Alaska Shareholders Agreement

Description

How to fill out Shareholders Agreement?

Choosing the right legitimate papers design can be quite a battle. Needless to say, there are a lot of layouts accessible on the Internet, but how will you find the legitimate develop you will need? Use the US Legal Forms internet site. The services provides thousands of layouts, for example the Alaska Shareholders Agreement, which can be used for organization and private demands. Every one of the varieties are inspected by specialists and fulfill state and federal specifications.

If you are presently registered, log in for your accounts and click the Down load key to get the Alaska Shareholders Agreement. Make use of accounts to appear from the legitimate varieties you have ordered earlier. Check out the My Forms tab of your respective accounts and obtain an additional duplicate from the papers you will need.

If you are a fresh consumer of US Legal Forms, listed here are simple instructions that you can stick to:

- Initially, be sure you have chosen the appropriate develop to your city/region. You can look through the form utilizing the Preview key and browse the form description to guarantee it is the right one for you.

- If the develop fails to fulfill your preferences, utilize the Seach area to obtain the right develop.

- Once you are certain the form would work, click the Buy now key to get the develop.

- Pick the costs program you desire and enter the needed details. Build your accounts and pay for the transaction making use of your PayPal accounts or credit card.

- Choose the submit format and acquire the legitimate papers design for your system.

- Full, edit and printing and indication the attained Alaska Shareholders Agreement.

US Legal Forms may be the greatest library of legitimate varieties in which you can see different papers layouts. Use the service to acquire expertly-created papers that stick to status specifications.

Form popularity

FAQ

What to Think about When You Begin Writing a Shareholder Agreement. ... Name Your Shareholders. ... Specify the Responsibilities of Shareholders. ... The Voting Rights of Your Shareholders. ... Decisions Your Corporation Might Face. ... Changing the Original Shareholder Agreement. ... Determine How Stock can be Sold or Transferred.

We have 5 steps. Step 1: Decide on the issues the agreement should cover. ... Step 2: Identify the interests of shareholders. ... Step 3: Identify shareholder value. ... Step 4: Identify who will make decisions - shareholders or directors. ... Step 5: Decide how voting power of shareholders should add up.

How much does a shareholders' agreement cost? Cost can vary ing to the complexity of the agreement. The Company Law Solutions standard service, which covers most agreements, is very competitively priced at £300.00 plus VAT.

Bylaws ensure the corporation adheres to a certain standard and that everyone knows their role in the company. A shareholders' agreement differs from bylaws because it is an optional arrangement that only regulates the shareholders' relationship among themselves.

The agreement should outline what will happen when a shareholder leaves, retires, or dies. There may also be certain conditions imposed on the shareholder themselves when they simply want to leave. For example, the agreement may outline restrictions on setting up a competing company.

However, drafting a shareholder agreement requires careful consideration of a range of critical issues, such as ownership structure, transferability of shares, voting rights, management structure, decision-making procedures, dividend distribution, dispute resolution mechanisms, confidentiality, termination provisions, ...

Our fees for preparing and drafting a shareholders' agreement start at £1,250 plus VAT. A Shareholders' Agreement helps protect the legal rights of all shareholders in a business and aims to ensure everyone is treated fairly. The Agreement sets out: The allocation of shares among the owners of a limited company.

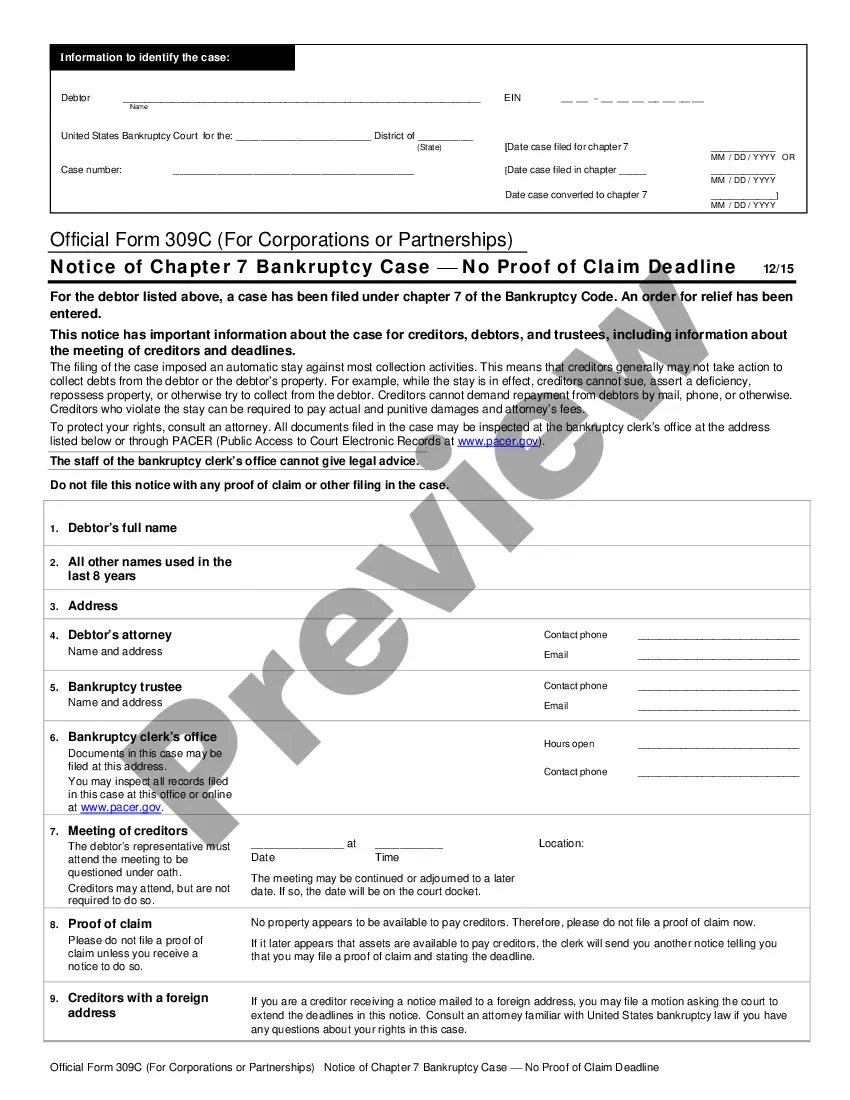

A shareholders' agreement includes a date; often the number of shares issued; a capitalization table that outlines shareholders and their percentage ownership; any restrictions on transferring shares; pre-emptive rights for current shareholders to purchase shares to maintain ownership percentages (for example, in the ...