Alaska Proposal to decrease authorized common and preferred stock

Description

How to fill out Proposal To Decrease Authorized Common And Preferred Stock?

You may commit several hours on the Internet attempting to find the legitimate document template that fits the federal and state needs you require. US Legal Forms gives a huge number of legitimate forms which can be reviewed by pros. You can actually download or print out the Alaska Proposal to decrease authorized common and preferred stock from my assistance.

If you have a US Legal Forms bank account, it is possible to log in and then click the Obtain button. After that, it is possible to full, modify, print out, or signal the Alaska Proposal to decrease authorized common and preferred stock. Each and every legitimate document template you acquire is your own property eternally. To get yet another version of the acquired kind, proceed to the My Forms tab and then click the corresponding button.

If you work with the US Legal Forms site the very first time, stick to the basic directions under:

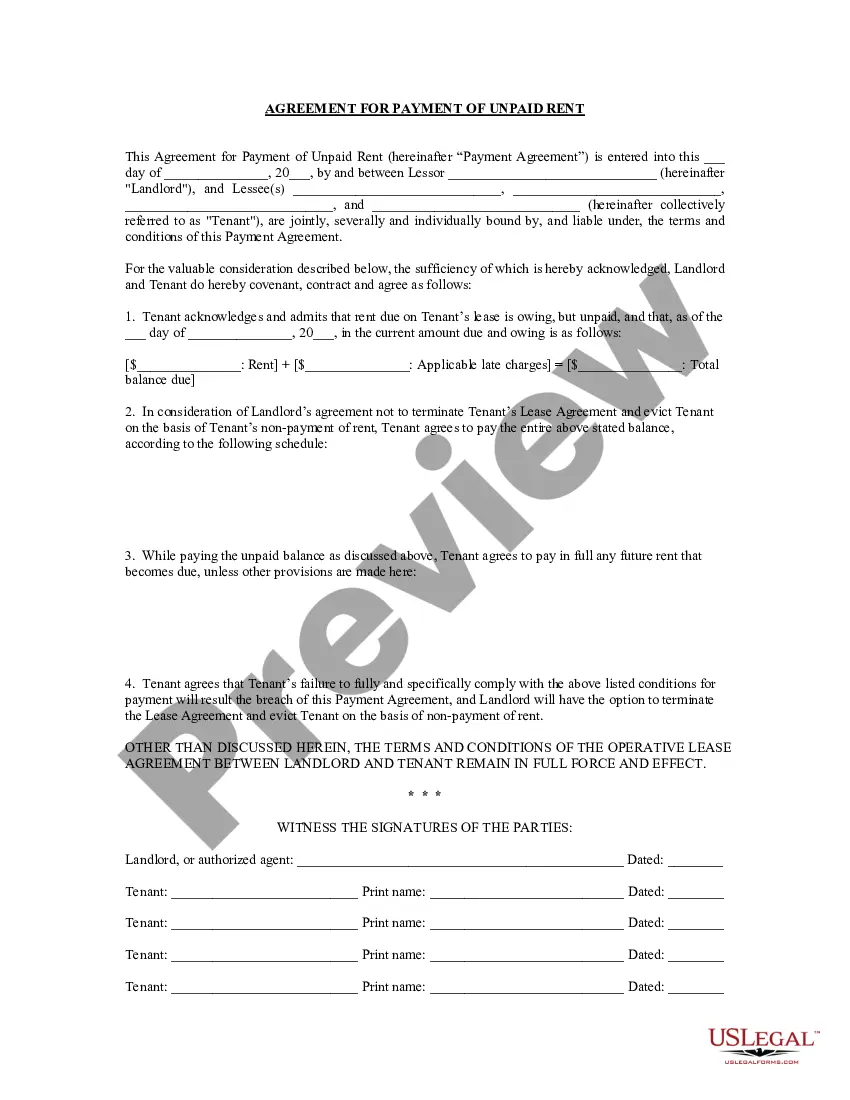

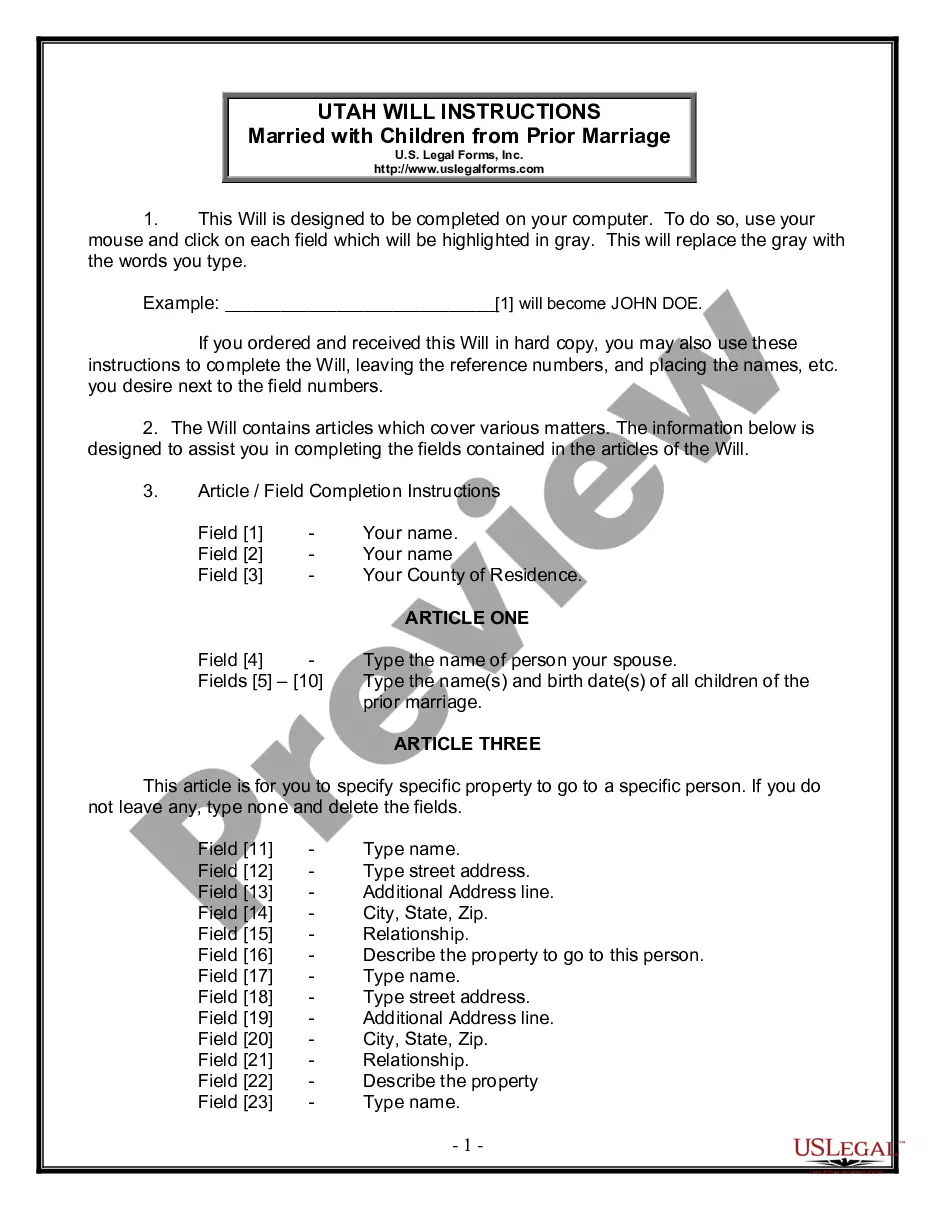

- Initial, make certain you have chosen the right document template for the state/town of your choice. Read the kind description to make sure you have picked out the proper kind. If available, make use of the Review button to look with the document template at the same time.

- In order to get yet another model in the kind, make use of the Look for industry to discover the template that fits your needs and needs.

- After you have identified the template you want, just click Get now to carry on.

- Pick the rates plan you want, enter your references, and register for your account on US Legal Forms.

- Full the transaction. You should use your bank card or PayPal bank account to pay for the legitimate kind.

- Pick the format in the document and download it in your gadget.

- Make adjustments in your document if required. You may full, modify and signal and print out Alaska Proposal to decrease authorized common and preferred stock.

Obtain and print out a huge number of document web templates using the US Legal Forms Internet site, that provides the most important selection of legitimate forms. Use specialist and status-particular web templates to deal with your business or personal needs.

Form popularity

FAQ

The issuance of preferred stock is accounted for in the same way as common stock. Par value, though, often serves as the basis for specified dividend payments. Thus, the par value listed for a preferred share frequently approximates fair value.

A company issues common stock to raise money, so the debit will always be to cash. There will always be a credit to common stock for the # of shares issued x the par value. Additional paid-in capital (APIC) is the plug.

Accounting Principles II If a company has preferred stock, it is listed first in the stockholders' equity section due to its preference in dividends and during liquidation. Book value measures the value of one share of common stock based on amounts used in financial reporting.

Upon issuance, common stock is recorded at par value with any amount received above that figure reported in an account such as capital in excess of par value. If issued for an asset or service instead of cash, the recording is based on the fair value of the shares given up.

Issuing preferred stock provides a company with a means of obtaining capital without increasing the company's overall level of outstanding debt. This helps keep the company's debt to equity (D/E) ratio, an important leverage measure for investors and analysts, at a lower, more attractive level.

The journal entry for issuing preferred stock is very similar to the one for common stock. This time Preferred Stock and Paid-in Capital in Excess of Par - Preferred Stock are credited instead of the accounts for common stock.

To comply with state regulations, the par value of preferred stock is recorded in its own paid-in capital account Preferred Stock. If the corporation receives more than the par amount, the amount greater than par will be recorded in another account such as Paid-in Capital in Excess of Par - Preferred Stock.

Redemption or Repurchase of Preferred Stock: If a company repurchases its preferred stock, it would debit (decrease) the ?preferred stock? account and credit (decrease) the cash account for the repurchase price.