Alaska Supplemental Employee Stock Ownership Plan of SPX Corporation

Description

How to fill out Supplemental Employee Stock Ownership Plan Of SPX Corporation?

US Legal Forms - among the biggest libraries of legal kinds in the USA - gives a wide array of legal papers layouts you are able to acquire or print. Using the internet site, you may get a large number of kinds for company and specific uses, sorted by categories, suggests, or keywords and phrases.You can find the newest versions of kinds such as the Alaska Supplemental Employee Stock Ownership Plan of SPX Corporation within minutes.

If you already possess a registration, log in and acquire Alaska Supplemental Employee Stock Ownership Plan of SPX Corporation from the US Legal Forms collection. The Acquire option can look on every single develop you see. You have access to all formerly delivered electronically kinds inside the My Forms tab of your own profile.

If you would like use US Legal Forms the first time, allow me to share simple recommendations to help you started off:

- Ensure you have chosen the best develop to your metropolis/area. Go through the Preview option to review the form`s articles. Browse the develop information to ensure that you have chosen the proper develop.

- If the develop does not match your demands, take advantage of the Lookup area near the top of the screen to obtain the one that does.

- If you are satisfied with the shape, validate your decision by visiting the Purchase now option. Then, opt for the rates program you favor and supply your credentials to sign up to have an profile.

- Process the financial transaction. Utilize your Visa or Mastercard or PayPal profile to accomplish the financial transaction.

- Pick the structure and acquire the shape on your device.

- Make adjustments. Fill up, modify and print and signal the delivered electronically Alaska Supplemental Employee Stock Ownership Plan of SPX Corporation.

Every single design you included in your bank account does not have an expiry day and it is your own property eternally. So, in order to acquire or print yet another version, just go to the My Forms segment and click on in the develop you require.

Obtain access to the Alaska Supplemental Employee Stock Ownership Plan of SPX Corporation with US Legal Forms, probably the most substantial collection of legal papers layouts. Use a large number of specialist and express-certain layouts that meet your small business or specific requires and demands.

Form popularity

FAQ

What Is an Example of an ESOP? Consider an employee who has worked at a large tech firm for five years. Under the company's ESOP, they have the right to receive 20 shares after the first year, and 100 shares total after five years. When the employee retires, they will receive the share value in cash.

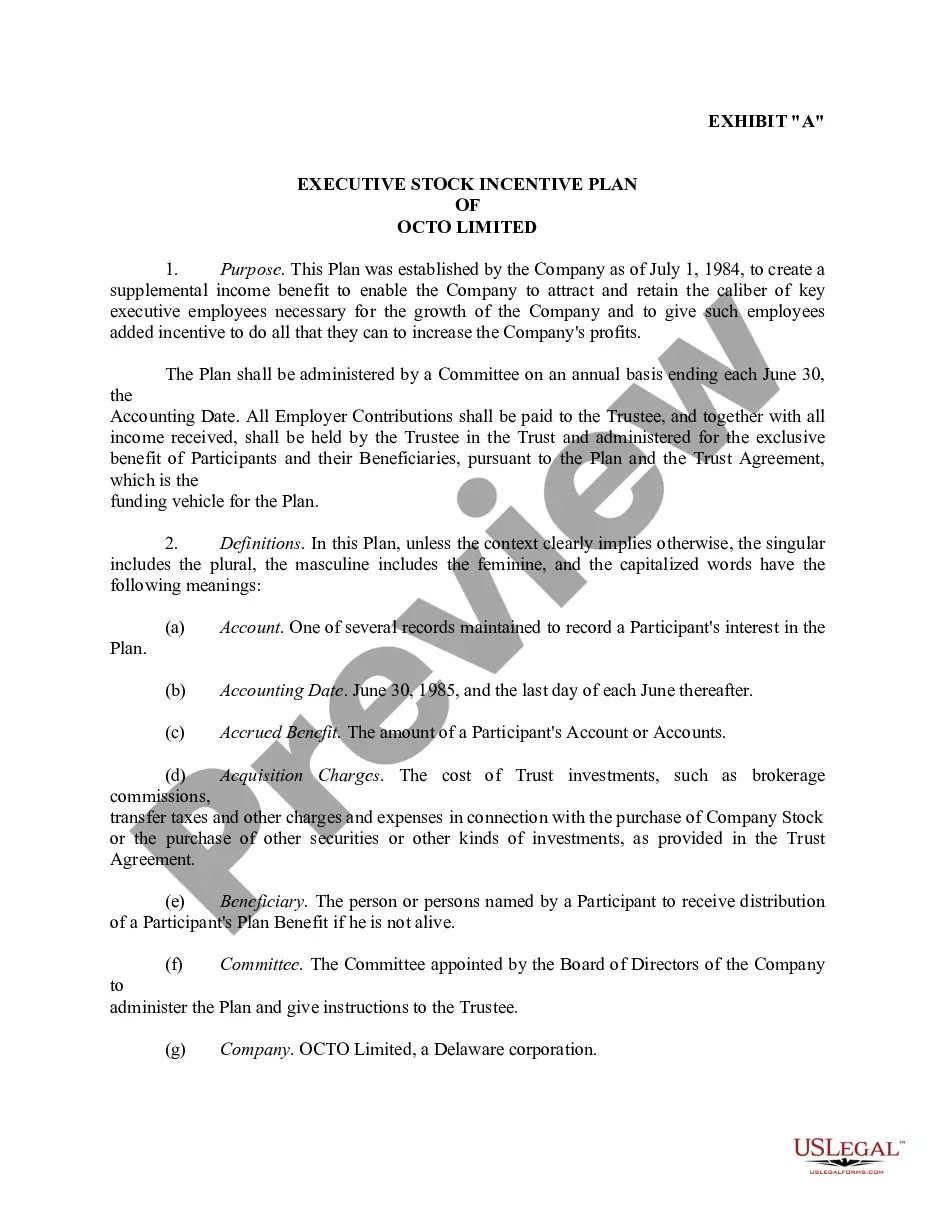

An employee stock ownership plan (ESOP) is an IRC section 401(a) qualified defined contribution plan that is a stock bonus plan or a stock bonus/money purchase plan.

An ESOP is an employee benefit plan that enables employees to own part or all of the company they work for. ESOPs are most commonly used to facilitate succession planning, allowing a company owner to sell his or her. shares and transition flexibly out of the business.

All transactions or qualified plans involving ESOPs are simply variations on one of these three types. Nonleveraged ESOP. This first type of ESOP (Diagram 1) does not involve borrowed funds to acquire the sponsoring employer's stock. ... Leveraged Buyout ESOP. ... Issuance ESOP.

Other notable examples of employee-owned companies include Penmac Staffing, WinCo Foods, and Brookshire Brothers. It's believed ESOP programs motivate employees to take more accountability over their work and improve their performance because they have a stake in the company.

Unlike most retirement plans, ESOPs: Are required by law to invest primarily in the shares of stock of the sponsoring employer. Are trusts that hold shares of the business for employees, making them beneficial owners of the company that employs them.

Quite a few different forms of employee ownership exist, including: Employee stock ownership plans (ESOPs) Let's begin with the most popular type of employee ownership scheme in America. ... Equity compensation plans. ... Worker cooperatives. ... Publix Super Markets. ... WinCo Foods. ... Penmac Staffing.

An ESOP is an employee benefit plan that enables employees to own part or all of the company they work for. at fair market value (unless there's a public market for the shares). So, the employee receives the value of his or her shares from the trust, usually in the form of cash.