The Alaska Accounting Agreement — Self-Employed Independent Contractor is a legal document that outlines specific terms and conditions between an accounting firm and an individual working as a self-employed independent contractor in Alaska. This agreement serves to establish a professional relationship, define responsibilities, and protect both parties involved. Key aspects covered in the Alaska Accounting Agreement — Self-Employed Independent Contractor include the scope of services to be provided by the accounting firm, the agreed-upon payment terms, and the duration of the agreement. These terms ensure transparency and facilitate a clear understanding between the accounting firm and the independent contractor. Specific types of Alaska Accounting Agreements — Self-Employed Independent Contractor can vary based on individual circumstances or the requirements of the accounting firm. However, some common types may include: 1. Basic Accounting Service Agreement: This type of agreement outlines the core accounting services to be provided by the firm, such as bookkeeping, financial statement preparation, and tax filing assistance. 2. Tax Planning and Compliance Agreement: This agreement focuses specifically on tax-related services, addressing tax planning strategies, compliance with Alaska tax laws, and ensuring accurate and timely filing of tax returns. 3. Financial Consulting Agreement: In situations where an independent contractor seeks financial advice or guidance beyond standard accounting services, a financial consulting agreement may be utilized. This agreement allows for personalized financial guidance tailored to the contractor's specific needs, including strategic planning, budgeting, and investment advice. 4. Payroll Management Agreement: For self-employed individuals who have employees, a payroll management agreement may be necessary. This type of agreement covers responsibilities related to payroll processing, tax withholding, and payroll tax filings, ensuring compliance with state and federal laws. Regardless of the specific type of Alaska Accounting Agreement — Self-Employed Independent Contractor, it is important to include essential elements such as confidentiality clauses, dispute resolution procedures, and termination clauses to protect both parties' interests. In conclusion, an Alaska Accounting Agreement — Self-Employed Independent Contractor is a vital document that establishes a professional relationship between an accounting firm and a self-employed individual. It outlines the services provided, payment terms, and other crucial details, ensuring clarity and protection for both parties involved. Different types of agreements exist based on the specific accounting needs of the independent contractor involved.

Alaska Accounting Agreement - Self-Employed Independent Contractor

Description

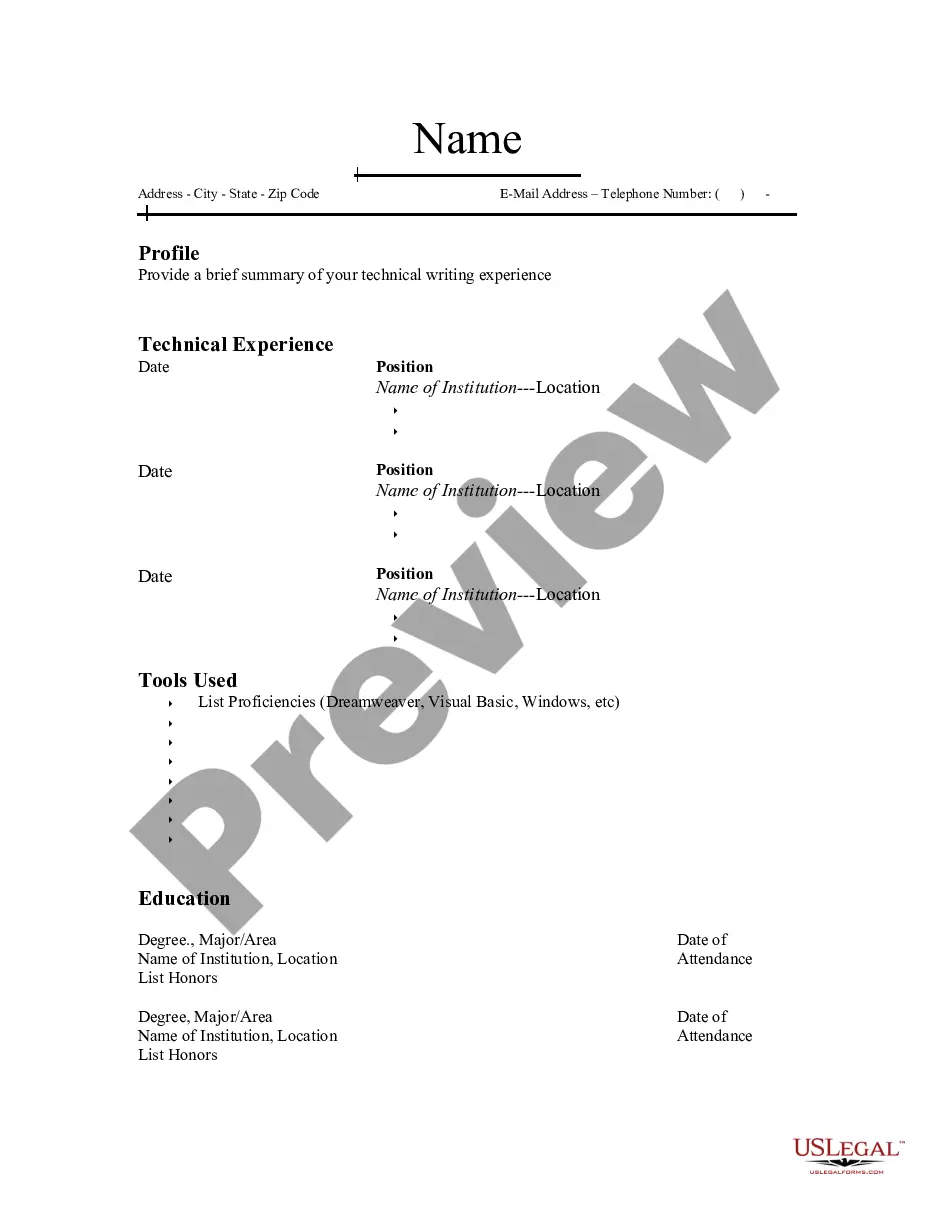

How to fill out Alaska Accounting Agreement - Self-Employed Independent Contractor?

Finding the right lawful document web template could be a battle. Of course, there are plenty of templates accessible on the Internet, but how will you obtain the lawful form you require? Take advantage of the US Legal Forms website. The services gives a large number of templates, for example the Alaska Accounting Agreement - Self-Employed Independent Contractor, which you can use for organization and personal demands. Each of the kinds are checked out by experts and satisfy state and federal specifications.

Should you be presently registered, log in for your accounts and then click the Obtain key to find the Alaska Accounting Agreement - Self-Employed Independent Contractor. Make use of accounts to appear with the lawful kinds you possess acquired earlier. Proceed to the My Forms tab of your respective accounts and obtain one more version of your document you require.

Should you be a whole new user of US Legal Forms, listed below are simple directions so that you can adhere to:

- Initial, be sure you have selected the right form for your personal metropolis/region. You are able to look through the shape using the Preview key and study the shape outline to ensure it will be the best for you.

- When the form fails to satisfy your expectations, utilize the Seach industry to get the right form.

- When you are sure that the shape is acceptable, go through the Purchase now key to find the form.

- Choose the costs strategy you need and enter in the necessary details. Create your accounts and pay for the transaction utilizing your PayPal accounts or bank card.

- Opt for the data file formatting and download the lawful document web template for your device.

- Total, change and print out and indicator the acquired Alaska Accounting Agreement - Self-Employed Independent Contractor.

US Legal Forms is the most significant library of lawful kinds that you can see different document templates. Take advantage of the service to download expertly-created paperwork that adhere to express specifications.