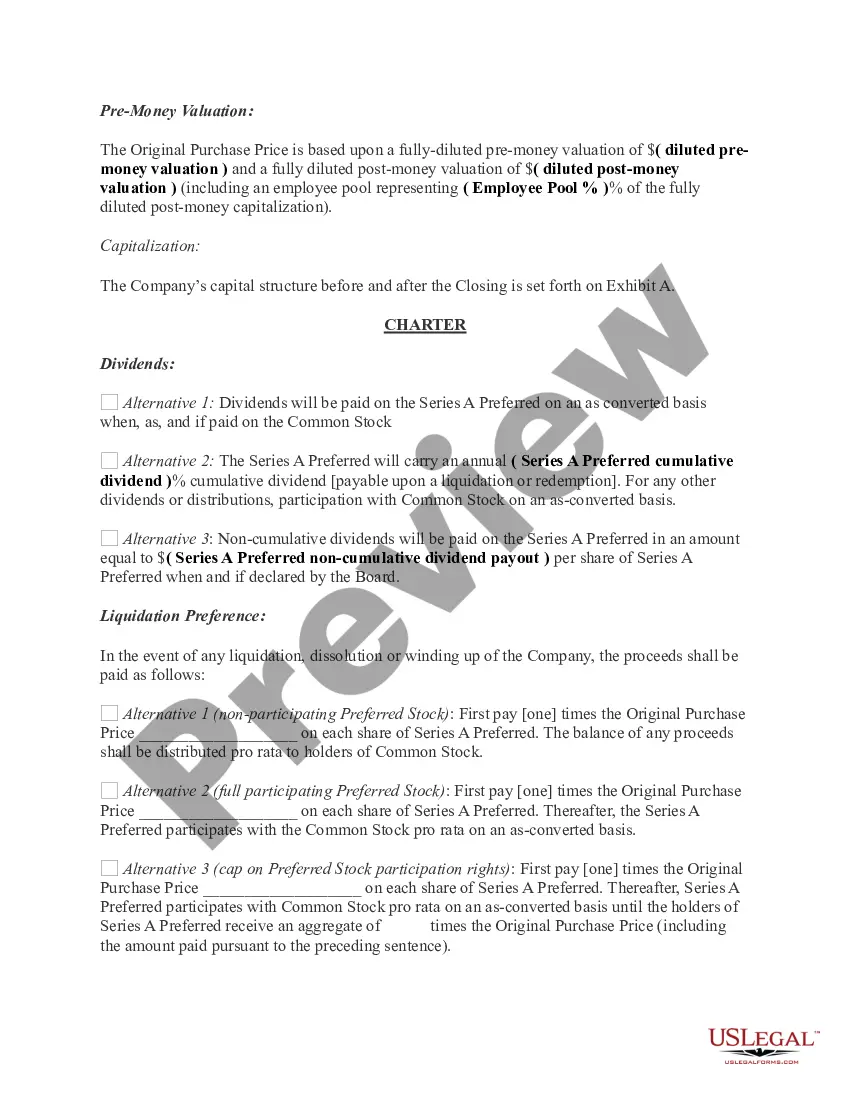

Alaska Term Sheet - Series A Preferred Stock Financing of a Company

Description

The Term Sheet is not a commitment to invest, and is conditioned on the completion of the conditions to closing set forth.

How to fill out Term Sheet - Series A Preferred Stock Financing Of A Company?

US Legal Forms - one of the largest libraries of authorized forms in the States - gives a variety of authorized record themes you are able to download or print. Using the site, you may get 1000s of forms for company and person functions, sorted by groups, claims, or keywords and phrases.You can find the latest models of forms like the Alaska Term Sheet - Series A Preferred Stock Financing of a Company in seconds.

If you already possess a monthly subscription, log in and download Alaska Term Sheet - Series A Preferred Stock Financing of a Company from the US Legal Forms library. The Download key will appear on every type you view. You gain access to all earlier saved forms in the My Forms tab of the bank account.

In order to use US Legal Forms the first time, allow me to share straightforward guidelines to get you began:

- Ensure you have selected the proper type for your city/county. Select the Preview key to check the form`s content. See the type outline to actually have selected the appropriate type.

- If the type doesn`t match your demands, make use of the Search discipline on top of the display to discover the the one that does.

- If you are satisfied with the form, verify your option by simply clicking the Purchase now key. Then, opt for the pricing prepare you favor and offer your qualifications to register on an bank account.

- Method the transaction. Make use of bank card or PayPal bank account to accomplish the transaction.

- Choose the format and download the form on your gadget.

- Make changes. Fill out, change and print and sign the saved Alaska Term Sheet - Series A Preferred Stock Financing of a Company.

Every template you included with your money lacks an expiry day and it is the one you have for a long time. So, if you wish to download or print an additional copy, just go to the My Forms area and then click on the type you need.

Obtain access to the Alaska Term Sheet - Series A Preferred Stock Financing of a Company with US Legal Forms, by far the most comprehensive library of authorized record themes. Use 1000s of professional and state-distinct themes that satisfy your company or person requirements and demands.

Form popularity

FAQ

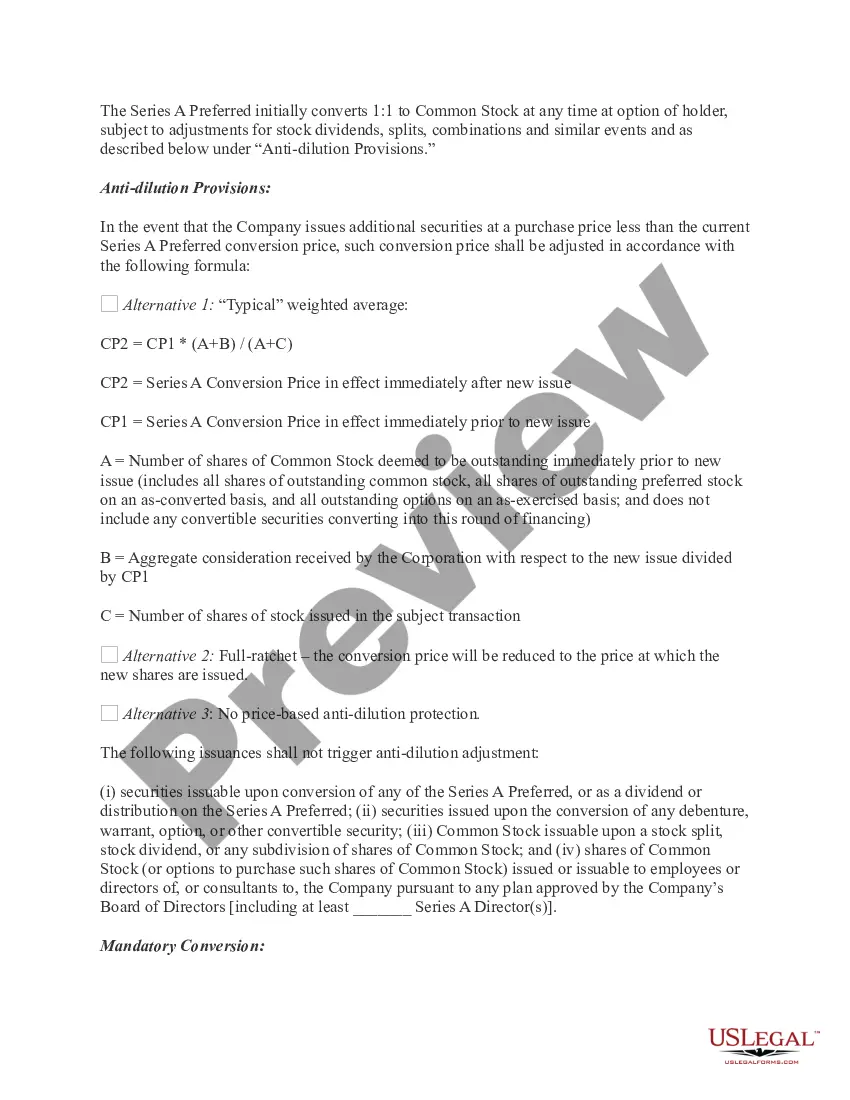

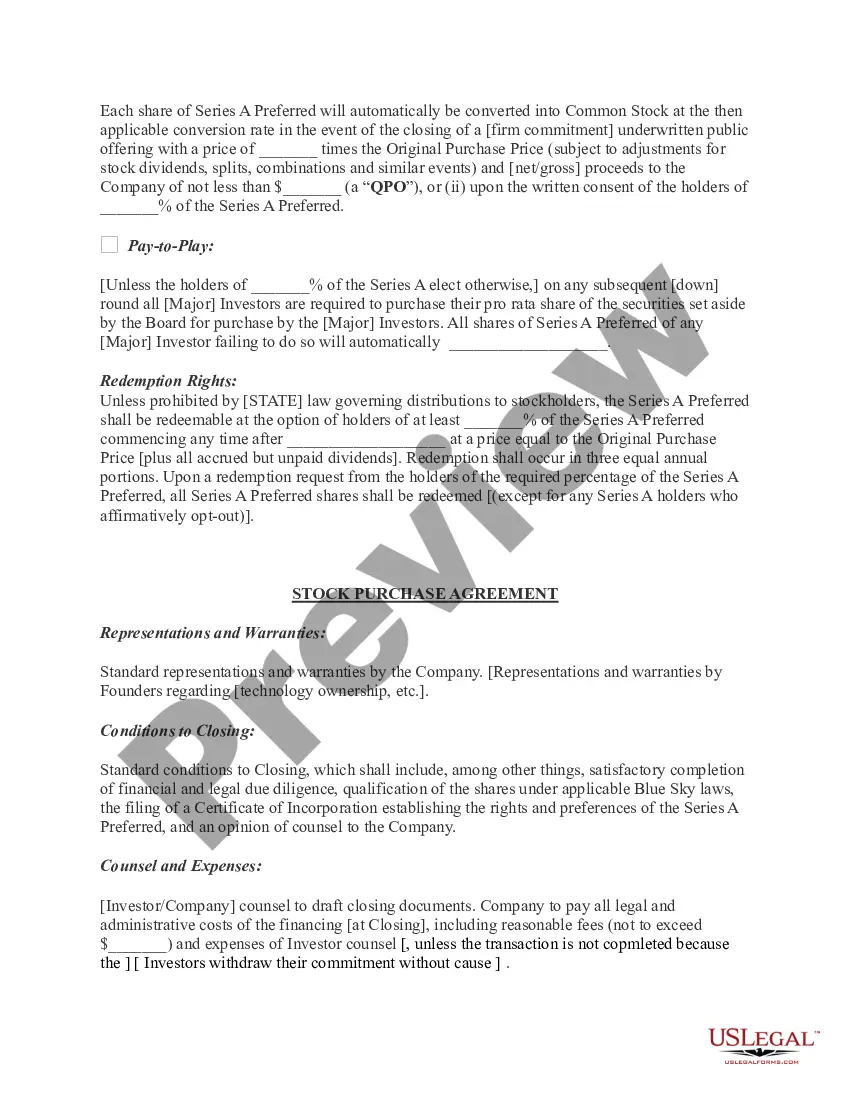

How to Prepare a Term Sheet Identify the Purpose of the Term Sheet Agreements. Briefly Summarize the Terms and Conditions. List the Offering Terms. Include Dividends, Liquidation Preference, and Provisions. Identify the Participation Rights. Create a Board of Directors. End with the Voting Agreement and Other Matters.

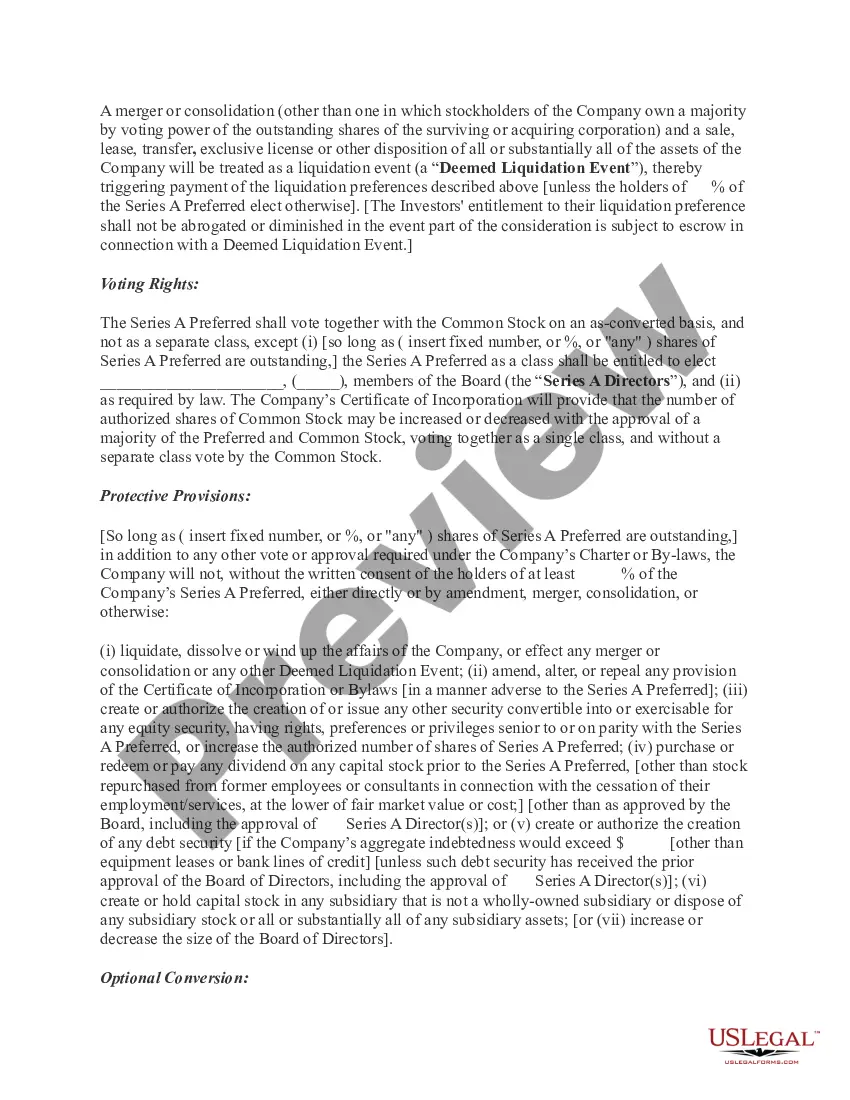

Format of Term Sheet Business Information. This section includes the name of the parties involved. ... Security Type. This segment identifies the type of security offered and the price per share of that security. ... Valuation. ... Amount. ... Liquidation Preference. ... Stake in Percentage. ... Voting Rights. ... Miscellaneous.

The first round of stock offered during the seed or early stage round by a portfolio company to the venture investor or fund. This stock is convertible into common stock in certain cases such as an IPO or the sale of the company.

A term sheet is a nonbinding agreement that shows the basic terms and conditions of an investment. The term sheet serves as a template and basis for more detailed, legally binding documents.

Term sheet examples: What's included? Along with setting the valuation for the company, a term sheet details the amount of the investment and detailed terms around the calculations of pricing for the preferred shares the investor will receive for their money. A term sheet also establishes the investor's rights.

Term sheets for venture capital financings include detailed provisions describing the terms of the preferred stock being issued to investors. Some terms are more important than others. The following brief description of certain material terms divides them into two categories: economic terms and control rights.

Preferred stock is listed first in the shareholders' equity section of the balance sheet, because its owners receive dividends before the owners of common stock, and have preference during liquidation.

6 Tips in Making a Term Sheet Make A List Of Terms. Condense The Terms. Describe The Dividends In Detail. Determine And Include Liquidation Preference In Your Term Sheet. Include Agreement On Voting And Closing Issues. Read, Amend, And Prepare For Signatures.