Alaska Proposal to consider and approve offer to exchange outstanding shares and amend certificate of designations, preferences and rights with Fairness Opinion Report

Description

How to fill out Proposal To Consider And Approve Offer To Exchange Outstanding Shares And Amend Certificate Of Designations, Preferences And Rights With Fairness Opinion Report?

It is possible to spend several hours on-line trying to find the legitimate document template that meets the state and federal demands you need. US Legal Forms gives thousands of legitimate kinds which are analyzed by professionals. You can actually obtain or produce the Alaska Proposal to consider and approve offer to exchange outstanding shares and amend certificate of designations, preferences and rights with Fairness Opinion Report from the services.

If you have a US Legal Forms accounts, it is possible to log in and then click the Acquire key. Next, it is possible to full, modify, produce, or signal the Alaska Proposal to consider and approve offer to exchange outstanding shares and amend certificate of designations, preferences and rights with Fairness Opinion Report. Each and every legitimate document template you buy is your own for a long time. To get another backup of any purchased develop, visit the My Forms tab and then click the related key.

If you use the US Legal Forms website the very first time, keep to the easy instructions under:

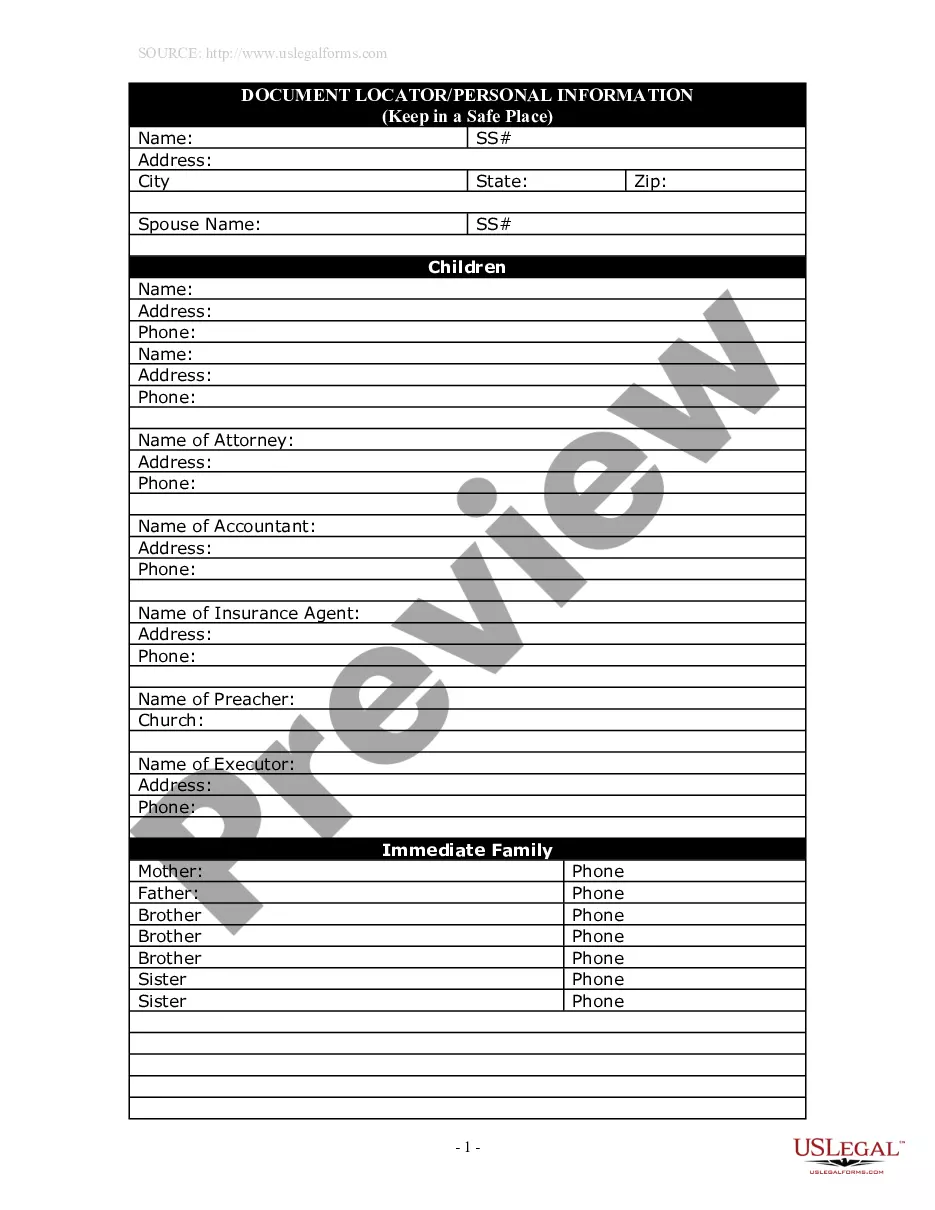

- Initially, be sure that you have chosen the right document template for that region/area of your liking. See the develop outline to make sure you have selected the proper develop. If accessible, make use of the Review key to look with the document template as well.

- In order to discover another edition from the develop, make use of the Lookup industry to find the template that suits you and demands.

- After you have found the template you desire, simply click Buy now to proceed.

- Pick the costs prepare you desire, key in your references, and register for a merchant account on US Legal Forms.

- Total the purchase. You should use your charge card or PayPal accounts to pay for the legitimate develop.

- Pick the formatting from the document and obtain it in your system.

- Make alterations in your document if required. It is possible to full, modify and signal and produce Alaska Proposal to consider and approve offer to exchange outstanding shares and amend certificate of designations, preferences and rights with Fairness Opinion Report.

Acquire and produce thousands of document templates making use of the US Legal Forms website, that provides the greatest variety of legitimate kinds. Use expert and status-certain templates to tackle your small business or personal requires.