Alaska Bookkeeping Agreement - Self-Employed Independent Contractor

Description

How to fill out Alaska Bookkeeping Agreement - Self-Employed Independent Contractor?

US Legal Forms - among the greatest libraries of legal forms in the USA - delivers an array of legal record web templates it is possible to down load or printing. Making use of the website, you may get thousands of forms for business and person uses, sorted by types, says, or keywords.You will find the newest models of forms much like the Alaska Bookkeeping Agreement - Self-Employed Independent Contractor in seconds.

If you currently have a monthly subscription, log in and down load Alaska Bookkeeping Agreement - Self-Employed Independent Contractor through the US Legal Forms library. The Acquire switch can look on every form you perspective. You have access to all earlier saved forms inside the My Forms tab of the accounts.

If you wish to use US Legal Forms the very first time, listed below are straightforward directions to help you started out:

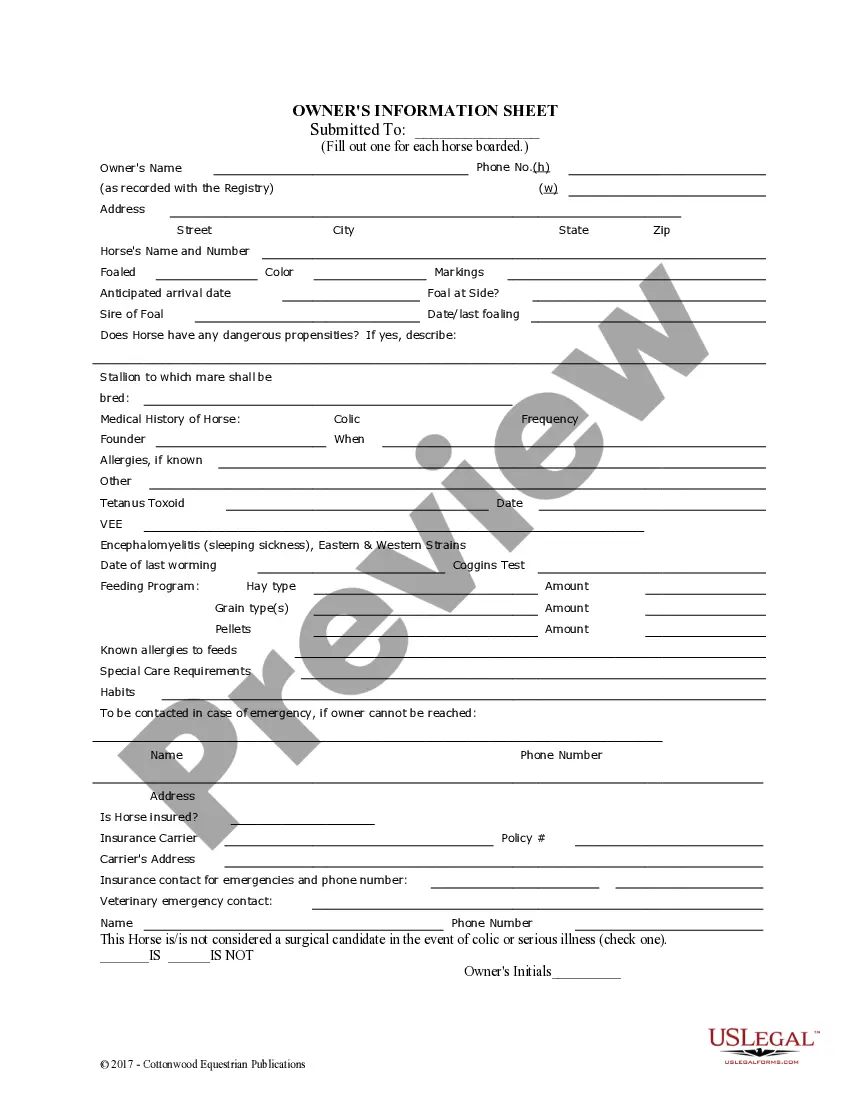

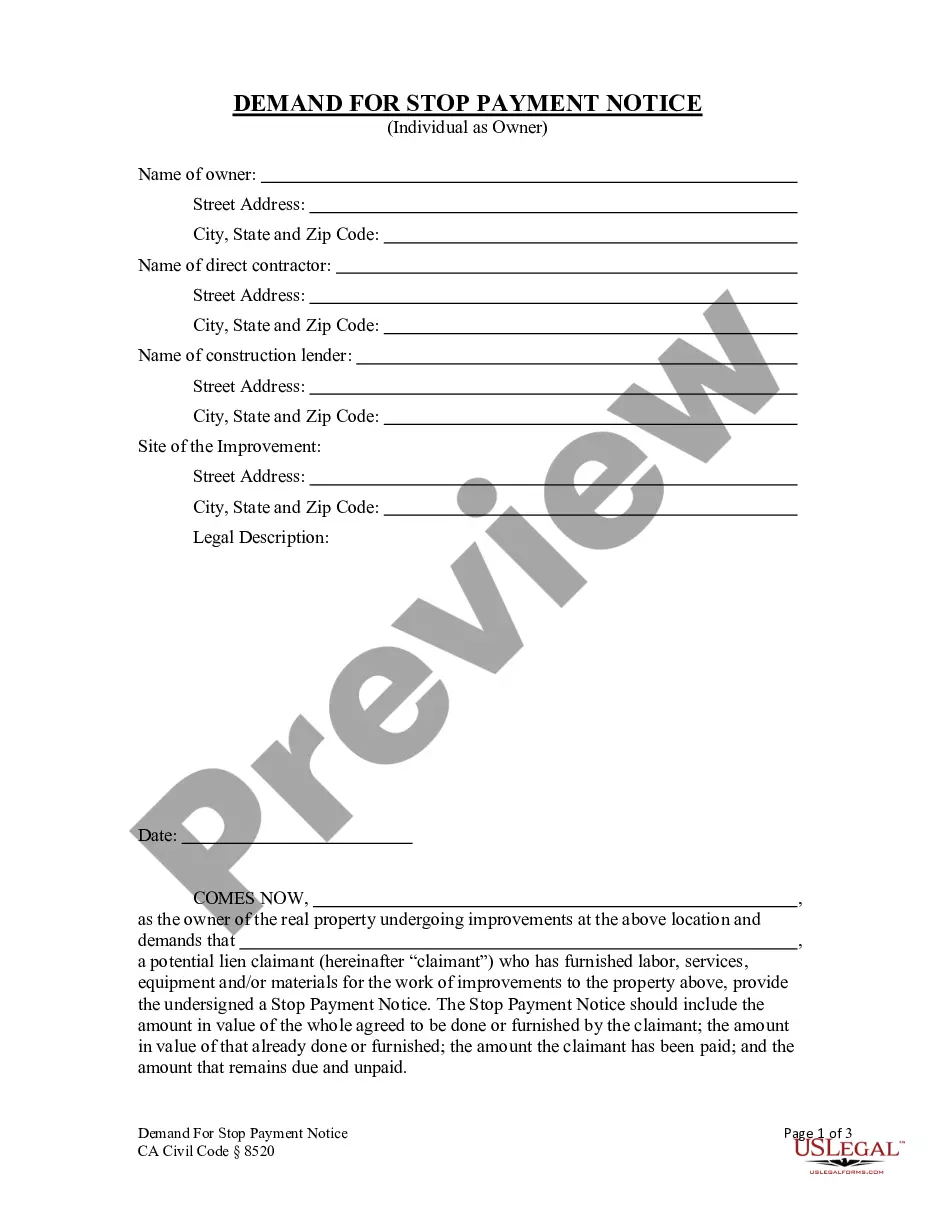

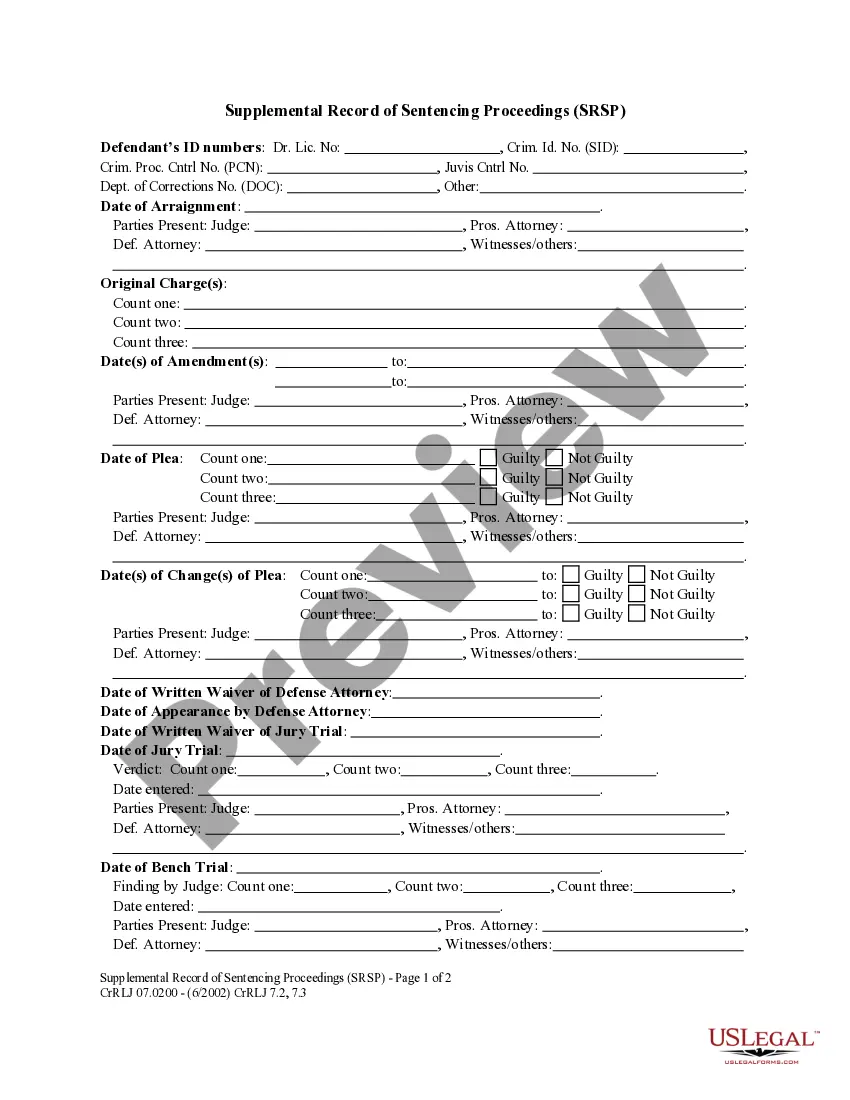

- Make sure you have picked out the right form for your area/state. Click the Preview switch to examine the form`s content. Read the form outline to actually have selected the appropriate form.

- When the form doesn`t fit your demands, make use of the Lookup area at the top of the monitor to get the one who does.

- If you are happy with the shape, verify your option by clicking on the Get now switch. Then, opt for the rates program you favor and offer your credentials to sign up for the accounts.

- Approach the financial transaction. Use your credit card or PayPal accounts to complete the financial transaction.

- Find the file format and down load the shape on your own device.

- Make modifications. Load, modify and printing and indication the saved Alaska Bookkeeping Agreement - Self-Employed Independent Contractor.

Every single web template you added to your money does not have an expiration time which is the one you have forever. So, if you would like down load or printing an additional copy, just visit the My Forms section and click about the form you need.

Gain access to the Alaska Bookkeeping Agreement - Self-Employed Independent Contractor with US Legal Forms, the most considerable library of legal record web templates. Use thousands of expert and status-particular web templates that meet your business or person requires and demands.

Form popularity

FAQ

Payroll software automates a large majority of your payroll program, and can calculate wages and taxes, and some even will turn in taxes for you. Doing payroll by hand is the most time-consuming and requires someone learning how to do payroll, and that person is called a bookkeeper.

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.

There are no legal requirements for a self-employed bookkeeper to have any formal qualifications. However, if you are planning to start a bookkeeping business, it is essential you have bookkeeping experience.

So, it's hard to say exactly what you can earn as a freelance bookkeeper in the UK. But a typical hourly rate would be between £10-A£25 depending on experience. The average hourly pay for a bookkeeper in the UK is calculated at A£11.89 by Payscale, with annual salaries between A£18,000 and A£36,000.

Small to mid-size businesses might employ their own bookkeepers. But in recent years, many have started offering bookkeeping services on a self-employed basis. This is good for businesses, as it means they can get all the benefits of a bookkeeper without having to employ a full-time member of staff.

Bookkeepers and accountants are independent contractors when they: Are hired (temporary or potentially for a long period of time) to accomplish a specific result and are not subject to direction or control over the methods or means to accomplish it.

So if you're paying unlicensed California accountants or bookkeepers as independent contractors, you're probably going to have to rehire them as employees regardless of whether or not your firm is located in California.

How to become a bookkeeperPursue a high school degree. Unlike accountants, many bookkeepers have associate's or bachelor's degrees.Acquire training. Bookkeeping training can come from a variety of sources.Apply for positions.Become a freelancer.Consider certification.

Independent contractors generally report their earnings to the IRS quarterly using Form 1040-ES, Estimated Tax for Individuals. This covers both their federal income tax and self-employment tax liabilities. They may also have to pay state and local taxes according to their state and local government guidelines.

Small to mid-size businesses might employ their own bookkeepers. But in recent years, many have started offering bookkeeping services on a self-employed basis. This is good for businesses, as it means they can get all the benefits of a bookkeeper without having to employ a full-time member of staff.