Alaska Reimbursable Travel Expenses Chart

Description

How to fill out Reimbursable Travel Expenses Chart?

Choosing the right authorized papers web template can be a have a problem. Of course, there are a lot of web templates available on the Internet, but how can you get the authorized type you require? Take advantage of the US Legal Forms website. The assistance gives a huge number of web templates, including the Alaska Reimbursable Travel Expenses Chart, that can be used for company and personal needs. All of the types are examined by pros and fulfill state and federal specifications.

When you are presently authorized, log in for your accounts and click on the Download button to find the Alaska Reimbursable Travel Expenses Chart. Utilize your accounts to search throughout the authorized types you may have purchased formerly. Proceed to the My Forms tab of your own accounts and obtain an additional version of your papers you require.

When you are a fresh consumer of US Legal Forms, allow me to share straightforward recommendations for you to follow:

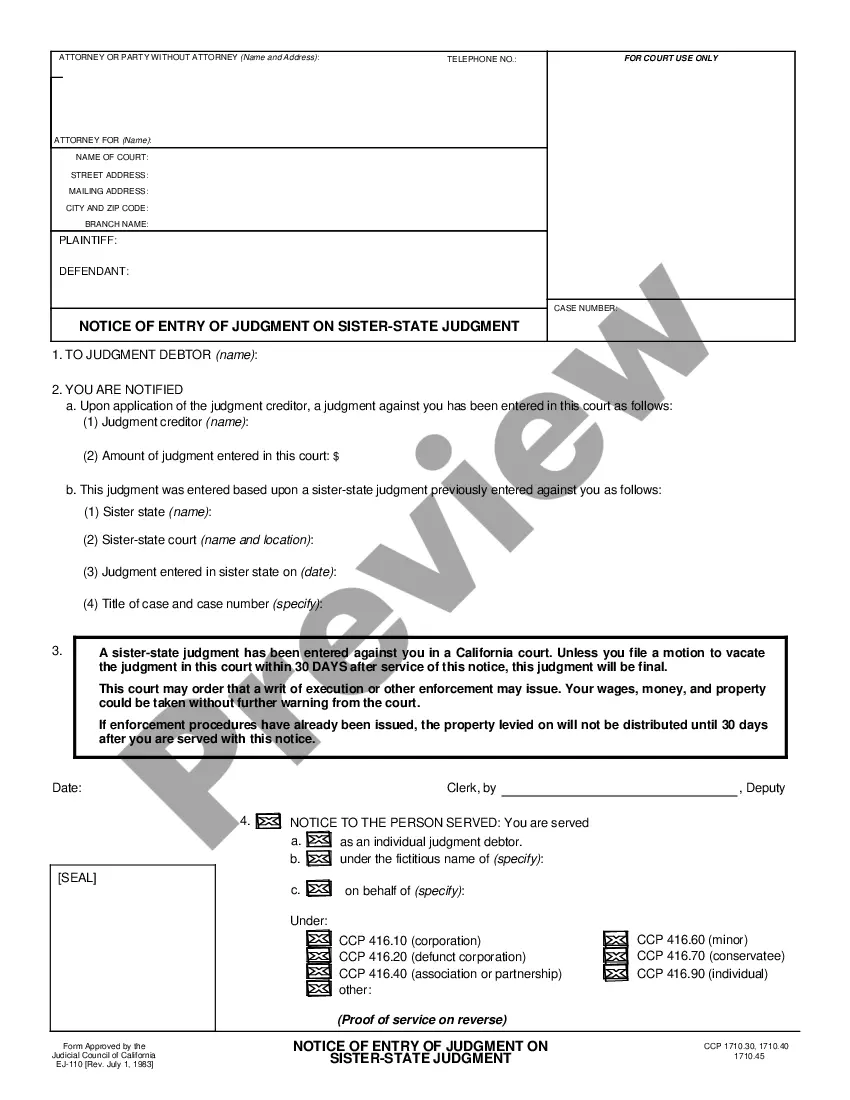

- Initially, be sure you have selected the proper type for the metropolis/area. It is possible to look over the shape while using Review button and browse the shape explanation to make sure this is basically the right one for you.

- In case the type fails to fulfill your preferences, make use of the Seach area to obtain the proper type.

- Once you are certain the shape is suitable, click the Buy now button to find the type.

- Opt for the prices plan you would like and enter the necessary details. Design your accounts and buy the order using your PayPal accounts or charge card.

- Choose the submit formatting and down load the authorized papers web template for your gadget.

- Total, change and produce and signal the attained Alaska Reimbursable Travel Expenses Chart.

US Legal Forms is the biggest local library of authorized types that you can see a variety of papers web templates. Take advantage of the service to down load professionally-produced documents that follow condition specifications.