Alaska Public Relations Agreement - Self-Employed Independent Contractor

Description

How to fill out Alaska Public Relations Agreement - Self-Employed Independent Contractor?

If you wish to full, obtain, or produce lawful file layouts, use US Legal Forms, the most important variety of lawful types, which can be found on the Internet. Take advantage of the site`s simple and easy hassle-free research to obtain the papers you need. Numerous layouts for enterprise and personal uses are sorted by types and suggests, or keywords and phrases. Use US Legal Forms to obtain the Alaska Public Relations Agreement - Self-Employed Independent Contractor within a handful of mouse clicks.

In case you are already a US Legal Forms buyer, log in to the bank account and click on the Down load key to have the Alaska Public Relations Agreement - Self-Employed Independent Contractor. Also you can access types you formerly saved within the My Forms tab of your own bank account.

Should you use US Legal Forms the very first time, follow the instructions under:

- Step 1. Ensure you have selected the shape for your correct town/country.

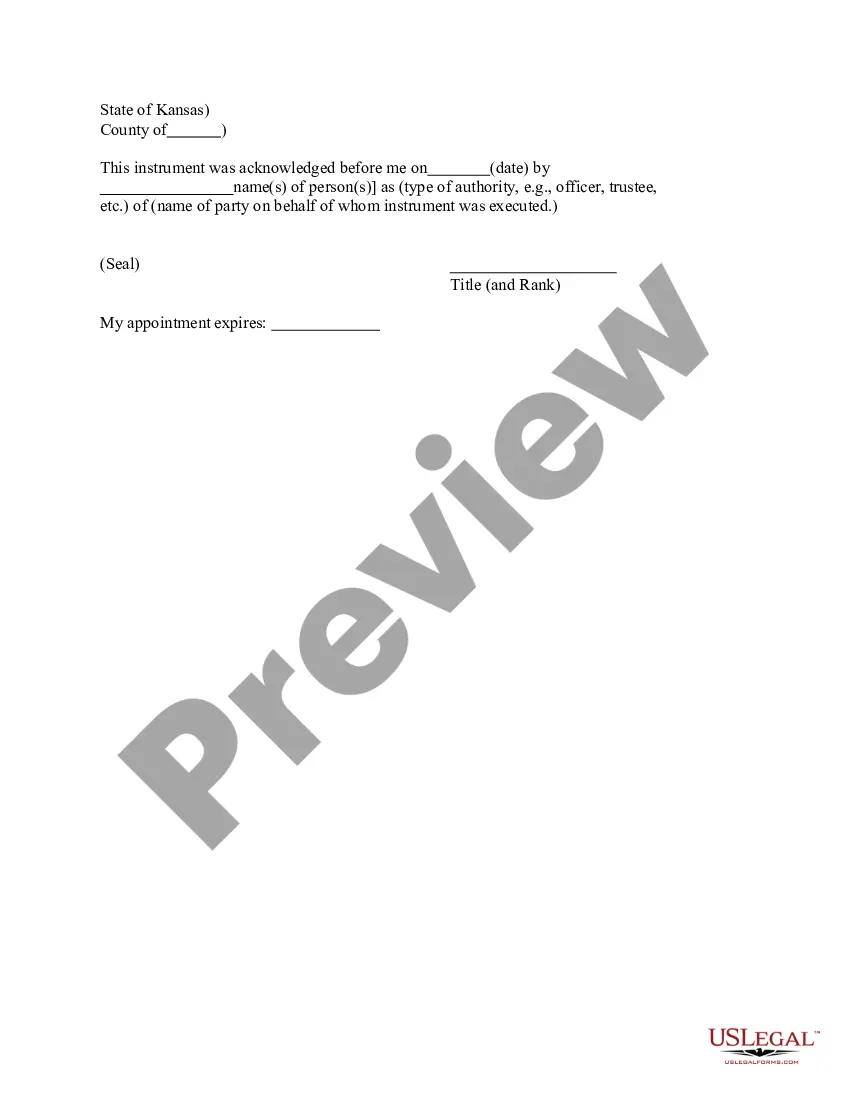

- Step 2. Use the Review choice to check out the form`s information. Do not forget to read through the description.

- Step 3. In case you are unhappy with the form, make use of the Look for discipline at the top of the display to find other variations in the lawful form format.

- Step 4. After you have located the shape you need, select the Purchase now key. Opt for the rates strategy you like and include your credentials to register on an bank account.

- Step 5. Procedure the financial transaction. You may use your Мisa or Ьastercard or PayPal bank account to finish the financial transaction.

- Step 6. Select the format in the lawful form and obtain it in your product.

- Step 7. Comprehensive, change and produce or indicator the Alaska Public Relations Agreement - Self-Employed Independent Contractor.

Each lawful file format you acquire is the one you have eternally. You have acces to every single form you saved inside your acccount. Select the My Forms portion and decide on a form to produce or obtain once more.

Be competitive and obtain, and produce the Alaska Public Relations Agreement - Self-Employed Independent Contractor with US Legal Forms. There are many specialist and status-specific types you may use to your enterprise or personal demands.

Form popularity

FAQ

Independent contractors are self-employed workers who provide services for an organisation under a contract for services. Independent contractors are not employees and are typically highly skilled, providing their clients with specialist skills or additional capacity on an as needed basis.

The main pieces of employment legislation, chief among which are the Labour Relations Act 66 of 1995 (LRA) the Basic Conditions of Employment Act 75 of 1997 (BCEA) and the Employment Equity Act 55 of 1998 (EEA), apply to employees and not independent contractors.

The Labour Relations Act applies to all employers, workers, trade unions and employers' organisations.

Independent contractors provide goods or services according to the terms of a contract they have negotiated with an employer. Independent contractors are not employees, and therefore they are not covered under most federal employment statutes.

Employees in South Africa are entitled to certain minimum employment benefits, while independent contractors are not. Subject to some exclusions, all employees are entitled to a number of statutory minimum entitlements and basic conditions of employment.

Often Independent Contractors are completely unaware that they are not Employees as defined in South African labour legislation and therefore unprotected by labour legislation.

Some general protections provided under the Fair Work Act 2009 extend to independent contractors and their principals. Independent contractors and principals are afforded limited workplace rights, and the right to engage in certain industrial activities.

What Is an Independent Contractor? An independent contractor is a self-employed person or entity contracted to perform work foror provide services toanother entity as a nonemployee. As a result, independent contractors must pay their own Social Security and Medicare taxes.

An attorney or accountant who has his or her own office, advertises in the yellow pages of the phone book under Attorneys or Accountants, bills clients by the hour, is engaged by the job or paid an annual retainer, and can hire a substitute to do the work is an example of an independent contractor.

The other contract (Independent contractor) is a Contract for Service, and is usually a contract where the contractor undertakes to perform a specific service or task, and upon completion of the agreed service or task, or upon production of the result agreed upon, the contractor will be paid.