Alaska Payroll Specialist Agreement - Self-Employed Independent Contractor

Description

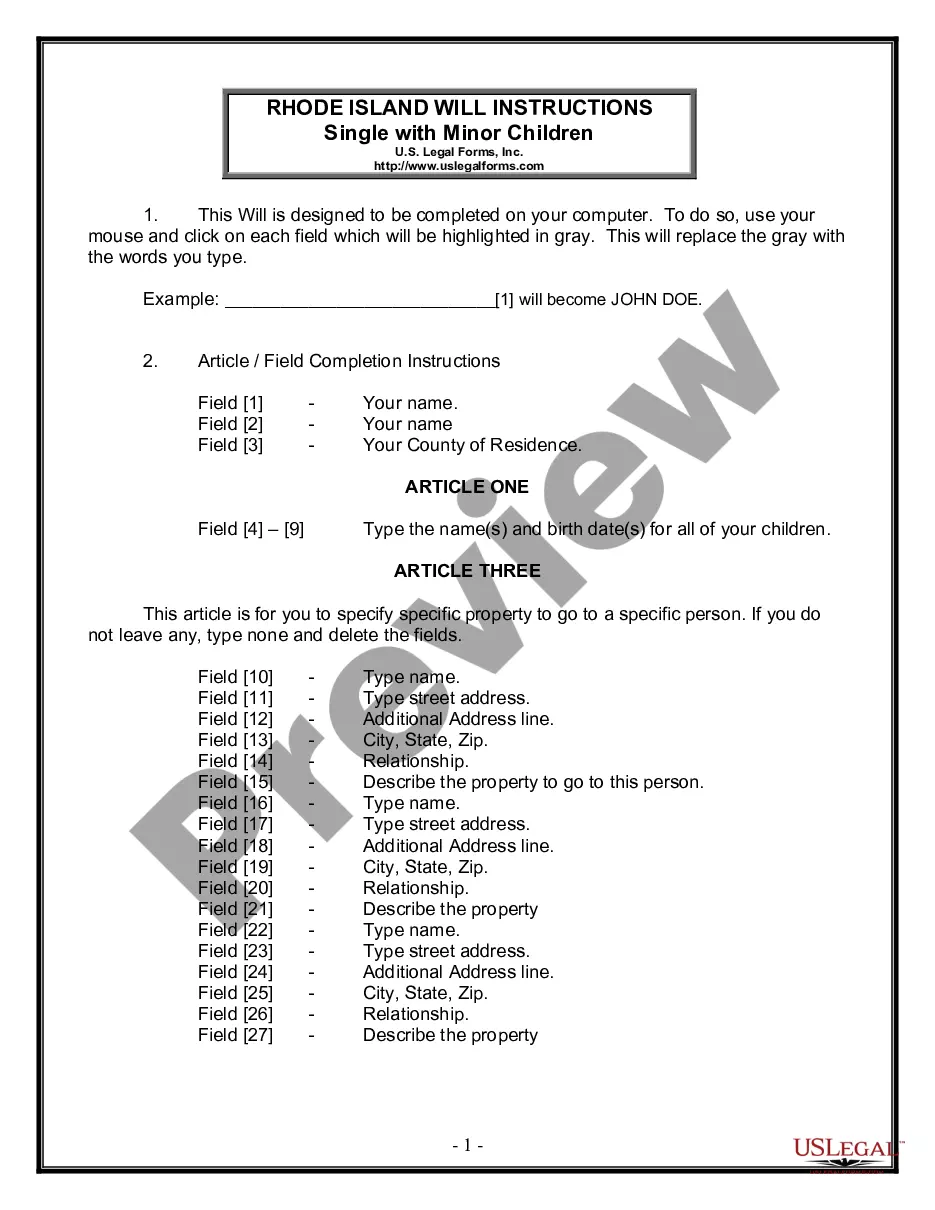

How to fill out Alaska Payroll Specialist Agreement - Self-Employed Independent Contractor?

Are you in a position in which you require paperwork for possibly enterprise or person reasons just about every day? There are plenty of legal document themes available on the Internet, but finding ones you can trust is not easy. US Legal Forms offers a large number of form themes, just like the Alaska Payroll Specialist Agreement - Self-Employed Independent Contractor, that happen to be composed in order to meet federal and state requirements.

If you are already informed about US Legal Forms site and also have an account, merely log in. After that, you can down load the Alaska Payroll Specialist Agreement - Self-Employed Independent Contractor format.

Unless you provide an bank account and would like to begin to use US Legal Forms, adopt these measures:

- Find the form you need and ensure it is for your correct area/area.

- Utilize the Review option to examine the shape.

- Read the explanation to actually have chosen the proper form.

- In case the form is not what you`re looking for, make use of the Research area to get the form that meets your requirements and requirements.

- Whenever you find the correct form, just click Purchase now.

- Select the costs prepare you want, complete the necessary info to make your money, and pay money for the transaction making use of your PayPal or bank card.

- Decide on a hassle-free data file format and down load your version.

Find each of the document themes you may have bought in the My Forms menus. You may get a more version of Alaska Payroll Specialist Agreement - Self-Employed Independent Contractor anytime, if required. Just click the essential form to down load or printing the document format.

Use US Legal Forms, probably the most extensive selection of legal types, to save lots of efforts and steer clear of blunders. The support offers skillfully produced legal document themes that you can use for an array of reasons. Create an account on US Legal Forms and begin producing your lifestyle a little easier.

Form popularity

FAQ

Payroll refers to the tasks an employer must execute to ensure employees are paid accurately and on time. An independent contractor is not an employee; therefore, he's not paid through the payroll.

When paying independent contractors, employers do not have to pay any employer taxes. Employees typically have social security and Medicare (FICA) taxes taken out of their paycheck. Independent contractors, however, pay Self-Employment Tax (SE tax).

How to Pay 1099 Contractors in PayrollAdd the contractor by going to Payroll > 1099 Contractors > Add Contractor.Enter the 1099 Type and their FEIN or Social Security/Individual Taxpayer ID number.If you have Patriot's Accounting software, be sure the Pay this contractor in payroll box is checked on their record.More items...

Payroll refers to the tasks an employer must execute to ensure employees are paid accurately and on time. An independent contractor is not an employee; therefore, he's not paid through the payroll.

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.

Independent contractors are self-employed workers who provide services for an organisation under a contract for services. Independent contractors are not employees and are typically highly skilled, providing their clients with specialist skills or additional capacity on an as needed basis.

A 1099 employee is a US self-employed worker that reports their income to the IRS on a 1099 tax form. Freelancers, gig workers, and independent contractors are all considered 1099 employees.

How is an independent contractor paid?Obtain the independent contractor's Form W-9, Request for Taxpayer Identification Number and Certification.Provide compensation for work performed.Remit backup withholding payments to the IRS, if necessary.Complete Form 1099-NEC, Nonemployee Compensation.

Remember that an independent contractor is considered to be self-employed, so in effect, you are running your own one-person business. Any income that you earn as an independent contractor must be reported on Schedule C. You'll then pay income taxes on the total profit.

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.