This form provides instructions for the software license due diligence checklist in business transactions.

Alaska Instructions to Software License Due Diligence Checklist

Description

How to fill out Alaska Instructions To Software License Due Diligence Checklist?

Choosing the right legal papers template can be a battle. Of course, there are a lot of layouts accessible on the Internet, but how do you find the legal develop you require? Make use of the US Legal Forms site. The assistance delivers 1000s of layouts, including the Alaska Instructions to Software License Due Diligence Checklist, that you can use for organization and private demands. All the varieties are checked by experts and meet up with federal and state needs.

If you are already signed up, log in to the account and click the Obtain button to find the Alaska Instructions to Software License Due Diligence Checklist. Use your account to appear with the legal varieties you might have ordered formerly. Go to the My Forms tab of your own account and obtain an additional version of the papers you require.

If you are a new consumer of US Legal Forms, here are straightforward directions that you should comply with:

- First, ensure you have selected the correct develop for your town/region. You may look through the form using the Review button and read the form description to make certain this is the best for you.

- In the event the develop is not going to meet up with your requirements, use the Seach industry to get the correct develop.

- When you are sure that the form would work, go through the Acquire now button to find the develop.

- Opt for the pricing strategy you desire and type in the needed details. Make your account and buy the order utilizing your PayPal account or Visa or Mastercard.

- Choose the data file structure and down load the legal papers template to the system.

- Complete, revise and print and indication the received Alaska Instructions to Software License Due Diligence Checklist.

US Legal Forms is definitely the biggest catalogue of legal varieties that you can find a variety of papers layouts. Make use of the company to down load expertly-created files that comply with express needs.

Form popularity

FAQ

Due diligence checklistLook at past annual and quarterly financial information, including:Review sales and gross profits by product.Look up the rates of return by product.Look at the accounts receivable.Get a breakdown of the business's inventory.Make a breakdown of real estate and equipment.More items...?

Due Diligence Process Steps, Policies and ProceduresEvaluate Goals of the Project. As with any project, the first step delineating corporate goals.Analyze of Business Financials.Thorough Inspection of Documents.Business Plan and Model Analysis.Final Offering Formation.Risk Management.

Below, we take a closer look at the three elements that comprise human rights due diligence identify and assess, prevent and mitigate and account , quoting from the Guiding Principles.

A tax due diligence requirements checklist includes property taxes, tax assets, audits, returns and any overseas activities. Target companies should provide extensive documentation on their tax history to prove their legality, legitimacy, and viability.

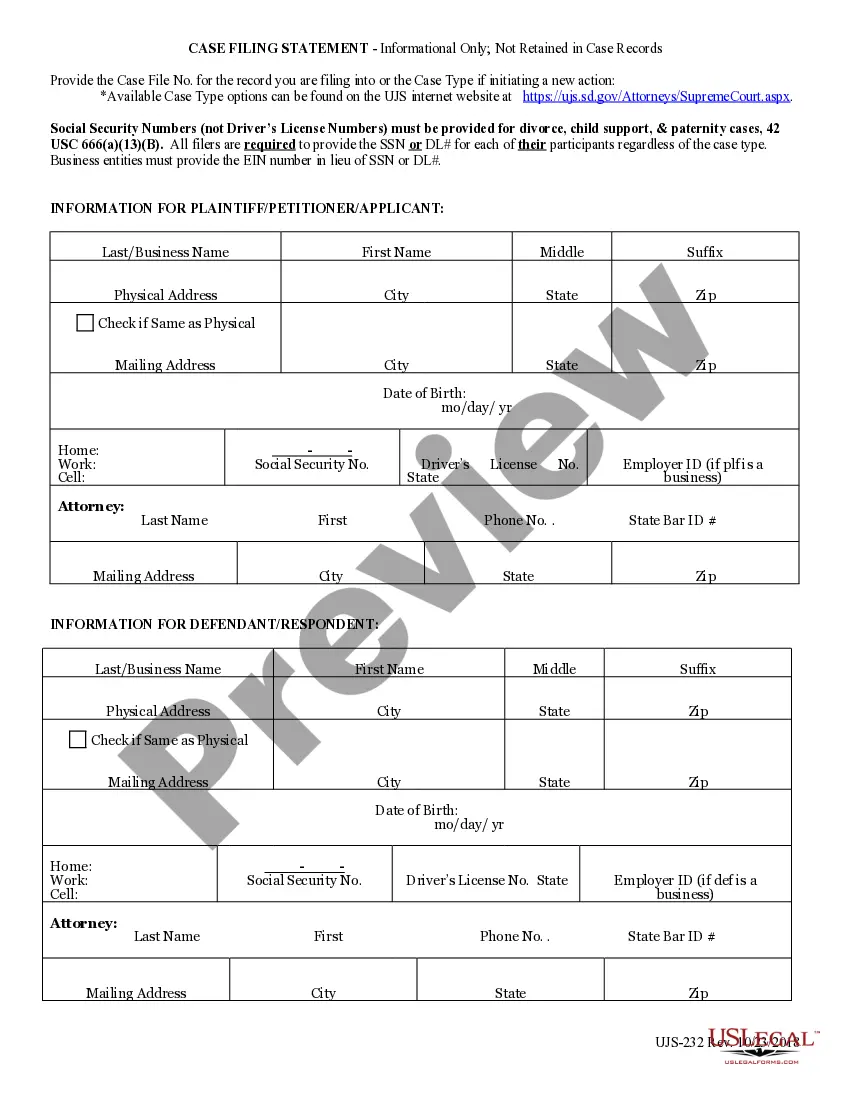

Due diligence documents include any paperwork, research, or information needed for the due diligence process. For example, stockholder agreements, government audits, trademarks, customer contracts, and license agreements are all different types of due diligence documents.

Organization and Good Standing of CompanyThe Articles of Incorporation and any amendments.A list of company bylaws and amendments.A list of company assumed names.A list of all states or countries where the company does business, has employees, or owns/leases an asset.Annual reports for the last three years.More items...

This is a non-exhaustive list of information and documentation that will be needed in the due diligence process. As each investigation will differ in terms of needed materials, the below can serve as a preparatory guide.

Documents Required During Company Due DiligenceMemorandum of Association.Articles of Association.Certificate of Incorporation.Shareholding Pattern.Financial Statements.Income Tax Returns.Bank Statements.Tax Registration Certificates.More items...