Choosing the best legal document design might be a struggle. Obviously, there are a lot of themes available on the net, but how do you find the legal form you will need? Utilize the US Legal Forms web site. The service delivers thousands of themes, for example the Alaska Letter Informing Debt Collector of Unfair Practices in Collection Activities - Collecting an Amount not Authorized by the Agreement Creating the Debt or by Law, that you can use for company and personal needs. All of the forms are inspected by experts and fulfill state and federal specifications.

Should you be already authorized, log in in your account and then click the Down load switch to find the Alaska Letter Informing Debt Collector of Unfair Practices in Collection Activities - Collecting an Amount not Authorized by the Agreement Creating the Debt or by Law. Use your account to appear through the legal forms you might have bought previously. Go to the My Forms tab of your account and have an additional backup in the document you will need.

Should you be a fresh consumer of US Legal Forms, listed here are straightforward directions that you should adhere to:

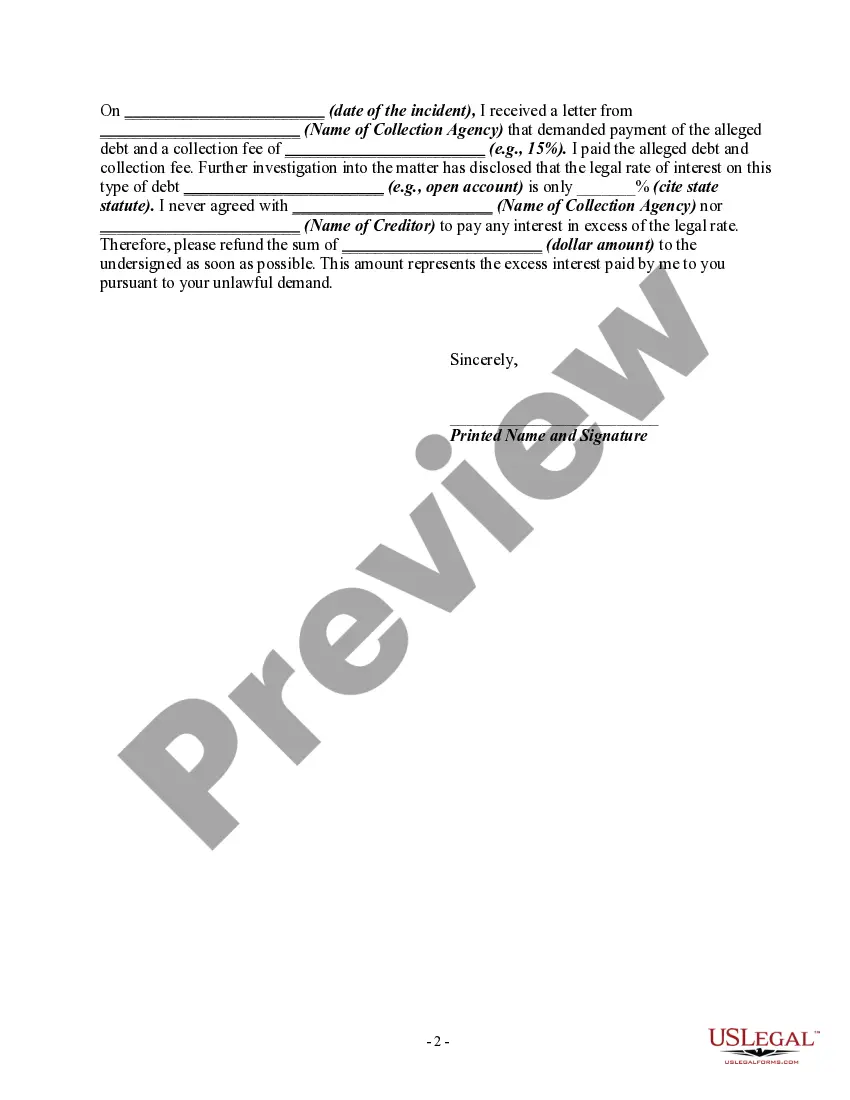

- First, be sure you have selected the right form for your personal metropolis/area. You are able to examine the form utilizing the Preview switch and study the form outline to make sure it is the right one for you.

- When the form is not going to fulfill your requirements, take advantage of the Seach area to discover the proper form.

- Once you are certain the form would work, click on the Purchase now switch to find the form.

- Choose the pricing program you would like and enter the needed information and facts. Create your account and pay money for the transaction utilizing your PayPal account or charge card.

- Select the document file format and acquire the legal document design in your product.

- Complete, revise and print and indication the acquired Alaska Letter Informing Debt Collector of Unfair Practices in Collection Activities - Collecting an Amount not Authorized by the Agreement Creating the Debt or by Law.

US Legal Forms is the greatest collection of legal forms in which you will find different document themes. Utilize the service to acquire appropriately-created documents that adhere to status specifications.

Authorization; unlawful practice in consumer debt collection; misdemeanor; punishment(1) A debt collector or collection agency shall not use unfair or ... Alaska, Unfair Trade Practices and Consumer Protection Act, AS 45.50.471 et seq.; Arkansas,537.7101, the Iowa Debt Collection Practices Act.The federal Fair Debt Collection Practices Act (FDCPA) was enacted to curb these annoying and abusive behaviors, but some debt collectors flout the law. If you get a summons notifying you that a debt collector is suing you, do not ignoreyou from abusive, unfair, or deceptive debt collection practices. Send a Demand Letter When Debt Collectors Violate the FDCPA · You have a collector calling you regarding a debt you do not owe. · The statute of ... Letter Authorized Form. Letter Informing Debt Collector of Unfair Practices in Collection Activities - Collecting an Amount not Authorized State level consumer protections vary greatly and cover a wide range of topics, but 32 states, Puerto Rico, the U.S. Virgin Islands, ... The Military Commander and the Law is a publication of The Judge Advocate. General's School. This publication is used as a deskbook for instruction at ... A borrower, as well as the rights borrowers have with respect to debt collection. Chapter 6 Student Loan Lenders, Servicers, Scams and Bad Deals sets forth ...