The Alaska Master Agreement is a legal contract that establishes the terms and conditions of a financial arrangement between Credit Suisse Financial Products and Bank One National Association. This agreement serves as a framework for conducting various financial transactions and activities between the two parties. Credit Suisse Financial Products, a leading global financial services provider, and Bank One National Association, a prominent banking institution, enter into the Alaska Master Agreement to outline their rights, obligations, and responsibilities when engaging in business activities related to financial products. This agreement encompasses a wide range of transactions, including derivatives, securities lending, repurchase agreements, and other financial instruments. It governs the pricing, lateralization, settlement, and termination procedures for these transactions. The Alaska Master Agreement establishes the rules for margin requirements and governs the process of posting collateral in the event of counterparty default. It also outlines the dispute resolution mechanisms, specifying the designated jurisdiction and applicable laws. Different types of Alaska Master Agreements may exist between Credit Suisse Financial Products and Bank One National Association based on the specific financial transactions being undertaken. For instance, there could be distinct agreements for derivatives trading, securities lending, or repurchase agreements. Each agreement would address the specific terms and conditions unique to the respective type of transaction. Keywords: Alaska Master Agreement, Credit Suisse Financial Products, Bank One National Association, financial arrangement, legal contract, terms and conditions, financial transactions, activities, framework, derivatives, securities lending, repurchase agreements, financial instruments, rights, obligations, responsibilities, pricing, lateralization, settlement, termination procedures, margin requirements, posting collateral, counterparty default, dispute resolution, jurisdiction, applicable laws, types of agreements, derivatives trading, securities lending, repurchase agreements.

Alaska Master Agreement between Credit Suisse Financial Products and Bank One National Association

Description

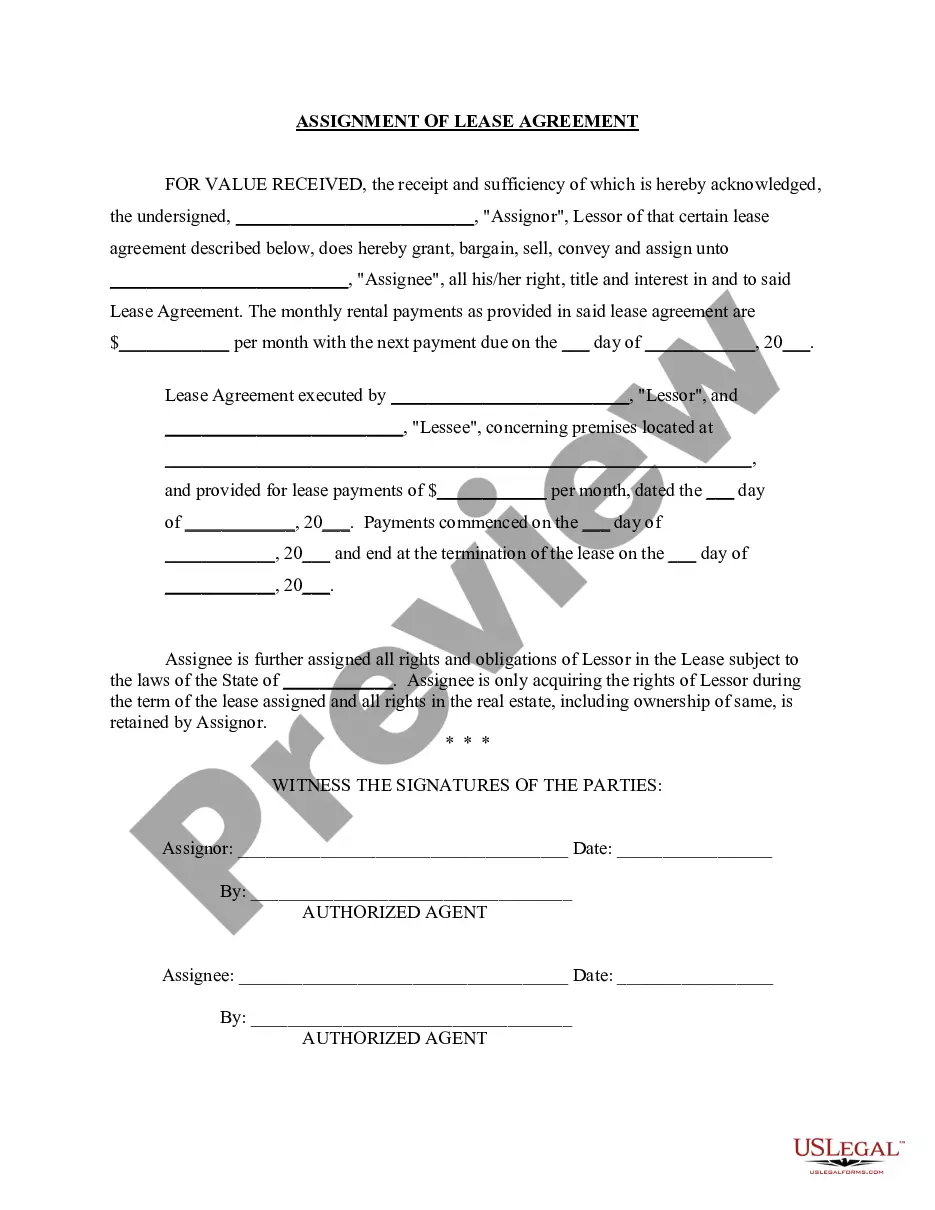

How to fill out Alaska Master Agreement Between Credit Suisse Financial Products And Bank One National Association?

It is possible to spend hrs on the web attempting to find the legal file web template which fits the state and federal requirements you need. US Legal Forms offers thousands of legal kinds which can be analyzed by experts. You can actually acquire or printing the Alaska Master Agreement between Credit Suisse Financial Products and Bank One National Association from my service.

If you currently have a US Legal Forms profile, you can log in and click the Obtain option. Afterward, you can full, revise, printing, or sign the Alaska Master Agreement between Credit Suisse Financial Products and Bank One National Association. Every single legal file web template you buy is your own property for a long time. To acquire another duplicate for any obtained form, check out the My Forms tab and click the corresponding option.

If you work with the US Legal Forms site for the first time, keep to the simple guidelines beneath:

- Initially, ensure that you have selected the best file web template for the county/metropolis of your liking. Read the form explanation to make sure you have selected the proper form. If available, use the Preview option to look with the file web template too.

- If you wish to get another model from the form, use the Look for industry to find the web template that fits your needs and requirements.

- Upon having discovered the web template you want, just click Get now to proceed.

- Find the rates prepare you want, type your accreditations, and sign up for a merchant account on US Legal Forms.

- Complete the financial transaction. You may use your credit card or PayPal profile to pay for the legal form.

- Find the format from the file and acquire it for your gadget.

- Make adjustments for your file if possible. It is possible to full, revise and sign and printing Alaska Master Agreement between Credit Suisse Financial Products and Bank One National Association.

Obtain and printing thousands of file web templates while using US Legal Forms website, that provides the largest collection of legal kinds. Use specialist and express-certain web templates to handle your company or individual demands.