Title: Alaska Equity Compensation Plan: A Comprehensive Overview Introduction: Alaska Equity Compensation Plans are specialized programs designed by companies to incentivize and reward employees through offering stocks, stock options, or other equity-based instruments. These plans are a vital component of attracting and retaining talented professionals, aligning their interests with the company's long-term growth and success. In Alaska, various types of equity compensation plans are commonly implemented, including stock options, restricted stock units (RSS), and employee stock purchase plans (ESPN). This article aims to provide a detailed description of Alaska Equity Compensation Plans, along with insights into different plan types. 1. Stock Options: Stock options grant employees the right to purchase a specific number of company shares at a predetermined price (known as the exercise price or strike price). Companies use two primary types of stock options: a) Non-Qualified Stock Options (Nests): These are the most common type of stock options offered, providing employees with the flexibility to exercise options at any time. Upon exercising, employees may receive taxable income based on the stock's fair market value at that time. b) Incentive Stock Options (SOS): SOS are exclusively offered to employees, offering potential tax advantages upon exercising. To qualify for favorable tax treatment, employees must hold the shares for a specific period before selling them. 2. Restricted Stock Units (RSS): RSS grant employees the right to receive company shares at a predetermined future date or upon meeting specific performance goals. Unlike stock options, employees do not need to purchase shares in RSS but rather earn them through continued service or meeting performance targets. During the vesting period, RSS remain non-transferable and subject to forfeiture. 3. Employee Stock Purchase Plans (ESPN): ESPN allow employees to purchase company shares at a discounted price through regular payroll deductions. These plans offer employees the opportunity to accumulate company stock over time, fostering a sense of ownership and alignment with the company's success. ESPN typically provide a predetermined percentage discount based on the stock's fair market value. Conclusion: Alaska Equity Compensation Plans serve as powerful tools for attracting, motivating, and retaining talented individuals within organizations. Offering various types of equity compensation, including stock options, RSS, and ESPN, allows companies to tailor their plans according to employee preferences and overall compensation strategies. By aligning employee and company interests through stock ownership, these plans promote long-term commitment and incentivize performance, ultimately contributing to the overall success and growth of Alaskan companies.

Alaska Equity Compensation Plan

Description

How to fill out Alaska Equity Compensation Plan?

Have you been in the placement where you need to have files for sometimes business or person reasons almost every day? There are plenty of legitimate file layouts available on the net, but discovering kinds you can rely on is not simple. US Legal Forms delivers a huge number of type layouts, much like the Alaska Equity Compensation Plan, that happen to be composed to satisfy federal and state needs.

In case you are previously familiar with US Legal Forms internet site and possess a free account, merely log in. Following that, you can down load the Alaska Equity Compensation Plan template.

Should you not offer an bank account and need to begin to use US Legal Forms, adopt these measures:

- Obtain the type you will need and ensure it is for the proper town/region.

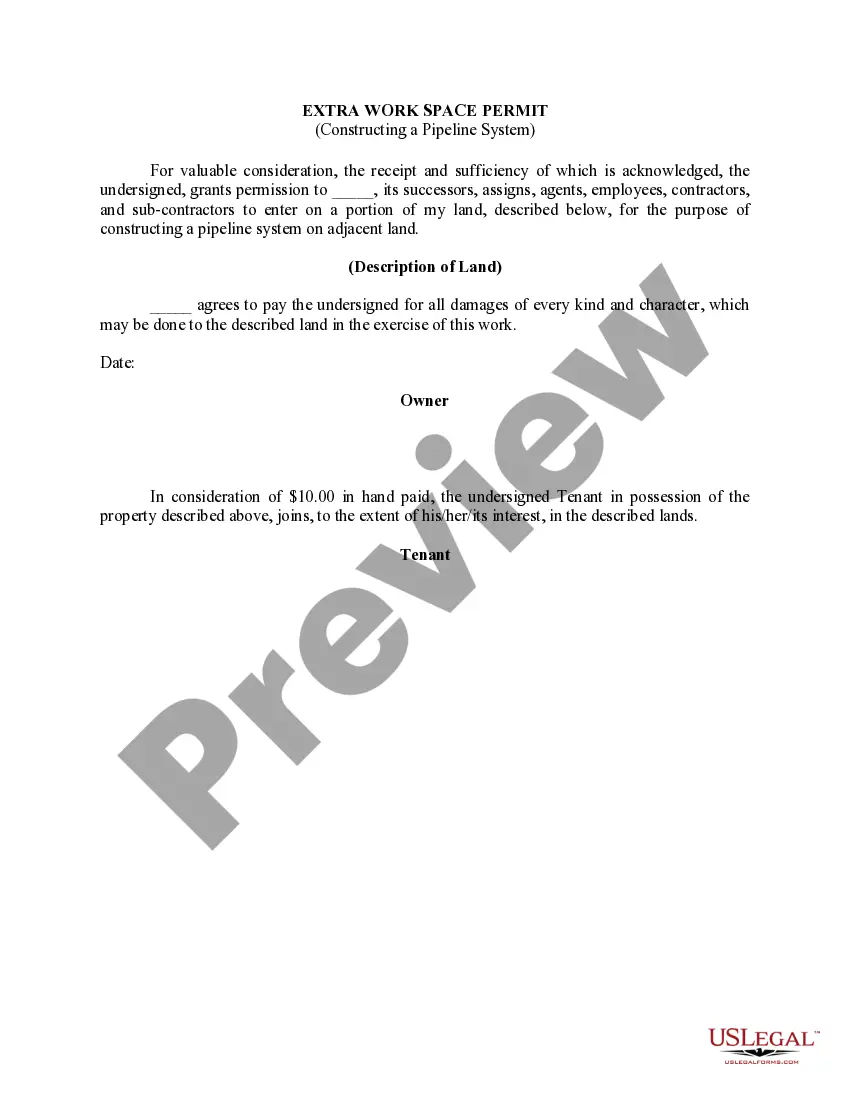

- Make use of the Review option to examine the form.

- See the explanation to ensure that you have selected the right type.

- In case the type is not what you`re looking for, use the Look for industry to obtain the type that meets your requirements and needs.

- If you obtain the proper type, simply click Get now.

- Choose the rates program you would like, fill out the required information and facts to produce your bank account, and pay for the transaction making use of your PayPal or bank card.

- Decide on a hassle-free data file formatting and down load your copy.

Discover all of the file layouts you might have bought in the My Forms menu. You can obtain a additional copy of Alaska Equity Compensation Plan anytime, if required. Just go through the necessary type to down load or printing the file template.

Use US Legal Forms, probably the most extensive collection of legitimate forms, to save time as well as avoid mistakes. The assistance delivers appropriately created legitimate file layouts that can be used for an array of reasons. Make a free account on US Legal Forms and initiate generating your life a little easier.