Alaska Notice of Annual Report of Employee Benefits Plans

Description

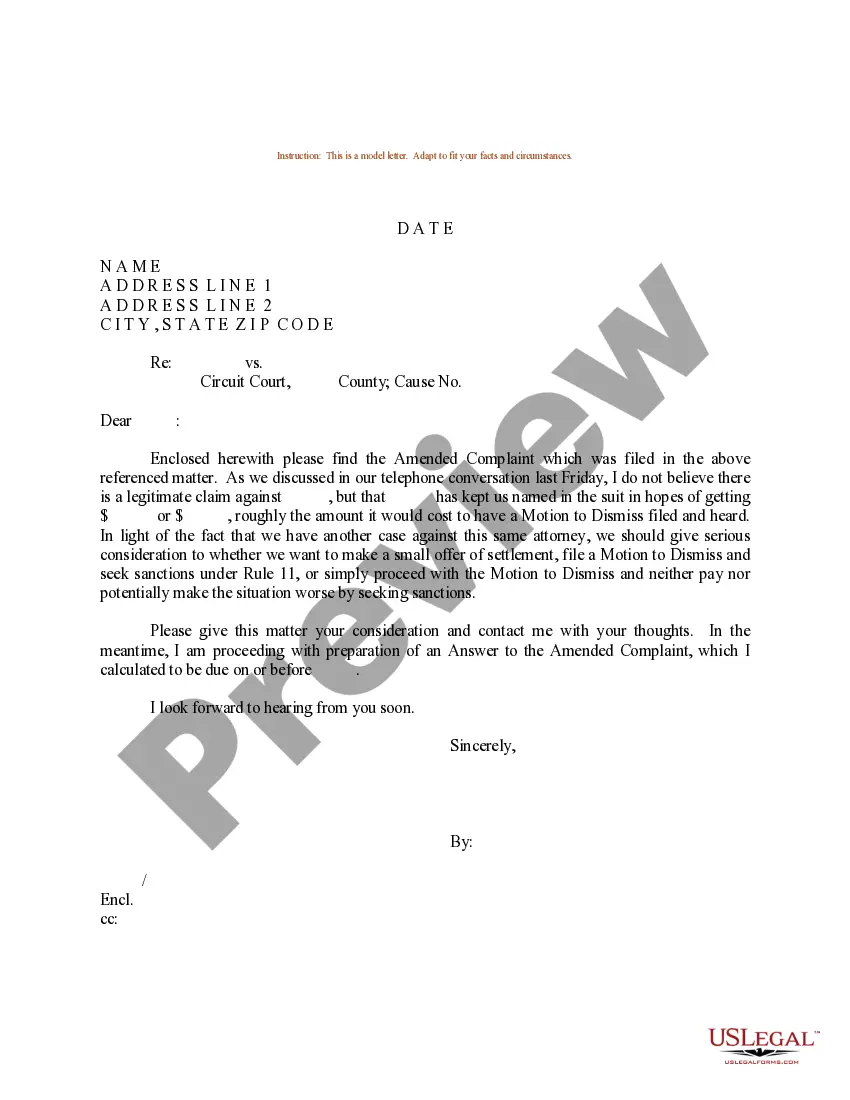

How to fill out Notice Of Annual Report Of Employee Benefits Plans?

You are able to devote hrs on the Internet attempting to find the legitimate record template which fits the federal and state needs you need. US Legal Forms supplies a huge number of legitimate types that are evaluated by professionals. It is simple to download or produce the Alaska Notice of Annual Report of Employee Benefits Plans from your support.

If you have a US Legal Forms profile, it is possible to log in and then click the Acquire button. After that, it is possible to complete, change, produce, or indicator the Alaska Notice of Annual Report of Employee Benefits Plans. Every legitimate record template you buy is yours for a long time. To obtain one more version of the purchased type, visit the My Forms tab and then click the related button.

If you use the US Legal Forms site the first time, stick to the basic recommendations beneath:

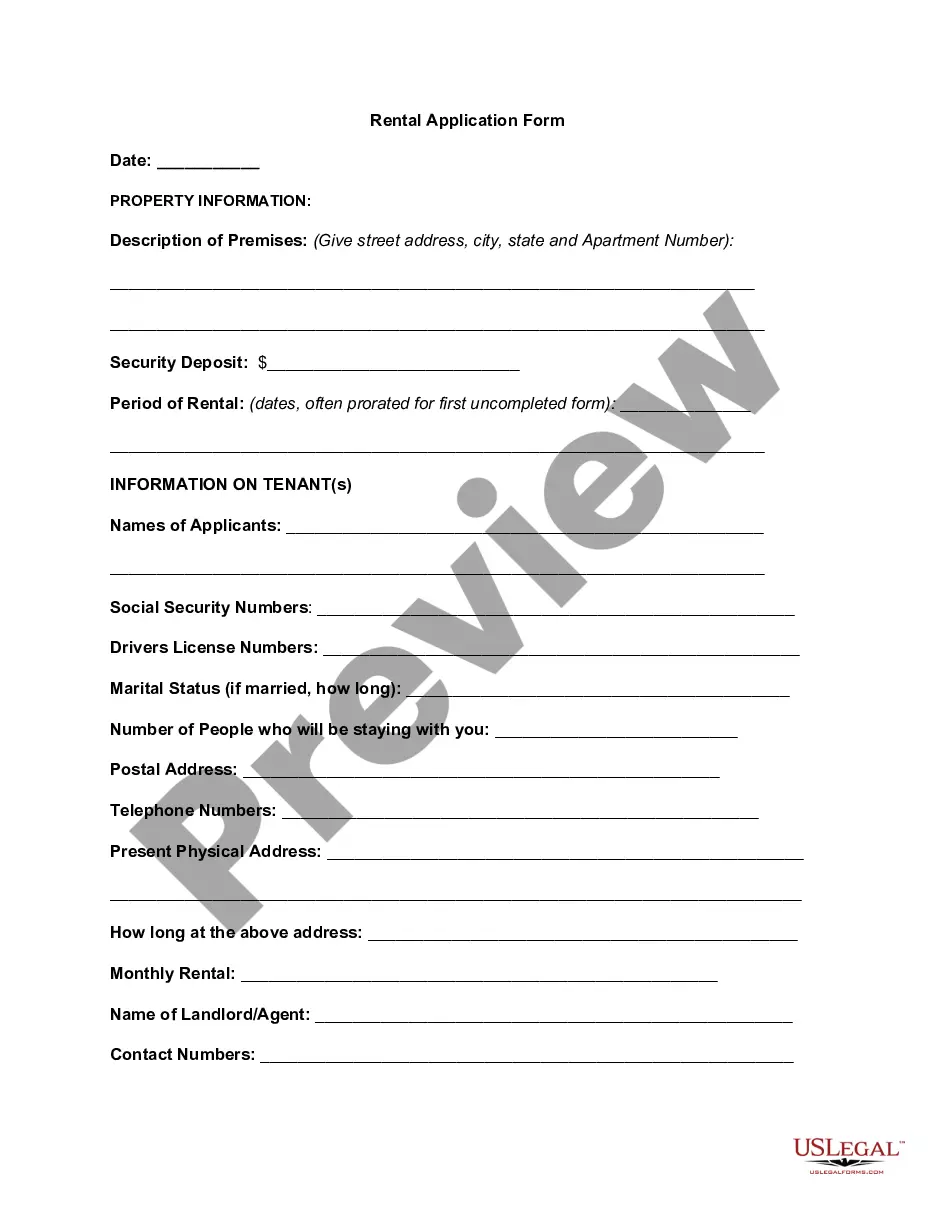

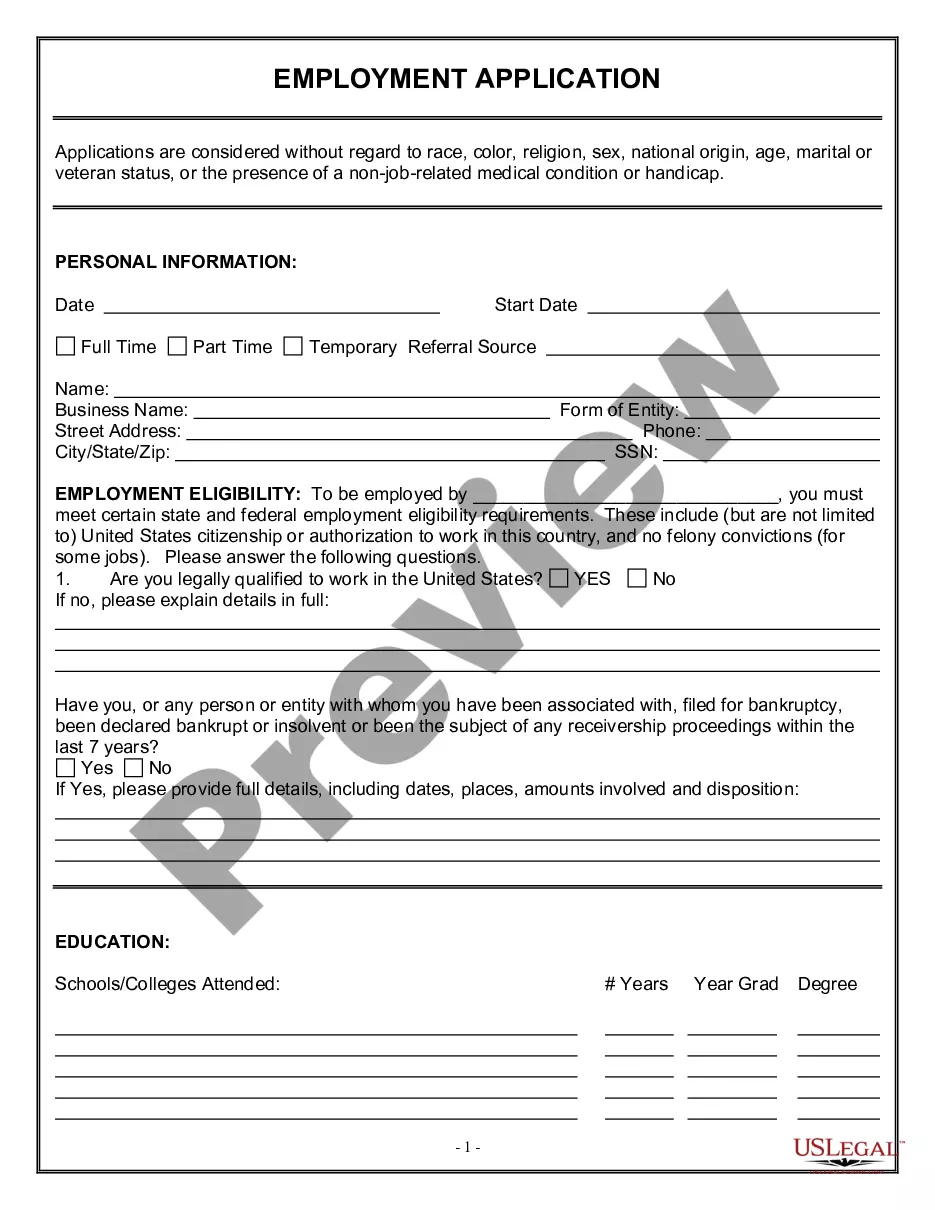

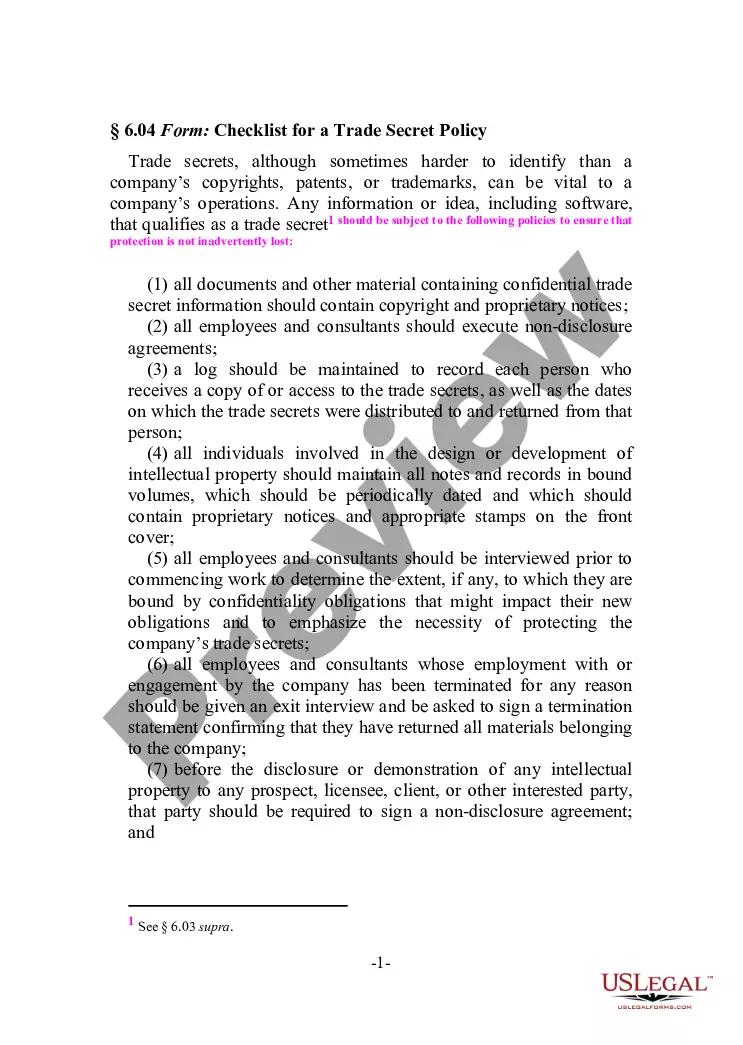

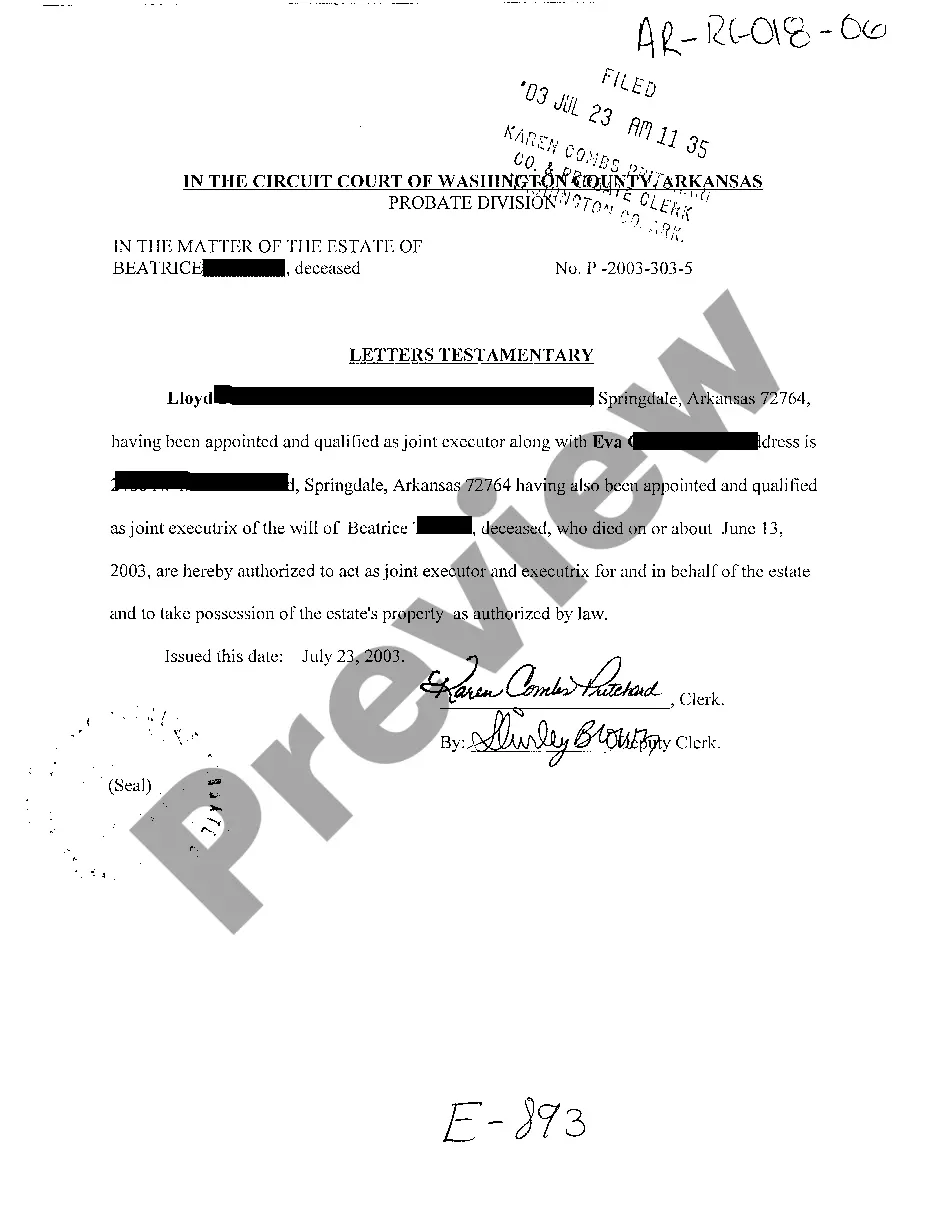

- First, make sure that you have selected the right record template to the region/area of your choosing. Browse the type explanation to ensure you have chosen the correct type. If accessible, use the Review button to look with the record template too.

- If you wish to find one more variation in the type, use the Search discipline to discover the template that meets your requirements and needs.

- Upon having identified the template you want, simply click Get now to move forward.

- Choose the costs program you want, key in your references, and register for a merchant account on US Legal Forms.

- Comprehensive the transaction. You can utilize your charge card or PayPal profile to pay for the legitimate type.

- Choose the format in the record and download it for your product.

- Make changes for your record if needed. You are able to complete, change and indicator and produce Alaska Notice of Annual Report of Employee Benefits Plans.

Acquire and produce a huge number of record themes utilizing the US Legal Forms web site, that provides the most important assortment of legitimate types. Use specialist and status-particular themes to deal with your company or specific requires.