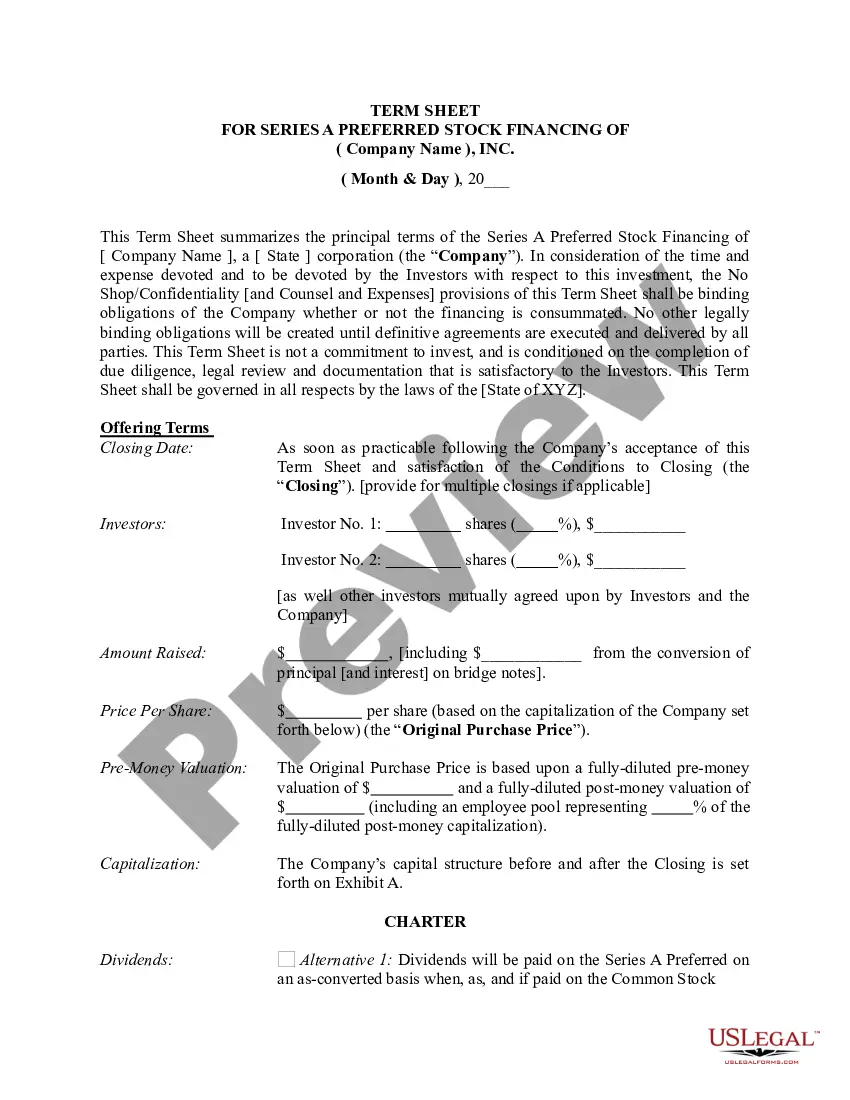

Alaska Term Sheet - Series A Preferred Stock Financing of a Company

Description

The Term Sheet is not a commitment to invest, and is conditioned on the completion of the conditions to closing set forth.

How to fill out Term Sheet - Series A Preferred Stock Financing Of A Company?

US Legal Forms - one of the biggest libraries of legal varieties in the USA - provides an array of legal papers templates it is possible to obtain or printing. Making use of the internet site, you may get thousands of varieties for enterprise and personal functions, sorted by types, states, or key phrases.You can get the most up-to-date types of varieties much like the Alaska Term Sheet - Series A Preferred Stock Financing of a Company in seconds.

If you currently have a membership, log in and obtain Alaska Term Sheet - Series A Preferred Stock Financing of a Company from the US Legal Forms local library. The Acquire button will show up on every form you perspective. You have accessibility to all earlier acquired varieties in the My Forms tab of your own bank account.

If you wish to use US Legal Forms the first time, here are simple directions to help you get started:

- Make sure you have picked out the best form for your personal metropolis/region. Select the Preview button to analyze the form`s articles. Browse the form information to actually have selected the proper form.

- If the form does not satisfy your requirements, utilize the Research discipline near the top of the screen to obtain the one who does.

- If you are pleased with the form, validate your decision by simply clicking the Acquire now button. Then, choose the pricing prepare you prefer and give your qualifications to register on an bank account.

- Procedure the deal. Make use of charge card or PayPal bank account to complete the deal.

- Select the structure and obtain the form in your device.

- Make adjustments. Fill out, edit and printing and indication the acquired Alaska Term Sheet - Series A Preferred Stock Financing of a Company.

Each and every format you included in your account does not have an expiration particular date which is the one you have eternally. So, if you wish to obtain or printing yet another version, just proceed to the My Forms portion and click about the form you want.

Gain access to the Alaska Term Sheet - Series A Preferred Stock Financing of a Company with US Legal Forms, the most substantial local library of legal papers templates. Use thousands of skilled and status-particular templates that meet up with your company or personal requires and requirements.

Form popularity

FAQ

The journal entry for issuing preferred stock is very similar to the one for common stock. This time Preferred Stock and Paid-in Capital in Excess of Par - Preferred Stock are credited instead of the accounts for common stock.

Preferred stock is listed first in the shareholders' equity section of the balance sheet, because its owners receive dividends before the owners of common stock, and have preference during liquidation.

How to Prepare a Term Sheet Identify the Purpose of the Term Sheet Agreements. Briefly Summarize the Terms and Conditions. List the Offering Terms. Include Dividends, Liquidation Preference, and Provisions. Identify the Participation Rights. Create a Board of Directors. End with the Voting Agreement and Other Matters.

The first round of stock offered during the seed or early stage round by a portfolio company to the venture investor or fund. This stock is convertible into common stock in certain cases such as an IPO or the sale of the company.

To comply with state regulations, the par value of preferred stock is recorded in its own paid-in capital account Preferred Stock. If the corporation receives more than the par amount, the amount greater than par will be recorded in another account such as Paid-in Capital in Excess of Par - Preferred Stock.

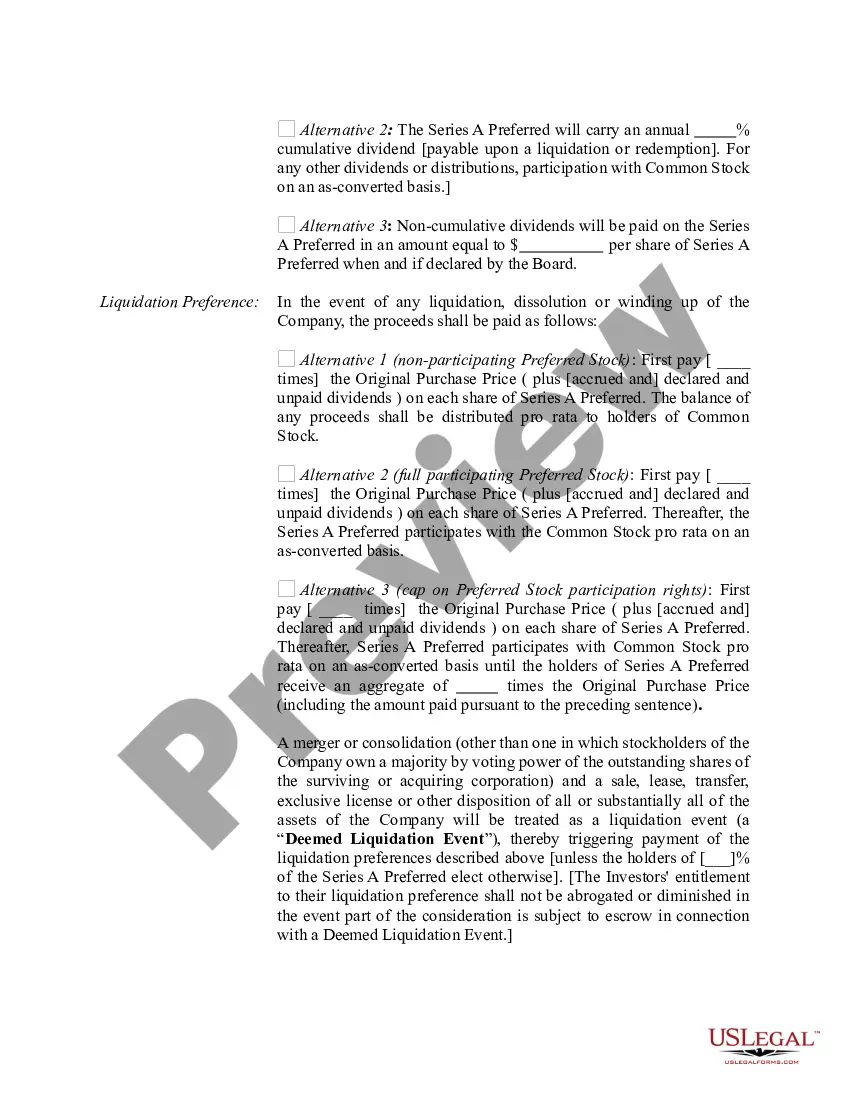

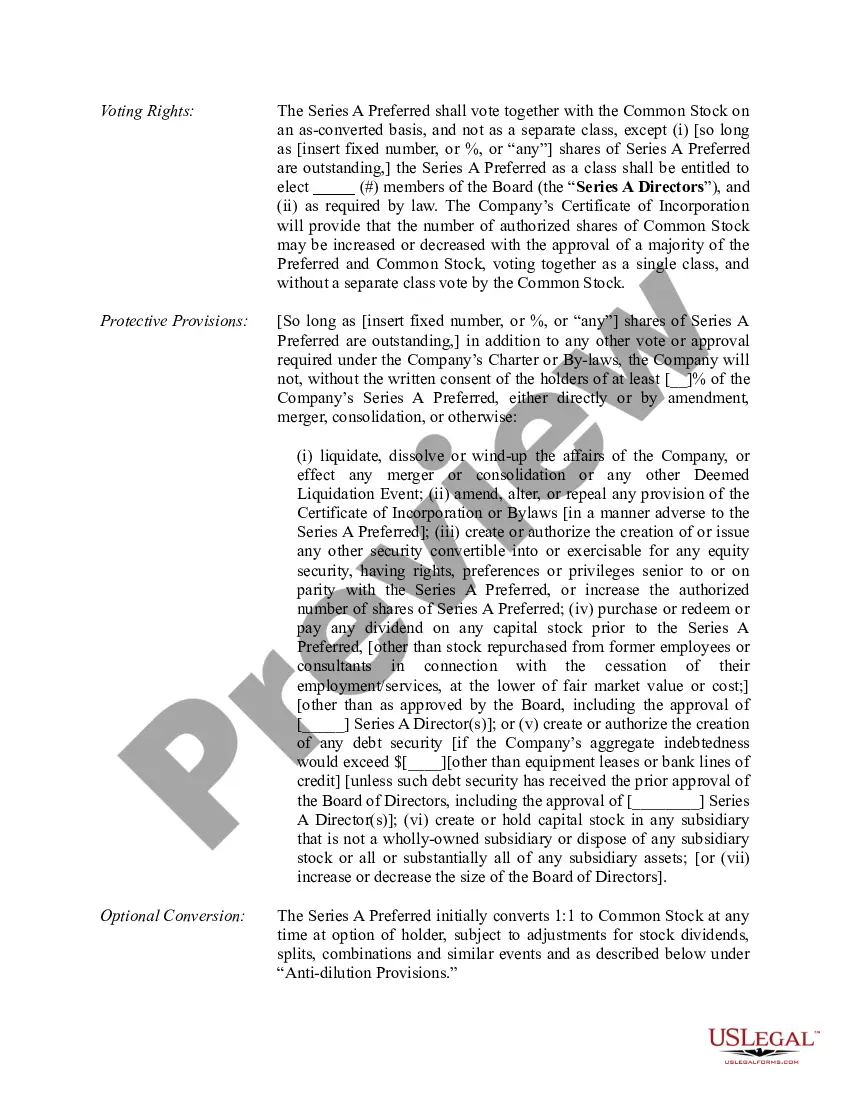

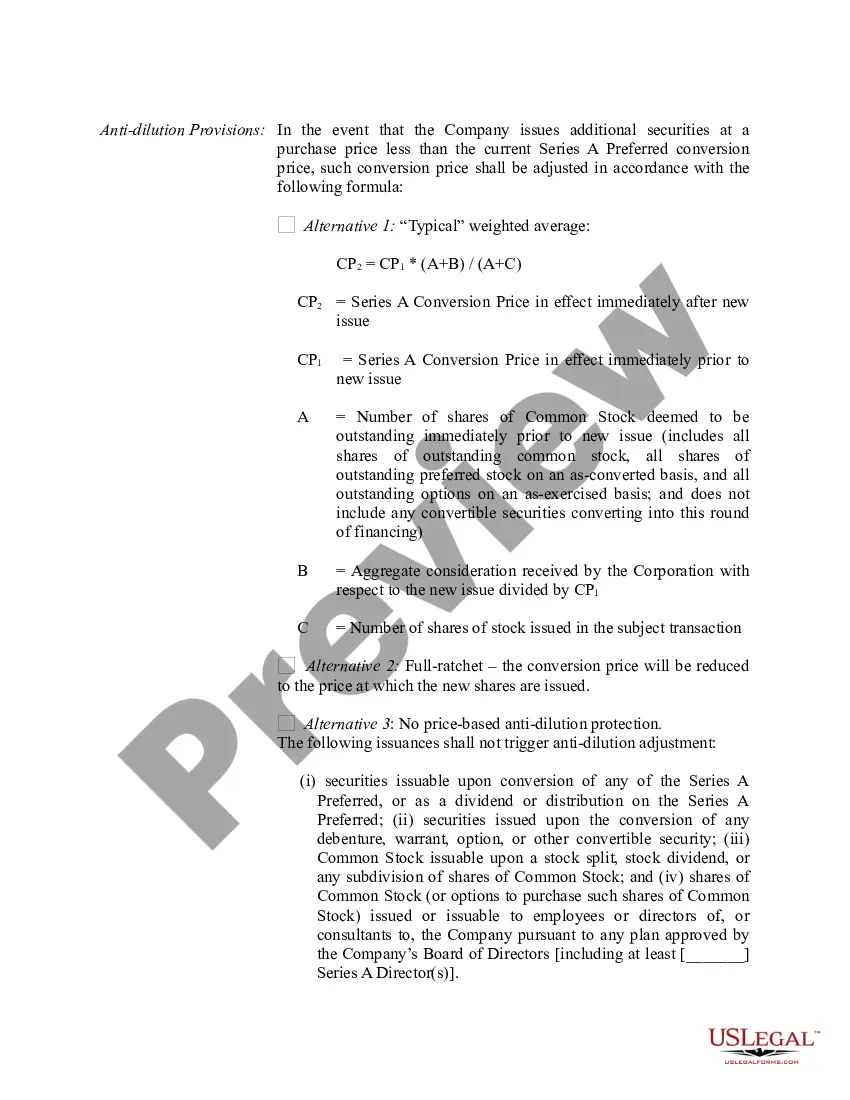

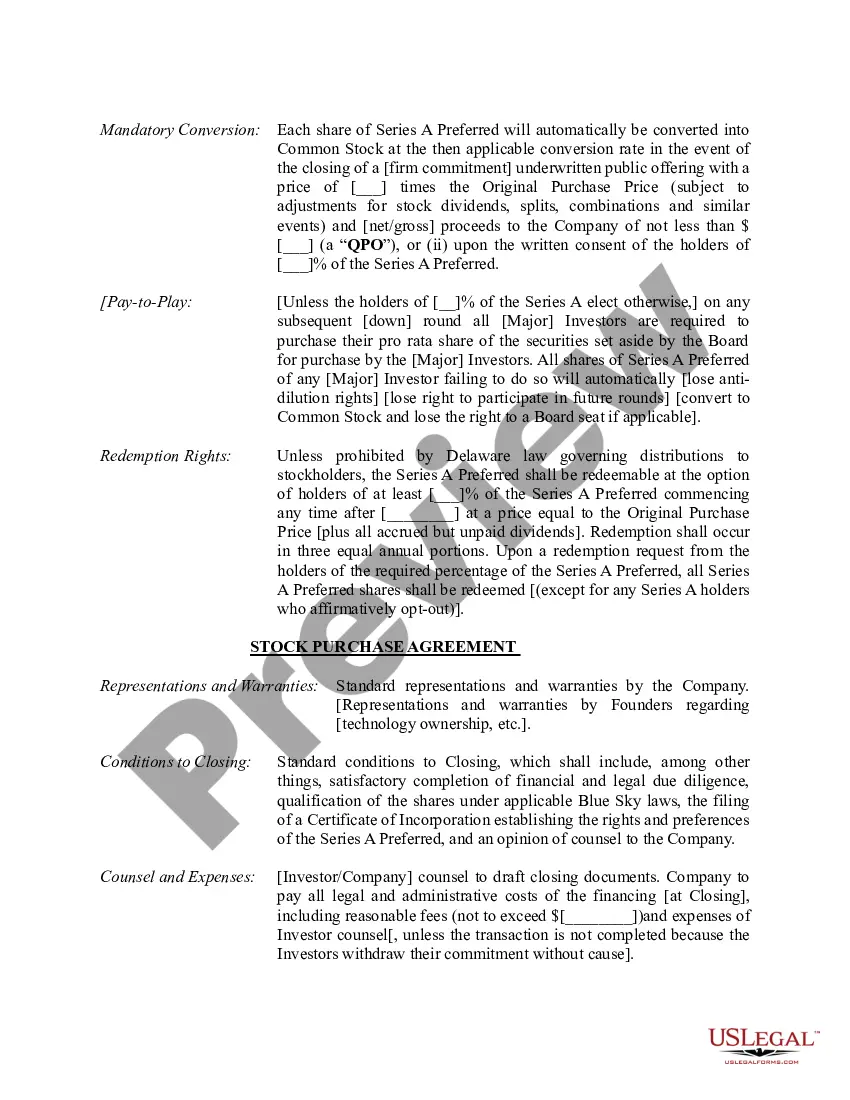

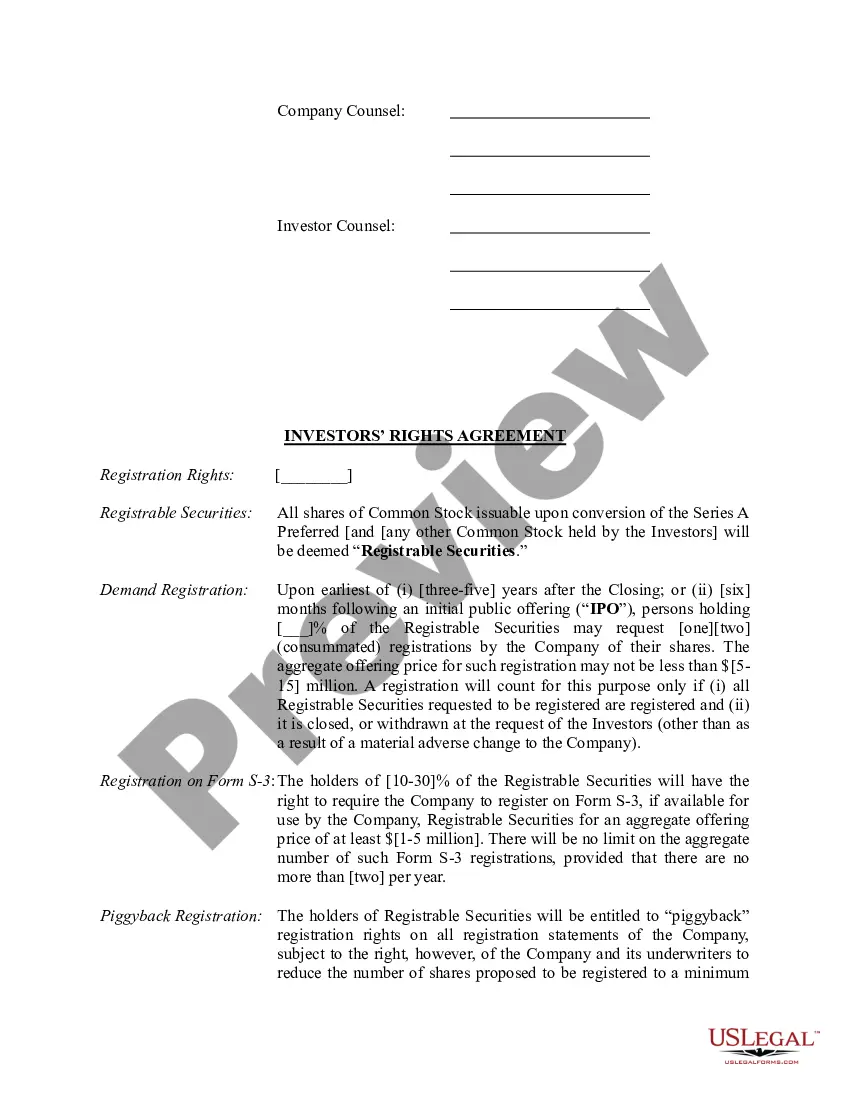

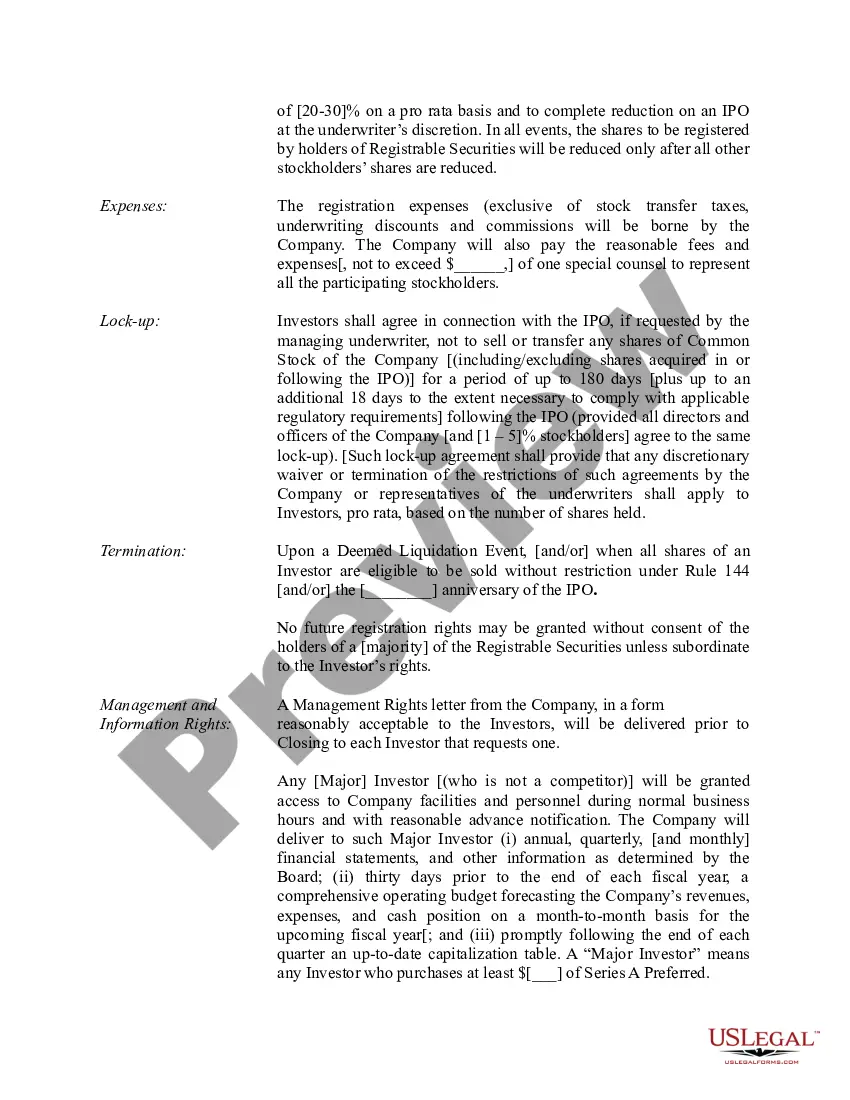

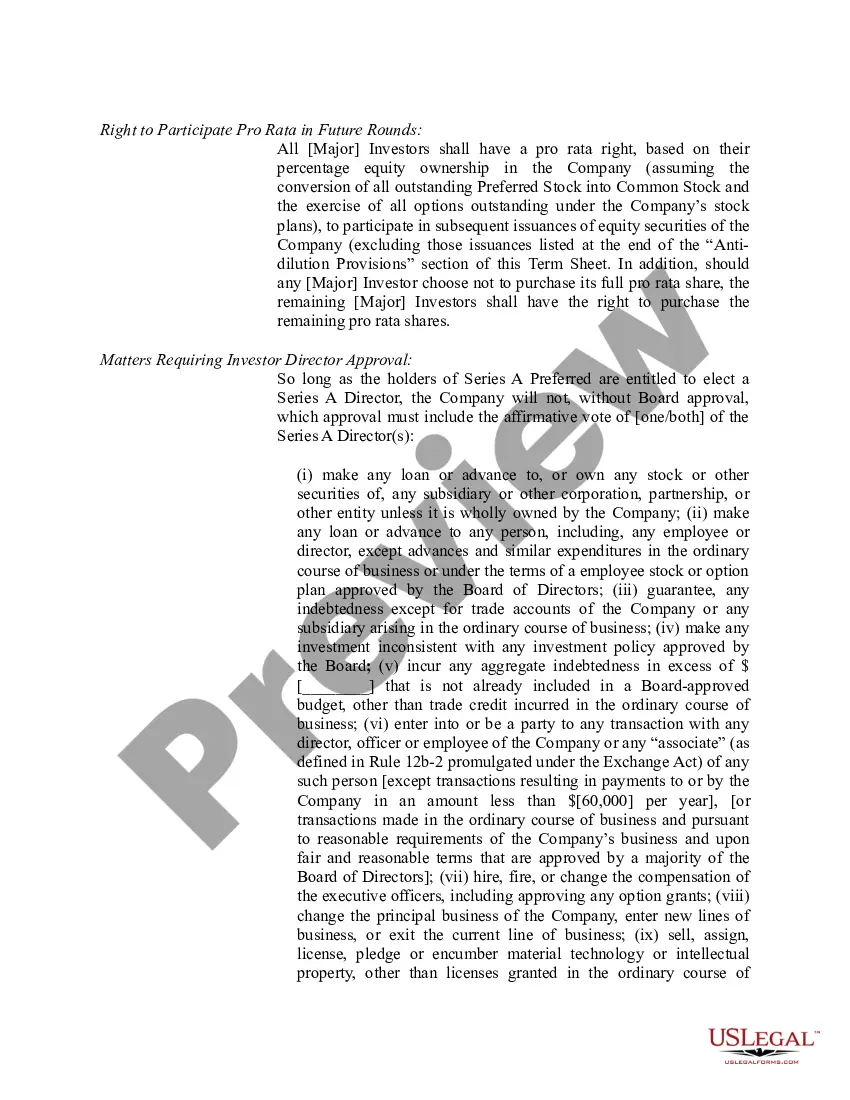

Term sheets for venture capital financings include detailed provisions describing the terms of the preferred stock being issued to investors. Some terms are more important than others. The following brief description of certain material terms divides them into two categories: economic terms and control rights.

Yes. If the call is irrevocable, the preferred stock should be reclassified as a liability until the shares are redeemed.

All preferred stock is reported on the balance sheet in the stockholders' equity section and it appears first before any other stock. The par value, authorized shares, issued shares, and outstanding shares is disclosed for each type of stock.