

A charitable contribution is a donation or gift to, or for the use of, a qualified organization. It is voluntary and is made without getting, or ex- pecting to get, anything of equal value. Qualified organizations.

You don't have to report your child's Permanent Fund Distribution on your own return. If your child had more unearned income than $1,050, but less than $10,500, then you have a choice to either report it on your child's tax return or your own tax return.

You may deduct charitable contributions of money or property made to qualified organizations if you itemize your deductions. Generally, you may deduct up to 50 percent of your adjusted gross income, but 20 percent and 30 percent limitations apply in some cases.

Mandatory Payroll Tax DeductionsFederal income tax withholding.Social Security & Medicare taxes also known as FICA taxes.State income tax withholding.Local tax withholdings such as city or county taxes, state disability or unemployment insurance.Court ordered child support payments.

Enter the ordinary dividends from box 1a on Form 1099-DIV, Dividends and Distributions on line 3b of Form 1040, U.S. Individual Income Tax Return, Form 1040-SR, U.S. Tax Return for Seniors or Form 1040-NR, U.S. Nonresident Alien Income Tax Return.

For 2020, the charitable limit was $300 per tax unit meaning that those who are married and filing jointly can only get a $300 deduction. For the 2021 tax year, however, those who are married and filing jointly can each take a $300 deduction, for a total of $600.