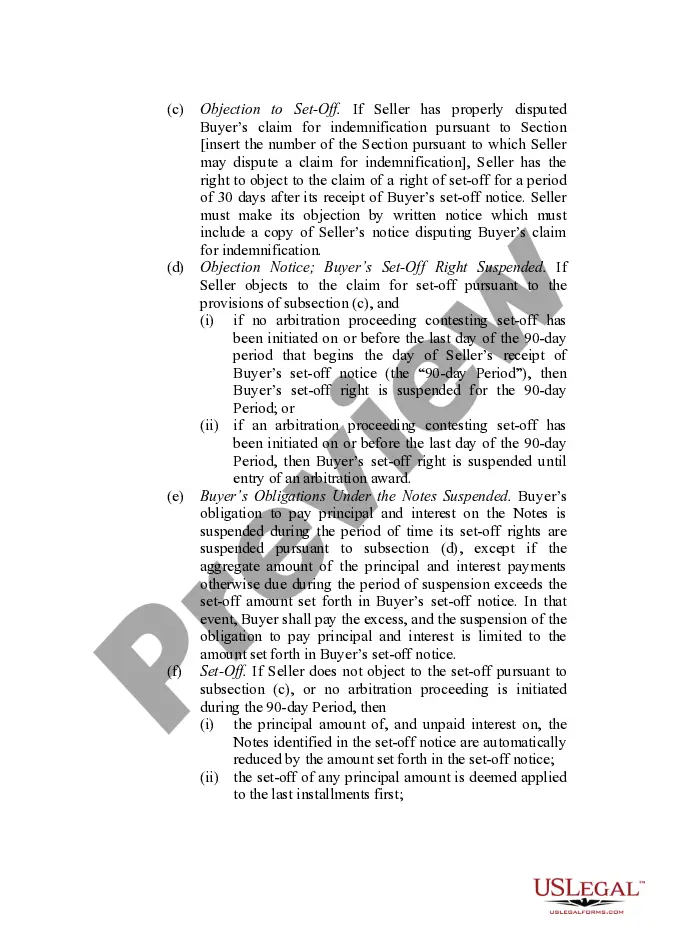

This form provides boilerplate contract clauses that outline means of securing the funds for payment of any indemnity, including use of an escrow fund or set-offs.

Alaska Indemnity Provisions - Means of Securing the Payment of the Indemnity

Description

How to fill out Indemnity Provisions - Means Of Securing The Payment Of The Indemnity?

Discovering the right legal document web template can be a battle. Needless to say, there are a variety of themes accessible on the Internet, but how would you get the legal type you need? Utilize the US Legal Forms web site. The service offers thousands of themes, for example the Alaska Indemnity Provisions - Means of Securing the Payment of the Indemnity, that can be used for enterprise and personal requires. Each of the forms are inspected by specialists and meet up with state and federal demands.

In case you are already signed up, log in in your accounts and then click the Obtain switch to find the Alaska Indemnity Provisions - Means of Securing the Payment of the Indemnity. Make use of your accounts to search throughout the legal forms you possess bought earlier. Visit the My Forms tab of your own accounts and have yet another backup of the document you need.

In case you are a whole new consumer of US Legal Forms, here are easy instructions for you to adhere to:

- Initially, make certain you have chosen the appropriate type for the city/area. You may check out the shape while using Review switch and study the shape outline to make sure it is the best for you.

- In case the type will not meet up with your requirements, use the Seach area to get the appropriate type.

- When you are sure that the shape would work, select the Acquire now switch to find the type.

- Pick the costs plan you want and enter the essential information. Create your accounts and pay money for the order utilizing your PayPal accounts or Visa or Mastercard.

- Opt for the submit formatting and down load the legal document web template in your product.

- Comprehensive, modify and printing and signal the obtained Alaska Indemnity Provisions - Means of Securing the Payment of the Indemnity.

US Legal Forms may be the largest library of legal forms for which you can find various document themes. Utilize the company to down load professionally-manufactured papers that adhere to express demands.

Form popularity

FAQ

An indemnification clause should clearly define the following elements: who are the indemnifying party and the indemnified party, what are the covered claims or losses, what are the obligations and duties of each party, and what are the exclusions or limitations of the indemnity.

How to Write an Indemnity Agreement Consider the Indemnity Laws in Your Area. ... Draft the Indemnification Clause. ... Outline the Indemnification Period and Scope of Coverage. ... State the Indemnification Exceptions. ... Specify How the Indemnitee Notifies the Indemnitor About Claims. ... Write the Settlement and Consent Clause.

A typical example is an insurance company wherein the insurer or indemnitor agrees to compensate the insured or indemnitee for any damages or losses he/she may incur during a period of time.

Letters of indemnity should include the names and addresses of both parties involved, plus the name and affiliation of the third party. Detailed descriptions of the items and intentions are also required, as are the signatures of the parties and the date of the contract's execution.

An LOI must clearly list all of the parties involved (shipper, carrier and when applicable, consignee or recipient) and should include as much detail as possible (i.e. vessel name, ports of origin and destination, description of goods, container number, specifics from the original bill of lading, etc.).

It is primarily intended to protect the person who is providing goods or services from being held legally liable for the consequences of actions taken or not taken in providing that service to the person who signs the form. Indemnity clauses vary widely.

Indemnity may be paid in the form of cash, or by way of repairs or replacement, depending on the terms of the indemnity agreement.

The Contractor shall defend, indemnify and hold the County, its officers, officials, employees and volunteers harmless from any and all claims, injuries, damages, losses or suits including attorney fees, arising out of or in connection with the performance of this Agreement, except for injuries and damages caused by ...