Alaska Headhunter Agreement - Self-Employed Independent Contractor

Description

How to fill out Headhunter Agreement - Self-Employed Independent Contractor?

Are you in the situation the place you require paperwork for possibly enterprise or person reasons almost every day? There are plenty of legal record web templates available online, but discovering types you can trust isn`t straightforward. US Legal Forms provides 1000s of kind web templates, such as the Alaska Headhunter Agreement - Self-Employed Independent Contractor, that are composed in order to meet federal and state demands.

If you are previously acquainted with US Legal Forms website and have an account, basically log in. Afterward, you can acquire the Alaska Headhunter Agreement - Self-Employed Independent Contractor template.

Unless you provide an accounts and wish to begin to use US Legal Forms, follow these steps:

- Discover the kind you want and ensure it is to the appropriate city/state.

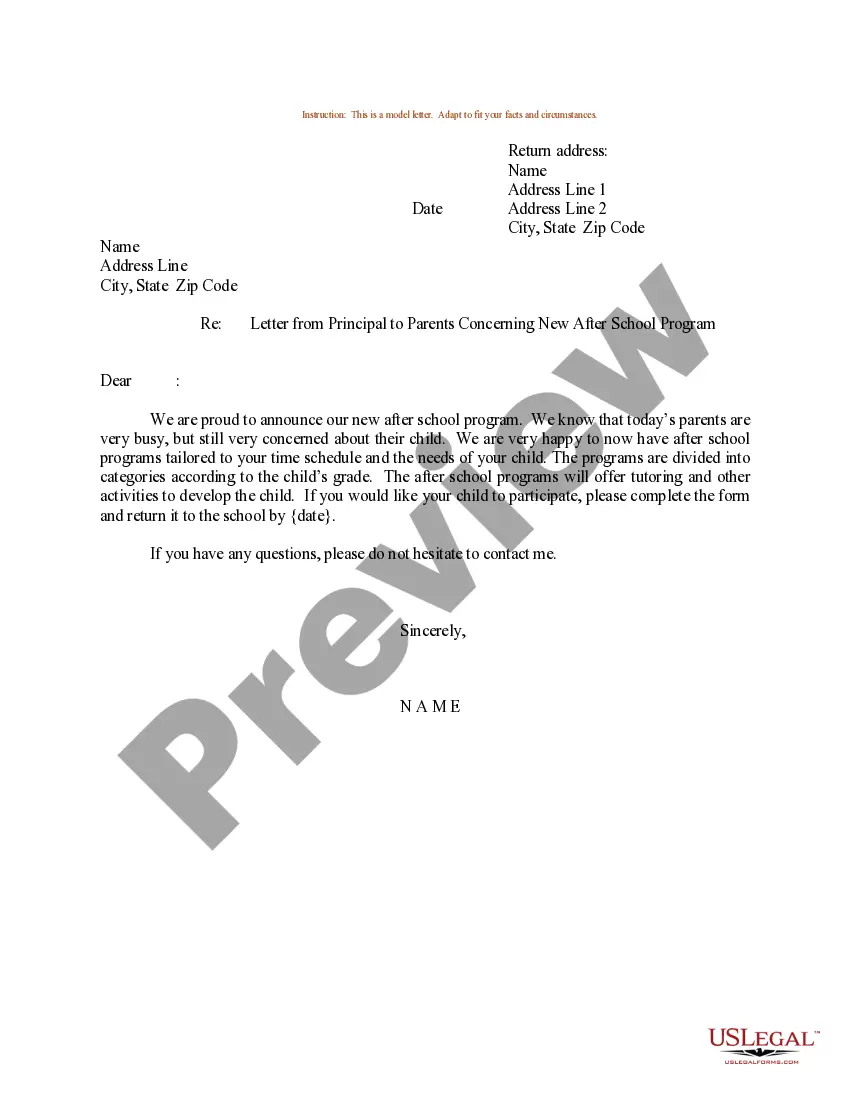

- Utilize the Preview key to check the form.

- See the explanation to actually have selected the proper kind.

- In the event the kind isn`t what you`re looking for, take advantage of the Lookup industry to obtain the kind that suits you and demands.

- When you obtain the appropriate kind, click Purchase now.

- Opt for the pricing program you would like, fill out the necessary information and facts to create your money, and pay money for an order utilizing your PayPal or charge card.

- Select a practical paper formatting and acquire your duplicate.

Locate every one of the record web templates you may have bought in the My Forms food list. You can get a more duplicate of Alaska Headhunter Agreement - Self-Employed Independent Contractor anytime, if necessary. Just select the necessary kind to acquire or print the record template.

Use US Legal Forms, the most considerable variety of legal types, in order to save time and stay away from blunders. The service provides professionally made legal record web templates that you can use for a selection of reasons. Make an account on US Legal Forms and start generating your life a little easier.

Form popularity

FAQ

Employees in South Africa are entitled to certain minimum employment benefits, while independent contractors are not. Subject to some exclusions, all employees are entitled to a number of statutory minimum entitlements and basic conditions of employment.

Independent contractors are self-employed workers who provide services for an organisation under a contract for services. Independent contractors are not employees and are typically highly skilled, providing their clients with specialist skills or additional capacity on an as needed basis.

The main pieces of employment legislation, chief among which are the Labour Relations Act 66 of 1995 (LRA) the Basic Conditions of Employment Act 75 of 1997 (BCEA) and the Employment Equity Act 55 of 1998 (EEA), apply to employees and not independent contractors.

The IRS says that someone is self-employed if they meet one of these conditions:Someone who carries on a trade or business as a sole proprietor or independent contractor,A member of a partnership that carries on a trade or business, or.Someone who is otherwise in business for themselves, including part-time business.

The law does not require you to complete a contract with your self-employed or freelance workers - a verbal contract can exist even when there is nothing in writing.

If you are an independent contractor, then you are self-employed. The earnings of a person who is working as an independent contractor are subject to self-employment tax. To find out what your tax obligations are, visit the Self-Employed Individuals Tax Center.

The three types of self-employed individuals include:Independent contractors. Independent contractors are individuals hired to perform specific jobs for clients, meaning that they are only paid for their jobs.Sole proprietors.Partnerships.

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.

Often Independent Contractors are completely unaware that they are not Employees as defined in South African labour legislation and therefore unprotected by labour legislation.

Some general protections provided under the Fair Work Act 2009 extend to independent contractors and their principals. Independent contractors and principals are afforded limited workplace rights, and the right to engage in certain industrial activities.