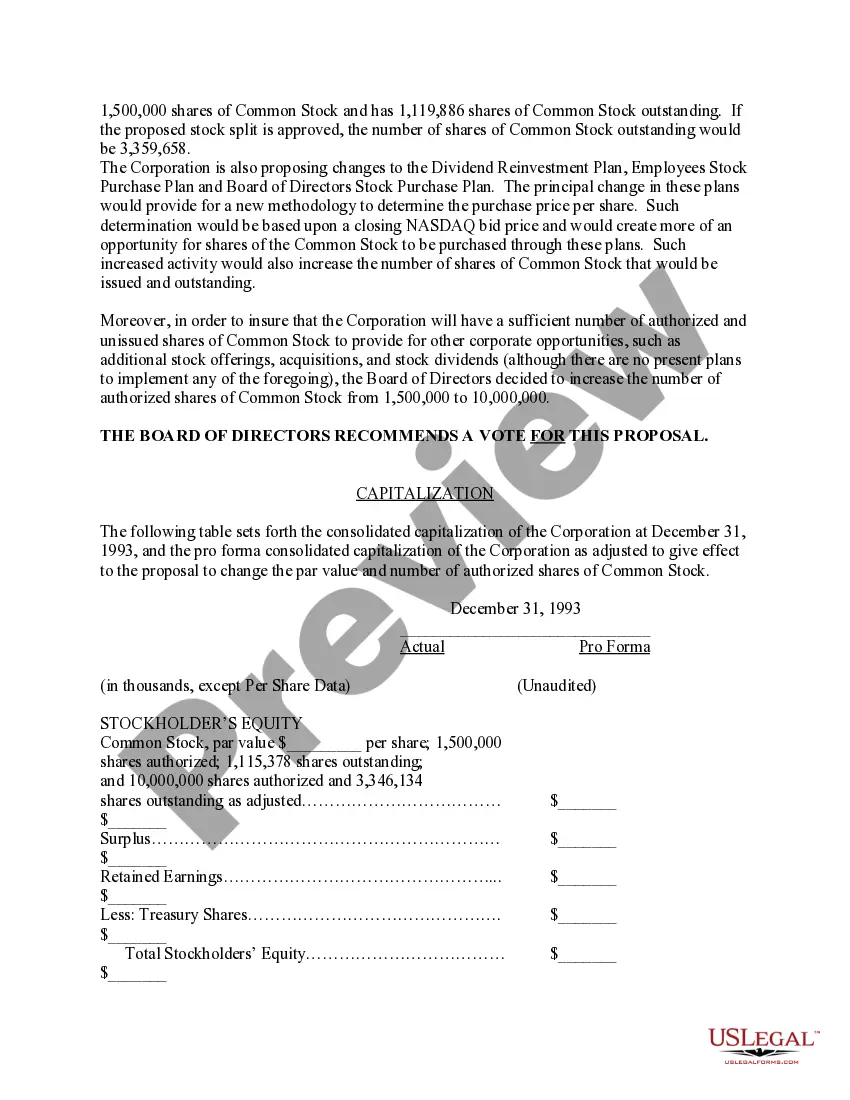

Alaska Proposal for the Stock Split and Increase in the Authorized Number of Shares

Description

How to fill out Proposal For The Stock Split And Increase In The Authorized Number Of Shares?

Finding the right lawful papers design might be a have a problem. Needless to say, there are tons of web templates available on the net, but how will you find the lawful kind you will need? Make use of the US Legal Forms internet site. The service provides thousands of web templates, including the Alaska Proposal for the Stock Split and Increase in the Authorized Number of Shares, that can be used for organization and personal demands. All the types are checked out by specialists and meet state and federal demands.

When you are previously authorized, log in to the account and click on the Obtain button to obtain the Alaska Proposal for the Stock Split and Increase in the Authorized Number of Shares. Use your account to appear throughout the lawful types you might have acquired previously. Proceed to the My Forms tab of your respective account and obtain one more version in the papers you will need.

When you are a brand new customer of US Legal Forms, here are easy guidelines so that you can follow:

- Initially, be sure you have selected the correct kind for your personal metropolis/county. You are able to look through the form using the Preview button and browse the form explanation to ensure this is the right one for you.

- In case the kind fails to meet your needs, take advantage of the Seach discipline to obtain the correct kind.

- When you are certain the form would work, click on the Acquire now button to obtain the kind.

- Choose the rates program you desire and enter in the essential details. Build your account and pay money for your order using your PayPal account or charge card.

- Choose the document format and acquire the lawful papers design to the product.

- Comprehensive, change and print out and signal the received Alaska Proposal for the Stock Split and Increase in the Authorized Number of Shares.

US Legal Forms may be the largest library of lawful types that you can find a variety of papers web templates. Make use of the service to acquire professionally-manufactured documents that follow condition demands.

Form popularity

FAQ

For example, a common stock split ratio is a forward 2-1 split (i.e., 2 for 1), where a stockholder would receive 2 shares for every 1 share owned. This results in an increase in the total number of shares outstanding for the company, though no change in a shareholder's proportional ownership.

split. Exercise value: # of shares X the strike price= 100 shares x 50= $5,000. New number of shares= 100 X 3/2= 150 shares. New strike price= exercise value/ new shares= $5,000/ 150= $33.33.

Splits are often a bullish sign since valuations get so high that the stock may be out of reach for smaller investors trying to stay diversified. Investors who own a stock that splits may not make a lot of money immediately, but they shouldn't sell the stock since the split is likely a positive sign.

Let's look at a common scenario, which is a 2-for-1 split: Investors receive one additional share for each share they already own. The stock price is halved?$50 becomes $25, for example?and the number of shares outstanding doubles.

After a stock split, the number of shares authorized, issued, and outstanding increase proportionately. After a stock split, no accounting entry is required. After a stock split, existing stockholders receive additional shares of stock in ratios such as or or (as some common examples).

The record date is when existing shareholders need to own the stock in order to be eligible to receive new shares created by a stock split. However, if you buy or sell shares between the record date and the effective date, the right to the new shares transfers.

2/1 stock split This common stock split is when one share is divided in half. So if you have 50 shares of a stock valued at $50 each, a 2/1 split means you'll have 100 shares valued at $25 each. This is one of the most common stock splits.

If the company declares a two-for-one stock split, you would now own 200 shares at $50 per share post-split. Shares Owned Post-Split = 100 Shares × 2 = 200 Shares. Share Price Post-Split = $100 Share Price ÷ 2 = $50.00.