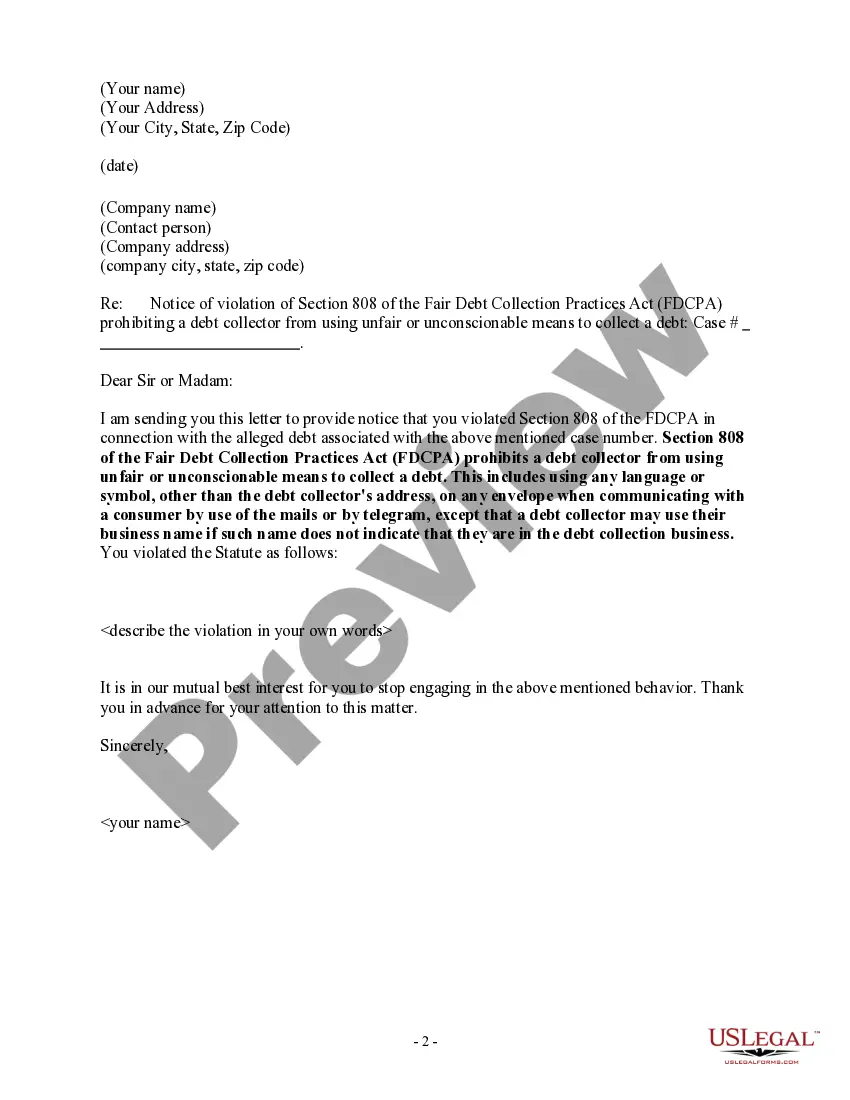

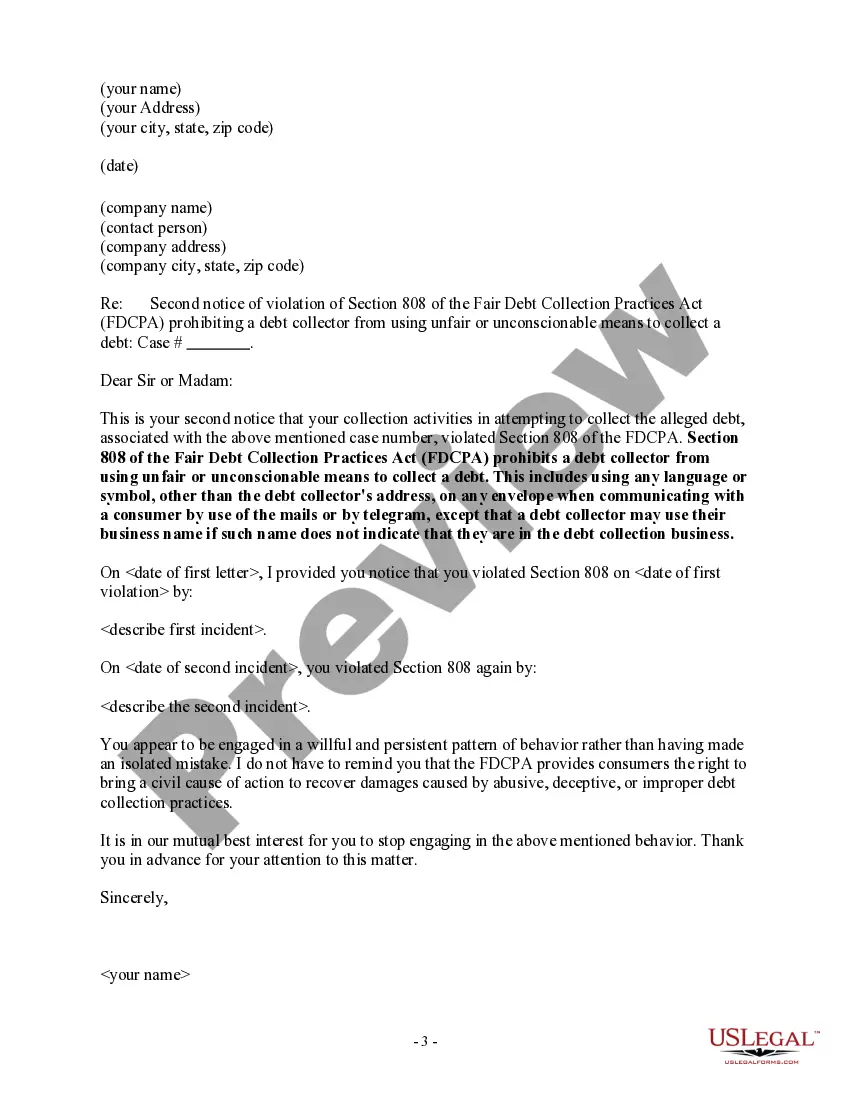

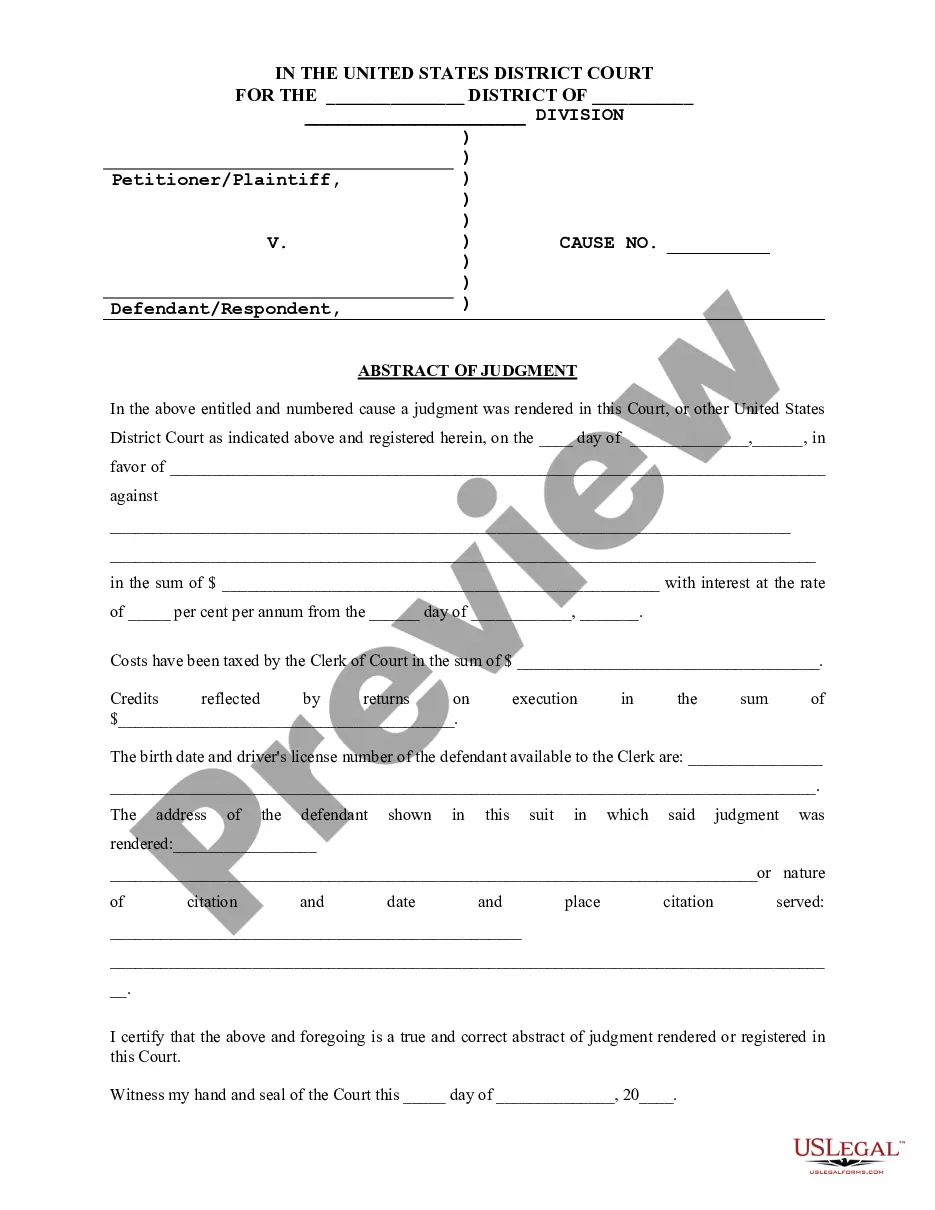

Title: Alaska Notice of Violation of Fair Debt Act — Improper Document Appearance Description: The Alaska Notice of Violation of Fair Debt Act — Improper Document Appearance is an official document that serves as a notice to individuals or businesses who have allegedly violated the Fair Debt Collection Practices Act (FD CPA) regulations by using improper document appearance during debt collection activities. Keywords: 1. Alaska 2. Notice of Violation 3. Fair Debt Act 4. Improper Document Appearance 5. Debt collection 6. FD CPA 7. Violation 8. Regulations 9. Official document 10. Individuals 11. Business Types of Alaska Notice of Violation of Fair Debt Act — Improper Document Appearance: 1. First-time Violation Notice: This type of notice is issued when a party is identified as violating the FD CPA regulations related to improper document appearance for the first time. 2. Repeat Violation Notice: Issued when a party has been previously notified of violating improper document appearance regulations and has committed another violation. 3. Warning Notice: A warning notice may be issued when there is evidence of potential violation of the FD CPA regulations related to document appearance, serving as a caution to rectify the issue before further actions are taken. Note: The specific types of notices may vary based on the Alaska Department of Law's guidelines and updates. It is important to consult the official Alaska Department of Law website or legal counsel to obtain the latest information and ensure compliance with any notices or regulations related to improper document appearance.

Alaska Notice of Violation of Fair Debt Act - Improper Document Appearance

Description

How to fill out Alaska Notice Of Violation Of Fair Debt Act - Improper Document Appearance?

You may invest hrs on the web looking for the lawful papers web template that fits the state and federal requirements you need. US Legal Forms supplies a large number of lawful kinds which can be reviewed by professionals. It is possible to down load or printing the Alaska Notice of Violation of Fair Debt Act - Improper Document Appearance from our support.

If you currently have a US Legal Forms profile, you may log in and click on the Download key. After that, you may comprehensive, edit, printing, or signal the Alaska Notice of Violation of Fair Debt Act - Improper Document Appearance. Each lawful papers web template you acquire is the one you have permanently. To acquire another version for any acquired develop, go to the My Forms tab and click on the corresponding key.

If you use the US Legal Forms site the very first time, stick to the straightforward directions below:

- Initial, make certain you have chosen the correct papers web template for that county/metropolis that you pick. See the develop description to ensure you have selected the appropriate develop. If accessible, take advantage of the Review key to appear through the papers web template too.

- If you wish to get another model of the develop, take advantage of the Research discipline to find the web template that suits you and requirements.

- After you have located the web template you desire, just click Get now to move forward.

- Find the prices plan you desire, enter your accreditations, and sign up for your account on US Legal Forms.

- Full the transaction. You can utilize your credit card or PayPal profile to cover the lawful develop.

- Find the structure of the papers and down load it to the system.

- Make adjustments to the papers if needed. You may comprehensive, edit and signal and printing Alaska Notice of Violation of Fair Debt Act - Improper Document Appearance.

Download and printing a large number of papers web templates making use of the US Legal Forms web site, that provides the largest assortment of lawful kinds. Use expert and state-certain web templates to deal with your business or personal requires.

Form popularity

FAQ

If you're thinking about negotiating a settlement or repayment agreement with a debt collector, consider the following three steps: Confirm that you owe the debt. ... Calculate a realistic repayment plan. ... 3. Make a repayment proposal to the debt collector.

I am responding to your contact about a debt you are attempting to collect. You contacted me by [phone/mail], on [date]. You identified the debt as [any information they gave you about the debt]. Please stop all communication with me and with this address about this debt.

A debt collector must stop all collection activity on a debt if you send them a written dispute about the debt, generally within 30 days after your initial communication with them. Collection activities can restart, though, after the debt collector sends verification responding to the dispute.

?Offering 25%-50% of the total debt as a lump sum payment may be acceptable. The actual percentage may vary depending on the circumstances of the borrower as well as the prevailing practices of that particular collection agency.? One benefit of negotiating settlement terms is likely to reduce stress.

I am responding to your contact about a debt you are attempting to collect. You contacted me by [phone/mail], on [date]. You identified the debt as [any information they gave you about the debt]. Please stop all communication with me and with this address about this debt.

Cease-and-desist letters can be an effective way to request a debt collector to stop harassing you. If you send a collector a written letter telling them to stop contacting you, they are required by law to stop all further contact immediately.

Refusal-to-pay letters are simple to write. The consumer only needs to send a letter to the debt collector stating something like ?I refuse to pay this debt? with the debt amount and account number listed for reference to eliminate confusion.

You must fill out an Answer, serve the other side's attorney, and file your Answer form with the court within 30 days. If you don't, the creditor can ask for a default. If there's a default, the court won't let you file an Answer and can decide the case without you.