The Alaska Convertible Note Subscription Agreement is a legally binding document used in investment transactions, specifically the purchase of convertible notes. It outlines the terms and conditions between the issuer, usually a startup or early-stage company seeking funding, and the investor. This agreement is a key component for raising capital and serves to protect the interests of both parties involved. The Alaska Convertible Note Subscription Agreement covers various aspects, including the principal amount, interest rate, maturity date, and conversion terms. It also highlights the rights and obligations of the investor and the company issuing the convertible notes. Additionally, it lays out the terms for potential events such as default, acceleration, and remedies in case of any breach of agreement. Overall, the agreement provides a comprehensive framework within which the investment transaction takes place. While there might not be specific types of Alaska Convertible Note Subscription Agreements, variations can occur based on specific conditions and terms negotiated between the parties. Some possible differentiators may include different interest rates, conversion mechanisms, or additional rights or protections for the investor. However, the overall structure and purpose of the agreement remain the same. Investors and companies in Alaska often rely on the Alaska Convertible Note Subscription Agreement to facilitate fundraising efforts while mitigating risks associated with early-stage investments. Being a legally binding contract, it ensures transparency, clarity, and security for both sides involved in the investment transaction.

Alaska Convertible Note Subscription Agreement

Description

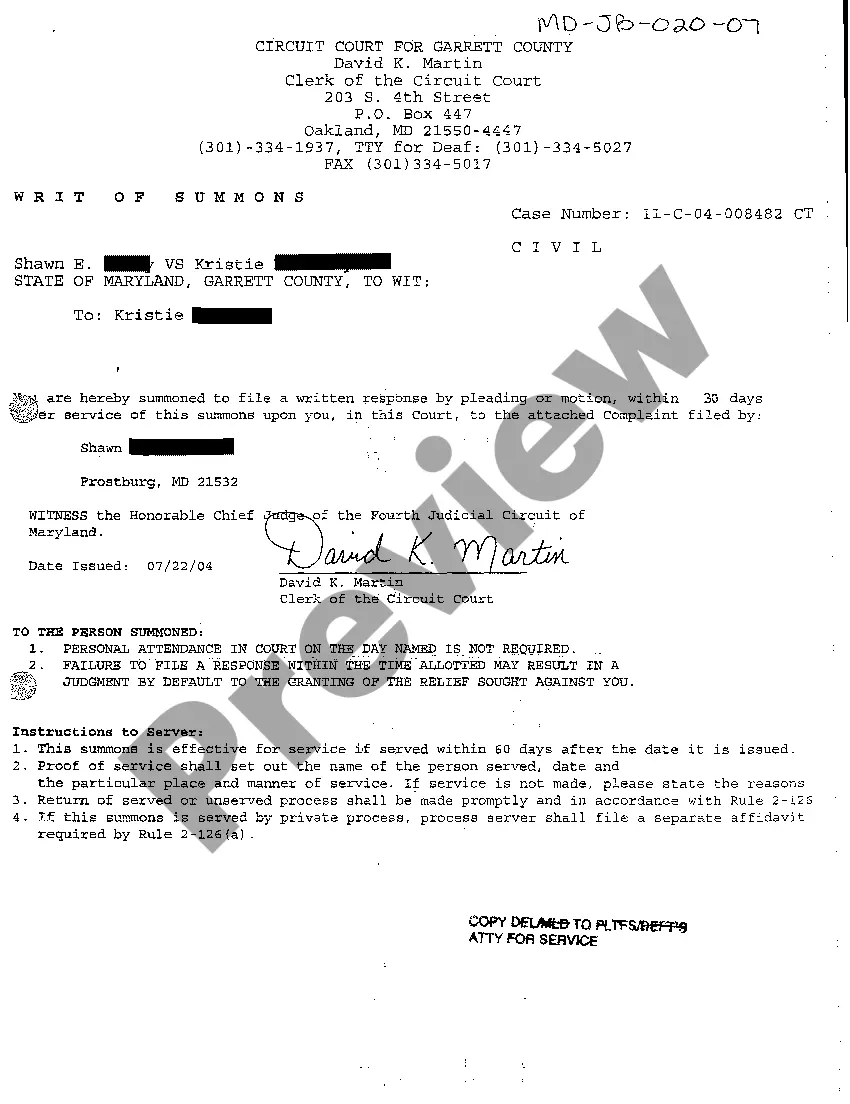

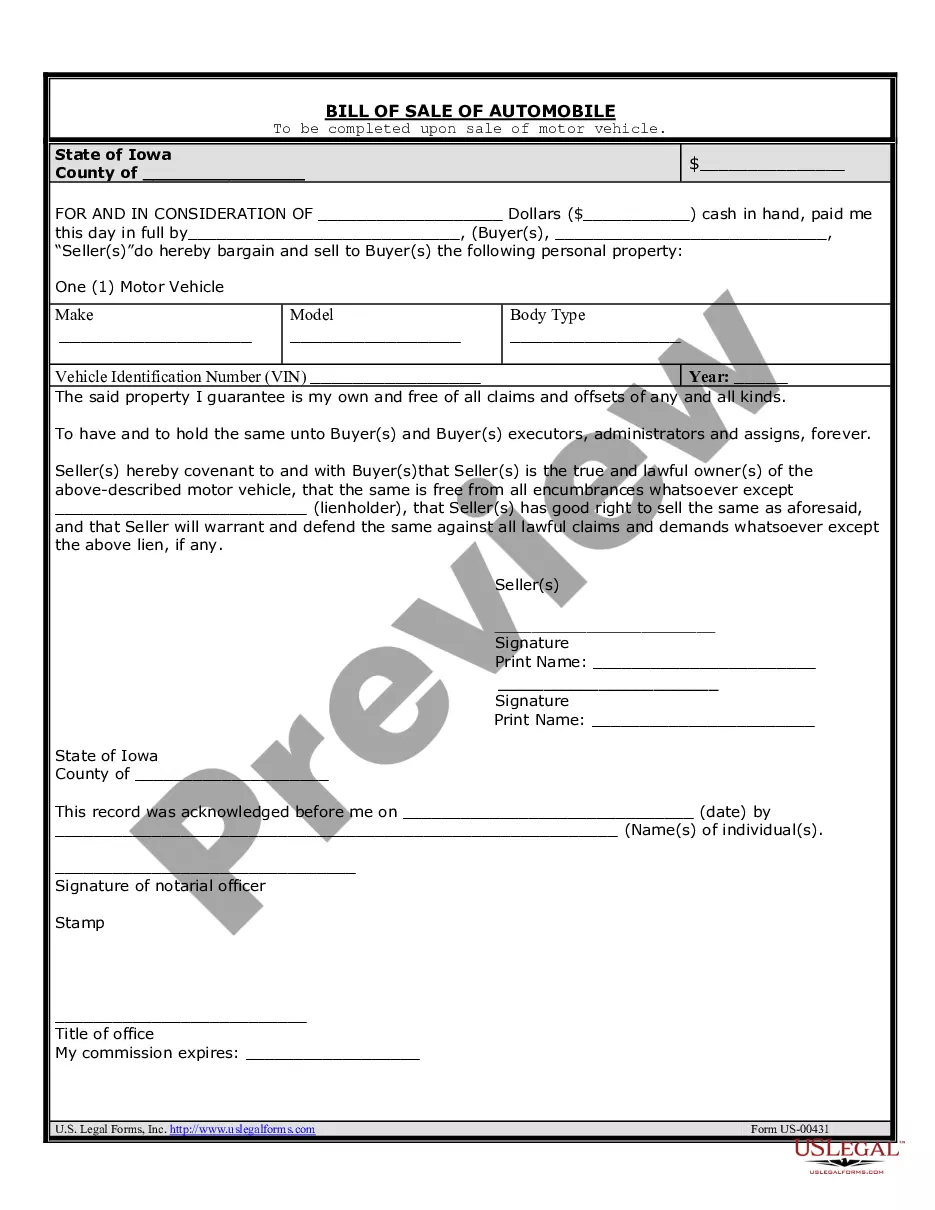

How to fill out Alaska Convertible Note Subscription Agreement?

US Legal Forms - one of many most significant libraries of legitimate kinds in the United States - provides a wide range of legitimate document layouts you may download or produce. Making use of the internet site, you may get a huge number of kinds for company and individual uses, sorted by groups, suggests, or key phrases.You can find the latest models of kinds much like the Alaska Convertible Note Subscription Agreement within minutes.

If you already possess a monthly subscription, log in and download Alaska Convertible Note Subscription Agreement in the US Legal Forms local library. The Acquire option will appear on each kind you look at. You have access to all earlier acquired kinds in the My Forms tab of your own accounts.

If you would like use US Legal Forms initially, listed below are simple recommendations to obtain started off:

- Make sure you have chosen the right kind for your town/region. Select the Review option to analyze the form`s content material. Look at the kind explanation to actually have selected the correct kind.

- When the kind doesn`t fit your requirements, take advantage of the Research area towards the top of the monitor to find the one who does.

- In case you are pleased with the form, verify your selection by simply clicking the Acquire now option. Then, select the costs strategy you favor and give your qualifications to sign up for an accounts.

- Approach the transaction. Make use of your Visa or Mastercard or PayPal accounts to perform the transaction.

- Select the format and download the form on the product.

- Make modifications. Fill up, change and produce and sign the acquired Alaska Convertible Note Subscription Agreement.

Each and every web template you added to your bank account does not have an expiration time and is also yours for a long time. So, if you want to download or produce one more version, just check out the My Forms area and click on in the kind you require.

Obtain access to the Alaska Convertible Note Subscription Agreement with US Legal Forms, the most extensive local library of legitimate document layouts. Use a huge number of skilled and state-certain layouts that fulfill your organization or individual needs and requirements.

Form popularity

FAQ

SPA is always executed after the incorporation of the company and there is a protocol for price valuation because consideration is the key in such an agreement whereas Share Subscription Agreement (?SSA?) is an agreement that is executed between the investors and the company in a share acquisition that involves the ...

Convertible loan notes (?CLN?) and advance subscription agreements (?ASA?) are ways of companies getting a cash injection which may later convert into shares, rather than being paid back in cash. ASAs tend to be shorter agreements than CLNs and therefore involve less negotiation.

Subscription agreements are more fixed than SAFEs. Very simply, the startup company offers to sell a set number of shares for a specific price. If an investor agrees to those terms, that investor is officially a shareholder of the startup. This can be less nebulous than a SAFE.

A limited partnership is when private investors or partners own the company. Under the subscription agreement, the terms are set for the company to sell a certain number of shares in return for a predetermined amount from the private investor.

Summary. A subscription agreement is a formal agreement between a company and an investor to buy shares of a company at an agreed-upon price. It contains all the details of such an agreement, including Outstanding Shares, Shares Ownership, and Payouts.

While a CLN is a loan, an ASA is an investment in shares which will be issued at a later date. When the shares are later issued (usually at the next Qualifying Financing Round), they will often be done so at a discounted price.

Summary. A subscription agreement is a formal agreement between a company and an investor to buy shares of a company at an agreed-upon price. It contains all the details of such an agreement, including Outstanding Shares, Shares Ownership, and Payouts.

The shareholders' agreement, on the other hand, stipulates the terms for the future partnership and is not directly related to the investment itself. The subscription agreement refers to the shareholders' agreement and typically they are signed at the same time.