Alaska Option to Purchase Real Estate - Long Form

Description

How to fill out Option To Purchase Real Estate - Long Form?

Have you ever found yourself in a situation where you need documentation for either business or personal purposes almost daily.

There are many legal document templates available online, but finding ones you can trust is not easy.

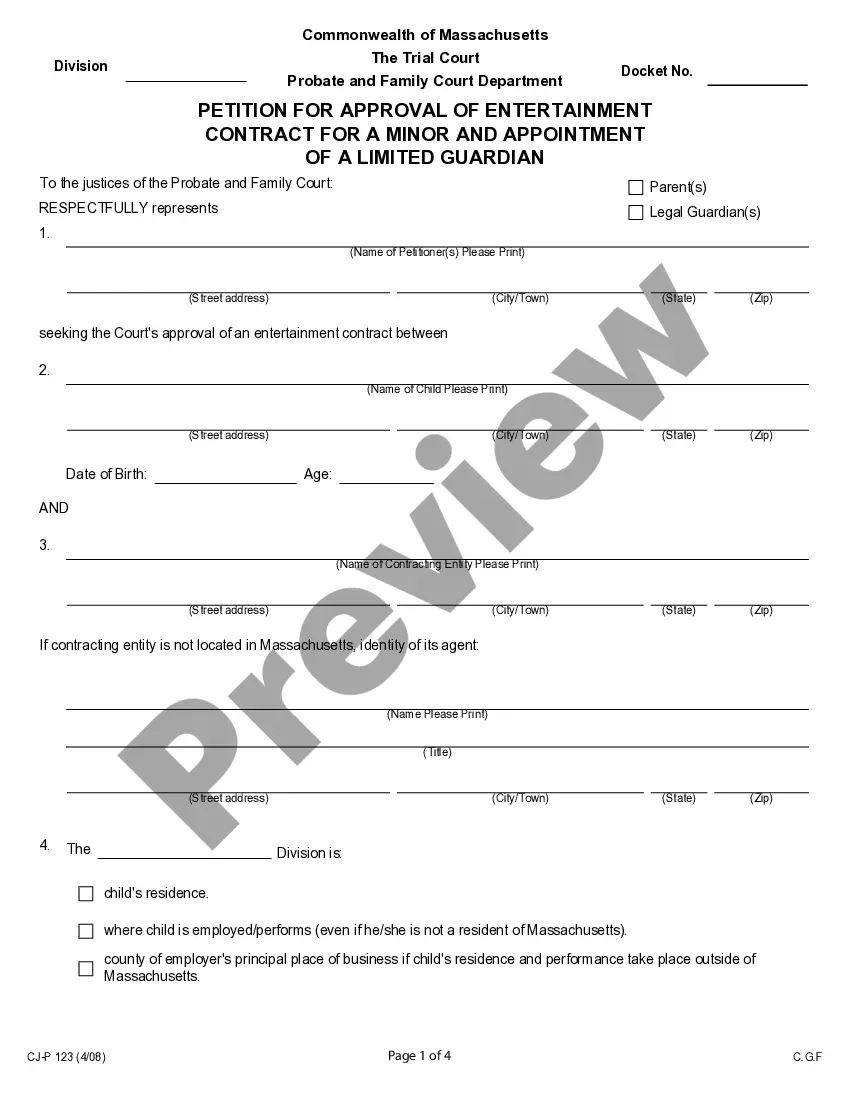

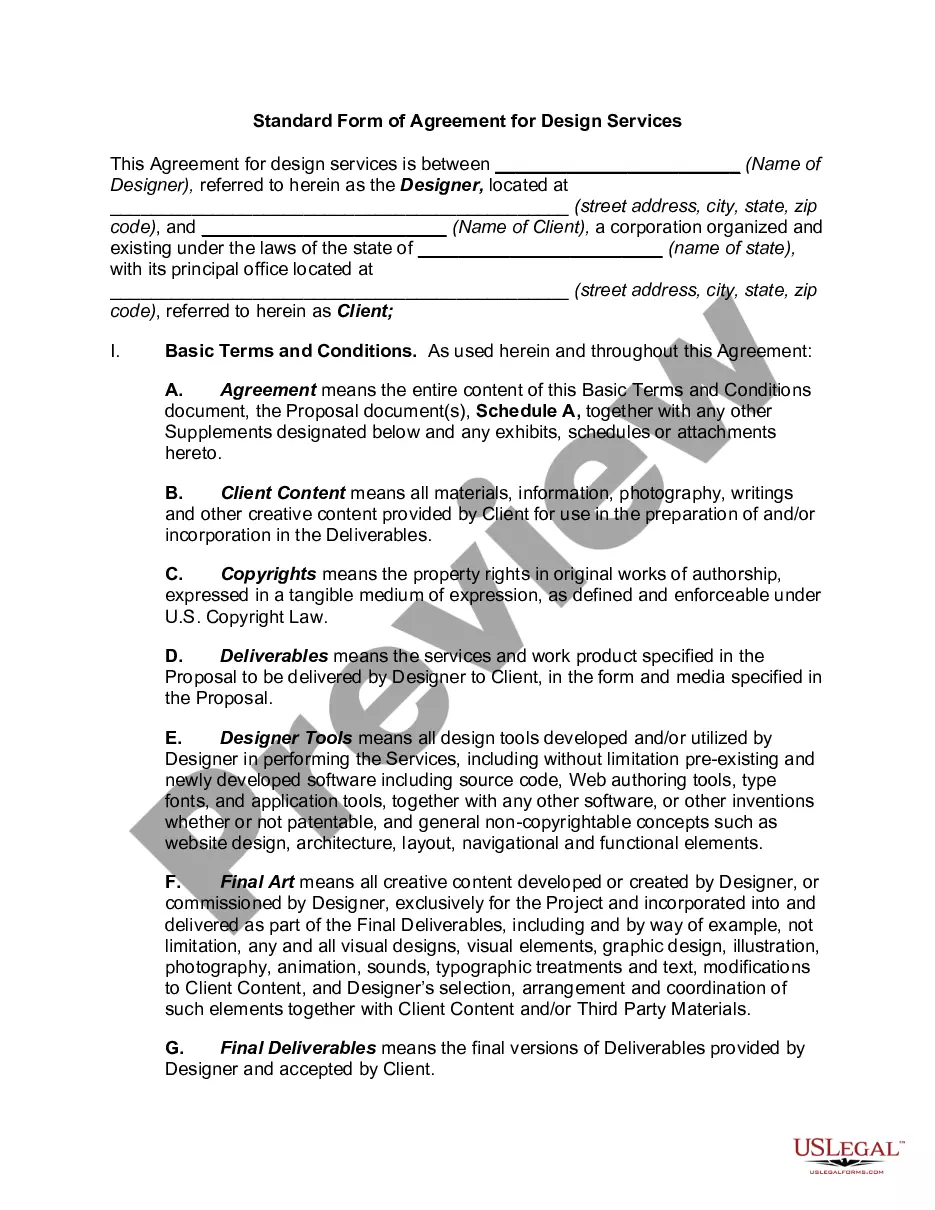

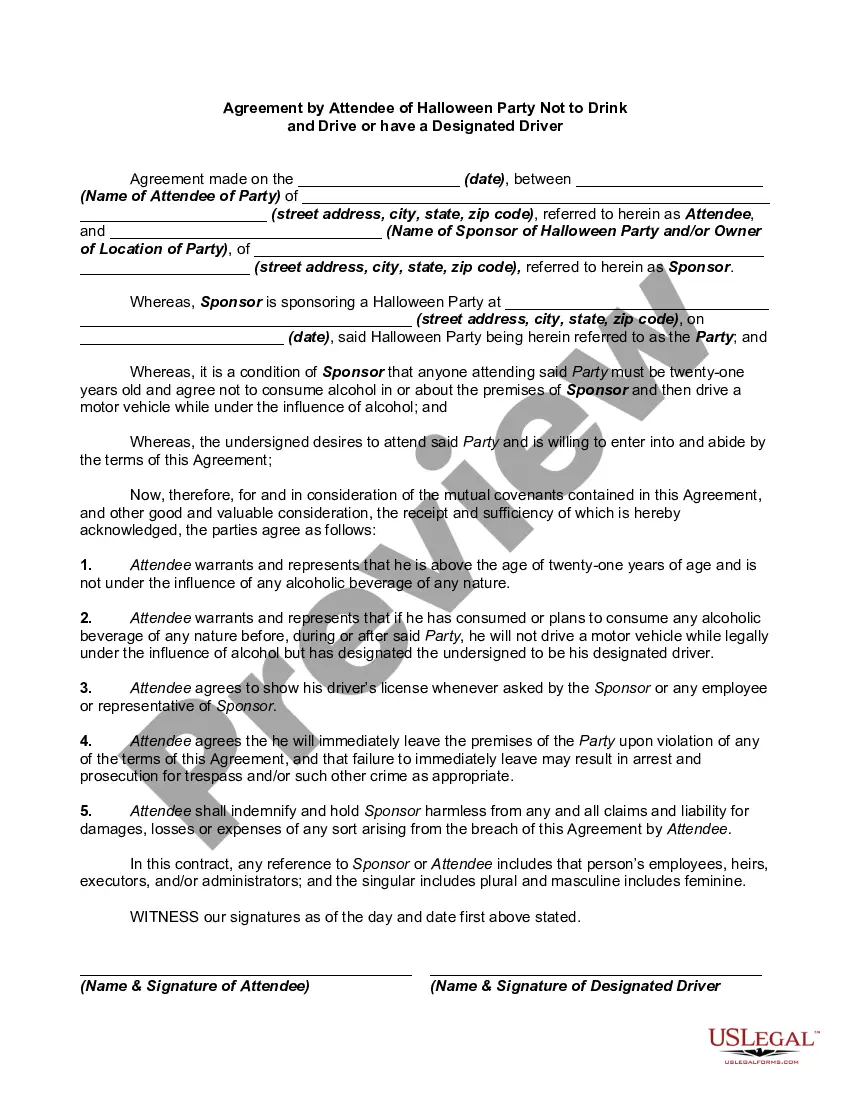

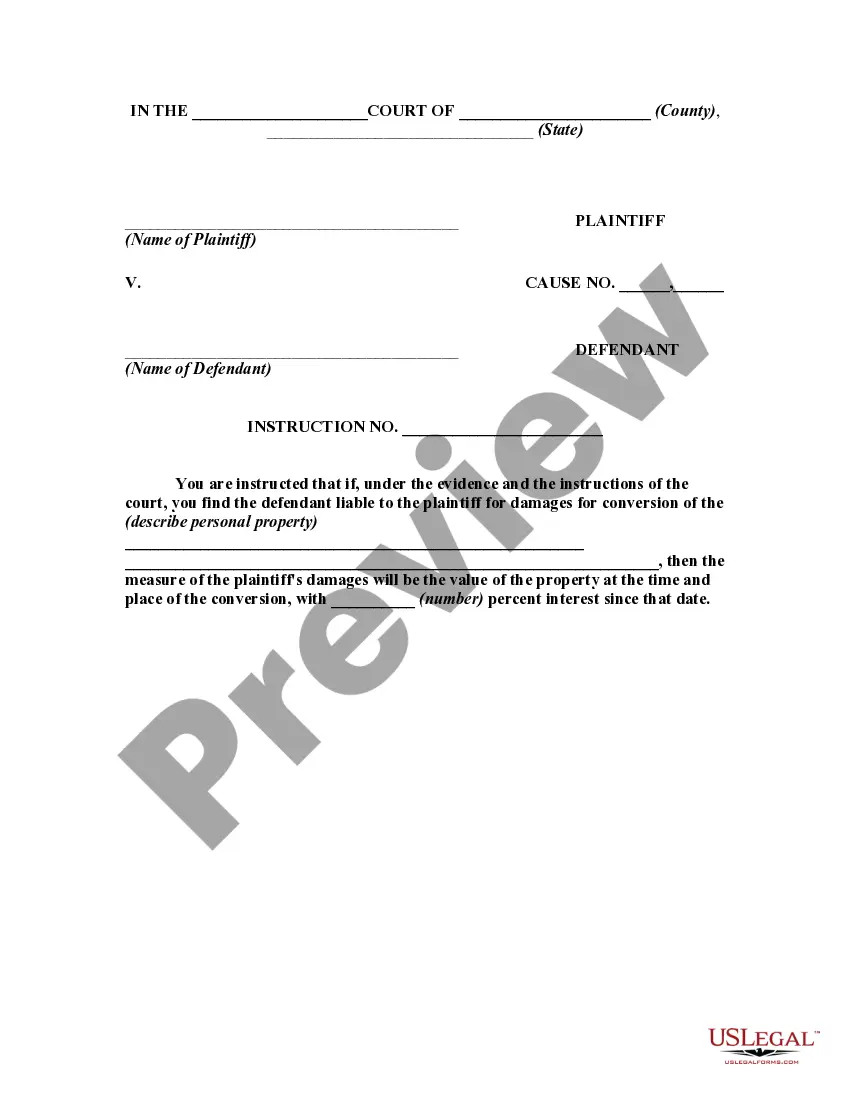

US Legal Forms provides thousands of form templates, including the Alaska Option to Purchase Real Estate - Long Form, which can be printed to meet both state and federal requirements.

Utilize US Legal Forms, the most extensive collection of legal forms, to save time and prevent mistakes.

The service offers professionally crafted legal document templates that you can use for various purposes. Create an account on US Legal Forms and start simplifying your life.

- If you are already acquainted with the US Legal Forms website and have an account, simply Log In.

- Next, you can download the Alaska Option to Purchase Real Estate - Long Form template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/state.

- Utilize the Review button to examine the form.

- Verify the details to ensure you have selected the correct form.

- If the form isn’t what you need, use the Search field to find the form that meets your needs and requirements.

- Once you find the correct form, click on Buy now.

- Select the payment plan you prefer, enter the necessary information to complete your transaction, and finalize your purchase using PayPal or Visa or Mastercard.

- Choose a convenient document format and download your copy.

- You can find all the document templates you have purchased in the My documents menu.

- You can download another copy of the Alaska Option to Purchase Real Estate - Long Form at any time if needed. Just click on the required form to download or print the document template.

Form popularity

FAQ

Yes, Alaska does not impose a state-level real estate transfer tax, making it an attractive option for buyers. However, certain local jurisdictions may have their own transfer fees, so it's essential to check those specifics. Understanding the Alaska Option to Purchase Real Estate - Long Form can help you navigate local regulations effectively and ensure that you are well-informed before making any decisions.

To submit an offer as a buyer's agent, begin by collecting all necessary documents, including the purchase agreement and any required disclosures. Next, fill out the offer form accurately, ensuring that the terms reflect the Alaska Option to Purchase Real Estate - Long Form you intend to use. Finally, present the offer to the seller's agent through your preferred communication method, such as email or in-person, ensuring you follow up appropriately.

In the context of the Alaska Option to Purchase Real Estate - Long Form, the 'Optionee' refers to the buyer who holds the right to purchase the property, while the 'Optionor' is the seller who grants this right. This distinction is crucial as it defines the roles and responsibilities of each party in the contract. The Optionee has the exclusive right to buy, whereas the Optionor cannot sell to anyone else during the option period. Understanding these terms can help you make informed decisions in real estate transactions.

To obtain your Alaska real estate license, you must complete pre-licensing education that includes courses on real estate principles and practices. After finishing the required coursework, you must pass the state exam and submit your application to the Alaska Real Estate Commission. Once you obtain your license, you can begin working with real estate transactions, including using the Alaska Option to Purchase Real Estate - Long Form. Ensure you stay informed about continuing education requirements to maintain your license.

An option agreement provides for the landowner to profit from the enhanced value of their land as a result of planning permission being granted, without having to go through the planning process themselves. The landowner may also receive an option fee.

What is an "option to purchase" agreement? An option to purchase is an agreement that gives a potential buyer (optionee) the right, but not the obligation, to buy property in the future. The optionee must decide by a certain time whether to exercise the option and thereafter by bound under the contract to purchase.

Broadly, a real estate option is a specially designed contract provision between a buyer and a seller. The seller offers the buyer the option to buy a property by a specified period of time at a fixed price. The buyer purchases the option to buy or not buy the property by the end of the holding period.

The basics: What is an option contract in real estate? In the simplest terms, a real-estate option contract is a uniquely designed agreement that's strictly between the seller and the buyer. In this agreement, a seller offers an option to the buyer to purchase property at a fixed price within a limited time frame.

An option to purchase is an agreement that gives a potential buyer (optionee) the right, but not the obligation, to buy property in the future. The optionee must decide by a certain time whether to exercise the option and thereafter by bound under the contract to purchase.

No matter the format, an option to purchase must: 1) state the option fee, 2) set the duration of the option period, 3) outline the price for which the tenant will purchase the property in the future, and 4) comply with local and state laws.